BEYOND STRUCTURES: CREATING AN ARCHITECTURE OF CARE

Featured 14th-November-2025

What does care look like when life takes an unexpected turn?

If we think about it, care is a framework that quietly holds everything together. Our lives rest on invisible assurances; the ones we rarely notice but always trust. They give us the courage to live boldly, knowing someone (or something) has our back.

But as life shifts, so do the roles. We move from being cared for to becoming the architects of care for

those we love. And that’s where the real questions begin:

How do you prepare for the unpredictable? How do you make sure your family’s dreams don’t collapse

when life throws a curveball?

The answer often starts with financial security as it’s the pillar that keeps our futures steady. It means facing a truth we’d rather avoid: our life has a financial value in our family’s tomorrow. It’s not easy to think about, but it’s essential.

That’s where life insurance steps in. It’s not a cold calculation, but a promise. A promise that helps us create this structure of care that says, “No matter what happens, they’ll be okay.”

At Digit Life Insurance, we take that promise seriously. Because when it comes to protecting futures, there’s no room for uncertainty. In this third edition of our Transparency Report, discover how we’re building trust, care, and empathy into every process to ensure your tomorrow stays as strong as your today.

CREATING SEAMLESS INSURANCE BUYING EXPERIENCE

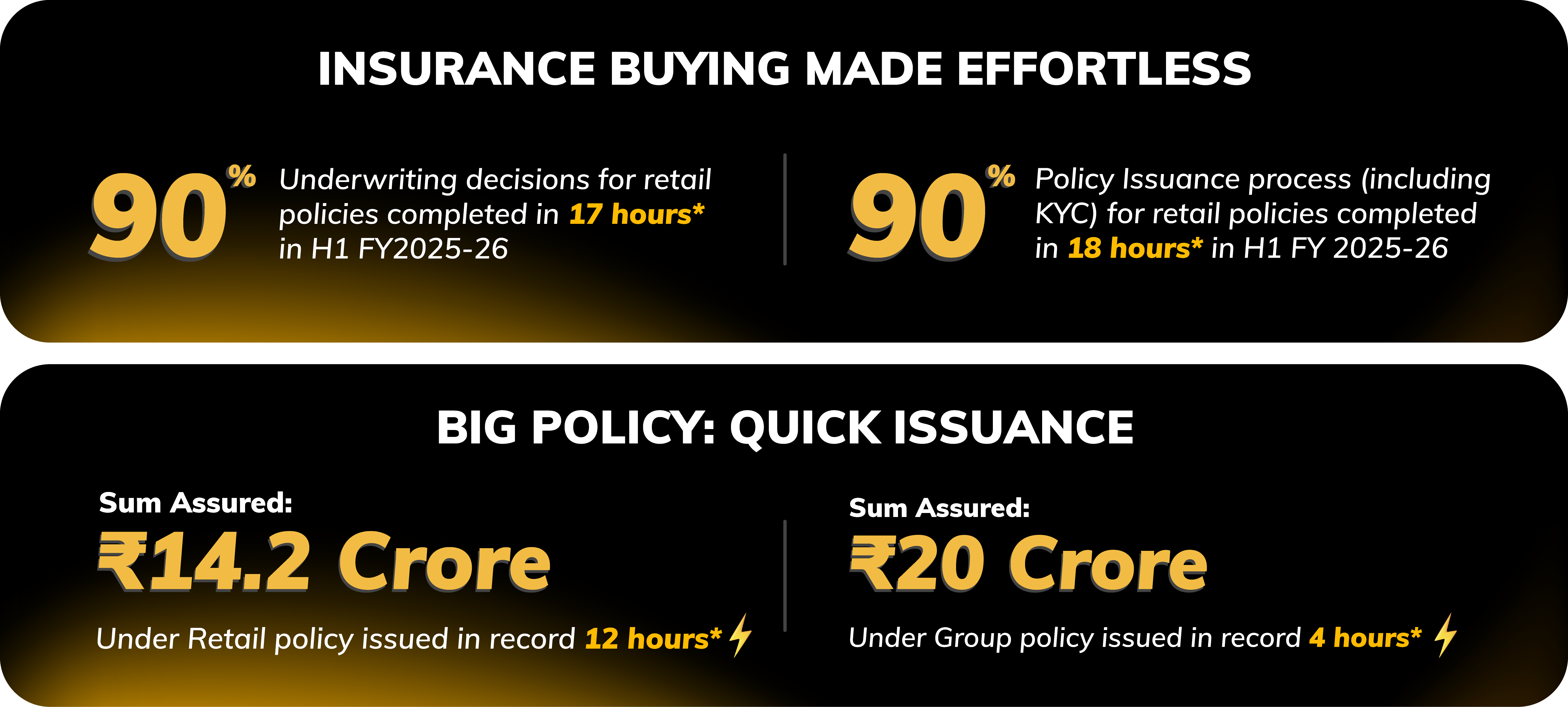

Unlike products you buy online, buying a life insurance product can be a slightly longer process. Insurers first receive a proposal basis which they underwrite the risk (like checking income, health conditions, etc), before issuing the policy to you. When buying a policy, you are also required to complete the mandatory KYC process to verify your identity. This can typically take multiple days. However, at Digit Life, we have made this process seamless to ensure your policy is issued as swiftly as possible.

*TAT for policy issuance/underwriting decision includes time taken to issue/decision the policy after collating all necessary documents.

Our care architecture is designed to eliminate friction and ensure your entire insurance buying process is quick and seamless. That’s why we ensure each step is completed as quickly as possible. In H1 FY25-26, 90% of our underwriting decisions were made in 17 hours and 90% of our KYC process and policy issuance was completed within 18 hours. No matter how big the policy size is, we try to ensure they, too, are issued swiftly. One of the biggest retail policy worth ₹14.2 crore was issued in just 12 hours, while our biggest member policy under group master policy worth ₹20 crore was issued in record 4 hours.

