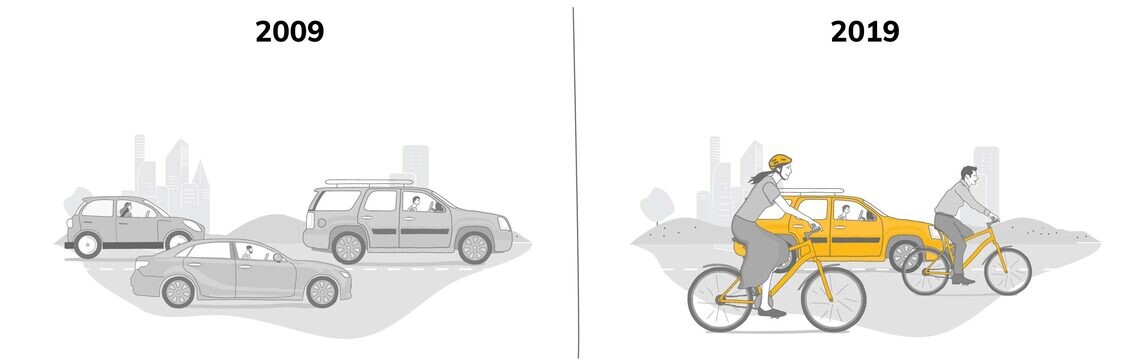

Traffic is choking the roads. Fuel powered engines are messing with the environment. And our sedentary lifestyle is impacting our health. The smart amongst us have found a simple, two-wheeled solution to all three issues. The humble bicycle.

Nimble, light and easy to ride, bicycles are fast becoming the preferred mode of commute. They make bicycles vulnerable to thefts and accidents. All the joy of having an efficient vehicle vanishes when you realize it has been stolen. Or even worse, if you get into an accident. Due to lack of awareness and caution of bicycle riders on the road.

So, what’s the next smart thing a bicycle-owner should do? Get insurance of course! Yes, you would have known for big fancy cars and motorcycles to get insurance, however some insurers, not to mention us too (we take a bow :D) have started offering bicycle insurance! The premiums are not too high, considering that some top-end bicycles now come with prices tags that vary from Rs.2000 to Rs. 2 lakhs!

The bicycle insurance, (sometimes referred to as pedal & bike insurance) offers different kinds of coverage. Let’s look at a few:

Personal Accident

If, in an unfortunate turn of events, you meet with a fatal accident or suffer permanent or partial disability in an accident, the insurance company will pay up to the sum insured.

Emergency Accidental Treatment

In case of a non-fatal accident, your hospital bills for any emergency treatment will be reimbursed.

Theft

As we said before, a bicycle is an easy target for thieves. In case of theft, your insurance will cover for the sum insured, minus the depreciation of course.

Damage

If your bicycle suffers total loss – meaning it is damaged beyond repair in an accident, you will get the entire sum insured. Some companies even offer a Crash Replacement Policy, where you can replace your damaged cycle with a similar make or model of the same age that’s available. In case of partial loss, the insurance company will pay for the cost of repairs.

Liability to Third Party

If in an event of an accident, you afflict injury or damage to a third party, you will be covered for any costs of treatment or repair of the claimant.

There you are then. Before you get on your bicycle, make sure you have ticked all the boxes – oiled those gears, put on the safety gear, and got insurance done. Then you’ll be all set to pedal away on the path to a healthier you and a greener planet.