Health Insurance

Buy Health Insurance Online

9000+

Cashless Hospitals

2.5 Crore+

Lives Insured

4.5 Lacs+

Claims Settled

I agree to the Terms & Conditions

Get Exclusive Porting Benefits

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

9000+

Cashless Hospitals

2.5 Crore+

Lives Insured

4.5 Lacs+

Claims Settled

What is Health Insurance?

Health insurance is like a safety net that helps you pay for medical care when you are sick or injured. You pay a certain amount regularly (called a premium) to the insurance company, and in return, they help cover the costs when you visit the doctor, undergo tests, or require treatment.

This includes expenses incurred during pre and post-hospitalisation, annual health check-ups, psychiatric support, critical illnesses and organ donor expenses, amongst others, as per your customised health insurance plan.

Think of it like that one friend who you know will always be there for you whenever you’re sick or even just feeling low.

Why Do You Need Health Insurance?

Health insurance is needed to protect you financially and ensure you get the best medical care when needed. Here are some reasons why having a health insurance policy is important:

“I don’t need Health Insurance”

If you believe that, read on:

Being healthy and having savings is great, but it’s not a substitute for health insurance. Medical expenses are unpredictable, and the cost of treatment is rising fast. According to the NSSO, 62% of Indians rely on personal savings for healthcare, and IRDAI reports that hospitalisation in private hospitals now costs more than ₹50,000+ on average.

Health insurance isn’t just about covering current risks; it’s about protecting your future. Buying a health policy while you’re young and healthy means lower premiums, better benefits, and uninterrupted coverage. Besides, one does not need to wait for a medical emergency to realise its value.

Vivek Chaturvedi

CMO & Head of Direct Sales

Types of Health Insurance Policies in India

Benefits of Buying Health Insurance at an Early Age

Buying health insurance at an early age has multiple benefits, including financial, medical and even emotional. Here’s why it's smart to have health insurance at a young age:

Why Choose Digit Health Insurance?

Key Benefits of Health Insurance Plans by Digit

Your health insurance plan with Digit extends several exclusive benefits that enhance your coverage. Here are the key benefits:

* These add-ons are subject to underwriting approval and your eligibility at the time of purchase or renewal

What’s Covered in the Health Insurance Plans Offered by Digit?

Coverages

Double Wallet Plan

Infinity Wallet Plan

Worldwide Treatment Plan

Important Features

This covers for all hospitalisation expenses including due to an Illness, Accident, Critical Illness or even pandemics like Covid 19. It can be used to cover for multiple hospitalisations, as long as the total expenses are up to your sum insured.

You need to wait for a defined period from the first day of your policy to get covered for treatment related to any non-accidental illness. This is the Initial Waiting period.

Exclusive Wellness Benefits like Home Healthcare, Tele consultations, Yoga and Mindfullness and many more available on our App.

We provide a back-up Sum Insured which is 100% of your Sum Insured amount. How does Sum Insured Back Up work? Suppose your policy Sum Insured is Rs. 5 lac. You make a claim of Rs.50,000. Digit automatically triggers the wallet benefit. So you now have 4.5lac + 5 lac Sum Insured available for the year. However, one single claim, cannot be more than the base Sum Insured as in the above case, 5 lac. .

Digit Special

Digit Special

No claims in the Policy year? You get a bonus -an additional amount in your total sum-insured for staying healthy & claim free!

Different categories of rooms have different rents. Just like how hotel rooms have tarrifs. Digit plans give you the benefit of having no room rent cap, as long as it is below your Sum Insured..

Health insurance covers medical expenses only for hospitalisations exceeding 24 hours. Day care procedures refer to medical treatments undertaken in a hospital, requiring less than 24 hours due to technological advancement such as cataract, dialysis etc.

Digit Special

Digit Special

Get a world class treatment with the Worldwide Coverage! If your doctor identifies an illness during your health examination in India and you wish to get a treatment abroad, then we’re there for you.You’re covered!

We pay for your health check-up expenses upto the amount mentioned in your Plan. No restrictions on the kind of tests! Be it ECG or Thyroid Profile. Make sure you go through your policy schedule to check the claim limit.

There may be emergency life-threatening health conditions which may require immediate transportation to hospital. We absolutely understand this and reimburse for expenses incurred for your transportation to a hospital in airplane or helicopter.

Digit Special

Digit Special

Co-Payment means a cost sharing requirement under a Health Insurance Policy that provides that the Policyholder/Insured will bear a specified percentage of the admissible claims amount. It does not reduce the Sum Insured. This percentage depends on various factors like age, or sometimes also on your treatment city called zone based copayment. In our plans, there is no age based or zone based Co payment involved.

Get reimbursed for the expenses of road ambulance, in case you are hospitalised.

