Renew Expired Car Insurance Online

Expired Car Insurance Renewal Online

9000+

Cashless Garages

2900 Crore+

Paid-in Claims

1.2 Cr+

Policies Sold

I agree to the Terms & Conditions

Buy Online for Huge Savings

Car insurance Online, Up to 90% Discount

It's a Brand New Car

9000+

Cashless Garages

2900 Crore+

Paid-in Claims

1.2 Cr+

Policies Sold

What is Expired Car Insurance?

Expired car insurance policy means that your policy is no longer active because you didn't renew it on time or missed a premium payment. It implies that your car insurance expired policy will now not cover you for any damage or loss caused due to any accident.

Driving with an expired car insurance policy has several disadvantages, which are covered below. Therefore, to remain safe in all unfortunate incidents and to have financial backup at all times, it is important to do renew expired car insurance online as soon as possible. Additionally, it also ensures your peace of mind.

Should I Do Expired Car Insurance Renewal with the Same or New Insurer?

Can You Do Car Insurance Renewal After Expiry Online?

Yes, you can do expired car insurance renewal online in case you fail to renew it within the car insurance expired grace period. However, you will not be able to raise a claim for an incident that occurs after the policy has expired.

Wondering how to renew expired car insurance? Well, here are three types of situations:

- Immediate Car Insurance Renewal Within Grace Period - In case you forget to renew the expired car insurance policy despite regular reminders, your insurance company usually allows you to renew the car insurance policy within a specific period, called the grace period, with no severe consequences. It generally ranges between 30 to 90 days, depending on the insurer. Also, if you renew car insurance expired policy within grace period, your insurer might not even increase the premium or inspect the car in such a case before renewing, and will keep your No Claim Bonus discount intact, if any.

- Car Insurance Renewal After Grace Period - If you fail to renew expired car insurance within 90 days after the policy has expired, then in such a case your car insurance policy will be terminated. This can mean that you will need a fresh car insurance policy which will require a car inspection upon renewal, and the accumulated No Claim Bonus, if any, will be cancelled. Thus, your car insurance premium will be significantly increased.

Why Should You Do Expired Car Insurance Renewal?

Everything comes with an expiry date, including your car insurance policy. What happens when your car insurance policy expires is simple, you don’t get to reap any of its benefits!

So, if your car insurance has expired and you haven’t renewed it yet, here’s why you should renew it immediately:

- No Compensation for Losses - One of the primary reasons people buy or renew car insurance for expired policy is to get compensation for any unforeseen damage and losses caused to or by the insured car. Therefore, if your car insurance policy expires, you will no longer be eligible for any compensation.

- Face Legal Consequences - A lot of car owners get a car insurance policy (at least a third-party car insurance) because it is mandatory by law. So, if car owners are caught with an expired car insurance policy, they would be liable to pay a fine of ₹2,000 if they are first time offenders, while repeat offences can lead to an ₹4,000 fine and possible imprisonment of up to three months.

- Lose Out on Your ‘No Claim Bonus’ - If you had had a car insurance policy earlier, you would be aware of the ‘No Claim Bonus’. It refers to the discount you get on your car insurance renewal premium if you haven’t made any claims the previous policy year. However, to ensure you get the benefit of the same, you must renew before your policy expires. If you do car insurance renewal after expiry, then you will, unfortunately, lose out on the possible discount.

- Go Through Inspection All Over Again! - If you plan on renewing your comprehensive car insurance policy and your current policy has already expired, then upon renewal, you’ll have to go through the process of self-inspection all over again. While this is a lot simpler at Digit, with smartphone-enabled processes, it will still take you longer to renew your comprehensive car insurance policy than it would, if you renew on time. That’s why, your best bet would be to check car insurance expiry date beforehand and renew on time, or well in advance. However, even if you haven’t done it yet, it’s never too late! Read on, to see how you can renew an expired insurance online with Digit.

Why Choose Digit for Renewing your Expired Car Insurance?

We treat our customers like VIPs, know how…

How to Renew Expired Car Insurance Online with Digit?

