‘INVISIBLE ARCHITECTURE’ MAKING GOOD EXPERIENCE IN INSURANCE POSSIBLE: SPEED & EMPATHY

Featured 3rd-Nov-2025

Life isn’t just a solo act! It’s a backstage crew pulling off a flawless show while you take centre stage.

Our lives run on an orchestra of tiny, unseen cogs working in perfect sync so we can focus on what truly matters. Most days, we barely notice this quiet choreography playing out around us. If you think about it, it’s kind of everywhere. In the people who show up for you, in systems built by you or your family, and in those little life-easers that run like clockwork: a mobile network that never drops, an online order that arrives instantly, a flight that takes off on time, or a well-organised concert.

This invisible architecture holds us together. Yet we rarely pause to see the elaborate ecosystem of care that surrounds us.

In insurance, this invisible architecture is even more critical.

The true measure of an insurer isn’t when a policy is sold. It’s the infrastructure of care that sets itself in motion when you need it most: claims teams working through weekends, tech processing documents while you sleep, or the caring voice of a customer care representative when you call.

At Digit Insurance, this understanding forms our core DNA as over the years we have tried to build systems so thoughtful and robust you rarely need to think about it.

In this 13th Transparency Report, we’re pulling back the curtain on that invisible architecture. Because while the best care might be invisible, transparency about that care shouldn’t be.

THE INVISIBLE ARCHITECTURE BEHIND OUR CLAIMS

When a claim is processed quickly, it may feel surprising, but it’s not. It’s the quiet orchestration of a deeply intelligent tech ecosystem, designed with empathy.

The moment we receive a claim, a symphony of systems springs into motion. APIs connect seamlessly with partner networks. Self-service portals empower customers to upload damage photos and details in seconds. AI tools instantly assess damage and classify documents. Natural language processing (NLP) engines transcribe calls to extract insights. Automated workflows route tasks with precision. And all of this is powered by a cloud-native infrastructure that ensures speed, scalability, and security.

This is our invisible care system. A digital architecture built not to be seen, but to be felt. Let’s show you how this enables speed and quick processing:

MOTOR CLAIMS: WORK APPROVAL IN FOCUS—THE KEY POINT OF ACCELERATION

MOTOR INSURANCE WORK APPROVAL TAT

That’s the time between first notice of loss (FNOL) and vehicle repair order being issued. It captures the time when the customer first intimated us about the loss, the time the insurer took to ascertain the admissibility of the claim and send the vehicle repair order to the garage to commence the repair work. Since most of our claim surveys happen digitally, most work approval is issued within the same day.

| H1 FY26 | H2 FY25 | |||

|---|---|---|---|---|

| Average | Fastest | Average | Fastest | |

| Overall TAT | 14 hrs 44 mins | 7 minutes ⚡️ | 15 hrs 36 mins | 5 minutes ⚡️ |

| TAT for Private Cars | 13 hrs 55 mins | 10 minutes ⚡️ | 14 hrs 46 mins | 5 minutes ⚡️ |

| TAT for Two-wheelers | 13 hrs 23 mins | 9 minutes ⚡️ | 14 hrs 32 mins | 5 minutes ⚡️ |

In H1FY26, our Overall Average TAT for Motor Work Approval improved to 14 hrs 44 mins from 15 hours and 36 minutes (in H2FY25). The fastest we provided the work approval was at a lightning speed of 7 minutes. For private cars, our average and fastest work approval TAT stood at 13 hours 55 minutes and 10 minutes respectively. Similarly, for two-wheelers, our average TAT stood at 13 hours 23 minutes, while our fastest approval came just in 9 minutes.

HEALTH CLAIMS: OVERALL QUICK MOVEMENTS

Reimbursement Claims Settlement is the time taken to settle the claim after collating all the necessary claims-related documents.

In H1FY26, our average turnaround time (TAT) for cashless pre-authorization stood at 26.9 minutes (fastest being 7 minutes), while hospital discharge approval TATs averaged 52.5 minutes (fastest being 7 minutes). Reimbursement claims were settled in just 2.4 days on average (with fastest claim being processed in just 4.4 hours).

THE INVISIBLE ARCHITECTURE LEADING TO REAL MOMENTS OF CARE IN ACTION!

STANDING STRONG IN THE AFTERMATH OF AIR INDIA CRASH

On June 12, 2025, India suffered a big loss as Air India Flight AI171 crashed in just 32 seconds after take-off. Among the victims was a pilot insured under the Federation of Indian Pilots’ Loss of License Cover, underwritten by Digit Insurance.

We released the full claim of ₹2.67 crore to the family within three business days. Our team coordinated closely with stakeholders, ensuring every step was handledwith sensitivity and care.