TURNING CARE INTO ACTION:

A COMPLETE PICTURE OF CLAIMS PAID

When families face loss, the architecture of care we’ve built is put to its ultimate test. Every pillar, every process, every system must work in perfect harmony to ensure claims are settled seamlessly. Because in one of the hardest moments a family goes through, time isn’t just money, it’s peace of mind.

Our philosophy is simple: just as we trust those who stand unwaveringly by us in our hardest times, we strive to be that steadfast pillar for every Digit Life policyholder: reliable, responsive, and rooted in care.

This is why we always want to show you where we stand when it comes to our commitment to the various claims we paid.

CLAIMS WE PAID IN H1 FY24-25 VS H1 FY25-26

| Category | Number of Claims paid (H1FY 24-25) | Number of Claims paid (H1FY 25-26) | Amount of Claims paid in H1FY 24-25 (in ₹) | Amount of Claims paid in H1FY 25-26 (in ₹) |

|---|---|---|---|---|

| Group Term LifeInsurance | 352 | 620 | ₹709.98 million | ₹1.27 billion |

| Group Long Term Plan | 73 | 337 | ₹16.8 million | ₹189.4 million |

| Group Micro Term Insurance | 3,826 | 11,421 | ₹197.7 million | ₹636.2 million |

| Total | 4,251 | 12,378 | ₹924.52 million | ₹2.09 billion |

Note: Claim numbers include all variants filed under different group product categories since inception.

In a span of just six months, we've already settled 12,378 claims, delivering critical financial support to families during their most challenging times. This commitment is rapidly scaling: the total amount paid in H1 FY25-26 reached ₹2.09 billion, marking a 126% increase over the previous half-year. This growth proves our pledge to be there when you need us most.

FAST TURNAROUNDS & BIG PAYOUTS:

H1FY26 CLAIM HIGHLIGHTS

When life takes an unexpected turn, every moment matters. That’s why the care framework we’ve built is designed to move without friction. As soon as we receive a claim, our systems work in sync, teams respond instantly, and our tech built in-house ensures nothing slows us down.

In the past six months, this architecture of care has enabled us to process and honor claims with remarkable speed and precision, so families can find stability when they need it most. Because for us, care isn’t just about paying the claim, it’s about being there without delay.

We believe our commitment must be measured by action. That’s why we are showing you how much time we take to settle our claims.