This cover is for all expenses before and after hospitalisation such as for diagnosis, tests and recovery.

Other Features

The disease or condition that you are already suffering with and have disclosed to us before taking the policy and has been accepted by us has a waiting period as per plan opted and mentioned in your Policy Schedule.

This is the amount of time you need to wait for, until you can make a claim for a specific illness. At Digit it is 1-3 years and starts from the day of policy activation. For the full list of exclusions, read Standard Exclusions (Excl02) of your policy wordings.

If You sustain an Accidental Bodily Injury during the Policy Period, which is the sole and direct cause of Your Death within twelve (12) months from the date of accident, then We will pay 100% of the Sum Insured as mentioned in Policy Schedule against this cover and as per plan opted.

Digit Special

Digit Special

Your organ donor gets covered in your policy. We also take care the pre and post hospitalisation expenses of the donor. Organ donating is one of the kindest deeds ever and we thought to ourselves, why not be a part of it!

Hospitals can go out of beds, or the patient’s condition may be rough to get admitted in a hospital. Don’t panic! We cover you for the medical expenses even if you get treatment at home.

Obesity may be the root cause of so many health issues. We absolutely understand this, and cover for Bariatric Surgery when it is medically necessary and advised by your doctor. However, we DONOT cover if hospitalisation for this treatment is for cosmetic reasons.

If due to a trauma, a member has to be hospitalised for a psychiatric treatment, it will be covered under this benefit, upto INR 1,00,000. However, OPD consultations are not covered under this. The waiting period for Psychiatric Illness Cover is same as Specific Illness waiting period.

Before, during & after hospitalisation, there are many other medical aids & expenditures such as walking aids, crepe bandages, belts, etc.,which need your pocket’s attention.This cover takes care of these expenses that are otherwise excluded from the policy.

What’s Not Covered?

Health Insurance Add-on Options with Digit

Enhance your health insurance policy with add-ons at Digit. These add-ons are subject to underwriting approval and your eligibility at the time of purchase or renewal. Here’s a list of add-ons available that provide additional layers of protection beyond the basic coverage of your policy:

What Our Customers Have to Say about Us

Not sure which health insurance policy to buy?

Talk to our advisor now!

We help you to choose the best health insurance plan basis your needs.

What is an Ideal Coverage for a Health Insurance Plan?

Ideal coverage means having sufficient health insurance to cover your hospital bills without depleting your savings. An ideal health insurance plan is usually suggested to have a sum insured equal to at least half of your annual income.

You must check if it is sufficient to meet your medical expenses. Experts suggest buying a health cover of at least ₹10 lakhs to combat rising healthcare costs easily.

To choose the right sum insured for you and your family, here are a few important points to keep in mind:

- Age & Lifestyle: As healthcare evolves with age & lifestyle. Hence, you must opt for a higher sum insured if you are planning for a family or have senior citizens.

- City or Zone: If you live in polluted metro cities, toiling with traffic and bearing office stress daily, you may be at a higher risk of falling ill. Opt for a higher sum insured in such cases to avoid out-of-pocket expenses.

- Family Size: Insuring all family members under a Health Insurance policy is a wiser way to protect your family against future financial risks related to high medical costs.

- Health Conditions: If a hereditary disease is present in the family or a common health condition is emerging in the city where you reside, consider a higher sum insured.

- Premium Affordability: Find the right balance between good coverage and what you can afford yearly. Consider getting a super top-up plan to increase coverage in low premiums.

But Why Digit Recommends ₹25 Lakhs Coverage?

Let’s face it! Hospital bills aren’t what they used to be. With medical costs going up faster, a ₹25 lacs health cover isn’t just nice to have - it’s a smart move!

This type of coverage acts like a strong umbrella in the event of a medical emergency. Experts at Digit recommend having ₹25 Lakhs coverage because:

- It covers the rising medical inflation in Tier 1 cities

- Protects against major surgeries, such as cancer, bypass procedures, etc

- Sufficient for a family of 3-4 members under a policy

- Reduces out-of-pocket expenses during multiple hospitalisations

- Ensures peace of mind during medical emergencies

Bonus Point: Opting for a higher sum insured early on can also help you lock in better premiums while you're still young and healthy. It’s an investment in your future self. 🙂

Choosing the right health insurance isn’t about picking the most popular plan; it’s about finding what fits you and your family. Start by considering these questions:

1. How old are you?

2. Do you have any existing health issues?

3. What’s your lifestyle like?

All these things help determine how much coverage you really need.

With hospital bills going up every year, even a short hospital stay can cost a lot. Hence, it’s safer to go for higher coverage, even if you’re healthy right now. And if you're on a budget, you can always start with a base plan and add a top-up later for extra protection.

