Accessibility Options

General

General Products

Simple & Transparent! Policies that match all your insurance needs.

37K+ Reviews

7K+ Reviews

Scan to download

Life

Life Products

Digit Life is here! To help you save & secure your loved ones' future in the most simplified way.

37K+ Reviews

7K+ Reviews

Scan to download

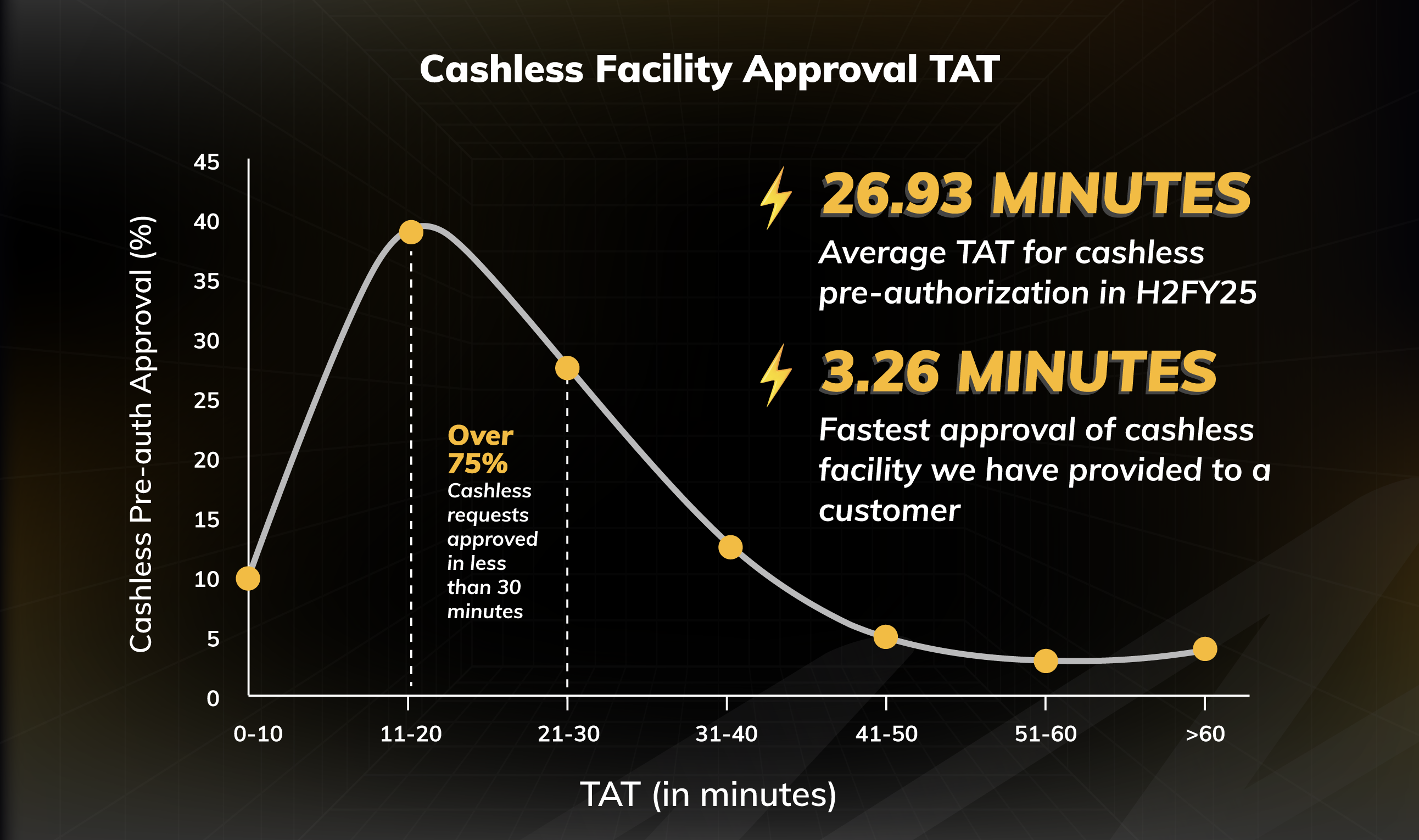

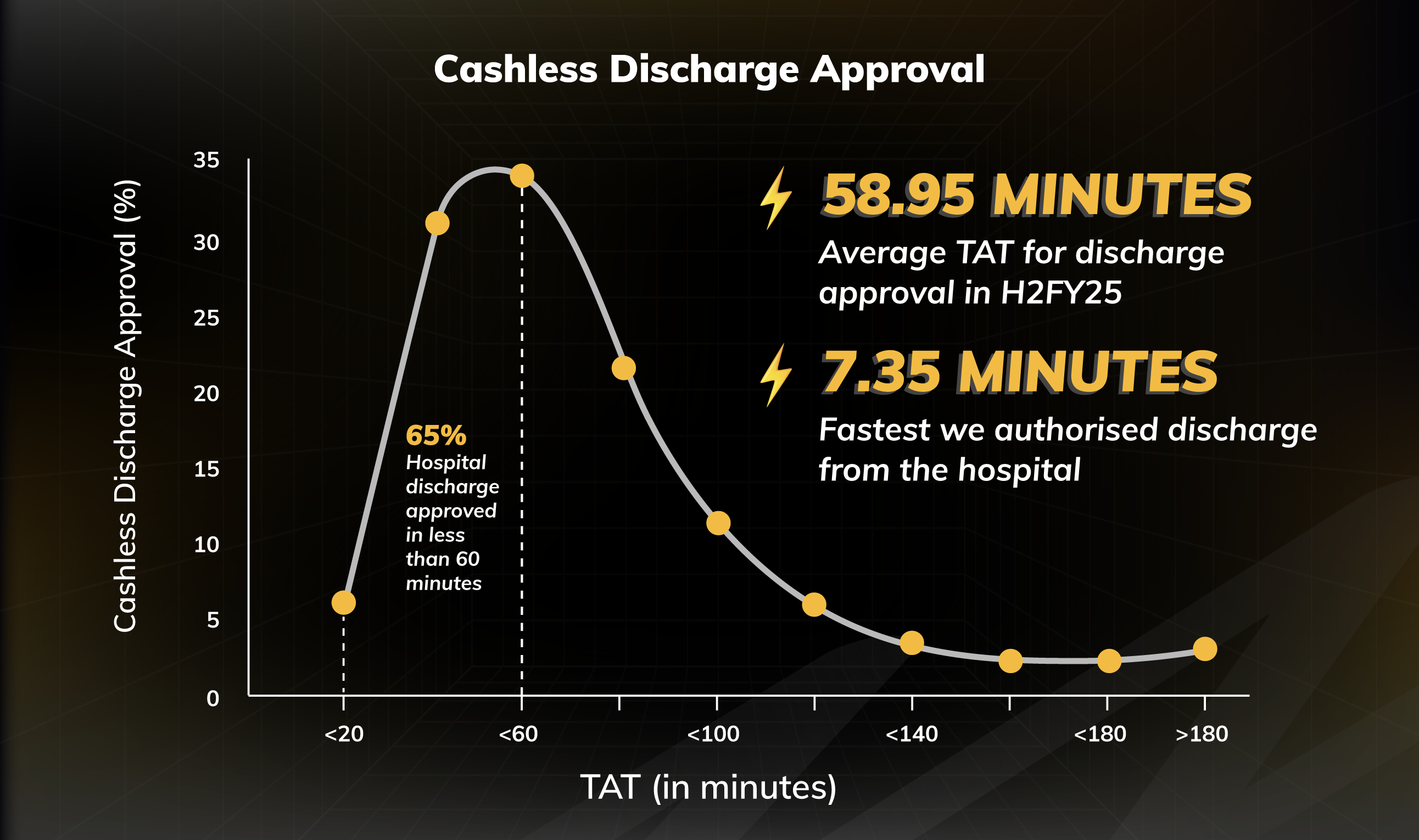

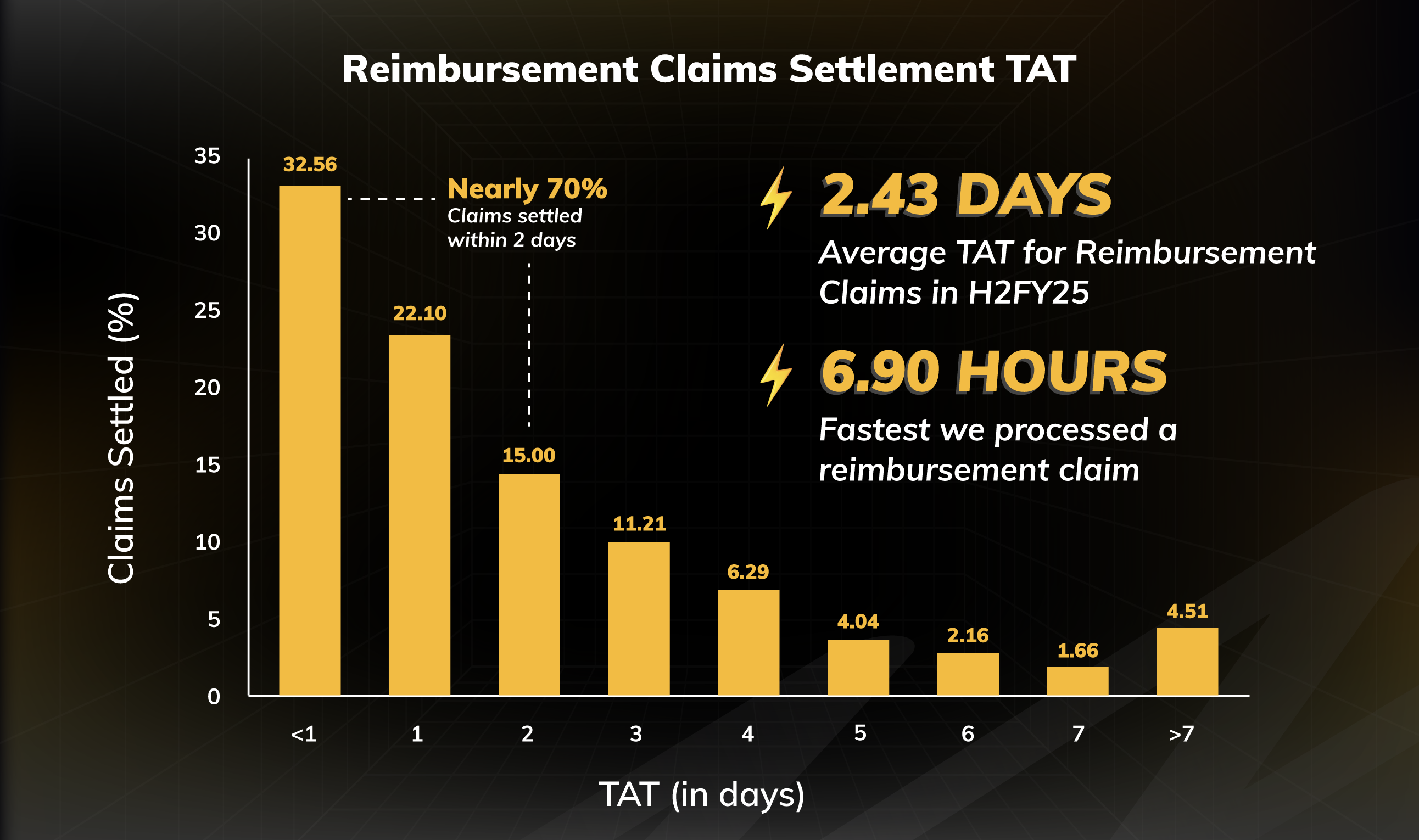

Claims

Claims

We'll be there! Whenever and however you'll need us.

37K+ Reviews

7K+ Reviews

Scan to download

Renewals

Resources

Resources

All the more reasons to feel the Digit simplicity in your life!

37K+ Reviews

7K+ Reviews

Scan to download

37K+ Reviews

7K+ Reviews

Select Preferred Language

Our WhatsApp number cannot be used for calls. This is a chat only number.

Enter your Mobile Number to get Download Link on WhatsApp.

You can also Scan this QR Code and Download the App.