Digit Glow Plus Term Life Insurance

(A Non-Linked NonParticipating Individual Pure Risk Life Insurance Plan)

UIN: 165N007V02

Digit Glow Plus Term Life Insurance is a non-linked and non-participating pure risk plan that provides life insurance coverage to you for the chosen policy term and financially protects your family in your absence. It also offers an inbuilt accelerated terminal illness benefit on diagnosis of terminal illness.

Additionally, it offers a range of inbuilt optional benefits to provide financial protection against accidental death and total & permanent disability, providing a comprehensive protection solution.

Key Features of Digit Glow Plus Term Life Insurance Plan

Life Insurance Cover for the financial security of your family

Flexibility to choose from two plan variants based on your needs

Inbuilt Accelerated Terminal Illness Benefit with no additional premium

Inbuilt Waiver of Premium on diagnosis of Terminal Illness

Get all your Premiums back as Maturity Benefit with Term Insurance with Return of Premium variant

Option to defer the premium payment by up to 12 months with the Pay Later Option

Get back 100% of Premiums paid as Smart Exit Benefit on Early Exit, if you do not need Life Insurance Cover anymore

Special Premium Discount for Salaried persons in the first policy year

Lower Premium Rates for Women

Wellness Benefits to Life Assured

Enhance the financial protection against Accidental Death, Accidental Total and Permanent Disability through optional benefits.

Flexibility to pay premiums once, for a limited period or throughout the policy term

240

208

Who Can Apply and How Much Coverage Can You Get?

Digit Glow Plus Term Life Insurance – Choice of Two Variants

Digit Glow Plus Term Life Insurance offers the following two variants, and you can choose any one of them at inception as per your needs. Once selected, the variant cannot be changed later. The premium will vary depending on the variants chosen.

Illustration for Term Insurance

Illustration for Term Insurance with Return of Premium

How is the Death Benefit Calculated?

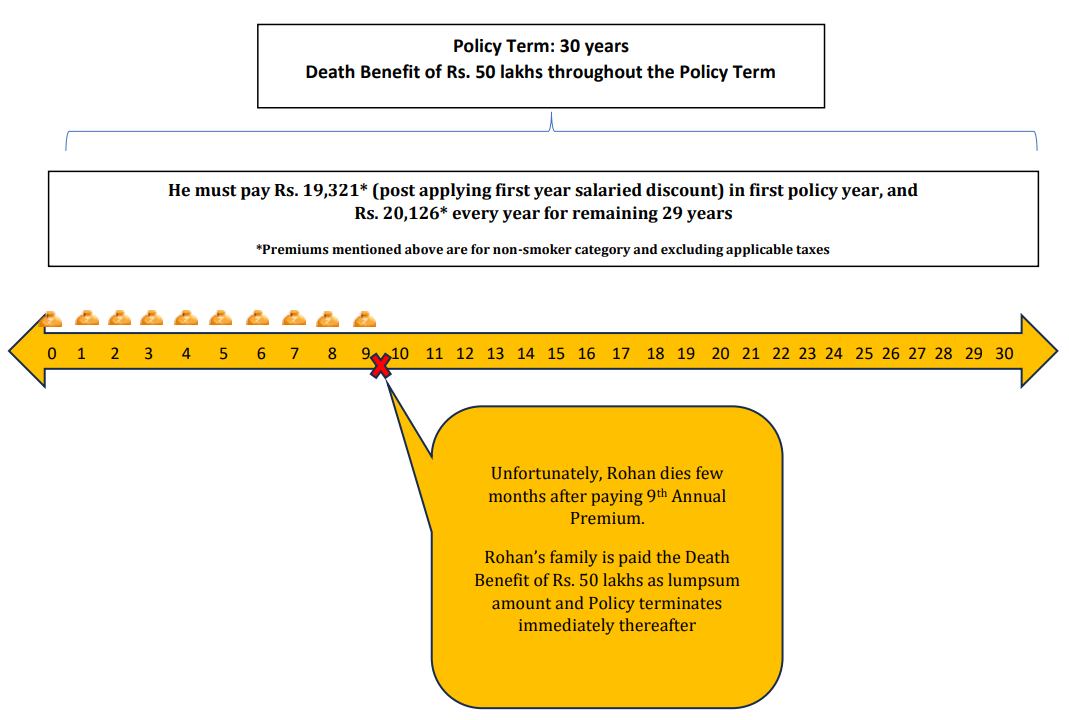

Digit Glow Plus Term Life Insurance provides a lump sum payout to your family if something happens to you during the policy term. This ensures they are financially protected in your absence. If you're diagnosed with a terminal illness during the policy term, the death benefit is paid early.

