‘With greater power, comes greater responsibility’- Loving Uncle Ben

Spiderman could have rejoiced in just being the neighborhood favorite guy, not having to deal with world problems. But that’s not what destiny has in store, as we grow, we have greater responsibilities. To manage those, we need to become better versions of ourselves, every day!

In our Transparency Report 3.0, we’re going to tell you what’s been happening in the Digit neighborhood and how we’re prepping ourselves for further leaps. 🤩💪💪

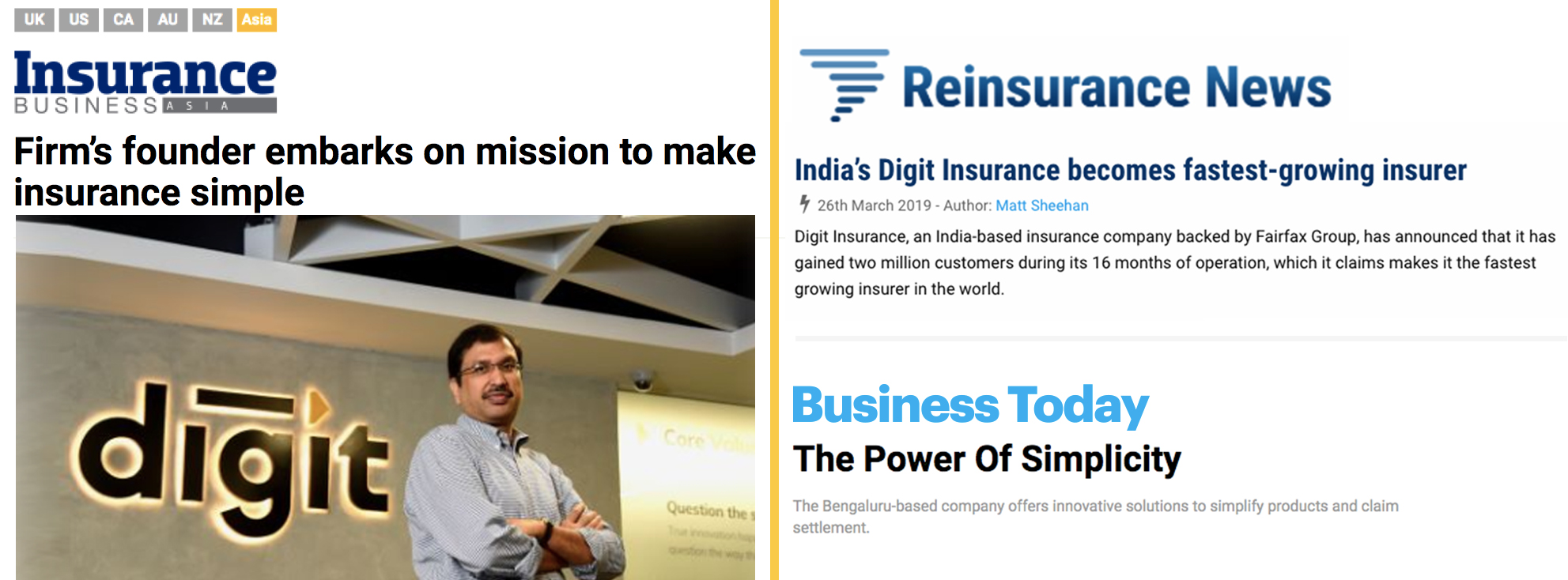

# ‘India’s Fastest Growing Insurtech’ (the media has been kind :))

*Note- The above numbers are till end of Q1 FY 2019-20

It’s a little heady when you cross such milestones and are lauded to be the ‘fastest growing’ in the country. But this is also the exact time you need to watch out for oversights and avoid a nosedive. It’s a time to make sure that with a growing base, we also maintain our Service Quality.

