Buy Term Insurance Plan & Policy Online in India 2026

Term Life Insurance, often referred to as a pure protection plan, provides financial security to your loved ones by offering a lump-sum payout in the event of your untimely demise during the policy term. This coverage ensures that your family can maintain their standard of living, pay off debts, or meet future financial goals without the burden of financial stress.

Thus, it allows you to safeguard your family's future without worrying about unforeseen circumstances impacting their well-being.

What is Term Insurance?

Term insurance is like a financial safety net that protects your loved ones in case something unexpected happens to you during a specific period. You pay a small amount regularly (known as a premium) to an insurance company, and in return, if you pass away during the policy term, the company pays a lump sum amount (called the death benefit) to your family or beneficiaries. This helps them manage expenses and maintain their lifestyle even in your absence.

Unlike other types of life insurance, term insurance focuses purely on life cover without any investment or savings component, making it more affordable. It can cover a range of needs, such as replacing lost income, paying off debts, or securing your family’s future. However, if you outlive the term, the policy ends without any payout or refund of premiums.

However, if you outlive the policy term, there is no premium or sum assured returned to you.

Think of it like a reliable guardian who steps in to support your family financially when you’re no longer there to do so.

Why Do You Need Term Insurance?

Term insurance doesn’t just offer peace of mind today, it’s a smart way to protect your family’s future and make sure they are financially secure if something happens to you. Let’s understand how:

Extended Financial Security

A term insurance policy can secure financial protection for a long duration, often up to 30 years or more. This long-term coverage ensures that your loved ones will be financially supported in your absence, providing peace of mind about their future well-being.

Financial Stability for Your Loved Ones

Term plans offer a lump sum benefit if an unfortunate event occurs, ensuring your family has a steady income stream. This lump sum can cover daily living expenses, pay off debts, or fund future goals, providing a safety net for your loved ones.

High Coverage at Low Cost

Term insurance stands out among other life insurance options for its balance of extensive coverage at considerably low premium costs. This affordability makes term insurance attractive for those seeking effective yet budget-friendly life insurance solutions.

Flexible-Premium Payment Options

You can choose how you pay your premiums. Whether annually, every six months, quarterly, or monthly, this flexibility allows you to align your premium payments with your financial situation, making it easier to manage your budget.

Additional Coverage with Riders

You can enhance your term insurance coverage with additional riders for disability cover, critical illness cover, and accidental death cover. These add-ons provide extra layers of protection, offering financial support for daily expenses, loan payments, and clearing debts, ensuring comprehensive coverage.

Customisable Protection Plans

Term insurance offers flexibility in terms of coverage amount, policy term, premium payment terms, and rider options. This allows policyholders to tailor a plan to their specific needs and adjust coverage as their life stage requirements evolve.

Loan Protection

Term insurance can be specifically designed to cover outstanding loans (e.g., home loans, car loans). In the event of your demise, the policy payout can directly settle these debts, preventing the financial burden from passing to your family.

Income Replacement

Beyond a lump sum, some term insurance policies can offer a regular income stream to your beneficiaries for a specified period, ensuring a more consistent financial support system for daily expenses and long-term planning.

Estate Planning

Term insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes or other settlement costs, ensuring that your assets are distributed to your heirs as intended without being diminished by immediate financial obligations.

MWP Act Protection

When policy is purchased under the Married Women’s Property (MWP) Act, the death benefit is legally secured for the wife and/or children. It cannot be claimed by creditors or other relatives, ensuring the payout goes directly to the intended beneficiaries. This is ideal for safeguarding family finances in case of business liabilities or legal disputes.

Tax Benefit

Term insurance policies offer the advantage of tax deductions on premiums paid up to INR 150,000 annually under Section 80C of the Income Tax Act, 1961. Moreover, the payouts are tax-exempt under Section 10(10D), providing a dual benefit of protection and tax savings. There is no cap on the exemption limit for the payout received.

Explore Digit Term Life Insurance Products

Digit GLOW Term Life Insurance

Suitable for self-employed and young salaried professionals who want smart and early protection.

Choose your sum assured, from ₹25 Lakhs up to ₹1 Crore, to match your financial goals.

0% GST on Premium

No physical forms or waiting, just buy your policy online with PAN and Aadhaar.

