What is a 1 Crore Term Insurance?

A ₹1 Crore Term Insurance plan is a type of life insurance policy where the insurer promises to pay your nominee a lump sum of ₹1 crore if you, the policyholder, pass away during the policy term. It is a pure protection plan, meaning it offers no maturity or survival benefits; its sole purpose is to provide financial security to your family in case of your untimely death.

Since term insurance is a no-frills product, the premiums are quite affordable, making it one of the most cost-effective ways to secure a large cover. For instance, a healthy 30-year-old non-smoker can get a ₹1 crore cover for as low as ₹500 - ₹600 per month. You can also enhance the policy by adding riders like critical illness, accidental death, or waiver of premium benefits.

1 Crore Term Insurance Plan Overview

Why You Need a ₹1 Crore Term Insurance Plan?

High Coverage at Affordable Premiums

A sum assured of 1 Crore offers substantial financial security to your family at a relatively low cost. Term plans are typically more affordable than other types of life insurance.

Financial Security for Family

Ensures that your family can maintain their standard of living and cover major expenses like mortgages, education, and daily living costs in your absence.

Tax Benefits

Premiums paid for the policy are eligible for tax deductions under Section 80C of the Income Tax Act. The death benefit received by the nominee is also tax-free under Section 10(10D).

Flexibility

Many insurers offer flexible premium payment options (annual, semi-annual, quarterly, or monthly) and policy terms. Some plans also allow you to increase coverage at major life stages (marriage, childbirth).

Customisable Add-ons

You can add optional riders, such as critical illness cover, accidental death benefit, and premium waiver, to enhance the coverage of your term insurance plan.

Loan Protection

The sum assured can be used to pay off outstanding loans, ensuring that your family is not burdened with debt in your absence.

Illustration of 1 Crore Term Insurance

Understand the Scenarios of 1 Crore Term Insurance

Death During the Policy Term

Outliving the Policy Term

Is a 1 Crore Term Insurance Plan Enough for You?

Factors for Evaluating Required Sum Assured of Term Insurance Plan

A correct evaluation of the required sum assured involves many factors:

- Family income

- Expenses

- Future goals

- Inflation

- Loans and liabilities

- Regularly increasing financial requirements of your family.

A more accurate assessment can be done using the human life value calculator, which considers all the above factors.

Consider the scenarios below to understand if a 1 Crore term plan is enough.

Case Studies for Evaluation of Required Sum Assured of Term Plan

Mr. Aryan

Aryan, a 26-year-old professional, had retired parents as dependents and an annual income of ₹10 lakhs. He planned to marry soon and buy a house afterwards. Foreseeing future responsibilities, he bought a 1 crore term plan with a tenure of 20 years as a financial cushion for his dependents.

At the age of 42, Aryan suffered a cardiac arrest. He had a dependent wife, two kids, an outstanding home loan of ₹40,00,000, and dependent parents. Considering these liabilities and future significant expenses like the kids’ higher education, the sum of ₹1 crore was insufficient. Aryan should have reevaluated his coverage once his responsibilities increased.

Mr. Rohan

Rohan, a 30-year-old professional, had retired parents dependent on him. He was married and owned a family house. At that time, his annual income was ₹15 lakhs. He decided to purchase a 25-year term plan worth 1 crore.

At the age of 40, Rohan passed away due to an accident. He had dependent parents and a 6-year-old daughter. However, his wife was earning, and he had no significant liabilities, like a home loan. His daughter’s education was one significant expense that needed to be taken care of. Rohan also had considerable savings since he was an active investor in different investment instruments. Given his fewer liabilities and more assets, a term plan of ₹1 crore might be sufficient.

Who Should Buy a 1 Crore Term Insurance Plan?

Young Earners

Youngsters who have just started earning and are responsible for dependents should consider a 1 Crore term plan to provide a substantial financial cushion for their loved ones in the event of their demise.

Small Business Owners

If you are into business, most of the expenses are on credit, and at any given time, you might find yourself under a certain debt. If it is a small business, 1 Crore Term Insurance plan might suffice to take care of these debts in case of your untimely demise and make sure that your family does not have to deal with this pressure of debts at a time when they are dealing with a personal loss.

Married Couples

When you get married, there are increased responsibilities. Even when your spouse is earning, your expenses and liabilities are directly proportional to the sum of both incomes. In such a case, a term plan ensures that your spouse does not struggle with finances, even in your absence.

Young Parents

Young parents must buy a term plan of at least 1 crore to secure their child's future. This will ensure that your child's education and other needs do not go for a toss if you are not there with them.

Individuals with Home Loans

If you have taken a home loan and are paying off the EMIs, that loan can burden your family in case of your unfortunate demise. These days, in any city, a decent home costs at least 1 Crore. Hence, make sure to buy a Term Plan for 1 crore dedicated to safeguarding your home.