# ‘Claims are good’ is what we believe in

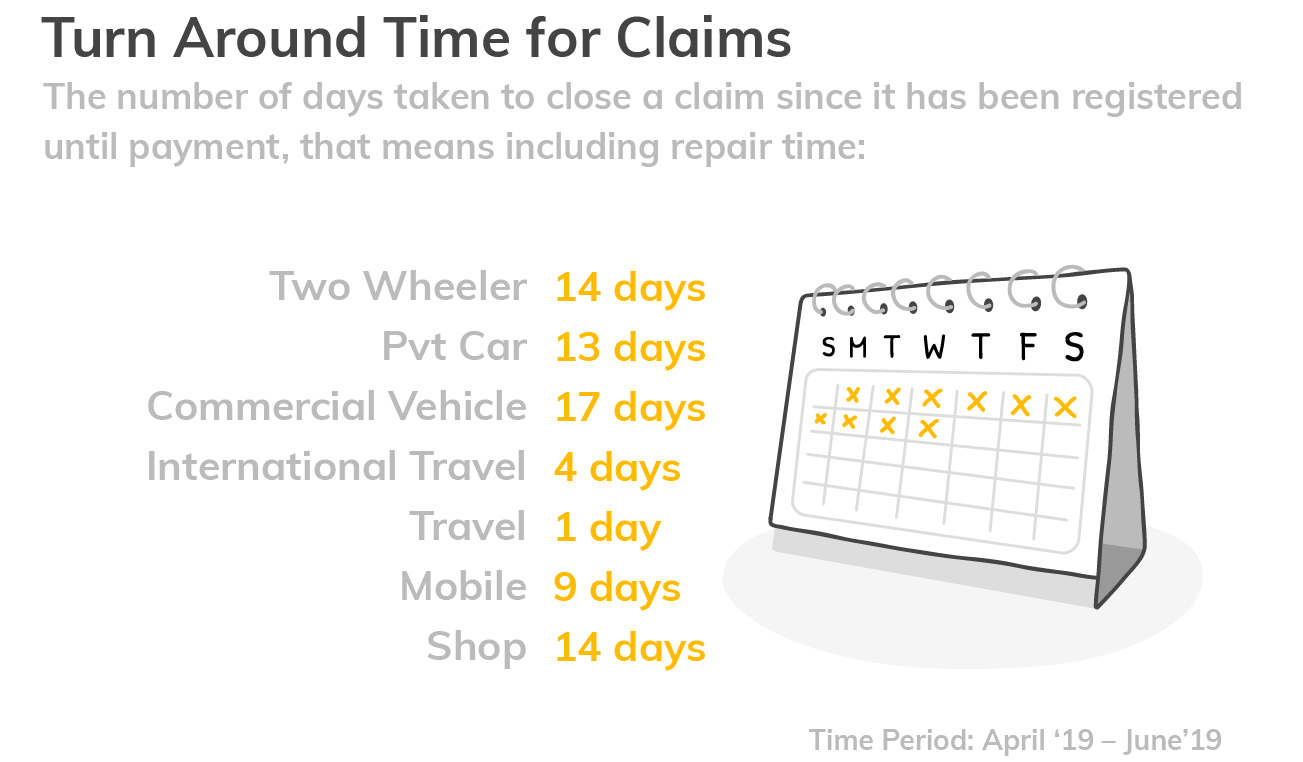

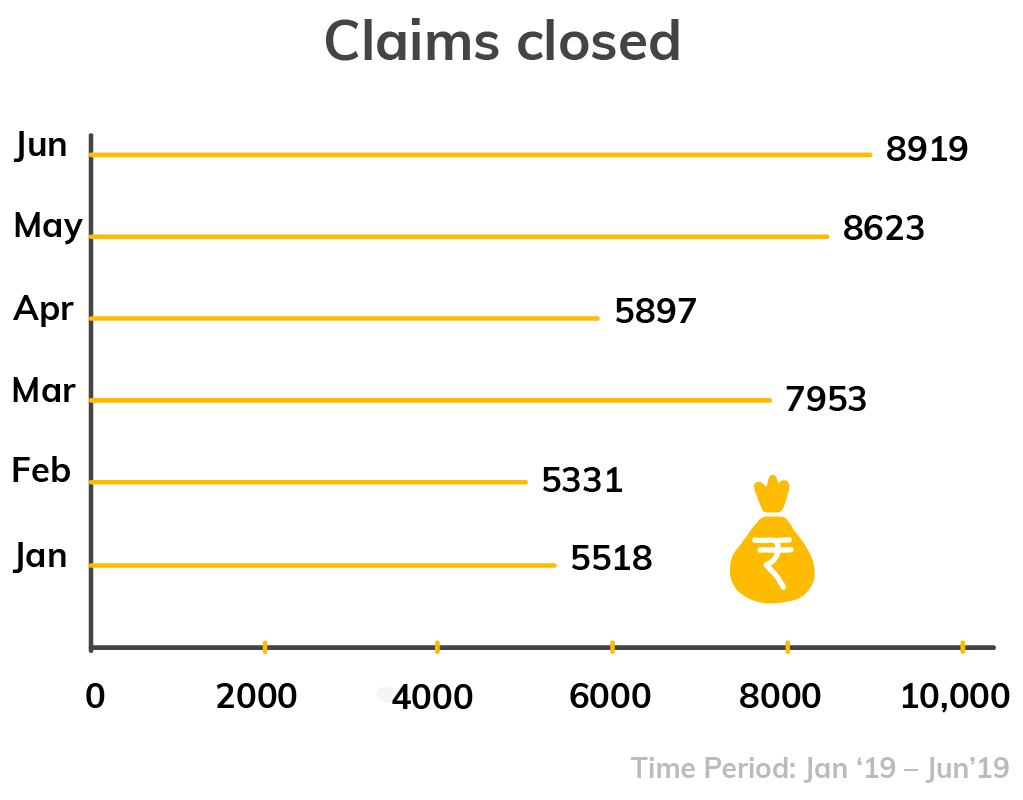

Claims are the real test for us. And we try hard to make sure, they are settled quickly and efficiently.

In June alone, we closed 8919 claims with healthy Claim Turn Around Times.

One of the reasons for this was a ‘Restructuring of resources’.

‘People power is mighty strong, and this army needs to be planned well.’

When our volumes were low, all our Operation team members were working across customer queries and cases. This was great initially but as traffic grew, we needed to be more efficient.

- Therefore, we built ‘Specialized Forces’ for different products. Much like you have in defense and in medical fields, people with sharper skills to handle specific operations.

- We started ‘Real-time allocation of resources’ for cases allocated to employees present on the floor. This ensured that case resolution is not dependent on an individual but on a system.

But if you have followed our Transparency Reports, you would see that our Turn Around Time for Motor has increased. Let’s see why…

# Doubling our speed of settlement

While we were restructuring our entire process we realized that there were quite several pending claims from previous quarters wherein there was a response pending from a customer.

So, we planned a ‘fast-tracking project’ for such cases, wherein we proactively followed up regularly and closed cases.

Most of these pending cases were for motor claims, which is one reason why you see a longer TAT for claim settlement for motor. For instance in July, our Motor Claims Closed are 5% higher in number than our Motor Claims Registered, that’s because of the backlog.

Apart from that, the TAT is also affected as we rolled out the new claims system. As whenever processes change, initially it takes a little while to settle down. But we should see the benefits of the changes overpower and better the TAT in the coming months. Let’s see what more we changed…

# 2X Faster through Automation

Again, with a growing customer base, we needed to further weed out redundancy in our system, i.e. spotting repetitive tasks and automizing them.

Therefore, with the help of BOTs, we reduced human intervention, making us more efficient, faster and more available to the end-customer.