Digit GLOW Plus Term Life Insurance

Suitable for salaried professionals, entrepreneurs, and high-income earners.

Access up to ₹20 crore sum assured to cover your extensive financial goals and liabilities.

Terminal Illness Benefit is included and covered at no additional cost.

Gain long-term protection up to Age 85 that supports post-retirement responsibilities.

240

208

Types of Term Insurance Plans in India

While the primary benefit of term insurance remains the same, based on a few features, Term Insurance can be classified into the following types:

Level Term Insurance Plan

The premium remains constant throughout the term life policy duration, ensuring that both the premium and the death benefit remain unchanged. Level term insurance can last anywhere from ten to thirty years, depending on the policyholder's requirements.

Increasing Term Insurance

With an Increasing term insurance plan, your insurance coverage grows over time. It's particularly useful because as life goes on, your financial responsibilities and the need for a larger safety net might increase. You start with a certain amount of coverage, and it gets bigger as the years pass, helping you keep up with the cost of living and inflation.

Decreasing Term Insurance Plan

Return of Premium Term Insurance Plan

A Term Plan with a Return of Premium option provides life coverage during the policy term; imagine paying premiums regularly for insurance to protect your family. If you outlive the policy term, you get all the money you paid back. You get peace of mind knowing your family is protected, and if the insurance isn't used, you don't lose the money you paid.

Convertible Term Insurance Plan

A Convertible term insurance plan offers flexibility. It starts as a basic term plan but allows you to switch to a whole-life policy later without going through medical exams again. It's perfect for those who have limited financial resources now but anticipate a need for longer-term coverage in the future. You do not need to pay a fee while converting but can expect higher premiums.

Group Term Insurance

Employers often provide Group Term Insurance as part of their employee benefits package. This type of insurance covers multiple people under a single policy, typically lowering premiums.

Joint Term Insurance

Joint Term Insurance is specifically designed for couples. Both you and your spouse can be covered under one policy. If either of you passes away, the surviving spouse receives the benefit. This type of insurance helps ensure financial security for the family.

Who Should Buy a Term Insurance Policy?

Any individual with financial dependents, such as a spouse, parents, retirees with liabilities, or business people with financial liabilities, must invest in a term insurance plan.

Young Professionals

Young, freshly employed individuals usually think they don't need Term Insurance since they don't have any dependents. However, this thought might not be correct. At a young age, with a healthy body and no liabilities, your premium would be much less than it becomes in the later stages of life and it remains the same for the entire term.

Self-Employed

Self-Employed individuals can protect their family's future and business obligations with term insurance, ensuring financial continuity and household stability after they're gone.

Home Loan Borrowers

The purchase of a home is a huge expense; if done through a Home loan, it’s a huge liability. Unfortunately, if the primary earner passes away, it would be difficult for the dependents to repay the home loan. Life Insurance provides this assurance that the burden of a loan would not come on the family members in such unfortunate circumstances.

Working Woman

Working women are pivotal in their families' financial well-being, and a term insurance plan safeguards their family's lifestyle and aspirations, covering any debts and serious health conditions and providing peace of mind.

Newly Weds

Post-marriage, you start a new life and build a new lifestyle. You don't have just an emotional dependency on each other, but there is a financial dependency too. So, while we are still lost in the roses and chocolates, do take time to purchase a gift that will secure your partner's future life. Buy a term plan.

Parents

Parents are vital in securing their children’s financial future through activities like paying for education and saving for university; mitigating these burdens with a term insurance plan ensures their dreams remain within reach, even in unforeseen circumstances.

Single Parent

If you are a single parent, your children depend on you completely. Term life insurance can provide peace of mind, knowing that your kids will have financial support if something happens to you.

Housewives

Housewives also significantly contribute to their family's financial stability; term insurance guarantees that, in their absence, the household and childcare costs are manageable, preserving their family's way of life.

Retirees

For retirees, term insurance is key to ensuring their partner’s financial comfort and healthcare needs in the later stages of life, maintaining their living standards without worry.

Non-Resident Indian

NRIs can support their family back home through a term insurance plan. This plan offers a safety net against the economic challenges of medical care and travel, ensuring peace of mind across miles.