Vivek Chaturvedi

CMO & Head of Direct Sales

Which Medical Insurance Plan is Perfect for You in Different Life Stages?

How to Choose the Best Health Insurance Plan in 2026?

Choosing the right health insurance plan in 2025 isn’t just about picking the cheapest option; it’s about finding a plan that truly fits your lifestyle, health needs, and future goals. Here are some tips for choosing the best health insurance plan:

Steps to Select the Right Health Insurance Plan

Choosing the right health insurance plan can feel overwhelming, but it’s one of the most important decisions for your well-being and financial future. Here are the steps you must follow to select the right health insurance plan:

Let’s simplify it for you!

➤ Start by assessing what you require from your insurance.

➤ Next, consider your preferred doctors and hospitals.

➤ Then, evaluate the premium, deductible, co-pay, waiting period, coverage, and benefits.

➤ Additionally, look for benefits such as maternity coverage, wellness programs, or mental health services, which can be valuable as life changes.

➤ Finally, always review the terms and conditions carefully to avoid unexpected exclusions.

Remember! The more personalised the plan, the better. Choose wisely! 🙂

Health Insurance Buying Tips for All Stages of Life

* Get insurance early in life, even if you're healthy.

* Opt for a higher sum insured plan; 5-10 lakhs should be sufficient.

* Ensure that you have critical illness cover included.

* Look for low premiums and a no co-payment clause.

* Ensure that all family members are covered.

* Go for a high sum insured, as it is distributed among all family members. A family floater plan with ₹25 lakhs coverage is recommended.

* Check the waiting periods for all benefits being offered.

* If you include your parents, check if common treatments like knee replacement and cataract surgery are covered.

* If you already have a plan, you can increase its sum insured with a top-up plan.

* Opt for a plan that includes no room rent, domiciliary coverage, and AYUSH coverage.

* Check if the plan you’re getting covers common treatments like knee replacement and cataract surgery.

* Check the waiting period mentioned for different pre-existing diseases.

Why Digit is the Best Health Insurance Option for Everyone?

Why You Must Buy Health Insurance Online?

Buying health insurance online offers a faster, more transparent and cost-effective way to secure your health coverage. Here are some reasons why you must consider getting health insurance online:

A health insurance plan might come with a lot of attractive features, but those shouldn’t be the main reason to buy it. What’s more important are the basic benefits that actually help when there’s a medical emergency.

Here are the seven most important things one must consider, including no limit on the choice of room, sum-insured backup, cumulative bonus offering, zero co-payment, consumables coverage, pre and post-hospitalisation benefits and organ donor expenses coverage.

Don’t just pick a plan; understand it. Make a choice that stands strong when life throws the unexpected at you.

Vivek Chaturvedi

CMO & Head of Direct Sales

What are the Tips to Compare Health Insurance Plans?

Comparing health insurance plans may seem a tiring task, but focusing on the right factors can make it easier. Here are the top tips to compare health insurance plans that offer the best coverage and protection.

- Compare Coverage: The primary purpose of health insurance is to provide maximum coverage for healthcare expenses. Therefore, always compare the kind of coverage and sum insured you will receive.

- Check Inclusions and Exclusions: Review what is covered and not covered in your plan. Read the policy document to know about maternity, dental, daycare procedure, mental health and PED coverage.

- Evaluate Waiting Period: Compare waiting periods for PED, maternity and specific diseases. The shorter the waiting period, the better the plan.

- Network Hospitals: Every health insurance provider has a network of hospitals you can visit and avail cashless claims from during times of need. Compare the range of hospitals available through your Insurance provider and choose one that suits you best.

- Type of Claims: There are generally two types of claims in a health Insurance plan; Cashless and Reimbursement. In times of need, Cashless Claims prove to be a lot easier and beneficial. Therefore, compare health Insurance plans to see if they provide you the benefit of cashless claims or not, and to what extent.

- Health Insurance Premium: This goes without saying, doesn’t it? This is something you’ll probably do. However, make sure your premium is relevant to the health Insurance plan you choose. Don’t blindly get lured into cheap premiums, but always compare the coverage details against the premium and make a sound decision accordingly.

See More

See Less

How to Buy/Renew a Health Insurance Policy Online?

Buying or renewing a health insurance policy online is now as easy as booking a movie ticket. 🤩 With just a few clicks, you can compare different plans, customise your coverage, and ensure continued financial security in medical emergencies. Follow these simple steps to buy or renew a health insurance plan:

Enter Basic Details

Visit the Digit app or website. Enter your PIN code and mobile number, select your preferred health insurance plan and provide age details, family members covered, etc.

Choose Plan & Add Member Details

Compare & select the plan, sum insured, add-on covers and apply any available discounts to get the final premium amount. Further provide the member details for everyone you’re covering.

