‘“The only sensible way to live in this world is without rules.” -Joker

While this quote runs havoc in the city and we don’t believe in that anarchy, we do love breaking the rules of the game a little, to be better.

In the flavor of the season, we saw an ode to the biggest villain of DC, ‘Joker’. Was it a final goodbye or a counterpoint of view, we can’t say, but for us, in our microcosm of insurance, the ‘Joker’ is ‘Complexity'.

Complexity tries to attract you, to derail you and ultimately leaves you confused & disappointed. It looks like the crutches of having an intelligent product, but written in jargons? But no, it does harm and we’re here to break that with our black & white approach towards insurance (yes, we made that pun on Batman’s black silhouette😊)!

Before you get all serious, let’s cut to the chase (pun intended again)…

Let's first tell you something happy! Digit has been placed in the world map, been announced as Best General Insurance Company of the Year at the 23rd Asia Insurance Industry Awards organized by Asia Insurance Review Awards in Singapore!

We are humbled that in just 2 years of starting operations we have won the best general insurance company award, not just in India but in Asia! It not only makes us immensely proud but also gives us the assurance that on this journey of simplification, we are on the right path.

And now, we are back with Transparency Report 4.0, our July-September edition, our quarterly commitment to you, our customers and partners to make sure what’s going inside Digit is never hidden!

A quick recap of the last report

Last time, we spoke about how we were further bringing in efficiency to our processes through technology, re-alignment of resource structures in our teams and launching a fastrack project to close pending claim cases.

We had hoped to see our Turn Around Times (TATs) further improve along with maintaining our Claim Settlement Ratio. Also, we had aimed to get more love from new customers and a larger share of the pie for the motor market share…

Letting the numbers speak for themselves…

September was a great month for us, with 1 million customers joining us in this one month alone!

And, this time, we have the overall market share for you, a happy 1%, with us becoming the highest gainer this quarter in terms of market share… (btw, the Motor Market Share also is up, to 2.58% till the end of September 2019)

Also, while we crossed 0.1 million claims, but this time we won’t say we love them as it comes with the sorrow of many flood damage cases which also increased the number of claims and sadly, also the repair times. We are now seeing this stabilize in October though and we will share the Turn Around Times (TATs) in our next report.

Last time we didn’t mention the settlement nos. and which is why here they are…

Note: Claim Settlement ratios include both repudiated and settled claims.

You see a new line of business, health added to it!

Well, if we have to summarize this quarter, we were in different phases, Launching, Improving, Sustaining, in our different product categories. Let us look at what all we did:

#1 Launching: Completing our army

We have launched our Health Group Medical Cover (GMC) with 30+ partners and insuring 6000+ lives.

Even from a Turn Around Time (TAT) pov, 70% of the pre-authorization cases are being processed in less than 2 hours and the reimbursement cases are fully settled within an average of 7 days!

What’s worked for us in kickstarting Health GMC?

- Paperless Claims, which is not too common for a health insurance product

- Technology backed smooth & simple processes, for example, fully digital health policy endorsements which save around 100 workhours everyday

- Trust from customers that Digit has earned till now

And we are excited to launch Health Insurance on our retail (Website, app) as well next month. Yippie!

#2 Improving: Upgrading our combat gear

85% of motor pre-inspection cases are being processed in 10 min, majorly due to Artificial Intelligence (AI) being used for bike cases. But we are now moving towards building the same process for car as well!

#3 Sustaining: Going through a rehaul if required

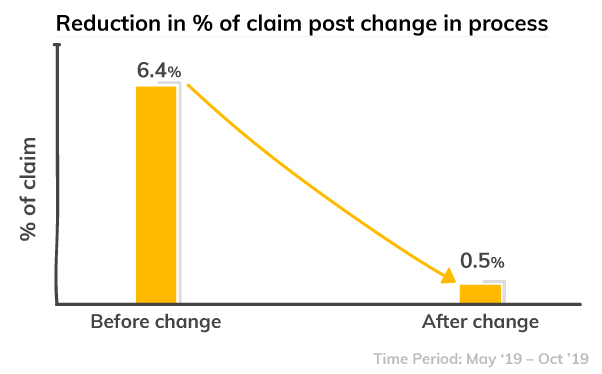

We launched mobile insurance for old and new handsets last quarter. But all wasn’t rosy. Our initial loss ratios were high, partly due to the misrepresentation of facts at the time of buying (fraud in other terms)!

But we had to make sure that for a few bad eggs, we don’t make things difficult for genuine customers or kill the product under the burden of losses.

Therefore, we reconfigured the process and developed a new system for pre-inspection.

And doing this we helped bring down the number of fraud claims, thereby bringing down the loss ratio.

6.4% of policies earlier were resulting in claims, now that is 0.5%!

Last month has thankfully started to look healthy, with loss ratios declining! Fingers crossed now…

Beyond these highlights, there were some positive re-affirmations that we are probably on the right path, let us share them with you…

Still love claims ❤️

We reimagined our products to be really beneficial to people. And we are glad people are using the benefits. For example, benefits like Baggage loss or delay during International Travel, which contributes to about 15% of claims generally (for the whole industry), rose to 50% in our case.

Why are we happy? Because our beneficial claim terms and simple claims process increased the willingness of people to lodge even small claims like these, which people otherwise give up in difficult times. Meaning, we succeeded to simplify the process while other companies still ask for bills, etc…!

Agile to opportunity

Opportunity comes unannounced and we need to be ready. This is why after the Motor Vehicle Act, we saw an 800% jump in our two-wheeler policies. And given that we have automated policy issuances and not manual ones, we could serve people with speed!

Happy people around us…

Our ultimate goal is the happiness of our customers, partners, and employees. So with a Net Promoter Score (NPS)* of 74%, the highest Facebook rating in the industry of 4.7 and a 4.2/5 employee happiness score, we think we are moving towards the goal with full gusto.

*This NPS is for non-claims cases only, for claim cases, the same is 50% (July 19-Sept 19). Generally claims NPS is quite lower than non-claims for the industry but we will continue to work harder to further improve the Claims NPS as well!

Well, that’s it for this quarter. A big thanks to our partners for their undying support, customers for their love and teams for their efforts. You are the force behind us!

Our transparency reports help us in continuous growth and improvement quarter on quarter. So please ask us for more numbers, quiz us and question us. You can write to us at hey@godigit.com, and we will incorporate our responses in our Transparency Report 5.0.

Till then stay happy, joyful, not the joker way though;) Btw, ‘Why so serious?’

P.S.- For those who enjoyed this report, you may also read our Transparency Report 3.0