Tax Payers

Term Insurance premiums fall under tax exemption under Section 80C of the Income-tax. The death benefits received under the term insurance are also exempt from tax, subject to some T&C under Section 10 (10 D) of the Income Tax Act.

Some Relatable Real-Life Examples for Better Understanding

Aravind, 35, and Priya, 30 (Married Couple)

Aravind and Priya, both successful IT professionals, are repaying a mortgage for their dream home. Their jobs include insurance covering the outstanding mortgage balance if either of them passes away during the loan term, leaving other financial needs unaddressed.

So they decided to buy term life insurance, knowing their loved ones would be secure even if the unexpected happened.

Rohit, 34, Family Man (Sole Breadwinner)

Rohit, aged 34, is a devoted husband and father of two who is responsible for his family's financial well-being. His father is close to retirement, while his parents-in-law are also approaching retirement.

To safeguard the financial future of his loved ones, he plans to obtain term life insurance with the flexibility to adjust the coverage as the family's dependency needs evolve, providing safety for their future.

Sneha, 23, (Single Woman)

Sneha, a young professional with no dependents to worry about, is considering applying for a home loan. She recognizes the value of purchasing term life insurance to secure her future while she is young and can benefit from lower premiums due to her age and health.

Plus, she knows that once she gets married, she can easily update her policy to include her spouse as the nominee. This proactive approach ensures Sneha stays ahead in her financial planning.

Why Choose Digit Life Insurance?

- Transparency Policy Wording - No hidden clauses. No jargon. Just clear terms and real coverage. What you see in your policy is exactly what you get, so there’s no second-guessing when it counts.

- Quick Online Processes - From policy purchase to claim filing, everything happens online; no paperwork, no running around. You get a smooth, fast process backed by human support when you need it.

- Worldwide Claim Support - Your family can still claim online if something happens to you outside India, without running around with fast claim process and support across time zones. T&C*.

- Eligible for NRIs of Indian Origin - NRIs of Indian origin can buy a plan while in India and manage it from anywhere. Premiums can be paid through NRE/NRO accounts, and coverage remains valid globally.

How Much Term Life Insurance Do You Need?

Calculate Monthly Family Expenses

Determine a comfortable amount your dependents would need per month if you weren’t there.

Evaluate Years of Support Needed

Decide for how many years your family would depend on this support.

Estimate Major Future Costs

List major expenses you want to cover such as children’s education, marriage, home loan payments, etc.

Subtract Savings & Existing Insurance

Subtract current investments, funds, fixed deposits, or other life insurance policies that your family can use.

Why Selecting Right Sum Assured is Important When Selecting the Term Plan?

Choosing the right coverage for your term insurance is crucial for your family’s financial safety. This amount, known as the sum assured, protects your family if something unexpected happens to you

- Financial Security for Beneficiaries: The primary purpose of a term plan is to provide financial protection to your loved ones in case of your untimely demise. A well-chosen sum assured ensures that your beneficiaries have adequate funds to maintain their standard of living and cover essential expenses, like mortgages, children's education, and daily living costs.

- Coverage of Debts and Liabilities: If you have outstanding loans or other financial obligations, the sum assured should be sufficient to clear these debts. This prevents your family from being burdened with financial liabilities during a difficult time.

Read More

When considering term insurance, it is essential to choose a coverage period that aligns with your financial goals.

The coverage should ideally extend until your children’s education and marriage expenses are taken care of, your dependents achieve financial independence, you accumulate a sufficient retirement corpus, and any outstanding loans are fully repaid.

This approach ensures that your family is financially protected during crucial phases of your life, while providing you with peace of mind as you work toward financial independence and being debt-free. Selecting a term that comprehensively addresses these milestones will enhance your long-term financial security.

Ashok Manwani

VP, Life Insurance Products

How to Decide the Term Insurance Policy Duration?

The duration of a term insurance policy, often referred to as the "term length," can vary significantly based on individual circumstances, financial goals, and life stages. Here’s a breakdown of how to determine the appropriate term duration for your needs:

Mortgage Coverage

It's crucial to ensure that your life insurance policy spans the duration of your mortgage. This means if you are committed to a 30-year mortgage, securing a 30-year term life insurance policy is sensible. This alignment guarantees that in the unfortunate event of your passing, your family won't have to worry about continuing mortgage payments, thus securing their living situation.

