What is High Security Number Plate (HSRP), Price & How to Apply Online?

Recently the Ministry of Road Transport and Highways (MoRTH) and Delhi Transport Department made it mandatory for all vehicles to get a high security registration plate (HSRP) fixed along with a colour-coded plate for vehicles which were sold before April 2019.

Not getting an HSRP number plate will cost you a fine of Rs. 5000 to Rs. 10000. In this post, we will give you all the information you need about HSRP.

What is an HSRP?

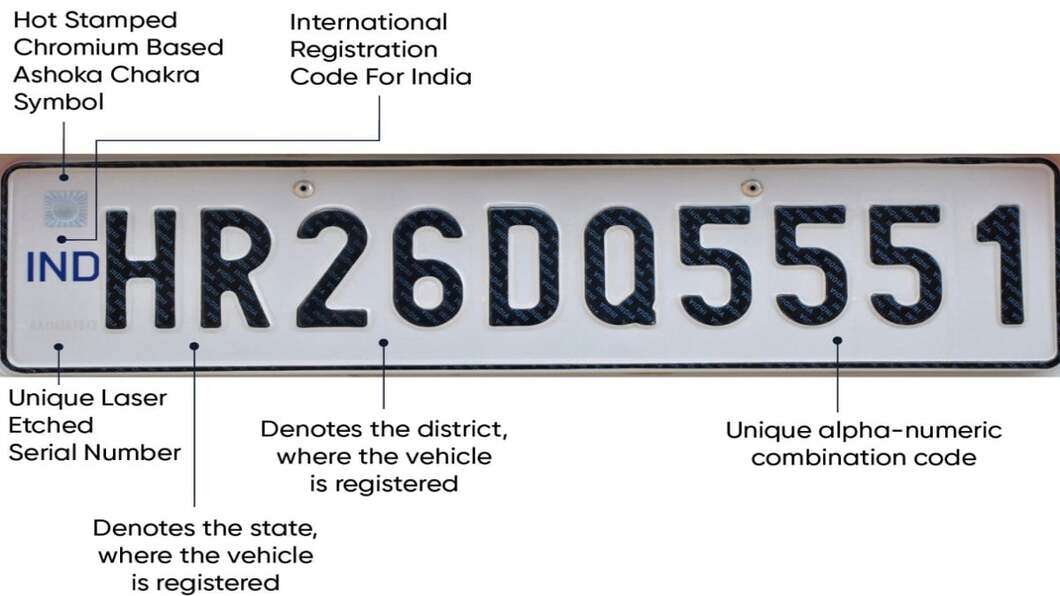

High security number plates are number plates made of aluminium and are fixed onto the vehicle using a minimum of two non-reusable snap-on locks. The plate has a hot-stamped chromium-based 20 mm X 20 mm hologram of Ashoka Chakra in blue colour on the top left corner. A 10-digit permanent identification number (PIN) is laser branded on the bottom left corner of this plate.

HSRP also has a hot-stamped film applied on the numerals and alphabets, which has ‘INDIA’ inscribed at a 45-degree angle. The alphabets and the numerical, written with hot-stamped film denote the state code, district or RTO code and car’s unique alpha-numeric identification number.This plate is also electronically linked to the vehicle where it is installed.

Who needs HSRP?

Now that you know what is HSRP for vehicles, you must understand who needs the same. All vehicle owners must get an HSRP fixed before July 2022. Number plates sold after 2019 are already HSRP, so people who bought a number plate before 2019 need to get it changed.

What are the benefits of HSRP number plates?

Getting an HSRP has been mandated. Even so, here are HSRP number plate benefits-

- The number plates available before April 2019 were easy to tamper with and could be removed and changed easily. This aided a rise in theft. Thieves replace registration numbers installed after stealing it, making it nearly impossible for the authorities to track the vehicle. HSRP number plates come with a non-removable snap-on lock that is non-reusable and cannot be replaced.

- HSRP’s are installed by select registered automobile dealers and private vendors which are approved by the state authorities. These plates are issued only when a vehicle owner provides information like engine number, chassis number, etc. By streamlining these authorized number plate installations, chances of counterfeits of these high security registration plates become impossible.

- Getting an HSRP also helps accumulate crucial information on car details, like engine number, chassis number, etc., and store it in a central database. This information with your vehicle’s pin helps the authorities to track down your vehicle easily.

- Previously installed number plates used to come with different fonts and styles customized by the vehicle owners. This made it difficult for traffic police personnel to read the vehicle's registration number, especially if it was moving. With HSRP, registration plates will have unified fonts and styles, making them better comprehensible.

How to apply for high security number plate

Vehicle owners in Delhi and Uttar Pradesh can purchase HSRP through a government-authorized portal bookmyhsrp.com. You can also buy these number plates offline from RTO’s and authorized automobile dealers.

Steps to apply for high security number plate online

If you are wondering how to apply high security number plate online, the following is the procedure for high security number plate registration -

Step 1: Visit the government authorized registration portal bookmyhsrp.com

Step 2: Fill in all the required details like vehicle number, chassis number, engine number, address, contact number, fuel type, etc.

Step 3: If the vehicle is for private use, click on ‘non-transport’ under the vehicle class option displayed on the screen.

Step 4: Submit this form and you will receive a username and password on your registered mobile number.

Step 5: Login using the given username and password to make a payment. A payment receipt shall be generated.

Step 6: As soon as your vehicle’s HSRP number is ready, you will receive a notification about the same on your registered mobile number.

HSRP charges

The Central Government has not capped the HSRP number plate price yet, so this implies that HSRP number plate cost can be different in different states. However, on average, the high security number plate charges for two-wheelers is around Rs. 400, which can exceed up to Rs.1,100 for four-wheelers based on the category where they belong. Getting a colour-coded sticker which is also a mandate, will cost you Rs 100. Knowing the cost of a high security number plate is crucial.

Apart from high security number plates cost, you must also assess how these are different from standard plates.

What are the differences between HSRP and a normal number plate?

Additionally, an HSRP number plate comes with several features which are missing in a normal number plate -

- The HSRP is strictly to be made of aluminium and comes with two non-reusable security locks which are tamper-proof. This means that once these locks are broken, you cannot reattach the number plate and need to purchase a new one from an authorized retailer only.

- The number plate also comes with a chromium-based Ashoka Chakra on the left.

- The PIN is laser encoded so it can be easily scanned and also makes it tamper-proof.

- The fonts and style are kept the same, unlike the previous number plates.

- The HSRP is also to be clubbed with a colour-coded sticker to denote the fuel type.

Protect What Matters - Explore Other Insurance Options