HONOURING A HERO IN LINE OF DUTY

In April 2025, an Assistant Sub-Inspector (ASI) of Punjab Police lost his life in the active line of duty while bravely responding to a violent clash in the area. His sacrifice left behind a grieving family and a void that can never be filled.

As his insurer, covering him under the Group Personal Accident cover, we ensured the claim amount of ₹1 crore was paid swiftly, within 8 days.

WHEN WAR DISRUPTS TRAVEL PLANS

When unexpected tensions between India and Pakistan led to government advisories, many plans were disrupted. Three of our customers (who were government employees) had to cancel their overseas trips as their leaves were cancelled on government advisory. Travel insurance is often associated with flight delays or lost baggage and not rare scenarios like these.

At Digit, we understand such moments bring not just disappointment but also financial stress. Our International Travel plan included Trip Cancellation cover due to government advisory, helping them get ₹1.3 lakh swiftly reimbursed for all non-refundable expenses.

BIG CLAIMS, BIGGER COMMITMENT: HIGHEST CLAIMS SETTLED IN H1FY26

At Digit, we understand that some claims can be unexpectedly large and when they happen, speed matters. Our robust ecosystem ensures that even high-value claims are handled in the same manner as any other claim. From automated workflows to real-time processing and seamless coordination across teams, every step in our ecosystem is designed to minimise delays.

̂Third-party TAT refers to the number of working days taken to settle a claim after the court has issued its order (excluding the litigation period). It measures the period from the receipt of the court judgment to the final settlement of the claims; #Own Damage TAT refers to the time taken to settle the final claim payment after receipt of the final bill; Claims Settlement TAT is the time taken to settle the claim after collating all the necessary claims-related documents.

CUSTOMER SERVICE: A SOLID BRICK

OF OUR CARE-ARCHITECTURE!

When an escalation comes in, speed and empathy should guide every step. That’s why we start with an immediate first response to reassure the customer that their concern matters. From there, the issue is swiftly escalated internally, investigated thoroughly, and resolved with clear, proactive communication throughout. Our goal isn’t just to respond quickly. It’s to close the loop completely and restore confidence as quickly as possible.

This relentless focus on efficiency and care has paid off. In H1 FY26, our average First Level of Response Turnaround Time (FLR TAT) was just 6 minutes and 15 seconds, an impressive improvement from 20 minutes and 7 seconds as of September 30 last year.

Not only that. Our average Social Media Closure TAT (Turnaround Time) has improved from 32.5 hours in H1 FY25 to just 20.5 hours in H1 FY26.

JARGON SIMPLIFIED

First Level of Response Turnaround Time (FLR TAT)

It’s the time taken to provide the initial acknowledgment or response to a customer query, comment, or post on social media after it is received. This metric measures the speed of engagement and responsiveness at the very first touchpoint.

Social Media Closure TAT (Turnaround Time)

It’s the total time taken to completely resolve a customer query or issue raised on social media platforms. It is measured from the moment the communication is received to the point where the entire resolution loop is closed.

DIALING DOWN: HOW WE ARE

REDUCING CALL VOLUMES

We saw a remarkable reduction in call volumes as we received 197,200 fewer calls in H1 FY26 compared to H1 FY25 where we were able to reduce our call volume only by 15,433. We were able to achieve this after revamping our digital self-service model early this year.

Two key enablers made this possible. First, our WhatsApp self-service feature, which empowers customers to handle everything from KYC updates, name and address changes, PIN code and mobile number corrections, vehicle registration updates, and even ownership transfers to pre-inspection and renewals—all at their fingertips. Second, the Digit app, which makes it effortless to register claims, download e-cards and policy copies, and track claim status. Together, these innovations have transformed customer convenience while significantly reducing dependency on call centres. And the result? In H1FY26, on an average, we reduced our call volume by 32,867 against number of policies issued.

THE REAL TEST OF OUR SYSTEM?

WHAT CUSTOMERS SAY

The real measure of whether our behind-the-scenes architecture truly works isn’t in the code or the processes; it’s when we get to hear genuine words from our customers. Every review is proof that our promise of simplicity and care translates into real experiences that matter. These voices are the heartbeat behind our high ratings on Facebook and Google, and they remind us why we keep pushing to make insurance effortless.

VOICES THAT INSPIRE US

HIDDEN FRAMEWORK: OUR INVISIBLE

TECH ARCHITECTURE

Behind every seamless experience is a powerful, unseen engine. As an insurer, we enable the magic you feel through a robust tech backbone; an architecture powered by natural language processing (NLP), artificial intelligence (AI), machine learning (ML), computer vision (CV), and advanced analytics. It’s the silent force that turns complexity into simplicity, driving personalized interactions and predictive insights. Here’s showing you some of that tech magic because what’s invisible often matters the most.