If you want to know how to renew car insurance after expiry online with Digit, follow these steps:

Login

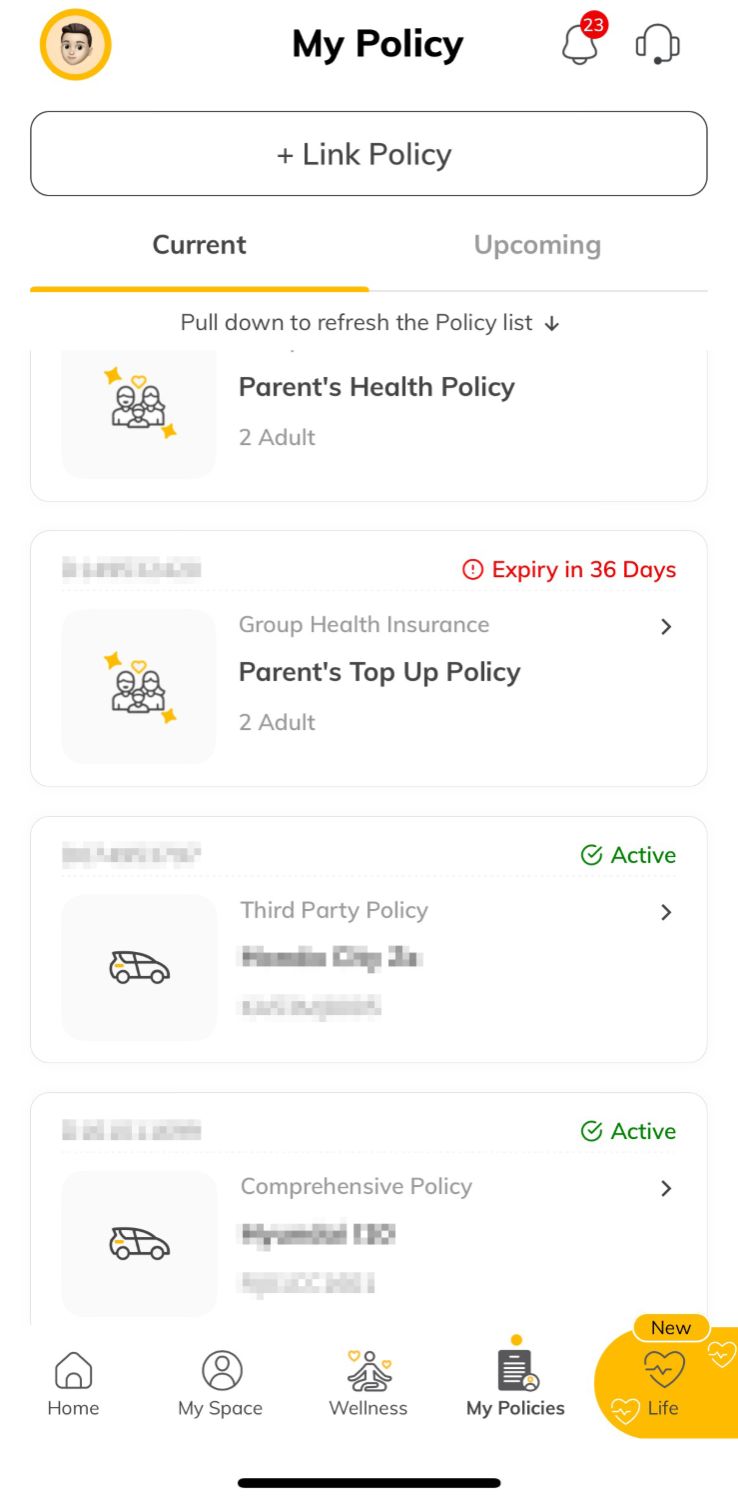

Login to Digit App or website and go to the ‘My Policy’ section.