Individuals with Education Loans

If you have taken out an education loan, your family may face the challenge of repaying it if something happens to you unexpectedly. A term insurance policy of 1 crore can offer significant protection, assisting in settling the remaining education loan and easing your family's financial burden.

Individuals with Dependent Parents

In cases where parents do not receive a pension and are dependent on their sole earning child, Term Plan should be purchased as it would save the parents from any financial turmoil in case of any unfortunate death of their earning child. The insurance cover would take care of their liabilities and regular expenses.

Senior Investors

Senior people, especially those nearing retirement whose major life goals like house purchase and kids’ education are over, can look at buying a 1 Crore coverage. This will provide financial protection to their dependent spouse and others in case of their unfortunate demise and take care of any pending milestones like their children’s marriage.

Why Choose Digit Life Insurance?

- Transparency Policy wording: No hidden clauses. No jargon. Just clear terms and real coverage. What you see in your policy is exactly what you get, so there’s no second-guessing when it counts.

- Quick Online Processes: From policy purchase to claim filing, everything happens online; no paperwork, no running around. You get a smooth, fast process backed by human support when you need it.

- Worldwide Claim Support: Your family can still claim online if something happens to you outside India, without running around with fast claim process and support across time zones. T&C*.

- Eligible for NRIs of Indian Origin: NRIs of Indian origin can buy a plan while in India and manage it from anywhere. Premiums can be paid through NRE/NRO accounts, and coverage remains valid globally.

How to Choose the Right Term Plan?

Choosing the proper term insurance plan involves assessing your needs, understanding the features and options available, and comparing policies to find the best fit. Here are the steps to help you choose the correct term plan:

1. Decide a Sum Assured that is Sufficient for you

We all have our long-term goals, lifestyle requirements and other financial needs. While deciding on coverage, ensure all your financial requirements are met. Additionally, it is enough to take care of all your liabilities and other expenses in case of your untimely demise.

2. Compare the Premium Rates

Choose a plan that has the most competitive premium rates. Make sure to compare the plans and choose the one that best meets your requirements at the most affordable rates.

3. Check for the Exclusions and Inclusions

Another critical point to check in an insurance plan is the inclusions and exclusions. Check this list thoroughly so that when there is a need, you do not get surprised that your insurance provider does not cover the specific condition.

4. Check for the Benefits and Riders

Check the plan entirely for all the benefits that it provides. Riders are an essential component because they increase the total coverage of your plan and cover specific conditions like critical illness, accidental death, and terminal illness.

Check your plan for all the rider options it provides, and pick the one most suited to your needs.

5. Check the Claim Settlement Ratio of the Insurance Provider

Claim Settlement Ratio reflects a company's credibility, and it indicates how quickly your dependents would receive the death benefit in case of your unfortunate demise. The higher the ratio, the more credible your insurer is.

Hence, you must check the claim settlement ratio of the insurance provider before opting for a term insurance plan from them.

Things to Consider When Choosing a 1 Crore Term Insurance Plan

Policy Term

Choose a policy term that covers your working years or until your primary financial responsibilities are over.

Premium Payment Term

Decide on a premium payment term that aligns with your financial planning (regular, limited, single pay).

Claim Settlement Ratio

Check the insurer's claim settlement ratio to ensure a reliable and prompt claim settlement process.

Inflation

Consider the impact of inflation on the coverage amount. You might need a higher sum assured to match future financial needs.

Health and Lifestyle

Be transparent about your health and lifestyle during application to avoid claim rejections later.

Comparing Plans

Compare different plans from various insurers based on premiums, coverage, add-ons, and customer reviews.

Documents Required to Buy a 1 Crore Term Insurance Plan

To purchase a term insurance plan, applicants are required to submit the documents listed below:

Identity & Address Proof

Income Proof

Age Proof

Medical

Other Documents

Eligibility Criteria for a 1 Crore Term Insurance

How to Buy Term Insurance Policy Online?

The five easy steps to buy term life insurance plans are as follows:

Visit Digit Website/App

Visit the official Digit Life Insurance website or app and compare the types of life insurance policy options and fill in your personal information.

Coverage & Payment

Now it’s time to choose your ideal coverage, premium payment methods, and any additional benefits you want!

Payment & KYC

Complete your payment, and then finish the KYC process and fill in your nominee details.

Access Documents

Congratulations! Your policy documents will be sent to your email and WhatsApp. You can also access it 24/7 on the Digit App.