Children’s Education

Planning for your children's education requires foresight. If your children are currently in elementary school, a policy term of 20-25 years is recommended. This timeframe ensures that funds will be available to cover their higher education expenses, from undergraduate to potentially graduate studies, providing them a solid foundation without the burden of student loans.

Debt Repayment

Spousal Support

If your spouse depends on your income, it's important to choose a policy term that allows for enough time for them to become financially independent. This might mean covering the timeframe until they can re-enter the workforce, complete education or training programs, or reach a financial milestone that ensures stability.

Dependents’ Self-Sufficiency

For those with dependents, the goal should be to maintain coverage until they no longer rely on your financial support. This often aligns with them completing their education and establishing their careers. Tailoring your policy's term to these life milestones ensures they have the support they need during their formative years.

Retirement Planning

Life insurance can also be a strategic part of retirement planning. Choosing a term that extends until your anticipated retirement age, say 65, means your spouse or dependents would have financial support in replacing your income, should something happen to you before then. This is especially critical if your retirement savings aren't sufficient to support your loved ones in your absence.

Income Replacement

If your family heavily relies on your income, ensuring your policy covers the span until your planned retirement is crucial. This approach acts as a safeguard, providing your family with the necessary financial resources to maintain their lifestyle and meet future goals without your income.

Age Considerations

Choosing a longer term of 20-30 years is often beneficial, as it aligns with key financial milestones like buying a home, family planning, and children's education. A 15-20 year term may suit those facing significant obligations such as mortgage and tuition payments. For individuals with fewer debts or financially independent children, a shorter term of 10-15 years could be sufficient.

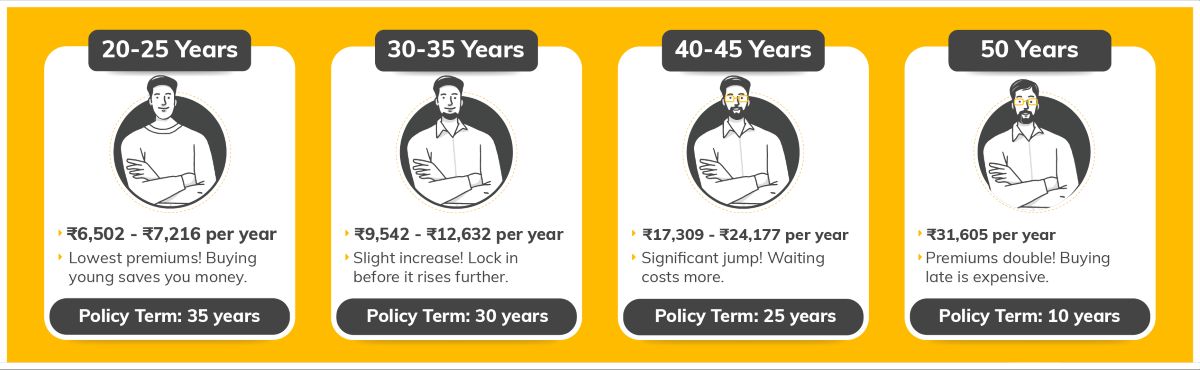

When Should I Buy a Term Plan?

Buying a term insurance plan is an important financial decision, and the timing of your purchase can have a significant impact on the cost of premiums and the benefits of the coverage. Here’s a breakdown of when to buy a term plan at different stages of life, and how the premium tends to vary with age:

In Your 20s (Age 20-29)

For fresh graduates and young professionals, it’s smart to secure lower premiums. If you are single or just starting your career, this is a great time to get long-term coverage at a lower cost. Additionally, if you have student loans or other debts, a term plan can help ensure these are covered in case of unexpected events.

In Your 30s (Age 30-39)

This stage is perfect for married couples, new parents, and homeowners. It’s a time when many start families, buy homes, and take on financial obligations. Ensuring financial protection for your dependents, like children or a spouse, is crucial in case of an unexpected event.

In Your 40s (Age 40-49)

This stage is ideal for parents with older kids and those approaching retirement. You might still have financial duties like paying off a mortgage, supporting college-bound children, or assisting elderly parents. Even though premiums are higher, it’s crucial to ensure your family is protected.

