Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

Different Types of Annuity Explained

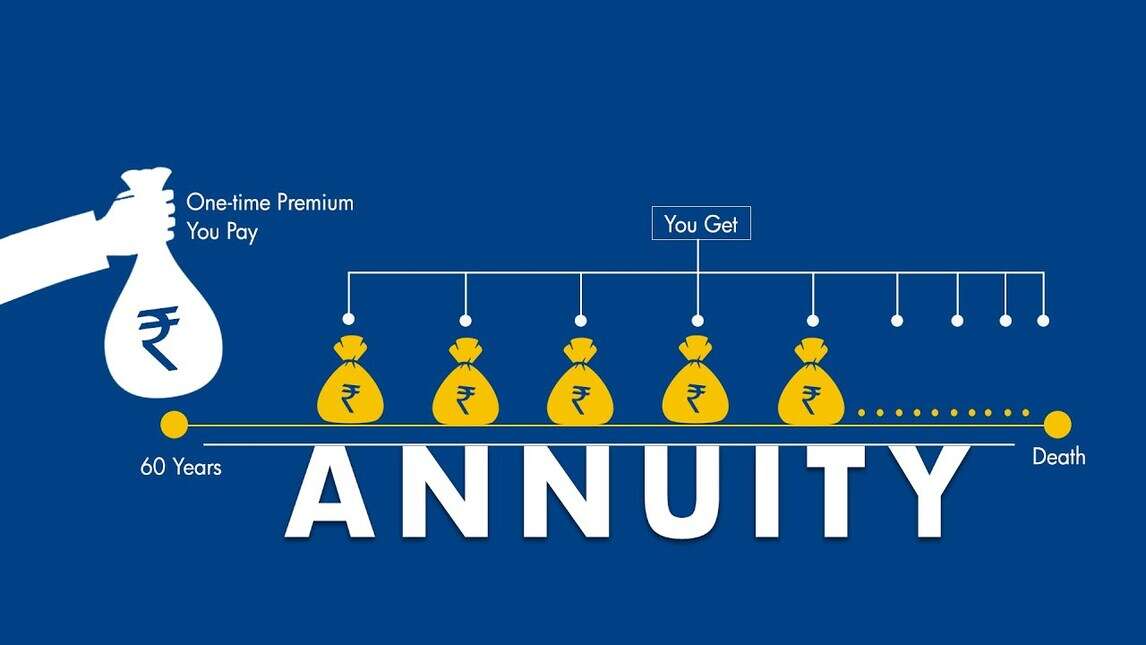

An annuity is a contract between an insurer and a policyholder where the latter receives a recurring payout by investing a lump-sum amount or making periodic payments.

This is one of the ideal savings schemes for individuals planning to make a substantial retirement corpus. In India, insurance companies offer a range of annuities. To make a proper selection, one needs to learn about the types of annuity in detail.

In this regard, following the below-mentioned piece can be a good start.

What Are the Different Types of Annuities?

Generally, there are 4 main types of annuity plans one should be aware of before investing. They are:

1. Immediate Annuity

In this type of annuity, individuals need to make lump-sum payments on behalf of which they will receive guaranteed payout immediately at a regular interval. This kind of annuity plan may be an ideal choice for someone who is on the verge of retiring and needs regular income urgently.

2. Deferred Annuity

Unlike immediate annuity plans, this annuity type generates regular income after a certain period. It consists of two phases- accumulation and vesting. In the initial accumulation phase, an individual gets to build a large retirement corpus. On the contrary, the regular payouts start in the vesting stage. Once the tenure ends, a policyholder can buy annuities with the accumulated money.

3. Fixed Annuity

A fixed annuity generates a constant and stable payout throughout tenure. In this type of annuity, an individual can invest his or her resources in fixed income instruments. Although the amount of return may be less, this annuity type might be a desirable option for someone with a low-risk appetite who expects stable returns.

4. Variable Annuity

Individuals settling for this annuity plan can expect a variety of payouts. However, these are market-connected investments that are comparatively unsafe than their fixed counterparts, making them unstable for retired personnel.

Additional Types of Annuity in Insurance

Apart from the above-mentioned categories, insurance companies extend customised annuity plans. They are as follows:

1. Lump-sum Annuity

Policyholders preferring lump-sum payouts against periodic payments might find this plan useful. However, insurers have certain terms and conditions associated with this. Therefore, one should go through the details properly before choosing a plan.

2. Life Annuity

Under this plan, an individual can receive regular payouts annually or quarterly or monthly till his or her death. For example, Mr Roy plans to get a fixed annuity of ₹50,000 for a long time post-retirement. In case he lives till 80 years and retires at 60 years of age, he gets to gather a substantial corpus. From this example, one can say that Mr Roy can benefit from a deferred or fixed or life annuity.

3. Joint Life Survivor Annuity

If a policyholder passes away, his or her spouse can continue receiving benefits under this plan. For instance, Raju plans to opt for an annuity plan with his wife, which generates regular income in case of his demise. In this regard, a joint-life survivor annuity might be beneficial.

4. Life Annuity with Return of Purchase Price

In a typical life annuity plan, individuals can receive benefits until their death. However, under this annuity type, the insurance provider will return the initial investment amount to the nominee in case of a policyholder’s death. Therefore, those who wish to leave a legacy behind might want to consider this plan.

5. Joint Life Annuity With Return of Purchase Price

Under this plan, an individual or spouse can receive benefits until death. In case both of them die, the nominee will receive the initial investment amount.

6. Inflation-indexed Annuity

In this plan, the annuity payout increases at a certain rate each year to incorporate inflation. Although it might not be related to a genuine inflation rate, it allows a buyer to cover an increase in expenses.

7. Annuity Payable for Guaranteed Time

This annuity type is payable only for a guaranteed period of 5, 10 or 15 years. After completion of the pre-decided term, the payment ceases.

Now that you know about the types of annuity in insurance, you might find it easier to decide on annuity choice.

How to Choose Your Plan from Different Types of Annuities?

While choosing the best plan out of the different types of annuity plans, one must look for the following features -

1. Safety

Evaluating risk appetite before choosing a plan is vital. Apart from this, one should also factor in inflation rates, interest rates and more while settling for a plan out of the several kinds of annuities.

2. Returns

Ideally, investors look for annuity plans that offer high returns. The return rate might vary across insurance companies. Therefore, individuals should check this aspect while investing in annuities.

3. Variability

It is evident from the section mentioned above that there are different kinds of annuities available in India. Whether you choose a fixed or variable annuity plan, it is vital that you compare the plans based on your requirements and risk appetite.

4. Liquidity

Fund requirements can arise anytime, during which you might need to make withdrawals from your accumulated corpus. Thus, one should choose a plan that comes with a certain level of liquidity.

5. Coverage

Individuals must settle for a plan that comes with maximum coverage. It is imperative that a plan that provides benefits to both the policyholder and his spouse is more desirable than other individual annuity plans.

What Should One Consider While Selecting from Several Types of Annuity?

Here are some tips for choosing a plan from the types of annuity options -

Payment Duration: Individuals opting for annuity plans can choose payment duration as per their requirements. A shorter duration implies higher payment. However, the income flow might stop in such a period during which some sort of boost is necessary.

Spouse Cover: When choosing annuity plans, it is imperative to choose a joint plan that offers extensive coverage for both the policyholder and spouse. These plans also provide benefits in case of the policyholder’s death and continue paying for their remaining life.

Knowing about the types of annuity plans can help you make a proper choice that can maximise your returns and help you meet your financial goal effectively. In this regard, following the tips mentioned above can be helpful.