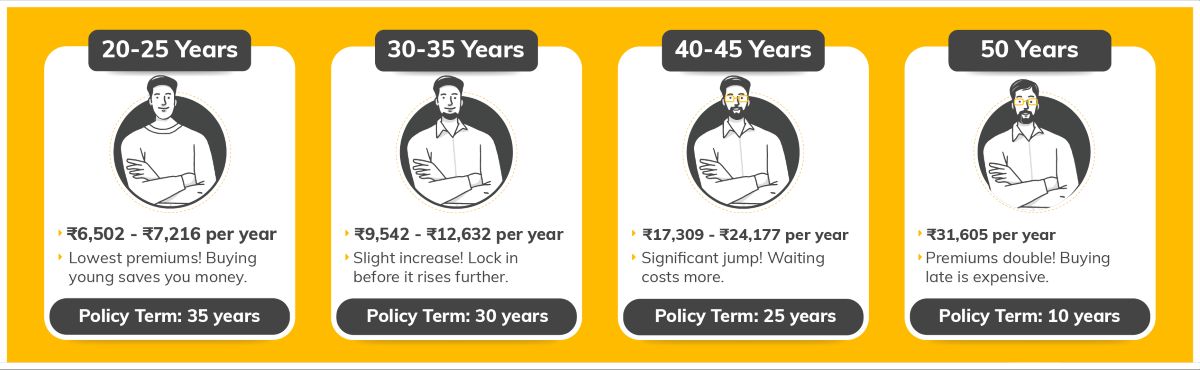

Rise in Premiums of ₹1 Crore Term Insurance with Age

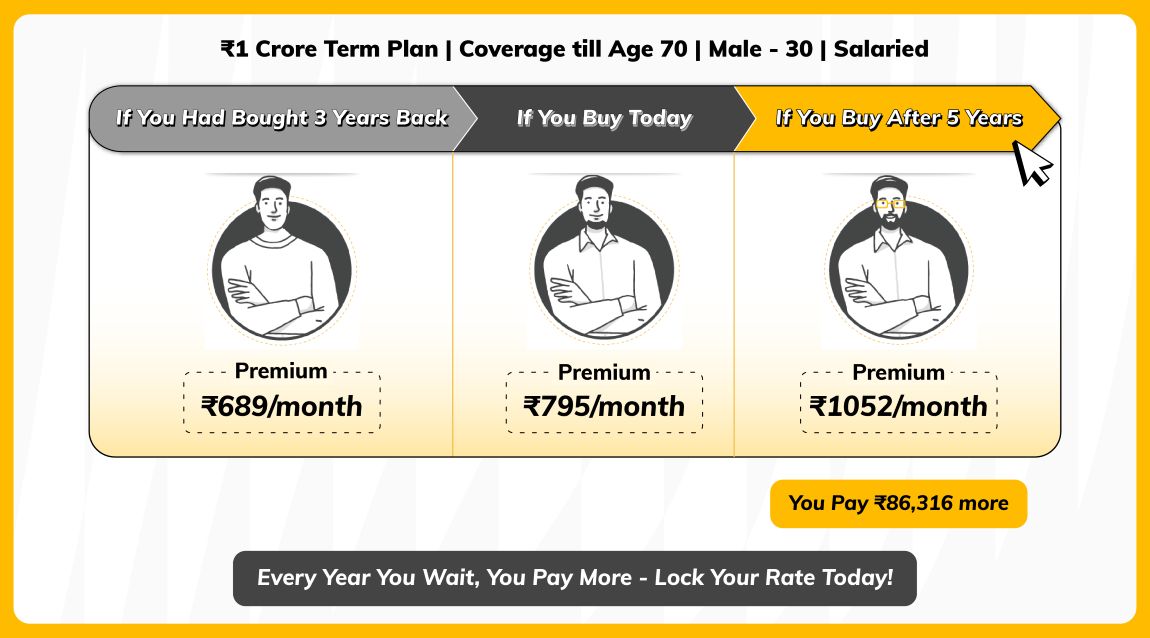

The longer you wait to buy term insurance, the higher your premium becomes.

For example, a 30-year-old salaried male can get a ₹1 Crore term plan coverage till age 70 for just ₹795/month today. If he had bought it 3 years ago, the premium would have been ₹689/month.

But if he waits 5 more years, the premium will rise to ₹1,052/month. That’s an extra ₹86,316 paid over the policy term, for the same coverage.

So purchasing term insurance at a younger age helps lock in lower premiums and ensures long-term savings.

How to File Term Insurance Claim with Digit?

Filing a Claim for your Digit Term Insurance can feel overwhelming during challenging times, but understanding the step-by-step process can help ensure ones receive the financial support one needs promptly and efficiently:

Inform Digit Immediately

Notify us about the occurrence of the claim event as soon as possible. You can do this by contacting via helpline at 1800-296-2626 or emailing lifeclaims@godigit.com.

Submit Required Documents

Provide necessary documents such as death certificate, policy document, valid ID proof of the nominee and claim form duly filled and signed.