In Your 50s (Age 50-59)

This stage is perfect for those nearing retirement, with dependent children or debt. It's a good time to reassess your insurance needs, especially if your children are grown or your debt is cleared. Since insurers evaluate health risks more strictly, it's wise to secure a policy sooner if you are in good health.

In Your 60s and Beyond (Age 60+)

This stage is ideal for those with minimal or no debt, aiming to cover final expenses like funeral costs or leave a small financial legacy. Opting for shorter-term policies, such as 10 or 15 years, can help keep costs lower.

Why NRIs Should Consider Buying Term Plan in India?

As an NRI, securing your family’s future is a top priority, no matter where you live. Buying a term insurance plan for NRI in India is a smart and practical decision because it offers strong financial protection at a much lower cost compared to policies in foreign countries.

Term insurance premiums in India are more affordable, offering high coverage, at low premiums. The process is simple, requiring minimal documents like a passport or income proof. NRIs benefit from convenient options like video medical exams and tests in their country of residence.

Term plans offer global coverage, ensuring your loved ones in India receive a tax-free lump sum in INR, no dealing with currency exchange or cross-border complications. Also premiums qualify for tax benefits under Section 80C.

If you’re an NRI with family or financial ties in India, it’s worth exploring term insurance policies tailored to your needs.

Digit Life Insurance in the Spotlight

How to Choose the Right Term Insurance Plan?

Assess Your Coverage Needs

Calculate the coverage you need based on your financial obligations, such as outstanding loans, future expenses (like children's education), and daily living expenses. A common rule of thumb is having coverage at least 10-15 times your annual income.

Claim Settlement Ratio of the Insurer

When choosing Term Insurance, focus on the Insurer's Claim Settlement Ratio. This ratio shows how many claims are settled compared to those received. Choose an insurer with a high ratio for quick and efficient claim processing. This ensures financial security for your family. Check the total claims settled to gauge the insurer's reliability.

Review the Solvency Ratio

The Solvency Ratio gives an idea of whether your insurance provider has enough financial buffer to settle all claims in case of any extreme situation, such as natural disasters. The Insurance Regulatory and Development Authority of India (IRDAI) mandates a minimum solvency ratio of 1.5, indicating the insurer's ability to meet its long-term obligations.

Customer Satisfaction and Ratings

High customer satisfaction scores and excellent service ratings are indicators of a company’s reliability and quality of service. Research customer reviews and ratings to ensure you choose an insurer known for good customer support.

Add Riders for Extra Protection

Opt for policies with customization options to meet your needs. Add riders like critical illness cover, accidental death benefit, and waiver of premium for extra protection. These can provide additional financial security in case of unexpected events.

Premium Cost

The premium cost of a term insurance plan is significant but should not overshadow the value of the protection offered. It's essential to look for plans with favourable terms and comprehensive coverage, including crucial riders, at fair rates.

Avoid Mixing Insurance with Investments

Insurance should primarily provide financial protection. Mixing it with investment products can dilute its effectiveness. Focus on pure term insurance for adequate coverage and keep investments separate.

Consider Inflation

Choose a term insurance plan with increasing coverage. These plans raise the sum assured annually, typically by 5-10%, to keep up with rising costs. This ensures your coverage remains adequate over time, protecting your family's financial security against inflation.

Right Way to Buy Term Life Insurance

Documents Required to Buy a Term Life Insurance Policy

When buying a term life insurance policy, you must provide several important documents. Here's a list of the key documents typically required:

Identity Proof

Age Proof

Address Proof

Income Proof

Photographs

Medical Reports

Eligibility Criteria for Term Life Insurance

- Age: Term insurance is available for individuals aged 18-65. You can still buy a policy at 65 with coverage up to 99. Age significantly affects the premium

- Citizenship: Residents of India are eligible for term insurance, even if they later move abroad for study or work.

- Medical Tests: Purchasing term insurance may require medical tests to assess the premium based on your health accurately. Some policies bypass medical tests but offer lower coverage.

- Lifestyle: Smoking, high-stress levels, and poor sleep habits can increase your premium. Jobs or hobbies that are considered risky can also lead to higher premiums.