Make Payment & Submit KYC

Once done, proceed to make the premium payment and submit your KYC documents to complete the purchase process.

Final Review & Processing

Now, your application undergoes a brief review process. Digit may request a health declaration, lifestyle information, or medical details & reports if required. Now, based on your medical underwriting, your policy will be issued and sent to your email. You can also access it anytime through the Digit app.

Documents Required to Buy a Health Insurance Online

When purchasing a health insurance policy, insurers typically require some basic documents for verification. Below is a list of optional documents that may be needed at the time of purchasing a policy:

Identity/Age Proof

Address Proof

Income Proof

Previous Medical Reports (If any)

KYC Documents

How to Calculate Health Insurance Premiums?

Calculate your health insurance premium online in 2 mins. Here’s how:

Step 1

Log in to your Digit account by entering your PIN code and mobile number.

Step 2

Provide details of your family members, including the age of the eldest, then click "Continue" to customise your plan by choosing your sum insured, type of plan and add-ons.

Step 3

Review and apply any available discounts and enter further contact details. You can now see your customised premium amount.

Health Insurance Premium Chart

Your health insurance premiums depend on several factors, including your age, lifestyle, location, and the type of coverage you select.

To know your premium in minutes, you can always use a health insurance premium calculator online to get quick and accurate estimates. However, let’s now look at how premiums vary at Digit, based on different zone classifications depending on your policy type:

Health Insurance Premium for Different Sum Insured Options

Let's look at a practical example to understand how the premium works for one of our most popular health insurance plans, the 'Infinity Wallet Plan.'

Pritesh, a 35-year-old unmarried individual residing in Bangalore (Zone 2 city), has opted for the 'Infinity Wallet Plan' with a sum insured of ₹10 lakhs.

Health Insurance Premiums for ₹10 Lakhs Sum Insured by Age Group

This table illustrates the starting premium amounts for a ₹10 lakhs sum insured under our Infinity Wallet Plan, varying by age group. The premium increases with age, reflecting the higher risk and potential medical costs associated with older age brackets.

Why Buying Health Insurance from Digit is Better?

What are Wellness Benefits at Digit for Health Customers?

Health insurance isn’t just about hospital bills and emergency coverage anymore; it’s about supporting your overall well-being every day. Wellness benefits in health insurance are additional features offered by Digit that reward you for maintaining a healthy lifestyle.

These benefits are designed to go beyond traditional coverage; wellness benefits offer access to preventive care, mental health resources, fitness programs, tele-consultations, and even discounts on dental care.

You also get access to monthly health sessions and wellness workshops through our WOW-12 campaign, which empowers you with the knowledge and resources to make healthier choices every day. 🙂

Wellness Benefits for Digit’s Health Insurance Customers

With your Digit’s Health Insurance, you can get exclusive access to a wide range of wellness perks, making taking care of yourself easier and more affordable:

Note: Please refer to the respective Service Provider’s T&Cs before availing services. Offers, including discounts or complimentary access, are subject to change.

Digit Health Insurance Featured in Headlines

How to Download Your Health Insurance Policy Document via the Digit App?

After purchasing a health insurance policy, it is essential to download and keep a copy for future reference. With us, you do not need to carry hard copies of your insurance policy. You can simply download it from our website. 🙂 Follow these simple steps to download your policy document from the Digit website or app:

Log in to Your Account

Visit the Digit website or app and click on ‘Login’ at the top-right corner. Enter your registered mobile number and verify with OTP.

Visit ‘Active Policies’

Once logged in, navigate to the Active/My Policies section. Here, you can check the policy number, end date & start date.

Download the Policy

Done! You can save, share, print or email the policy for future reference anytime, anywhere.

How to Add or Remove Members from the Health Insurance Policy?

To add or remove members from your Digit Health Insurance policy, follow these steps:

- Contact Customer Support: Reach out to our customer support via the helpline or email to inform them about adding or removing a member.

- Submit Required Details: Provide necessary documents such as identity proof, relationship proof, and medical history of the member to be added or details like policy number and other information for the member to be removed.

- Fill Out Form and Pay for Member Addition: Complete the member addition form if applicable and pay the additional premium for the new member.

Once processed, you will receive a confirmation.