HOW EFFICIENTLY WE SETTLED CLAIMS

| Particular | H1FY 24-25 | H1FY 25-26 |

|---|---|---|

| Average claim settlement time for death claims(post completion of documentation) | 1.1 days | 1.6 days |

| Average TAT for death claims settlement(End to End) | 11 days | 5.3 days |

| Total Claims Settled within one month(ageing of claims) | 100% | 100% |

| Percentage of claims settled (Settlement Ratio)^ | 100% | 98.97% |

^Claim Settlement Ratio= (Claims paid + Claims closed)/ (Claims Opening + Claims reported - Claims closing); Percentage of Group claims settled (Settlement Ratio)

JARGON SIMPLIFIED

Average End-to-End TAT for death claims settlement is the average number of days it takes to process and approve a death claim, calculated from the initial registration date of the claim to the official decision date (claims closing date).

Claims Closing Date: Closing Date is the date on which the insurance company makes the final decision regarding a claim, whether to approve or reject the same and update the decision in the system.

In moments when families need us most, speed and reliability matter. In H1 FY25-26, our Claims Settlement Ratio stood strong at 98.97%. We processed death claims after documentation in just 1.6 days on average, and our end-to-end settlement time improved to 5.3 days, down from 11 days in H1 FY 24-25. What’s more? 100% of claims continued to be settled within one month, reflecting our commitment to act quickly and keeping our promise of care intact.

