Simplifying Life Insurance in India

That's it, That's Digit

What would you like to Protect Today?

Life Insurance

Group Life Insurance

Explore Digit Life Insurance Plans Available in India

Digit Glow Term Life Insurance

Suitable for self-employed and young salaried professionals who want smart and early protection.

Choose your sum assured, from ₹25 Lakhs up to ₹1 Crore, to match your financial goals.

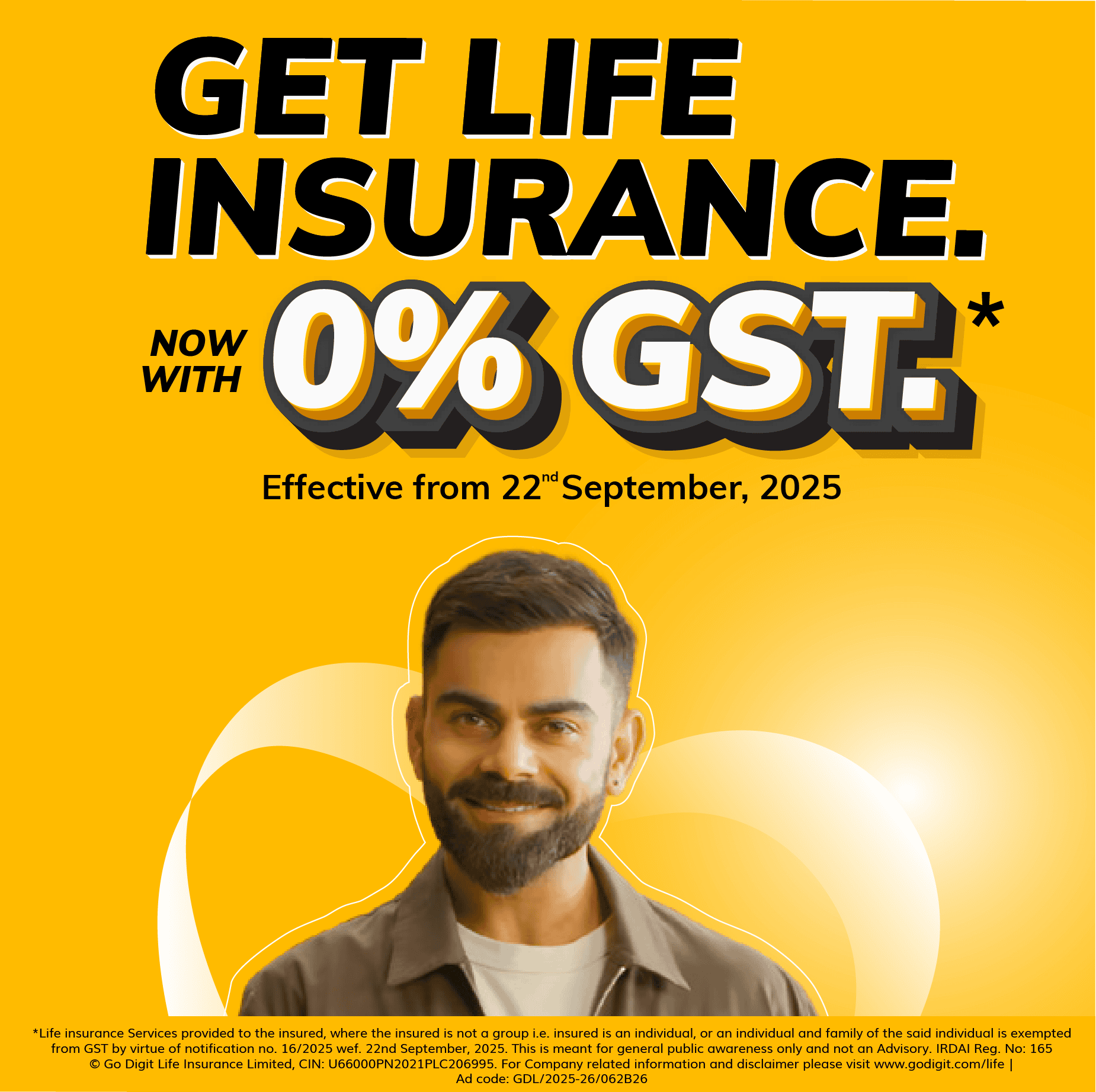

0% GST on Premium

No physical forms or waiting, just buy your policy online with PAN and Aadhaar.

Digit Glow Plus Term Life Insurance

Suitable for salaried professionals, entrepreneurs, and high-income earners.

Access up to ₹20 crore sum assured to cover your extensive financial goals and liabilities.

Terminal Illness Benefit is included and covered at no additional cost.

Gain long-term protection up to Age 85 that supports post-retirement responsibilities.

Digit ICON Guaranteed Return Savings Plan

Suitable for Risk-averse investors and individuals planning for long-term financial goals

Guaranteed returns immune to market fluctuations

Life cover + savings

Multiple payout options like lump sum, income, or both

Digit Glow Healthy Term Combo

Suitable for families and individuals who want all-in-one protection

Combines Health and Life Insurance in one plan

Covers Hospitalisation, Critical Illness, Maternity, and Accidental Death

Provides death benefit ensuring your family is financially secured

Cashless Claims and Worldwide Coverage

240

208

Kamesh Goyal and Fairfax come together yet again!

How we plan to Simplify Life Insurance?

How we plan to Simplify Life Insurance?