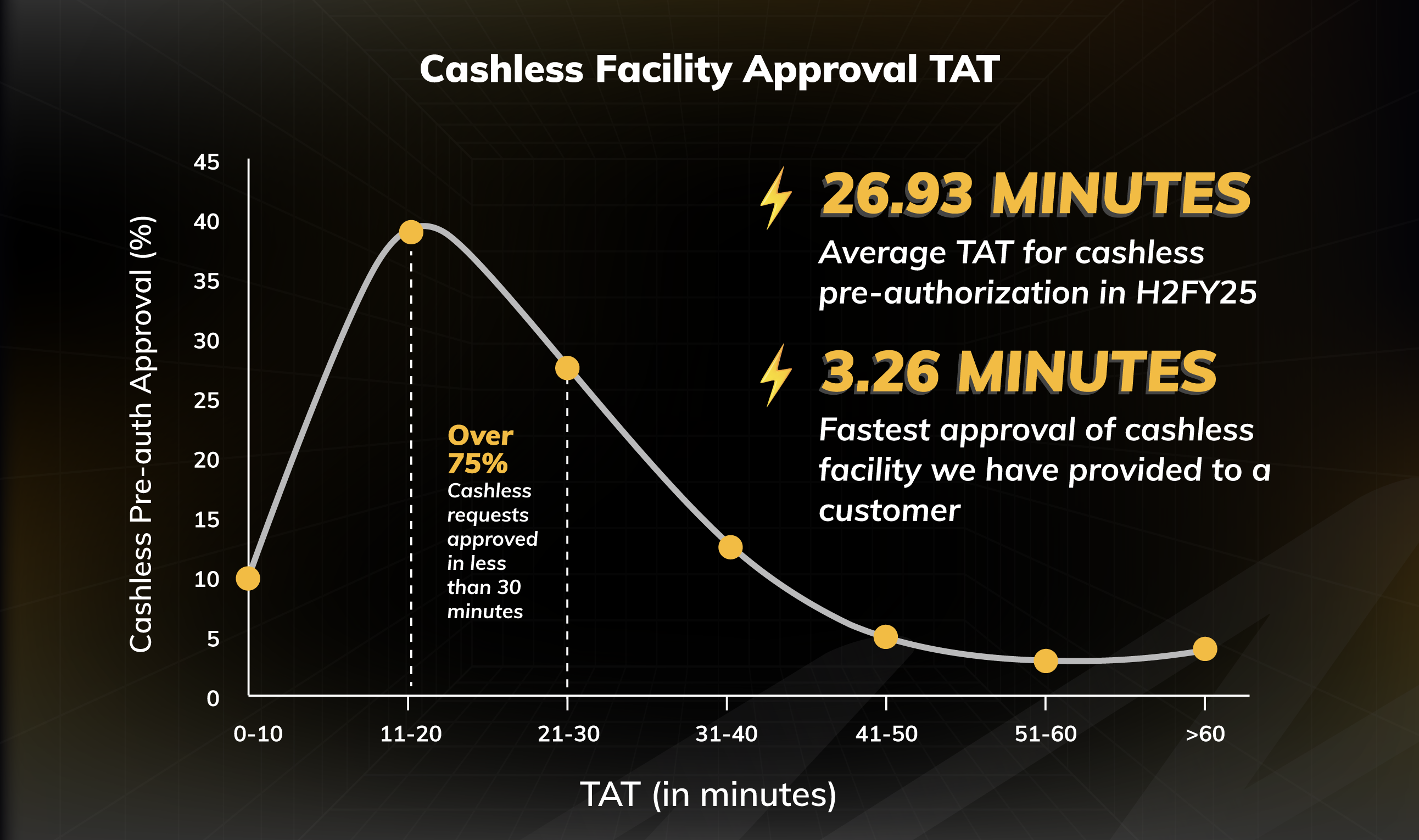

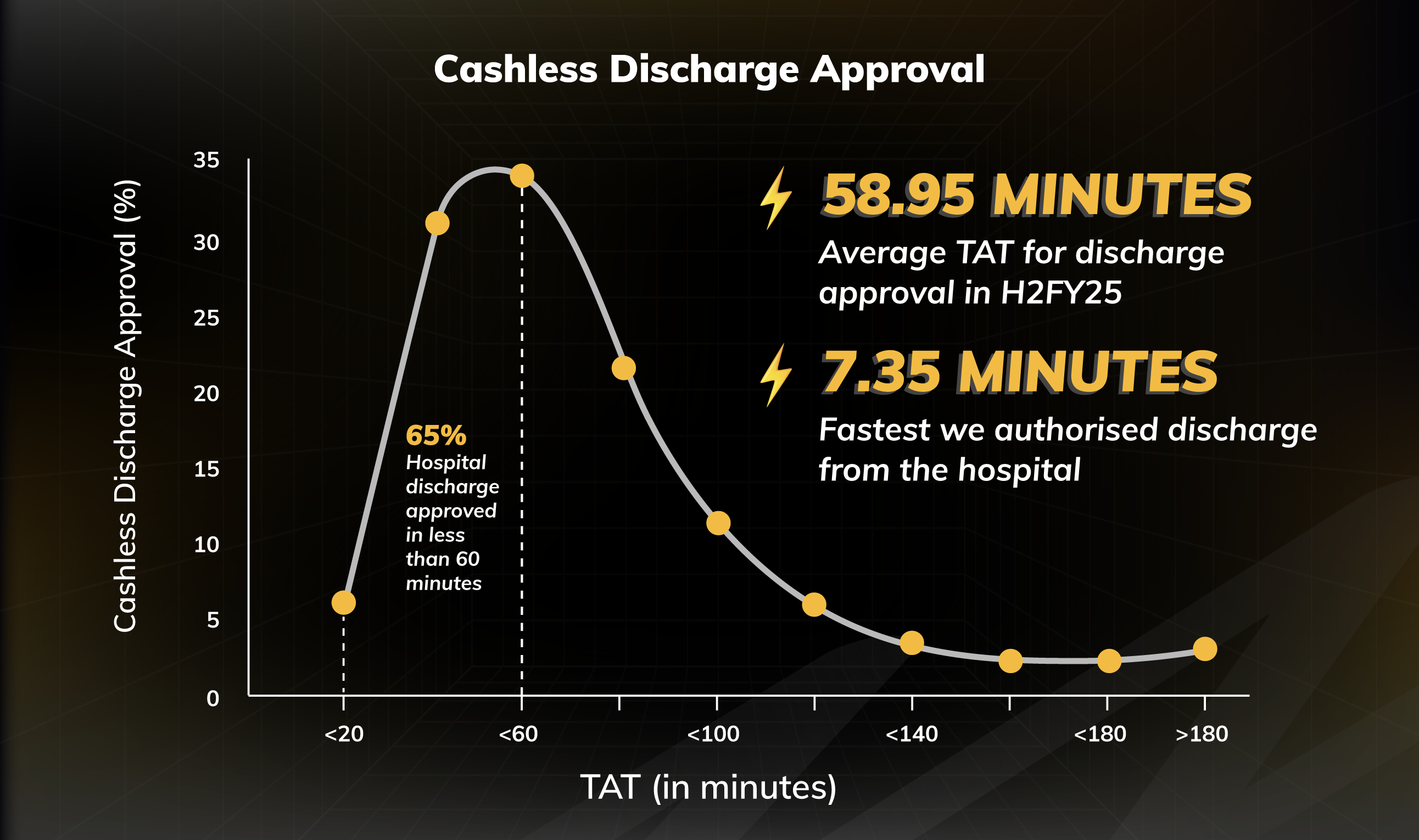

How to File & Track Health Insurance Claim with Digit?

Filing or tracking a health insurance claim with Digit is easy and convenient. If you are filing for a cashless claim, confirm that your hospital is on Digit’s network list. Inform Digit in time, submit the pre-authorisation form via the hospital, and enjoy cashless treatment! 🙂 Here are the steps to file and track a claim:

Get Treated & Save Everything

Visit any hospital, pay the bills upfront, and collect all the necessary documents (bills, reports, prescriptions, discharge summary, etc).

Open Digit App & File Claim

Log in to the Digit App. Navigate to the ‘File a Health Claim’ section on the app. Choose the policy & type of claim you are filing and other details.

Submit all the Documents

Fill out the type of treatment, symptoms, hospital details etc. Scan and submit all the necessary documents in the desired format.

Register Claim & Relax

Click ‘Register Claim.’ We’ll review everything, and once approved, the amount will be reimbursed directly to your bank account.

Digit's Cashless Network Hospitals

Get cashless treatment at 9000+ hospitals across India

How Does a Cashless Health Insurance Claim Work?

A cashless health insurance claim means the insurer directly settles your hospital bill with the hospital and you don't have to pay it upfront except for non-covered items. Here is how the cashless health insurance process works:

Visit a Network Hospital

Choose a hospital partnered with Digit.

Show Insurance Details

Present your health e-card or policy number and request approval.

Receive Treatment

Get treated without paying anything upfront (except deductibles).

Insurer Pays Directly

Digit will settle the bill directly with the hospital.

Pay Non-Covered Costs

You must pay any exclusions or extra charges.