HIGHEST CLAIMS SETTLED IN H1FY26

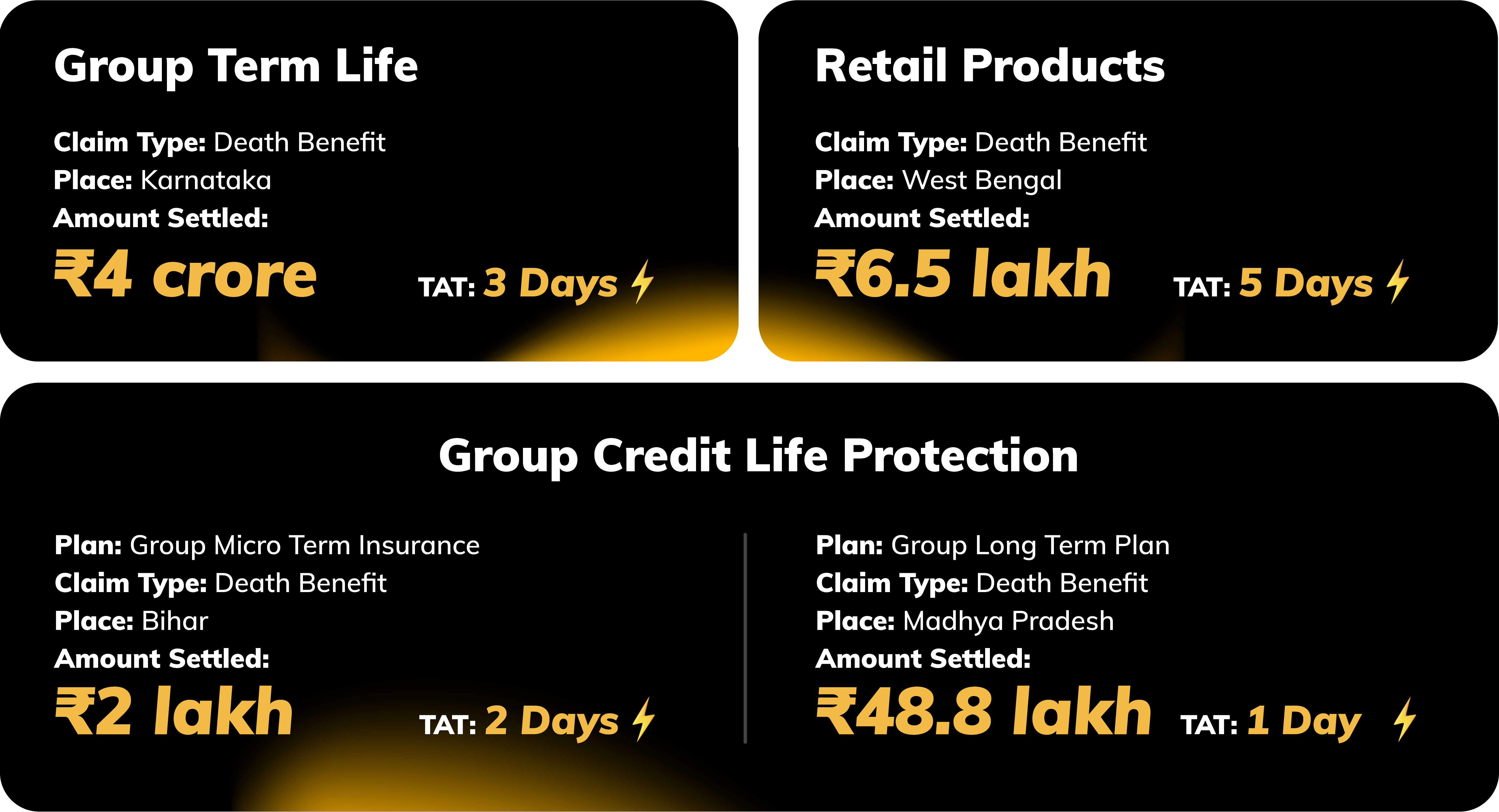

While every claim matters, settling high value claims swiftly reinforces trust. That’s why our tech infrastructure and internal processes are designed to treat every claim—big or small—with the same urgency and precision, ensuring swift settlements.

Claims Settlement TAT is the time taken to settle the claim after receiving all the necessary claims-related documents and decision.

In Group Term Life, a death benefit claim of ₹4 crore was settled in Karnataka within just 3 days. Meanwhile, Group Credit Life saw a payout of ₹48.8 lakh from Madhya Pradesh, processed in just 1 day. Similarly, Group Credit Life under Group Micro Term policy in Bihar for ₹2 lakh settlement was completed in 2 days. We also started settling claims in our Retail Product category. In Retail Term Life, a claim from West Bengal was settled for ₹6.5 lakh, with a turnaround time of 5 days.

SMART SYSTEMS: TECHNOLOGY AS A FRAMEWORK FOR CARE

At Digit Life, we believe technology should do more than just innovate. It must serve the human promise. Our tech team has been focusing on building an architecture of care that uses digital intelligence to simplify and secure every process, eliminating doubt and making every step feel effortless.

AI-Driven Document Authenticity Check: Fraud in the insurance sector doesn’t just affect companies. It impacts genuine customers as it drains the shared pool of resources contributed by them. Our duty as a life insurance company is clear: protect the many who trust us from the few who attempt to exploit the system. That’s why we’ve built an advanced AI-powered, computer vision-based image forensic technology, combining multiple layers of forensic detection to accurately identify any type of tampering in KYC or identity documents. By swiftly isolating fraudulent cases, we are able to simplify our processes and deliver faster and seamless service to our genuine customers because they deserve nothing but the best.

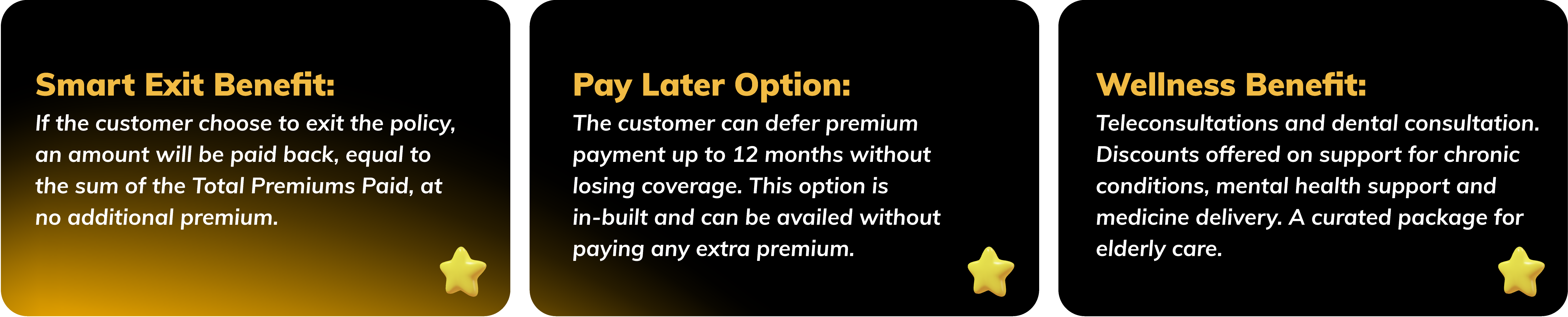

PROTECTING YOUR TOMORROW: OUR WELLNESS BENEFITS

We all recognize those subtle, everyday acts of support. The friendly reminder from a parent to carry a jacket or a friend checking in simply because they know you're having a rough day. These are the consistent, proactive acts that your loved ones do. At Digit Life, we believe protection should feel the same way: thoughtful, proactive, and always there when you need it.