How to Buy Digit Term Insurance Policy Online?

The five easy steps to buy term life insurance plans are as follows:

Visit Digit Website/App

Visit the official Digit Life Insurance website or app and compare the types of life insurance policy options.

Enter Details

Fill in your personal information, share your lifestyle habits, date of birth, annual income, and mobile number.

Coverage & Payment

Now it’s time to choose your ideal coverage, premium payment methods, and any additional benefits you want!

Payment & KYC

Complete your payment, and then finish the KYC process and fill in your nominee details.

Access Documents

Congratulations! Your policy documents will be sent to your email and WhatsApp. You can also access it 24/7 on the Digit App.

Why Should You Buy Term Insurance Online?

Buying term insurance online offers several advantages:

- Easy Comparison of Plans: Buying term insurance online allows you to quickly compare different plans and understand their benefits, ensuring that you make an informed decision.

- Lower Premiums: Online term insurance plans often have lower premiums than offline ones.

- Quick and Simple Process: Online buying is quick and straightforward, saving you much time.

- Convenience: You can compare, choose, and pay for the most suitable plan at your convenience without physical meetings or paperwork.

1 Crore Term Life Insurance Premiums for Different Age Groups

Here is a look at how premiums for a ₹1 crore term life insurance plan increase across different age groups, up to 70 years:

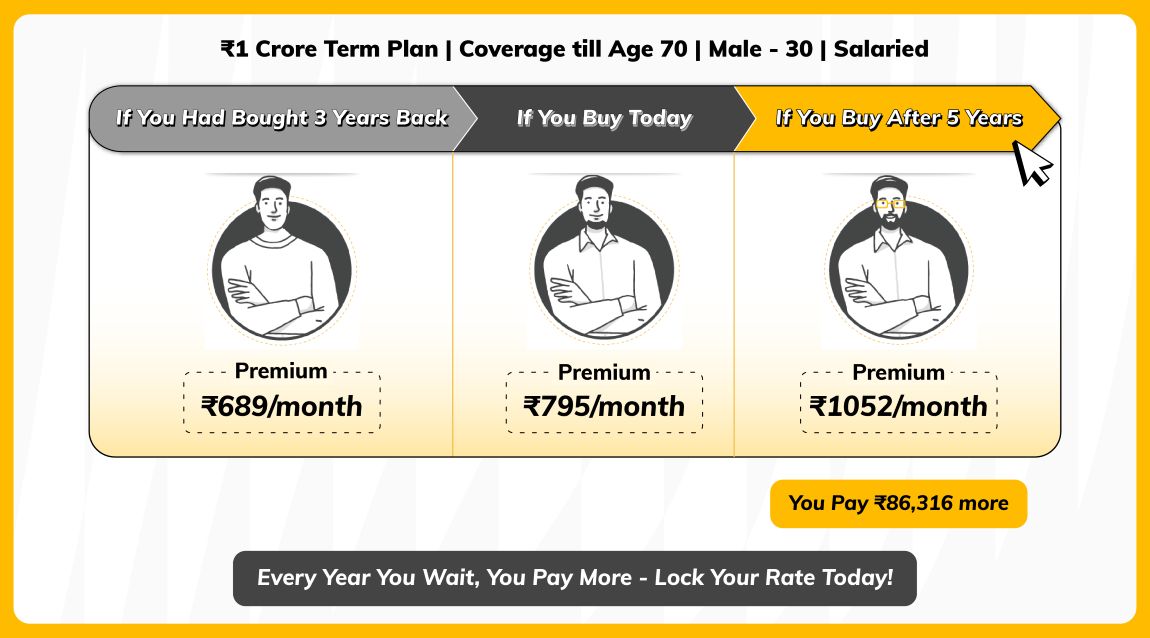

Buy Now or Pay More Later: The Cost of Waiting for Term Insurance

The longer you wait to buy term insurance, the higher your premium becomes.

For example, a 30-year-old salaried male can get a ₹1 Crore term plan coverage till age 70 for just ₹795/month today. If he had bought it 3 years ago, the premium would have been ₹689/month.

But if he waits 5 more years, the premium will rise to ₹1,052/month. That’s an extra ₹86,316 paid over the policy term, for the same coverage.