For example, we observed that we were spending 4 minutes 15 seconds post the approval of a claim to process the payment. This time was taken for manual checking and filling of data for all the parts of the vehicle that were damaged and for which the claim was approved. We felt this time could be shortened, so we now run a BOT for this, bringing down this time by almost 50%, to 2 minutes 30 seconds!

Also, our entire claims process has a 100% technology footprint i.e. all data and communications are automated and all teams have access to track a claim in ‘real-time’. For an end-customer, this means more transparency and less human error and for the employees it means more productivity.

# ‘Single’ View Claims Tool

There was another area where we thought there was a scope of optimization.

When there are different teams working on a single case, collaboration is sometimes a challenge. And our claims team was working on multiple tools for different processes to keep the entire team updated and track the claim status at each step. And this was taking up a lot of time and effort.

Simple solution. We built one integrated tool that would help in the entire claims process and would let any team track the claim.

This has helped in streamlining the process and managing the time that would be taken up in coordinating and managing different tools. Also, it has increased transparency between teams, as anyone can see the status of a claim at any point in time.

But despite these changes, if a continuous learning from mistakes is not happening, one cannot grow. Let’s see how we have a system of a feedback loop at Digit…

# Negative Review Analysis

Our ears are always close to our customers. Especially if there is a negative experience shared by a customer, we do not leave it just there.

There is an entire taskforce that analyses & checks what went wrong and collates the learnings to avoid such situations in the future.

Therefore, we started doing a ‘Negative Review Analysis’ per quarter to understand any trends in the cases and to see if there are any process changes required to improve the customer experience.

# Strong Fraud Detection Protocol

While we make sure negative experiences are minimized, as an insurance company, we also have a duty towards genuine customers to honour genuine and only genuine cases, and weed out any fraudulent ones.

This is to make sure that no fraud case should eat up from the pool of resources that we have collected from our genuine customers. Even if one fraud case is approved, it would mean that the entire section of genuine customers pays for it. And that is something we try and avoid to the best of our ability!

Therefore, we have been stern in cases that were not genuine after thorough investigation.

That one bad fish shouldn’t spoil the pond!

# 4X Customer Happiness Score

All over the world, companies measure a score called ‘Net Promoter Score (NPS)’. This shows how happy or unhappy the customers are with the company.

And we are humbled and grateful that our score is 73% against the avg. industry score of 18%, almost 4X!

And we’re also glad that even our Facebook rating is 4.5, one of the highest in the industry.

So while our negative reviewing customers are our fuel to be better, a big thank you to all our customers who give us a happy shout out and keep us encouraged in this journey to simplicity.

# And it’s a team effort!

Athletes in Olympics treat every day as the final lap, the final performance. They strategize, practice, fall, succeed but never stop trying. We are inspired by that and will do all in our capacity to be better than ourselves. And we’re not doing this alone, our team members & partners are always by our side, helping us with their feedback & suggestions, pushing us to be better versions of ourselves.

Our partners have been our strongest rocks, helping us bring changes in our processes and operations. We take their suggestions like the holy grail as we believe that we can only grow with genuine critique. This time, in our Partners meet in April, 82 improvements were suggested by our partners, out of which 52 suggestions have already been implemented, and 20 are in process.

Also, a big thank you to our claims and operations team who have clocked in uncountable hours passionately to ensure the road to simplification is smooth and seamless. We could have never done this without all of you!

Let’s get a bit ‘Crazy’ now!

To make insurance ‘Crazy Simple’, you need to be crazy yourself. And we’re not stopping, our aim is that Stark Suit, isn’t it? And we can’t do this without you…

We truly believe that our Transparency Reports make us more accountable to our customers & partners and help us in improving ourselves each day. So please ask us for more numbers, quiz us and question us. You can write to us at hey@godigit.com, and we will incorporate our responses in our Transparency Report 4.0.

Till then, hang on to the web, we’re going to be with you!

P.S.- For those who enjoyed this report, you may also read our Transparency Report 2.0