Digit Life in the News

Digit Life in the News

false

true

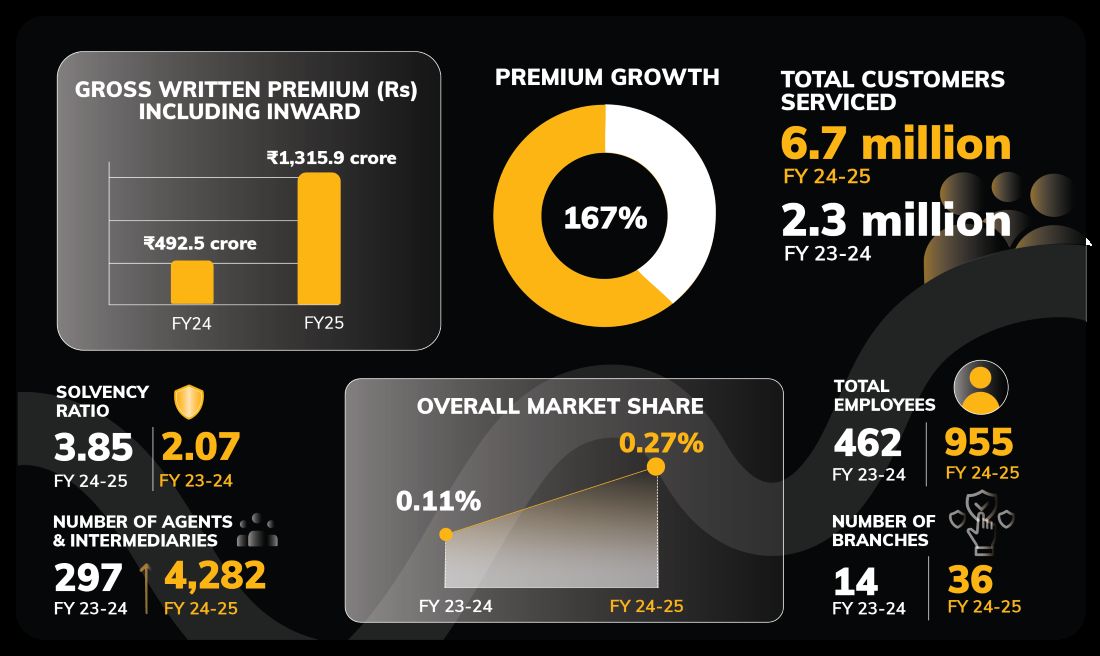

Digit Life Insurance Shows Strong FY'25 Growth Over FY'24

- Our gross written direct premium increased to ₹1,069.4 crore YoY from ₹426.4 crore.

- The company’s total gross written premium (including reinsurance inward) grew 167%

- YoY to ₹1,315.9 crore from ₹492.5 crore in the year-ago period, serving 6.7 million customers.

- We now have close to 1,000 Simplifiers (employees) and over 4,200 agents and intermediaries.

- Our Solvency Ratio has also improved from 2.07 to 3.85, showing our strong financial stability.

How Efficiently Digit Life Insurance Settles Claims?

At Digit Life Insurance, settling claims quickly and fairly is not just a goal—it’s a commitment. To ensure our customers and their families are supported when they need us most, we focus on two key things: speed and transparency.

1. End-to-End Turnaround Time (TAT)

- This is the total time taken, from the day we first get the death claim to the day we complete it.

- How is It Calculated: We subtract the date the claim was registered from the date it was closed.

- End-to-End TAT = Claim Closing Date – Claim Registration Date.

2. Last Document Received (LDR) TAT

- Sometimes, claims take time because we’re waiting for all the required documents. This number indicates how quickly we process a claim once we receive the final document from the claimant.

- How is It Calculated: We subtract the date we received the last required document from the claim closing date.

- LDR TAT = Claim Closing Date – Date Last Document Received

99.53% Claim Settlement Ratio For Digit’s Life Insurance in FY 2024-25

When life takes an unexpected turn, every second matters. With a 99.53% Claim Settlement Ratio (CSR), Digit Life Insurance stands as a pillar of trust and reliability. This isn’t just a statistic; it’s a promise to our policyholders.

Every claim tells a story. Whether it was a salaried parent overcoming loss, a child’s future hanging in the balance, or a spouse seeking stability, we acted fast to bring peace of mind to grieving families.

That’s why we are committed to settling genuine claims swiftly, transparently, and with compassion, ensuring that your loved ones receive the support they need when it matters most.

₹2.88 Billion Worth Claims Paid in FY 2024-25

At Digit, we don’t just talk about protecting families; we actually do it. In the last financial year, we paid ₹2.88 billion to families who lost a loved one. That’s a big jump from ₹351.52 million a few years ago, showing how much we have grown and how seriously we take our promise.

Every payout represents a family supported, a future safeguarded, and a promise fulfilled. We make sure claims are settled quickly and clearly, with zero confusion, so families don’t have to worry during tough times.

15,000+ Claims Settled in FY 2024-25

Solvency Ratio for Digit's Life Insurance in FY 2024-25 is 3.85

At Digit, being financially strong isn’t just a goal; it’s how we earn your trust. Our solvency ratio has grown from 2.07 to 3.85, which means we are more than ready to keep every promise we make.

This number shows we have more than enough funds to pay claims and support families, even in tough times. In fact, our ratio is nearly double the required limit, giving you extra peace of mind.

Because when you choose life insurance, you are not just buying protection; you are trusting us with your family’s future. And we take that seriously.

Interesting Digit Life Stories and Milestones from FY’25

240

208

Become an Agent with Digit Life Today

Become an Agent with Digit Life Today

Tools & Calculators to Simplify Your Life!