Emergency Accidental Treatment & Evacuation

Accidents occur at the most unexpected times. Unfortunately, we can’t save you there, but we can surely help you get the best treatment. We cover you for immediate medical treatment that results in hospitalization.

|

✔

|

✔

|

Emergency Medical Treatment & Evacuation

God forbid if you fall ill during your trip in an unknown country, don’t panic! We will take care of your treatment costs. We will cover you for expenses like hospital room rent, operation theatre charges, etc.

|

✔

|

✔

|

We hope this cover is never required. But for any accident during the trip, resulting in death or a disability, this benefit is there for support.

|

✔

|

✔

|

Daily Cash Allowance (Per day)

When on a trip, you manage your cash efficiently. And we do not want you to shell out anything extra for emergencies. So, when you are hospitalized, you get a fixed daily cash allowance per day, to manage your daily expenses.

|

×

|

✔

|

Accidental Death & Disability (Common Carrier)

While this cover has everything like the emergency accidental treatment cover, it has one extra layer of protection. It also covers death & disability while boarding, de-boarding or are inside the flight (Touchwood!).

|

✔

|

✔

|

Emergency Dental Treatment

If you encounter acute pain or meet with an accidental injury to your teeth on the trip, resulting in emergency dental treatment provided by a medical practitioner, we will cover you for the expenses incurred due to the treatment.

|

×

|

✔

|

If unfortunately, your trip gets cancelled, we cover the pre-booked, non-refundable expenses of your trip.

|

×

|

✔

|

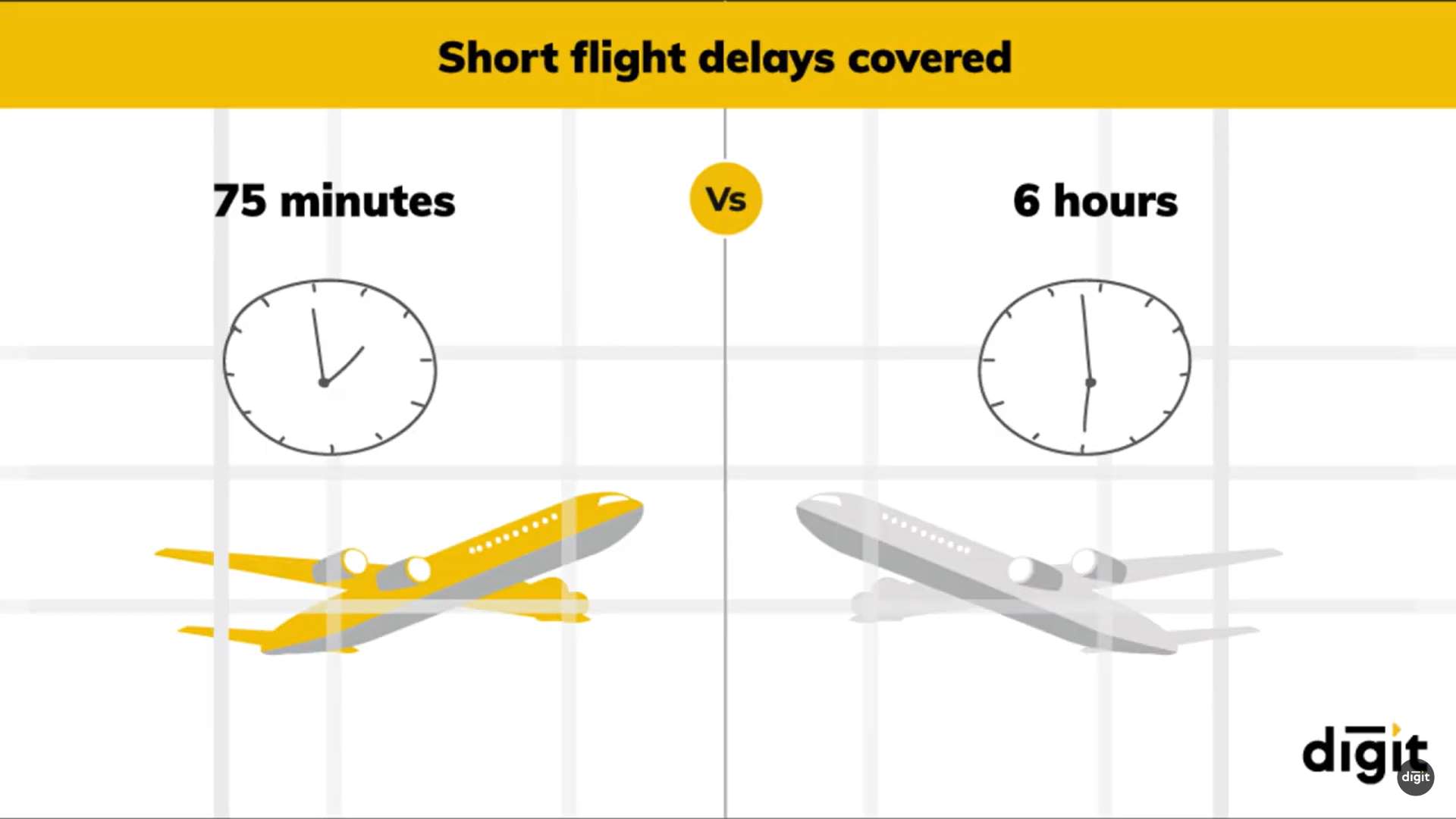

If your flight gets delayed by more than a certain time limit, you get the benefit amount, no questions asked!

|

×

|

✔

|

Delay of Checked-in Baggage

Waiting at the conveyor belt is annoying, we know! So, if your checked-in baggage is delayed for more than 6 hours, you get the benefit amount, no questions asked!

|

✔

|

✔

|

Total loss of Checked-in Baggage

The last thing that can happen on a trip is your baggage getting lost. But if something like this happens, you get the benefit amount for the entire baggage getting permanently lost. If two out three bags are lost, you get a proportional benefit, i.e. 2/3rd of the benefit amount.

|

✔

|

✔

|

Missed the flight? Don’t worry! We will pay for extra accommodation and travel needed to reach the next destination shown on your ticket/itinerary if, you miss a pre-booked onward flight because of a delay in the flight.

|

×

|

✔

|

The worst thing to happen in an unknown land is to lose your passport or visa. If something like this happens, we reimburse the expenses, if it is lost, stolen or damaged while you are outside of your country.

|

✔

|

✔

|

If on a bad day, all your money is stolen, and you need emergency cash, this cover will come to your rescue.

|

×

|

✔

|

We don’t want our vacations to end. But we don’t want to stay in a hospital too! If due to an emergency during your trip, you need to lengthen your stay, we will reimburse the cost of hotel extensions and return flight rescheduling. The emergency could be a natural calamity in your travel area or an emergency hospitalization.

|

×

|

✔

|

In case of emergency, If you had to return home early from your trip, that would be really sad. We can’t fix that but we will cover charges for alternate travel arrangements and non-refundable travel costs like accommodation, planned events and excursion expenses.

|

×

|

✔

|

Personal Liability & Bail Bond

Due to an unfortunate incident, if there are any legal charges against you while you are travelling, we will pay for it.

|

×

|

✔

|