AI-enabled Vehicle Damage Detection: To speed up vehicle pre-inspections, we use a smart damage detection system for four-wheelers. Deep learning models work together to quickly and accurately identify whether a car panel is healthy or damaged, enabling faster processing and multi-panel inspections.

NLP-based Call Transcription and Intent Identification: We use NLP to transcribe and summarize live motor claim investigation calls. It converts conversations into real-time English transcripts and identifies caller intent, improving the speed and accuracy of claim registration and documentation.

AI-based Vehicle Parts Repair Recommendation: Remember seeing our vehicle work approval TAT earlier? One of the reasons behind our quick approval is our in-house AI tool that recommends whether a damaged car panel should be repaired or replaced during live claim assessments. It analyses eight vehicle poses to detect total damage more accurately, speeding up claims and improving decision-making. Choosing repair over replacement is not only a win for your vehicle but also for the planet. Every repaired panel reduces the need for new parts, cuts down plastic waste in landfills, and lowers the carbon footprint of vehicle maintenance, ensuring a greener future.

Sentiment-based Call Summarization: This tool helps our Customer Care team learn better from live calls by converting speech to text and analysing the sentiment. It creates clear transcripts and summaries of caller intent, enabling faster and personalized service, reducing the need for follow-up calls.

AWARDS AND ACCOLADES

We’re deeply honoured to have received the Best Fintech Insurance Award at the Financial Express Best Banks Awards 2025 presented by the Hon’ble Union Minister of Home Affairs Shri Amit Shah, along with Maharashtra CM Devendra Fadnavis and Deputy CM Eknath Shinde. Receiving this recognition from such esteemed leaders makes the moment truly special for all of us at Digit. It’s a proud reminder that our commitment to simplifying insurance through technology and customer-first thinking is making a meaningful impact.

AWARDS WE WON IN H1FY26

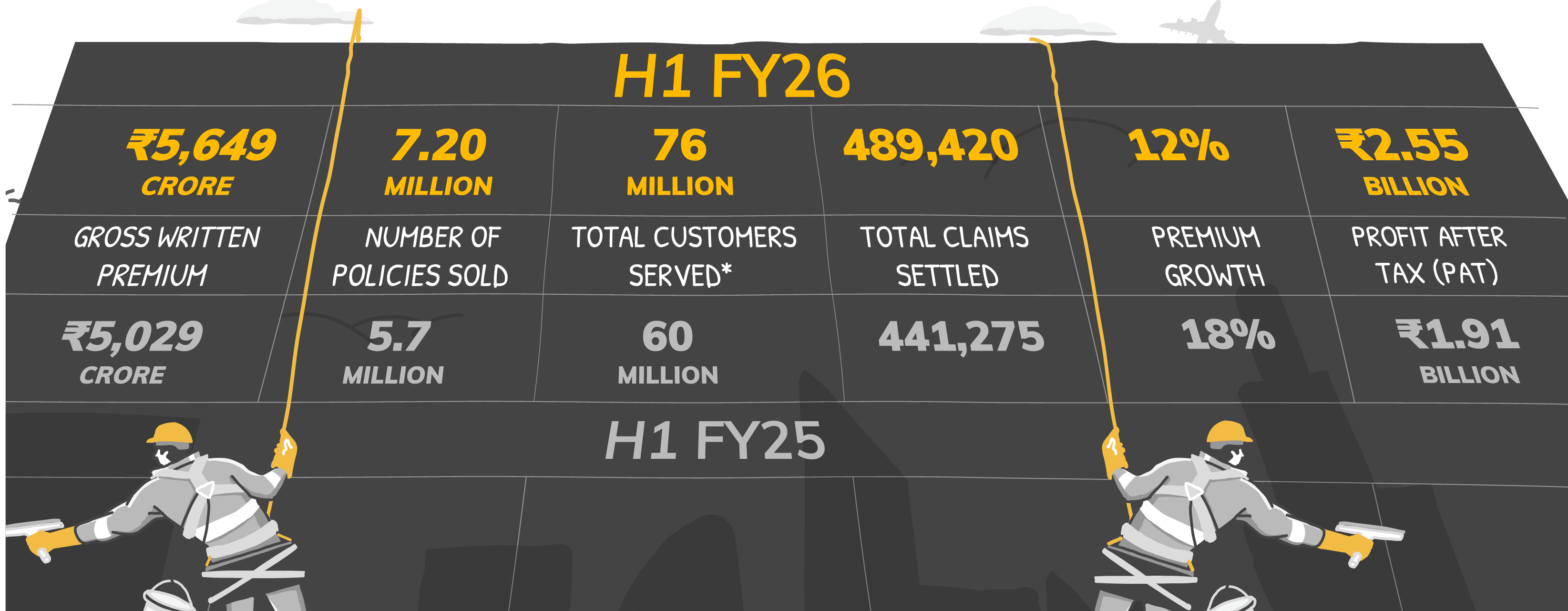

OUR KEY GROWTH METRICS

We’re almost at the finish line, but before we wrap up, let’s take a quick look at our key numbers.