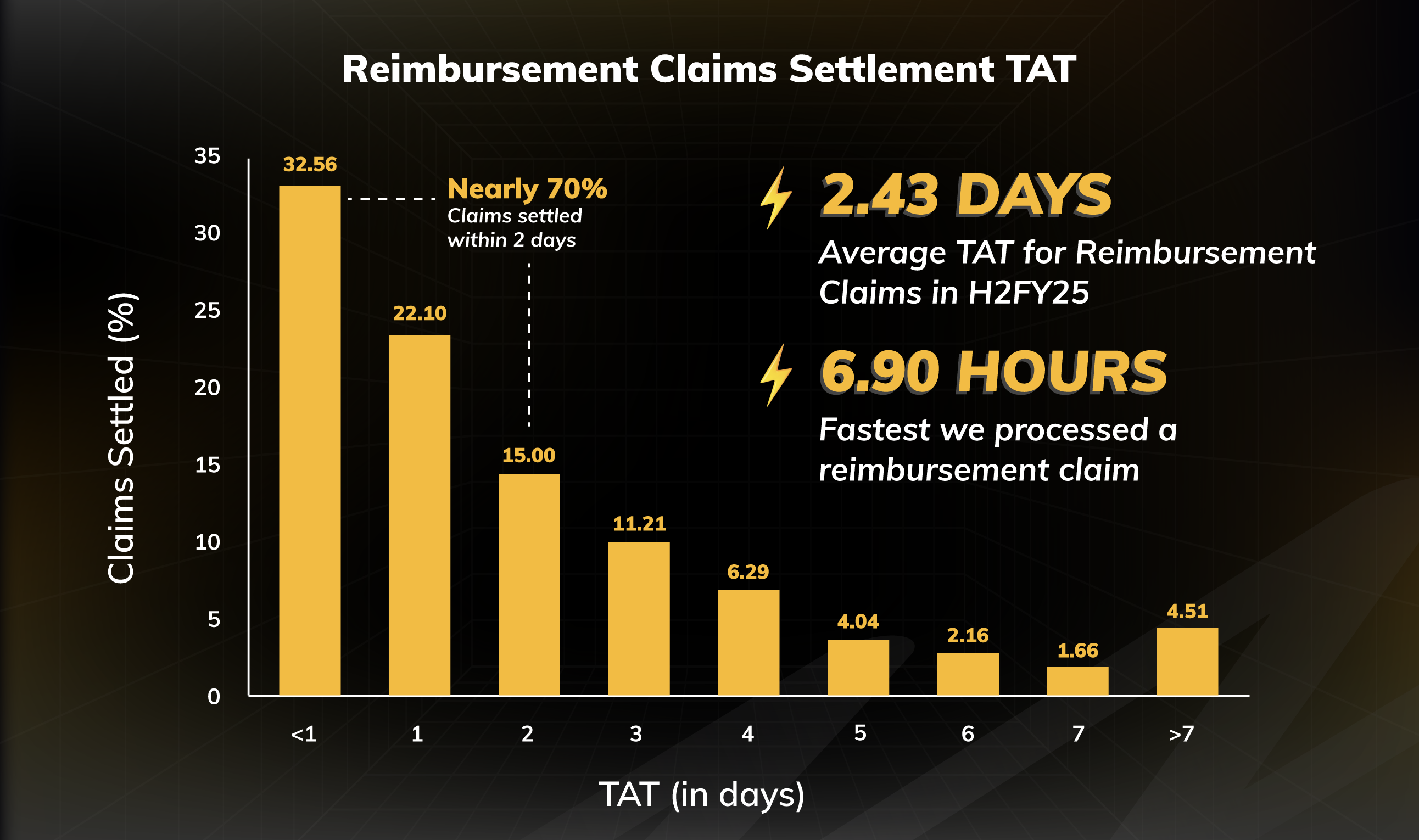

How Does the Reimbursement Claim Process Work?

A reimbursement claim works by allowing you to pay for your medical treatment upfront and then recover the eligible expenses from your health insurance provider. Here's a step-by-step explanation of how it works:

Get Treated at Any Hospital

Choose any hospital (network or non-network) for treatment.

Pay the Bills Yourself

Settle all the medical expenses upfront from your pocket and keep the bills.

Submit a Claim to the Insurer

Fill out the claim form and send it with the required documents.

Insurer Reviews the Claim

The insurer will verify the documents and approve the claim.

Reimbursement Process

Once approved, the insurer transfers the amount to your bank account.

Documents Required to File a Health Insurance Claim

When filing a health insurance claim, you need to submit certain documents to ensure a smooth and hassle-free process. Below is a list of essential documents that may be required while filing a health insurance claim at Digit:

Hospitalisation Documents

Cashless Documents

KYC Documents

How to Avoid Health Insurance Claim Rejections?

Receiving a claim rejection can be frustrating, especially when you thought you had everything in order. Well, Digit Transparency Report for FY 2024-25 shortlisted some common and completely unavoidable reasons why your health claims get rejected and how to avoid them:

- Medical Information Disclosure: Be transparent about your medical history. Disclose any existing illnesses or conditions, even those you’ve recovered from. Non-disclosure can lead to claim rejection.

- Know What’s Not Covered: Before finalising your health insurance plan, look for the policy’s exclusions and limitations. Take the time to thoroughly read your insurance policy documents. Being aware helps prevent surprises during the claim settlement process.

- Incorrect Information Shared: Whether intentional or a genuine mistake, wrong details on forms or reports can raise red flags, leading to rejection of your health claim.