We, through various wellness partners, offer all our customers a comprehensive suite of wellness benefits, the 'little things' we know can protect your health in the long run. This includes complimentary services or discounts on everything from easy access to teleconsultations (general, specialist, and physiotherapy) and dental consultation, to crucial support for life stages and chronic conditions (pregnancy care, PCOS care, thyroid care, diabetes care), along with vital mental health support, medicine delivery, at-home nursing services for seniors, and more.

WHAT’S NEW IN OUR PRODUCT UNIVERSE

Innovation isn’t just about adding features; it’s about anticipating what you’ll need tomorrow. In the past six months, we've focused on making Digit Glow Plus significantly more accessible and affordable. Let's take a look:

The Product Offers

What It Covers

Optional add-ons with little extra premium:

What else?

Note: The mentioned product features are for reference purposes. For more details, please read the Sales Brochure.

📈 CAPTURING OUR GROWTH NUMBERS (H1FY26 vs H1 FY25)

| Particular | H1FY 24-25 | H1FY 25-26 |

|---|---|---|

| Gross Written Premium (Rs) including RI inward | ₹653.5 crore | ₹858 crore |

| Premium Growth (New Business) | 488% # | 27% |

| Total Customers Serviced* | 3.3 million | 2.9 million |

| Overall Market Share^ | 0.28% | 0.33% |

| Total Employees (full time) | 722 | 1,062 |

| Number of Branches | 19 | 36 |

| Number of Agents & Intermediaries | 1,750 | 6,270 |

| Solvency Ratio | 1.96 | 2.43 |

#488% growth driven by low base of ₹90.3 crore in H1 FY23-24 (operations began in June 2023). *Number includes customers/Lives covered under policies issued during the period (H1 FY25-26 count is lower due to lesser micro insurance customers). ^Market share calculated based on IRDAI's monthly published data on New Business Statement of Life Insurers for the period ended September 30, 2025. All H1 FY24-25 data as on September 30th 2024; All H1 FY25-26 data as on September 30th 2025.

In H1 FY 25-26, our gross written premium (including reinsurance inward) grew to ₹858 crore, up from ₹653.5 crore in H1 FY 24-25. New business premium growth stood at 27%, building on last year’s strong momentum of 488% (on a low base).

We serviced 2.9 million customers during this period, while our overall market share improved to 0.33% from 0.28%. The Digit Life family is expanding rapidly. We now have 1,062 full-time employees, up from 722, and our distribution network has grown to 36 branches and 6,270 agents and intermediaries.

Our financial strength remains solid, with the Solvency Ratio improving to 2.43, reinforcing our ability to keep every promise we make.

It’s time to say goodbye!

Thank you for spending time reading the third edition of our Transparency Report. As we continue to build this journey together, we remain fully dedicated to being there for all our customers and partners.

Do tell us what other data points, stories, or insights would help you feel the extra care, and we’ll definitely try to include that in our next edition. The promise you place in us is the compass guiding our care.

We look forward to your email at corpcomm.digitlife@godigit.com. Thank you for reading, and we’ll see you again in May 2026!😊

Copyright © Go Digit Life Insurance Limited | Registered Office Address: Ananta One, Pride Hotel Lane, Narveer Tanaji Wadi, City Survey No.1579, Shivaji Nagar, Pune-411005, Maharashtra | Corporate Office Address: Atlantis, 95, 4th B Cross Road, Koramangala Industrial Layout, 5th Block, Bengaluru-560095, Karnataka | CIN: U66000PN2021PLC206995, IRDAI Registration No. 165 | "Digit Life Insurance” trademark belongs to Go Digit Life Insurance Limited (“the Company”). “Digit” logo is registered trademark of Go Digit Infoworks Services Private Limited and is used by the Company under sub-license from Oben Ventures LLP. This document may contain Proprietary Information of Digit Life and/or Digit Group of Companies and provided solely for information purpose for our Customers, Employees and Partners. This document shall not be used for any duplication or for commercial use. This document does not intend to create any binding or legal obligation. For details on any Products, kindly refer to the Company website www.godigit.com/life.