H1FY26 KEY FINANCIALS: DELIVERING RESULTS THAT DELIGHT

Data for the period H1 FY2025 and H1 FY2026; *Cumulative count of all customers/lives onboarded and includes without limitation persons who have availed insurance benefits under various policies issued since inception till September 30, 2025.

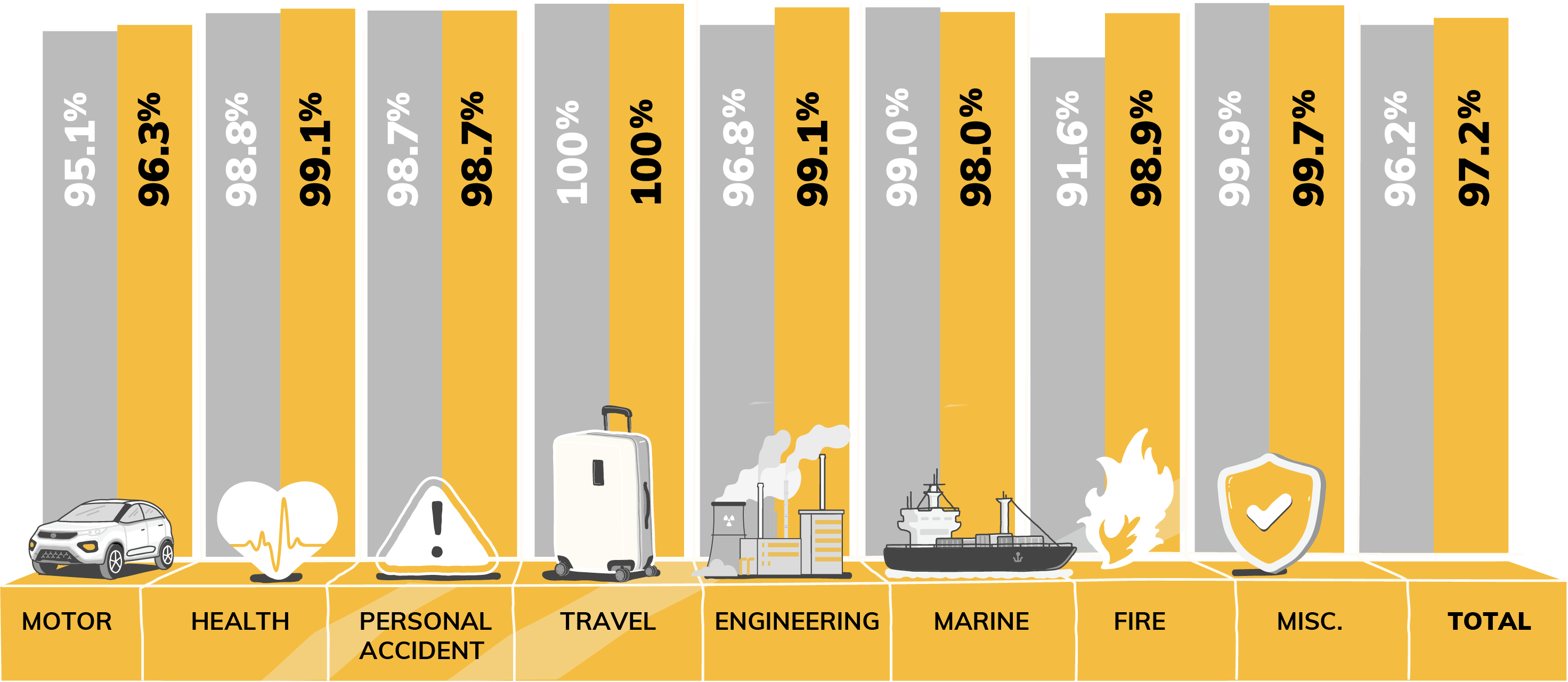

Here is a look at Digit’s Claims Settlement Ratio across various LOBs:

Note: Claims Settlement Ratio = (Claims Paid + Claims Closed)/(Claims outstanding at beginning of the year + Claims Reported - Claims outstanding at the end of the year).

We regularly put out our Claims Settlement Ratio every quarter in our Public Disclosures. One can access the same by going through "NL 37: Claims Data".

And that’s a wrap!

Hope you enjoyed the 9-minute joyride through our Transparency Report — short, snappy, and (hopefully) insightful.

Got feedback? Hit us up at mediarelations@godigit.com. Tell us what made you nod, what made you squint, or what you'd love to see next.

We’ll be back with our next drop in April. Until then, stay awesome and take care!