Motor Insurance Claim Filing made simple through Digit App!

File Digit Motor Claims Online in Simple Steps

Follow the steps given below to file your motor claims instantly.

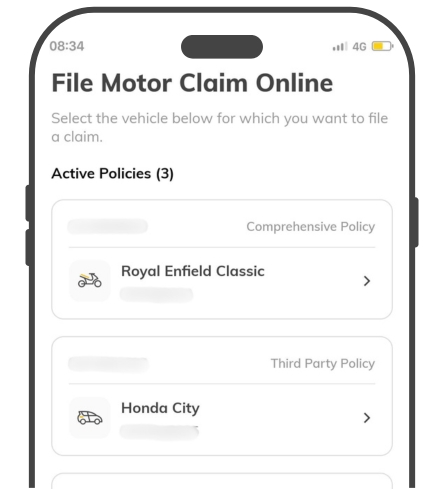

Step 1

Download the Digit App using the QR code above or by clicking on the "File Motor Claim" button. Login and you'll be directed to "File Motor Claim" page. Click on the policy card to start claim filing.

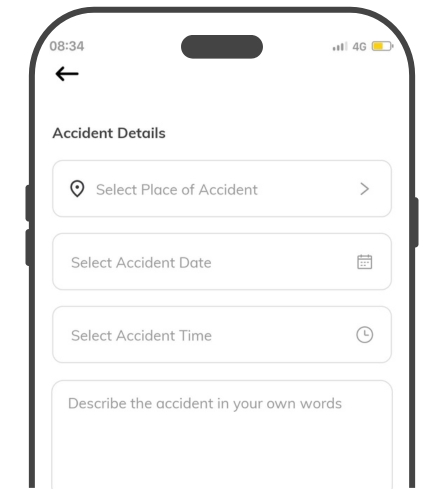

Step 2

Fill all the details related to the accident and damages.

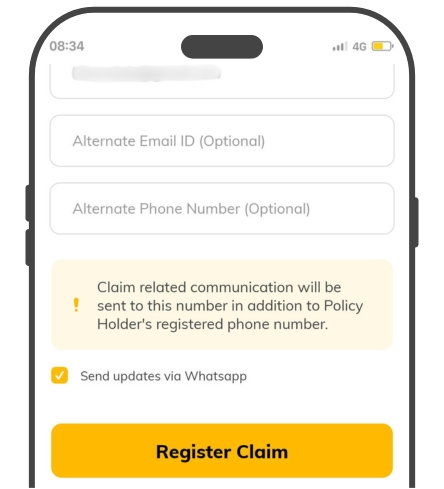

Step 3

Update your personal details and click on the "Register Claim" button. That's it, your claim is successfully filed and you will receive the next steps on your email & whatsapp.

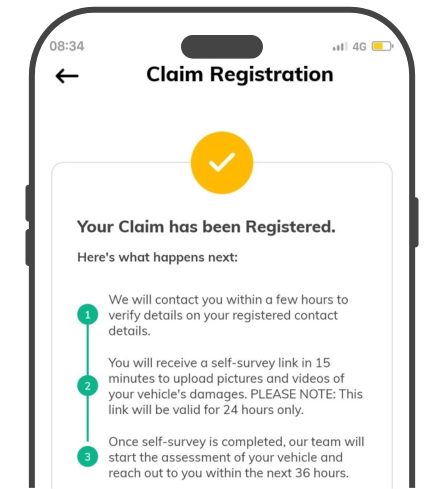

Step 4

That's It! Your claim has been registered, it's that simple with the Digit App.

67% Car Repair Work Approvals Done within 12 Hours

In H2 FY 2024-25, our average car repair approval time was 14 hours and 46 minutes, with 67% of approvals completed within 12 hours. Only a few cases experienced longer wait times, typically due to complex assessments or the need for additional documentation, highlighting our commitment to minimising delays and maximising efficiency.

Rest assured, we carefully monitor every step to ensure your car is back on the road as swiftly as possible!

How to Avoid Car Insurance Claim Rejections?

You can easily avoid car insurance claim rejections by just paying a little more attention to the following factors.

Understand Your Policy: Many claims are rejected simply because the policyholder is unaware of what their insurance covers. Always read your policy document to understand the inclusions, exclusions, and conditions.

Be Honest and Accurate: Providing false information or hiding facts like previous claims, accident details, or car modifications can lead to claim denial. Always be transparent with your insurer from the start.

Keep Documents Updated: Ensure your driving licence, Registration Certificate (RC), and Pollution Under Control Certificate (PUCC) are valid and up to date. Missing or expired documents can delay or even reject your claim.

Follow Traffic Rules: Claims can be rejected if the accident occurred due to violations like drunk driving, underage riding, or reckless behaviour. Safe and lawful riding helps protect your eligibility for a claim.

Inform Before Repairs: In the event of an accident or any other issues, always notify your insurer before seeking any repairs. Unauthorised repairs without insurer approval can result in claim rejection.

Transfer Insurance for Used Cars: If you buy a second-hand car, transfer the insurance policy to your name immediately. Claims may be denied if the policyholder’s details don’t match the registered owner.

Digit Settled 9.16 Lakh Claims in FY 2024-25

The below data is for all the products as given in the table below.