- Policy Coverage: Not everything is covered. For example, cosmetic surgeries or weight loss surgeries are excluded from some health insurance policies. Hence, it is always recommended to read your policy document thoroughly before purchasing.

- Waiting Period Not Over: Especially in health insurance, some conditions have a waiting period before claims can be made.

According to Digit’s Transparency Report, around 8% of health claims were rejected mainly due to waiting periods.

Many people think that once they have a health insurance policy, they won’t have to spend a single rupee during hospitalisation, but that’s not always the case. If you’re not careful while choosing your plan, you might still end up paying out of your own pocket.

Look closely at things like co-payment clauses, room rent limits, disease-specific sub-limits, and deductibles. These might sound technical, but they play a big role when you file a claim. The key is to go beyond just the premium and the coverage amount.

Take a few extra minutes to understand what the policy truly offers and what it doesn’t. That way, when you actually need to use your health insurance, you won’t be unprepared by unexpected expenses.

Vivek Chaturvedi

CMO & Head of Direct Sales

Digit’s Health Insurance Claim Numbers for FY 2024-25

Interesting Claim Stories about Digit Health Insurance

Understand Complex Health Insurance Concepts in Minutes with Digit

What are the Tax Benefit Under Section 80D of the Income Tax?

The premium you pay towards a health insurance policy qualifies for a tax deduction under Section 80D of the Income Tax Act, 1961.

Section 80D allows individuals to claim a deduction of up to ₹25,000 from their taxes for health insurance paid within a particular fiscal year. However, senior individuals (above 60 years of age) can claim a deduction of up to ₹ 50,000 per financial year.

Therefore, people can benefit from tax savings under section 80D by buying insurance for themselves, their spouses, parents, and children.

How Much Tax Benefit Can You Get on Health Insurance Under 80D?

The table below lists the section 80D tax benefits related to health insurance. It shows the maximum tax deductions for self, spouse, dependent children, and parents.

Debunking Popular Myths about Health Insurance Policy

When it comes to health insurance, there's no shortage of myths, like “young people don’t need it” or “all illnesses are covered from day one.” These common misconceptions can keep you from making smart, timely decisions. Hence, here are some popular health insurance myths and the facts that everyone should know before buying a policy:

Common Health Insurance Terminologies Simplified

Read More about Health Insurance Tips

Invest in Your Health: Scenarios that Show the Importance of Health Coverage

Health insurance is a significant investment that provides financial security in the event of a medical emergency. Consider the following scenarios where you may want to reconsider not having health insurance:

1. My Employer is Taking Care of my Health Insurance; I do Not Need One:

While it is great that your employer provides health insurance, it may not be sufficient. Employee health insurance may have limitations, such as a lower sum insured or coverage that may not meet your needs adequately.

Additionally, an employer's health insurance coverage typically extends only during your tenure with the company. Once you switch jobs and if there is a break between the next employer's coverage, you are left without any insurance coverage in that period.

2. My 5 lac Sum Insured is Sufficient to Cover Even Serious Illnesses if Such a Day Arrives:

You might have health insurance, but with a low sum insured. A low sum insured may not be sufficient to cover medical expenses in the event of serious illness-related hospitalisations. It is essential to review your health insurance policy and consider increasing the sum insured to meet your specific needs.

3. I am a Government Employee, Have Coverage for the Entire Family Under the Government Scheme, and I Don't Need an Extra Personal Health Cover:

As a government employee, you may have health coverage under certain government health schemes; however, please note that such facilities are available only at a few select medical centres, generally concentrated in major metropolitan cities. Hence, it is recommended to have an additional personal health insurance policy to cover emergencies when government facilities may not be readily accessible.

4. I Just Needed a Basic Health Insurance Policy, So I Purchased One with a Low Premium and Limited Coverage. I feel it's Just Fine:

You may opt for a lower-premium health insurance policy with limited coverage. While this may save money in the short term, it may not provide adequate coverage when needed. It is essential to strike a balance between premium and coverage, choosing a policy that offers sufficient coverage for your needs.

5. I Have Saved Enough Tax Under Different Sections of IT and Hence, I Don't Need Health Insurance for Saving Tax:

While health insurance can save additional taxes under Section 80D of the Income Tax Act, it should not be viewed only as a tax-saving tool. The primary function of Health insurance is to provide financial security and peace of mind in case of medical emergencies.

6. I am Young, Fit, and Fine. I do Not Need a Health Insurance Plan:

While you may be young and healthy now, medical emergencies can occur unexpectedly. Having health insurance can provide financial security and help you cover the cost of medical treatments and hospitalisation. Also, investing in health insurance at a young age can help you secure a lower premium and accumulate cumulative bonuses over time.

You can also find our product on

FAQs about Health Insurance Policy