So purchasing term insurance at a younger age helps lock in lower premiums and ensures long-term savings.

How Term Insurance Calculator Can Be Helpful?

A term insurance calculator is a helpful online tool designed to assist individuals in determining the premium amount for a term insurance policy. Users provide details such as:

- Age

- Income

- Desired coverage amount

- Policy term

- Lifestyle habits (smoker or non-smoker)

- Health conditions.

Based on this information, the calculator estimates the premium required to secure the specified coverage. It’s a convenient way to assess your insurance needs without the need for medical exams.

Benefits of Using a Term Insurance Calculator

The benefits of using a term insurance calculator are:

What are the Factors Affecting Term Insurance Premiums?

When you buy a Term Insurance plan, your premium is calculated based on several demographic and lifestyle factors, such as age, gender, present or past medical ailments, habits like smoking or drinking, and hereditary diseases.

Here are the most common factors that affect a Term Insurance premium:

Age

The topmost factor affecting your Life Insurance premium is your age. A younger age means fewer chances of developing any life-threatening ailments and a long premium payment term. This translates to lower premiums at lower ages that, in turn, increase with age.

Term

The Insurance Premium directly depends on the period and increases with the increasing term, considering the older and the riskier years of life.

Medical History

Insurers usually ask for medical checks before issuing a policy, and they assess the health records, especially any serious ailments or family history. Other body metrics like cholesterol, BP, etc., are also considered since any health risk would mean a higher chance of a Life Insurance claim, which results in a higher premium.

Current Health Condition

While issuing the policy, a health assessment of the prospective policyholder is done to ensure they do not suffer from any serious ailment that might pose a life risk and thus increase the policy's premium.

Occupation

Your premium is also affected by the profession you are in. People in professions where they are directly exposed to life risks, like soldiers, mine workers, etc., are charged higher premiums.

BMI

A skewed BMI index can directly mean you are at a health risk, increasing your premium.

Lifestyle Habits

Smoking, Alcohol consumption, inclination towards adventure sports, all these lifestyle habits increase your premium.

What are Term Life Insurance Riders/Add-ons?

A basic term insurance policy offers financial protection, but adding Term insurance riders enhances coverage. Riders provide additional benefits for specific risks, such as critical illness, accidental disability, or income loss due to disability. They help tailor your policy to your needs, ensuring broader protection for you and your family during challenging times.

Note that adding riders to a policy typically costs as low as ₹50 - 300 per month, depending on the type of riders, in addition to the premiums for the primary policy.

Types of Term Insurance Riders

240

208

Riders can be added to the plan at a small additional cost. They enhance the coverage and provide much-needed financial support during challenging times.

For instance, the accidental death and disablement rider ensures financial stability in the event of accidental death or disability. The critical illness rider offers a lump-sum payout if diagnosed with severe illnesses like cancer or heart disease. Lastly, the waiver of premium rider keeps the policy active even if premiums cannot be paid due to disability or illness. These riders offer tailored protection to meet unique needs.

Ashok Manwani

VP, Life Insurance Products

Benefits of Adding Riders to Your Term Insurance Policy

Adding riders to your term insurance policy significantly enhances its value and provides a more comprehensive safety net. Here are the key benefits of including riders in your term life insurance plan:

How to Download Term Insurance Policy Document With Digit App?

Need a copy of your term life insurance policy document? You can download it easily through the Digit App by following these simple steps:

Login Your Account

Visit the Digit website or app and click on ‘Login’ at the top-right corner. Enter your registered mobile number and verify with OTP.

Visit ‘Active Policies’

Once logged in, navigate to the Active/My Policies section. Here, you can check the policy number, end date & start date.

Download the Policy

Done! You can save, share, print or email the policy for future reference anytime, anywhere.

Complimentary Wellness Benefits for Digit Life Customers

At Digit, we believe life insurance should do more than just protect you from the unexpected; it should also help you live a healthier and happier life. That's why we offer Wellness Benefits to support your overall well-being. These programs are designed to improve your physical, mental, and emotional health through various resources and activities.

With Digit Life Insurance, you gain exclusive access to wellness perks that make living well more achievable and affordable. These benefits are part of our life insurance plans and aim to enhance your holistic health and wellness. Some of these great benefits include -

Unlimited 24×7 Teleconsultations with General Physicians

Get expert medical advice anytime, anywhere.