Select Policy

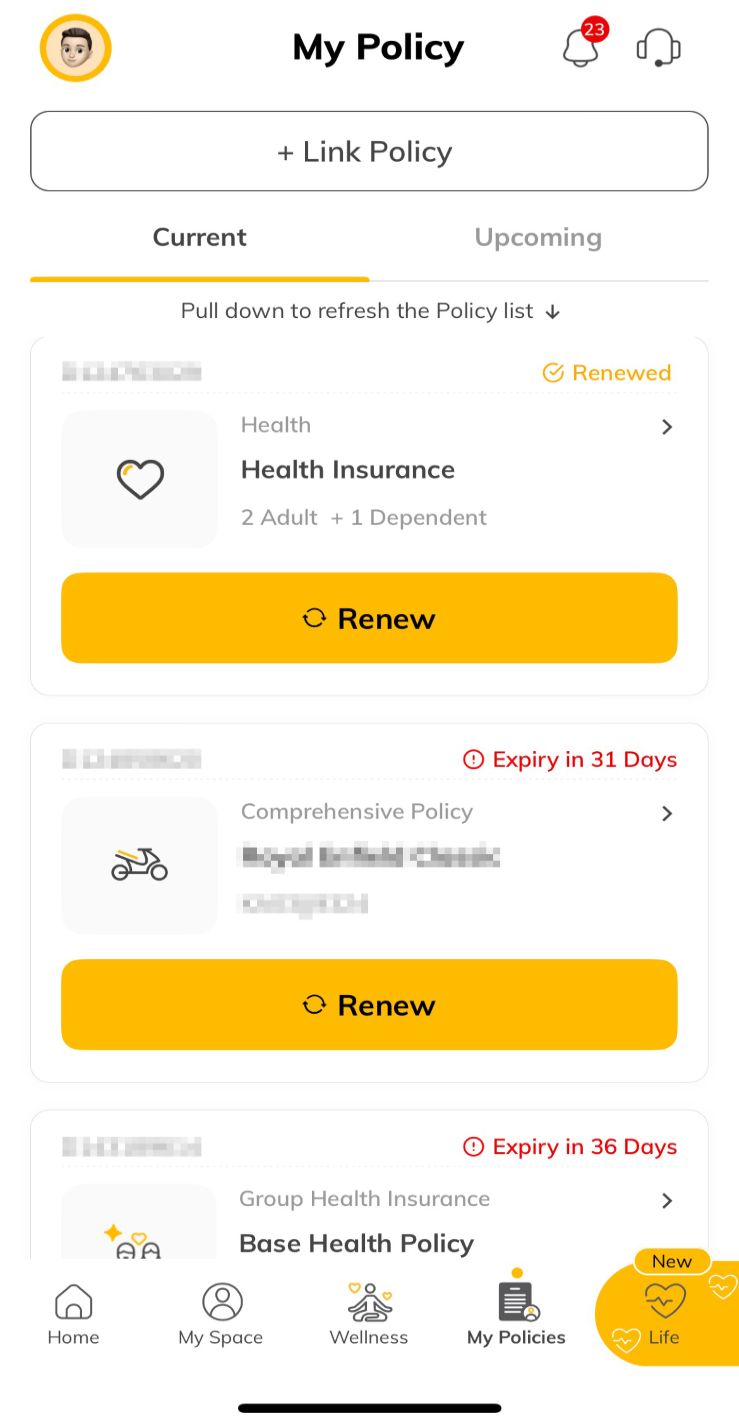

Select the policy pending for renewal and click on ‘Renew Policy.’

Choose a Plan

Next, select the add-ons and tenure and confirm the details, and move to the next step.

Make Payment

Complete the payment and mandatory KYC verification process.

That's It!

You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

How to Check Car Insurance Expiry Date Online?

If you want to know how to check car insurance expiry date online, you can visit any of the following online portals, enter your details, and easily check car insurance expiry date online in just a few steps:

Insurance Information Bureau of India portal, a portal introduced by IRDAI that gives you the details of policies purchased after 1st April 2010.