Receive Claim Acknowledgment

After submitting the documents, you will receive an auto-generated ticket number for your claim.

Claim Settlement

Digit will verify the documents and assess the claim. Once the claim is approved, you will receive updates via SMS, email, or through the app, and the company will process the payout to the beneficiary's account.

Common Reasons for 1 Crore Term Insurance Claim Rejection

Certain factors can lead to claim rejection under a ₹1 Crore term insurance plan. Knowing these can help you prepare and address any issues before applying:

- Suicide Clause: Most insurance policies include a suicide clause, stating that if the policyholder commits suicide within the first one or two years, the claim won’t be paid. If the insurer suspects the application is an attempt to exploit this, they might reject it.

- Participation in Hazardous Activities: If you participate in high-risk activities like skydiving, scuba diving, or motor racing, insurers may either reject your application or charge you higher premiums due to the increased risk.

- Self-Inflicted Injuries: Policies often exclude coverage for death due to self-inflicted injuries. If there's evidence that the applicant has a history of self-harm or attempted suicide, the insurer may deny coverage.

- Criminal Activities: Death resulting from criminal activities is usually not covered. If you have a criminal record, insurers may reject your application to reduce their risk.

- Substance Abuse: Abusing alcohol, drugs, or other substances increases health risks and the chance of premature death. Insurers may deny coverage if you have a history of substance abuse.

- Pre-existing Medical Conditions: Severe or multiple pre-existing conditions like diabetes, heart disease, or cancer make you a higher risk for insurers. They might reject your application or offer coverage with exclusions and higher premiums.

- War and Terrorism: If your profession or location is at high risk for war or terrorism, the insurer may deny coverage to avoid large potential claims.

- Non-Commercial Aviation: Engaging in aviation activities, like being a pilot or frequently flying in non-commercial aircraft, increases the risk of accidents. Insurers may reject your application or raise premiums if you’re involved in such activities.

Tax Benefits for 1 Crore Term Insurance Policies

If you have a term insurance policy worth 1 Crore in India, you can get several tax benefits under the Income Tax Act 1961. Here's a simple breakdown of the main benefits:

1. Section 80C: Premium Payments

Under Section 80C, you can claim a tax deduction for your term insurance policy premium, up to 1.5 lakh INR annually. This deduction is available to individuals and Hindu Undivided Families (HUFs).

Who Can Qualify?

If your policy was issued on or after April 1, 2012, your premium should not be more than 10% of the sum assured. The premium should not exceed 20% of the sum assured for policies issued before that date.

2. Section 10(10D): Maturity Benefits

Under Section 10(10D), the money you receive from your term insurance policy, including the death benefit, is completely tax-free.

- Conditions: For policies issued on or after April 1, 2012, the premium must not exceed 10% of the sum assured. The premium must not exceed 20% of the sum assured for older policies.

- TDS: If your policy doesn’t meet these conditions, a 5% tax will be deducted at the source if the payout exceeds 1 lakh INR in a financial year.

3. Section 80D: Health Riders

Under Section 80D, if your term insurance policy includes extra health-related coverage like critical illness or accidental death, you can claim an additional tax deduction for the premium paid for these riders.

How Much Can You Deduct?

If you are under 60, you can claim up to 25,000 INR. If you are a senior citizen, you can claim up to 50,000 INR. This deduction is separate from the 1.5 lakh INR limit under Section 80C.

FAQs about 1 Crore Term Insurance Plan

What will be my premium for a 1 crore term insurance plan?

Should I buy a 1 crore term insurance plan or an endowment plan?

What is the minimum income requirement to purchase term insurance of ₹1 crore?

What are the eligibility criteria for buying the best term insurance plan for ₹1 crore?

When should I buy the best term insurance plan for 1 crore?

How do I buy a 1 crore term insurance plan online?

What is the minimum age to purchase a 1 crore term insurance plan?

What are the riders benefits available on a 1 crore term insurance plan?

What happens to a 1 crore term plan on maturity?

How does the critical illness rider impact the overall premium and claim settlement process for a 1 crore term insurance plan?

What are the specific tax implications of a 1 crore term insurance plan?

How do insurers assess the risk profile for individuals seeking a 1 crore term insurance plan?

How does the Human Life Value (HLV) concept influence the decision to opt for a 1 crore term insurance plan?

What are the key factors when comparing different 1 crore term insurance plans?

Should I buy health insurance or term insurance?

Both. You should have both health insurance and term insurance for comprehensive financial protection. Term insurance protects your family after you, while health insurance protects you and your family while you're alive.

However, if your goal is to protect your family’s financial future in case something happens to you, then term insurance is essential. And if your concern is managing medical expenses during your lifetime, such as hospital bills, surgeries, or treatments, then health insurance is what you need.

Other Important Articles Related to Term Insurance