You’ve just bought a new mobile phone. You (being a responsible phone-owner) want to do everything in your power to protect it. That’s where manufacturer’s warranty and mobile insurance come in.

A manufacturer's warranty is a promise from the manufacturer that, if it’s within a given time period, they will repair or replace your phone in case of manufacturing defects. Many manufacturers also offer an ‘extended mobile warranty’ so you can protect your phone for longer. A mobile insurance, on the other hand, gives your phone an extra layer of protection – because it is an All Risk Cover and covers losses arising out of any accident, Act of God Perils, theft or burglary. The Cover can also be extended to include liquid damage or damage due to mechanical & electrical breakdown.

Basically, a mobile phone warranty will cover the device only against defects, but mobile phone insurance covers any damage that results from an accident or unforeseen incidents.

Usually, you get the manufacturer’s warranty at the time of purchasing your phone. Some mobile insurances are also available at the time of purchase – otherwise, you can buy them online, or through your insurance provider.

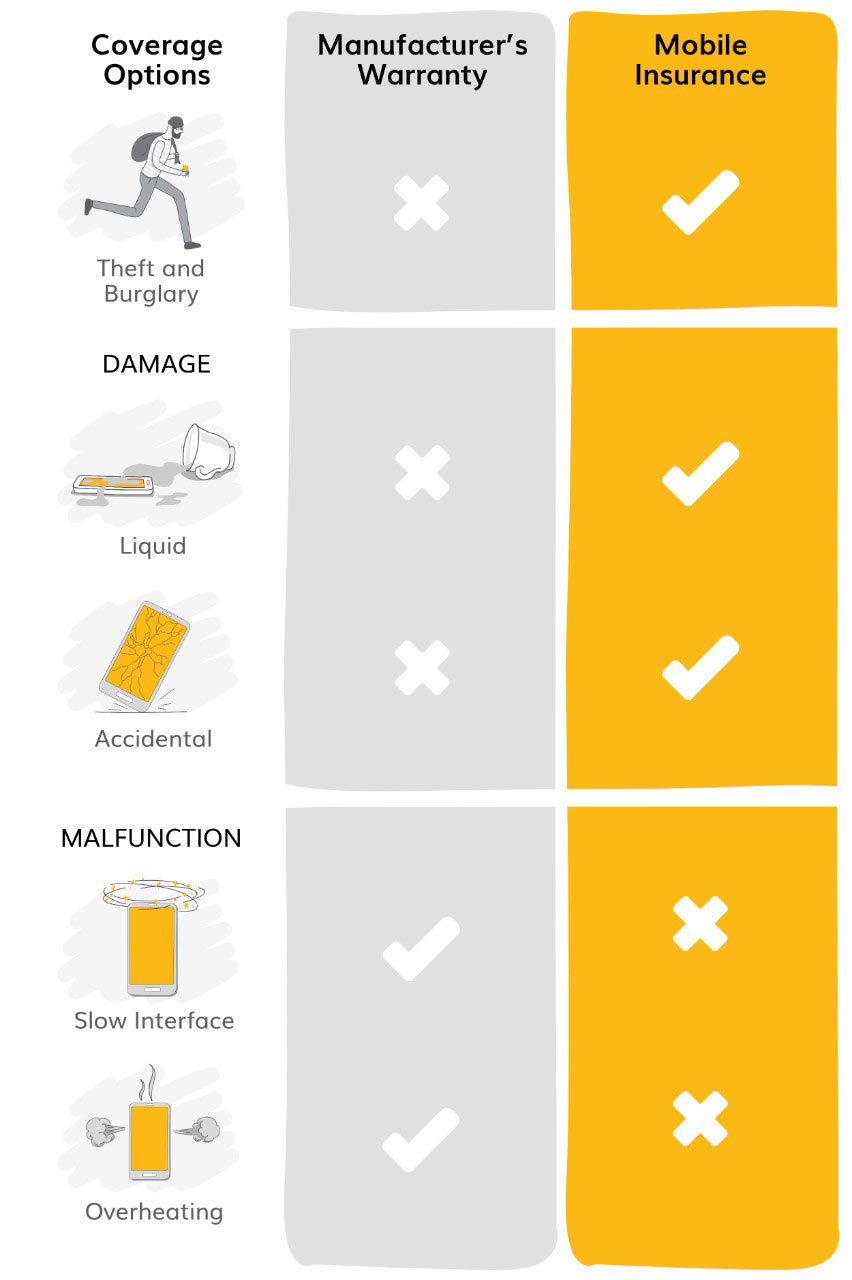

Here’s what they both cover:

So, to sum it up, here are some important questions on warranty vs insurance:

Is a warranty and insurance the same thing?

People often think mobile warranty and mobile insurance are the same thing. But they are significantly different forms of consumer protection and they can cover different things, although there may be some overlap at times.

What does warranty cover on a phone?

Warranties usually cover manufacturing defects and hardware malfunctions but do not cover damage from unforeseen incidents. These costs are covered by Mobile Insurance.

Does warranty cover stolen phone?

Warranty covers defects from the manufacturer and doesn't cover unforeseen incidents like theft. Theft can be covered by mobile insurance.

Does warranty cover accidental damage?

Warranties usually cover your appliance for mechanical or electrical failure, but not for accidental damage. For such damages, buying a mobile insurance is always wise.

Does screen damage come under warranty?

As accidental damage is not covered under a warranty, so screen damage is not covered under a warranty. However, a mobile insurance usually covers screen damage.

There you have it! The two power tools you need to keep your phone in tip-top condition. 😃

Now that you have all the important info, if you’re having a bad day and your phone suffers damage or loss, you can make the right decision on which one works best for you.

Explain it like I'm five

We're making insurance so simple, now even 5-year-olds can understand it.

Imagine those days when you were in school and your parents took care of your studies. Your mom and dad had their own departments. English and Science- Mom, Maths and Social Studies- Dad. Each of them took care of their subjects independently, and if by mistake you took the wrong subject to the wrong person, you knew the answer "These are not my subjects! Ask your mom/dad to help." 😃

But both of them helped in maintaining the right balance for your studies, protecting your grades. Manufacturer's warranty and mobile insurance is quite like that. They have their own benefits, together helping in protecting your phone!