VAHAN website

Parivahan Sewa Portal

mParivahan Mobile App

RTO website

Digit’s app

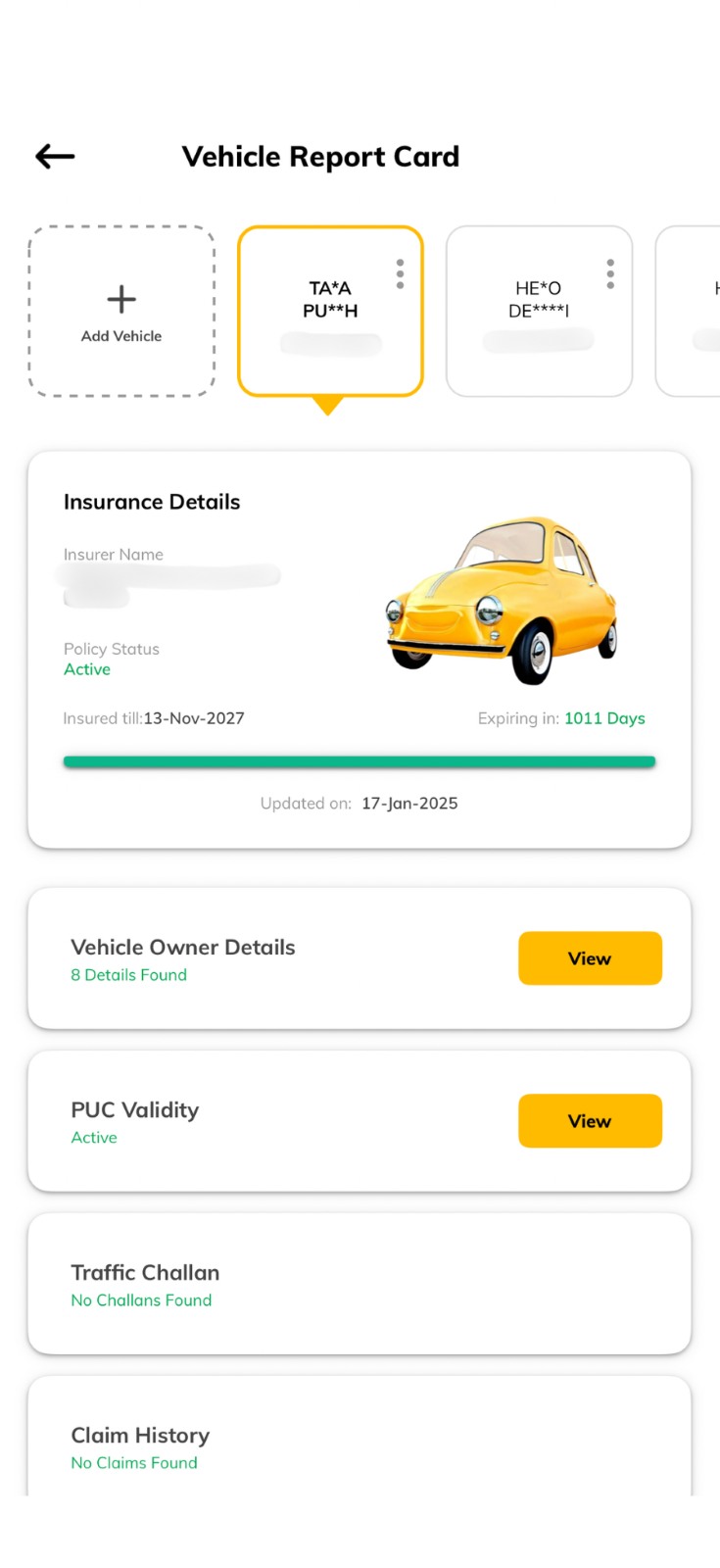

How to Check Car Insurance Expiry Date via Digit App?

For Digit Car Insurance Policy

Let’s see how you can check car insurance expiry date online via Digit’s app if you have a Digit car insurance policy:

Step 1 - On the Digit app, go to the ‘My Policies’ tab at the bottom of the screen. You will see all your current policies.