The amount paid depends on your premium payment type and will be the highest of the following:

For Single Premium (one-time payment):

- 1.25 times the single premium, or

- The sum assured on death

For Limited or Regular Premiums (paid over time):

- 105% of total premiums paid till date, or

- 10 times the annual premium, or

- The sum assured on death

Once the death benefit is paid, the policy ends and no further benefits are provided.

In-built Accelerated Terminal Illness Benefit

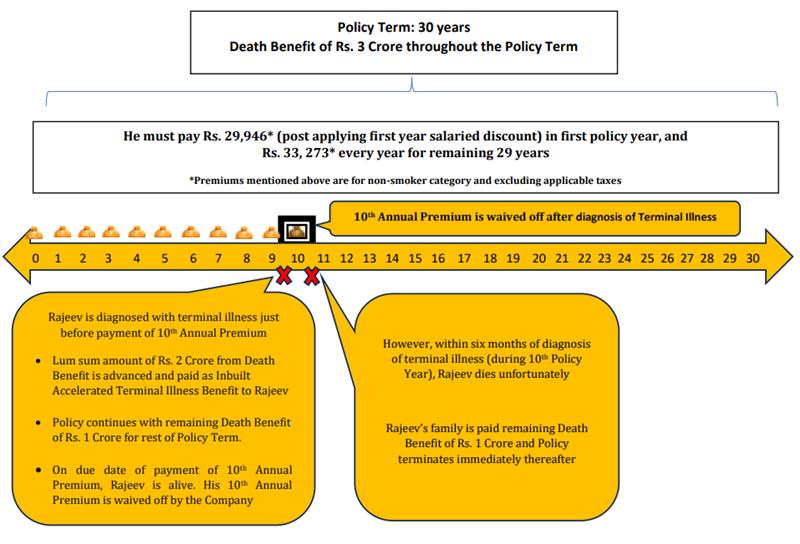

If the life assured is diagnosed with a terminal illness during the policy term (defined as an incurable condition expected to cause death within 6 months, and confirmed by two independent medical practitioners), Digit will accelerate a portion of the death benefit and pay it early.

The amount paid equals the policy death benefit or ₹2 crore, whichever is lower.

- If the death benefit ≤ ₹2 crore, the entire death benefit is paid, and the policy terminates.

- If the death benefit > ₹2 crore, up to ₹2 crore is paid now; the policy continues for the remaining death benefit and future premiums are waived from the date of diagnosis. Optional in-built benefits (ADB/ATPD) terminate when TI benefit is paid.

If Digit rejects the terminal-illness claim after assessment, regular cover continues (provided the policy is in force and premiums paid).

Optional Riders & Add-On Benefits (Non-POSP Only)

These are only available at inception, not for POS policies, and once chosen, cannot be changed.

Additional Accidental Death Benefit (ADB)

Suppose the policyholder dies due to an accident during the policy term, and the death happens within 180 days of the accident. In that case, an extra payout called the Accidental Death Benefit (ADB) is given in addition to the regular death benefit.

- The ADB amount can be up to 100% of the base sum assured.

- Once the ADB is paid, the policy ends.

- To qualify, the death must be directly caused by the accident, happen within 180 days, and not be excluded under the policy’s accident-related exclusions.

Additional Accidental Total & Permanent Disability (ATPD)

If the insured person becomes totally and permanently disabled due to an accident during the policy term, a lump-sum payout is made under the ATPD benefit. This amount can be up to 100% of the base sum assured, and is paid in addition to other benefits.

- The ATPD claim must be made within 180 days of the accident.

- Once the ATPD benefit is paid, that coverage ends, but the main life cover continues for the rest of the policy term.

This benefit has certain exclusions. If the disability is caused by any of the excluded conditions or situations, no payout will be made. It's important to carefully read the policy document to understand these exclusions before purchasing.

What Happens If You Survive the Buy Digit Glow Plus Term Life Insurance Period?

Case 1: If you choose a regular term insurance plan, there’s no payout if you survive the policy term; the coverage simply ends.

Case 2: If opted for the Term Insurance with Return of Premium (TROP) variant. You’ll receive a lump sum equal to all the premiums you paid (including any extra premiums due to underwriting) at the end of the policy term, except for the premiums paid for optional add-on benefits, which are not refunded.

Case 3: If you were diagnosed with a terminal illness during the policy term and received an accelerated payout, and your future premiums were waived, then your maturity benefit under TROP will include:

- All premiums paid before diagnosis

- All premiums that were waived after diagnosis (again, excluding premiums for optional benefits).

Policy Term and Premium Payment Options

Digit Glow Plus Term Life Insurance offers multiple combinations for how long you're covered and how you pay:

What Happens If You Miss Premium Payments?

Grace period

You get extra time to pay - 15 days for monthly payments, and 30 days for other modes. During this time, your coverage continues, but any unpaid premiums will be deducted from the benefit if a claim is made. This doesn’t apply to single-pay policies.

