Buy Health Insurance, Up to 20% Discount

9000+

Cashless Hospitals

2.5 Crore+

Lives Insured

4.5 Lacs+

Claims Settled

I agree to the Terms & Conditions

Get Exclusive Porting Benefits

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

9000+

Cashless Hospitals

2.5 Crore+

Lives Insured

4.5 Lacs+

Claims Settled

What is Domiciliary Hospitalization in Health Insurance Plan?

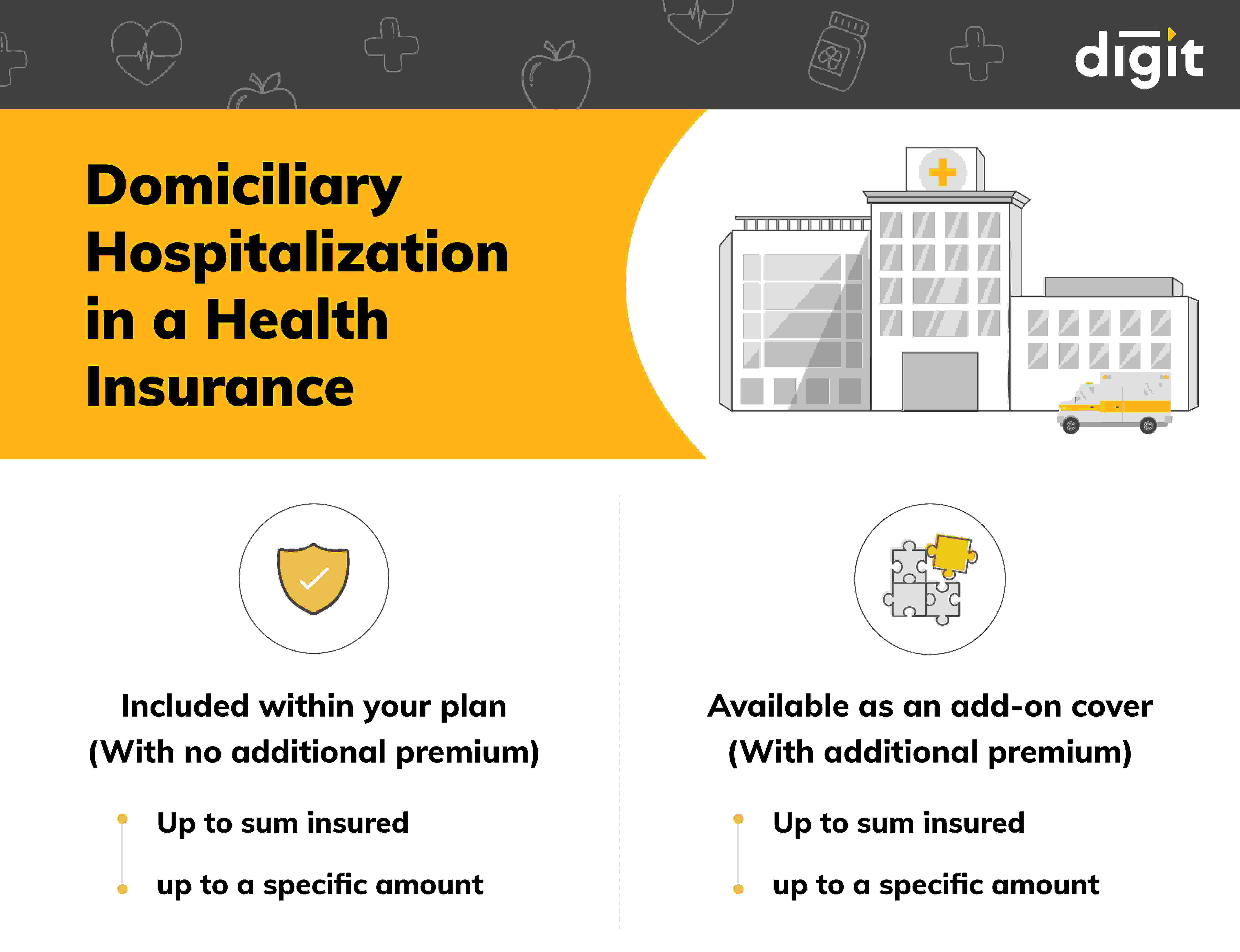

Domiciliary Hospitalization, also commonly known as Home Hospitalization is when you are undergoing treatment for a specific illness or disease, but at home instead of the hospital.

This usually happens if one cannot be moved to the hospital, or when there is no hospital bed available. All medical expenses in this case are covered by your health insurer, as long as it’s a benefit included in your health insurance policy or that you've opted for domiciliary hospitalization as an add-on cover.

What Type of Coverage is Included for Domiciliary Hospitalization?

What are the Benefits of Domiciliary Hospitalization?

What is covered in Domiciliary Hospitalization with Digit’s Health Insurance?

At Digit, Domiciliary Hospitalization is included as a benefit for all health insurance plans bought for seniors. Here is what it covers specifically:

- All medical expenses due to the treatment of an injury or illness done at home, which would have otherwise required hospitalization.

Conditions Under which one can avail for Domiciliary Hospitalization with Digit’s Health Insurance for Seniors

Transparency is one of the values we live by 😊 Hence, we would like you to know beforehand the conditions under which domiciliary hospitalization will be covered:

- If the condition of the patient is such that he/she cannot be moved into a hospital or, that there are no hospital beds available.

- If the medical treatment required continues for least 3-days.

What is not covered in Domiciliary Hospitalization with Digit’s Health Insurance?

Claims are not covered for home treatments due to the following:

- Asthma

- Bronchitis

- Tonsillitis

- Upper Respiratory Tract Infection including Laryngitis and Pharyngitis

- Cough and Cold

- Influenza

- Arthritis

- Gout and Rheumatism

- Chronic Nephritis

- Nephritic Syndrome

- Diarrhea

- All types of Dysenteries including Gastroenteritis, Diabetes Mellitus and Insipidus, Epilepsy, Hypertension, Psychiatric or Psychosomatic Disorders of all kinds, Pyrexia of unknown origin.