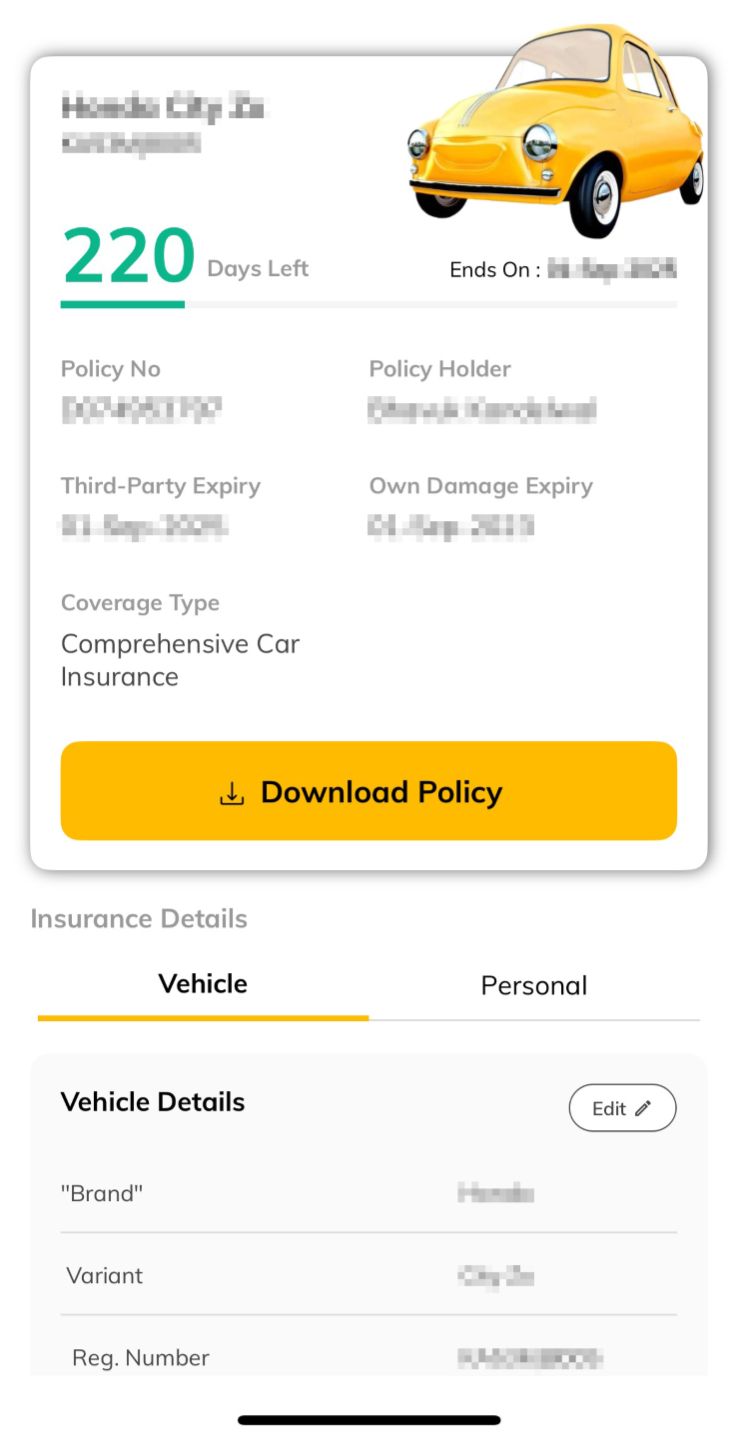

Step 3 – You will be able to see all the policy details, including its expiry date and how many days are left until you can renew the policy without any consequences.

For Any Other Car Insurance Policy

If you have any other car insurance policy, apart from Digit policy, you can follow these steps to check the expiry date:

Step 1 – Go to the Digit app, scroll down and click on

Step 2 – Select the policy for which you want to check the car insurance expiry date and you will be able to see all the policy details and how many days are left until you can renew the policy without any consequences.

Things to Know If Your Car Insurance Policy Has Expired

Once your expiry date is near, you should ideally renew your car insurance policy immediately. However, in some cases, this may take you some time and we understand that.

Maybe you want to evaluate some car insurers before making your decision or, you need time until your background check and self-inspection process is complete.

If your car insurance expired or isn’t active yet, here are some things you should do to keep you and your car safe.

Avoid driving without a valid car insurance policy. After all, you never know what can happen, and if you’re caught by a cop or even land in a small accident, the risks aren’t worth it!

If you’re confused about changing your car insurance provider from your previous policy, evaluate your options online and make an informed decision. After all, your car is one of your most prized possessions and you’d want to make the right decision for its safety.

If you can opt for a long-term policy when you’re renewing your policy online, this way you don’t need to worry about renewals for some time.

Ensure your car documents are in place, you’ll need them or some details of the same, to renew your car insurance policy.

What to Do if You Fail to Renew Your Car Insurance During the Break-in Period?

If you fail to renew your car insurance during the break-in period, remember the following:

Connect with Your Insurance Provider: In such a case, the first step is to contact your insurance provider and let them know you want to renew your policy as soon as possible. Depending on your insurer’s terms, either you will be allowed to quickly renew the plan or else, you will have to buy a new car insurance policy.

Do Not Drive an Uninsured Car: It is best to not drive your car on the road when you don’t have an active car insurance policy. This is because it is illegal to drive in India with an expired car insurance plan. So, if you get into an accident, you will not be protected.

Check for No Claim Bonus (NCB): In case you renew your car insurance expired policy within the break-in period, you may still be eligible for the No Claim Bonus, depending on your insurer, which can reduce your premium.

Explore Other Options: If your current insurer does not renew your policy, you can always consider other insurance providers suitable for your needs.

What is the Impact of Expired Car Insurance Policy on No Claim Bonus?

A No Claim Bonus (NCB) is a discount offered on the policy premium if you haven’t filed claims in the previous policy years. However, if your car insurance policy expires and you don't renew it within a certain period, it can significantly impact your No Claim Bonus (NCB). Here's what you should know about it:

If you fail to renew your car insurance expired policy within the grace period, which is usually up to 90 days after the policy expires, you will lose your accumulated NCB. This means you won't get any discount on your premium.

However, if you renew your policy within the grace period, your NCB is usually saved.

Also, if you choose to renew your policy from a new insurer, the accumulated NCB will not be unaffected.

FAQs about Expired Car Insurance Renewal

Latest News

Read More