Lapsation

If you don’t pay within the grace period, your policy will lapse (only for regular or limited pay plans). A lapsed policy can be revived within a certain time, subject to conditions, but single-pay policies don’t lapse.

Reduced paid-up (only for TROP)

If your TROP policy has built up a surrender value and you stop paying premiums, it may become reduced paid-up. This means your benefits (death, terminal illness, maturity) will be lower and calculated based on how much premium you have paid compared to the total due. Details are in the policy brochure.

Revival

You can revive a lapsed policy within 5 years by paying the overdue premiums plus interest (currently 9% per year, subject to change). The insurer may ask for medical tests. If you don’t revive it, the outcome depends on your policy type and how many premiums you had paid before it lapsed.

Flexible Features of Digit Glow Plus Term Life Insurance

Smart Exit Benefit

Digit Glow Plus Term Life Insurance offers a built-in Smart Exit option for term plans. After completing 29 policy years (excluding the last 5 years), you can exit early and receive 100% of the premiums paid, including any underwriting extras. This benefit is available only if the policy is active, all premiums are paid, and no claims have been made.

Note: This feature is not available with the Return of Premium (TROP) variant.

Pay-Later Option

With the Pay-Later feature, you can pause your premium for up to 12 months without losing coverage or paying interest. During this 12-month break, your policy remains fully active with all benefits intact. Available for regular and limited pay plans after 3 full years of timely payments, this option keeps your policy active while giving you flexibility.

At the end of the Pay-Later period, you must pay:

- All missed premiums during the break, and

- The next scheduled premium

- If these are not paid within the grace period, the policy will lapse.

You can use it multiple times with a 5-year gap between each use. Not allowed during the last year of your premium payment term or in the previous 5 years for some plans. You must inform Digit 30 days in advance.

Extra Benefits Through Digit Glow Plus Term Insurance

Wellness Benefit

With your Digit Life Insurance, you also get exclusive access to a wide range of wellness perks, making taking care of yourself easier and more affordable.

- Doctor-on-Call

- Wellness Coach

- Lab Services and Imaging (For Diagnostic Services)

- Pharmacy (Home Delivery)

- Vital/Physical Activity Monitoring Services

- Reminder Notifications

- Medical Wallet

- Medical Report Aggregator

- Home Care Service

- Ambulance Arrangement Services

- Pick-up and Drop Services for Consultation

- Prioritising Appointments

- Mental wellbeing

- Physiotherapy

- Childcare/Children's activities

- Out-Patient (OPD) Services

- Fitness

Note: These services are not part of your insurance coverage. Usage is entirely optional and paid for by the user.

Salaried Customer Discount

Digit Glow Plus Term Life Insurance offers a special first-year premium discount for salaried individuals who choose a sum assured of ₹50 lakhs or more. Depending upon the premium payment option and sum assured on death bands, following premium discount percentage

Will be offered:

- Single Pay Option: Get a 1% discount on the premium.

- Limited & Regular Pay Options: Discount varies based on the sum assured -

This discount applies only to the base premium (excluding underwriting extra premiums and taxes). For optional inbuilt benefits, the discount is calculated based on the sum assured chosen for each benefit.

Terms & Conditions Applicable to Wellness Benefit Program

240

208

Suicide Clause in Digit Glow Plus Term Life Insurance

If the policyholder dies by suicide within 12 months from the start of the policy, or the revival of a lapsed policy, then the insurer will not pay the full death benefit. Instead, the nominee will receive the higher of the following two amounts:

- 80% of the total premiums paid (excluding taxes and rider charges), or

- Unexpired risk value (a calculated value based on the remaining coverage period and policy terms).

This clause is designed to discourage misuse of life insurance policies and protect the insurer from financial risk in cases of early suicide. If the death by suicide occurs after 12 months, the death benefit is typically payable, as per the policy terms.

Accidental Death & Disability Benefit Exclusions

No benefit will be paid under ADB or ATPD if the claim arises due to any of the following:

- Suicide or self-inflicted injuries

- Use of drugs or alcohol

- Involvement in war, rebellion, or civil unrest

- Criminal activities or breaking the law

- Flying in non-commercial aircraft (except as a fare-paying passenger)

- Adventure or extreme sports (e.g., skydiving, bungee jumping)

- Undisclosed pre-existing medical conditions

- Mental health or nervous system disorders

- Cosmetic, fertility, or experimental treatments

- Injuries caused by radiation or nuclear exposure

These exclusions ensure that the benefits are paid only for genuine accidental cases as defined in the policy.

Digit Glow Plus Term Insurance is a smart life cover plan that supports your family financially if you're not around. It offers early payout for terminal illness, optional accident benefits, and flexible premium payments. You can choose a plan that returns your premiums if you outlive the term. With features like Smart Exit and Pay-Later, it gives you control and value, making it a great choice for long-term financial protection.

Other Important Articles Related to Term Insurance