Mental Health Consultation & Services

Speak to top specialists in Mental Health, Women’s Health, Diet & Nutrition, and more, at flat 50%!

Diagnostic Tests & Health Check-Ups

Specialist Teleconsultations

Speak to top specialists in Mental Health, Women’s Health, Diet & Nutrition, and more, at flat 50%!

Women's Health Care Programs

Pregnancy Care Programs, access to Mum Support Group, PCOS/PCOD Care Programs, Maternity Support and much more!

Physiotherapy Sessions

Stress and Pain relief covered with exclusive discounts on Physiotherapy consultation and session bookings.

Dental Consultation Offers

Avail unlimited, free dental consultations and exclusive discounts on dental treatments.

Sexual Wellness

Chronic Care Support Programs

Personalised assistance for long-term health conditions.

Tools to Simplify your Life!

Tools to Simplify your Life!

What Happens if I Outlive my Term Insurance Policy?

This is the most typical outcome for a standard term insurance policy. Once the policy term ends, the coverage simply ceases. You will no longer be required to pay premiums, and the insurer will no longer have any obligation to pay a death benefit.

You will not receive any payout or return of premiums paid. The premiums you paid essentially bought you protection for that specific period, similar to how you pay for car insurance or home insurance, you don't get your money back if you don't make a claim.

It is important to review your insurance needs periodically and consider other financial planning options to ensure continued protection and financial security for you and your loved ones.

How to File a Claim with Digit?

Filing a Claim for your Digit Term Insurance can feel overwhelming during challenging times, but understanding the step-by-step process can help ensure ones receive the financial support one needs promptly and efficiently:

Inform Digit Immediately

Notify us about the occurrence of the claim event as soon as possible. You can do this by contacting via helpline at 1800-296-2626 or emailing lifeclaims@godigit.com.

Submit Required Documents

Provide necessary documents such as death certificate, policy document, valid ID proof of the nominee and claim form duly filled and signed.

Receive Claim Acknowledgment

After submitting the documents, you will receive an auto-generated ticket number for your claim.

Claim Settlement

Digit will verify the documents and assess the claim. Once the claim is approved, you will receive updates via SMS, email, or through the app, and the company will process the payout to the beneficiary's account.

How Long Does it Take for the Claim Approval?

The approval time for a term insurance claim can vary based on several factors, including the completeness of the submitted documents and the specific procedures of the insurance company.

Verification and Investigation

Once the documents are submitted, the insurance company will verify them. This may involve an investigation to confirm the authenticity of the claim. This step can take anywhere from a few days to a few weeks, depending on the complexity of the case.

Claim Processing

After verification, the insurance company processes the claim. According to the Insurance Regulatory and Development Authority of India (IRDAI), insurers are required to settle claims within 30 days of receiving all necessary documents. If further investigation is needed, the insurer must complete it within 90 days.

Approval and Payout

If the claim is approved, the payout is made to the nominee as per the policy terms. The entire process, from claim intimation to payout, generally takes 30 to 60 days.

If there are any discrepancies or missing documents, the process might take longer. It’s always a good idea to keep in touch with the insurance company and provide any additional information they might need promptly.

What are the Payout Options in Term Life Insurance?

In term life insurance, payout options generally refer to how the death benefit is paid out to the beneficiaries upon the insured's death. The most common payout options include:

99.53% Claim Settlement Ratio For Digit’s Life Insurance in FY 2024-25

When life takes an unexpected turn, every second matters. With a 99.53% Claim Settlement Ratio (CSR), Digit Life Insurance stands as a pillar of trust and reliability. This isn’t just a statistic; it’s a promise to our policyholders.

Every claim tells a story. Whether it was a salaried parent overcoming loss, a child’s future hanging in the balance, or a spouse seeking stability, we acted fast to bring peace of mind to grieving families.

That’s why we are committed to settling genuine claims swiftly, transparently, and with compassion, ensuring that your loved ones receive the support they need when it matters most.

₹2.88 Billion Worth Claims Paid in FY 2024-25

At Digit, we don’t just talk about protecting families; we actually do it. In the last financial year, we paid ₹2.88 billion to families who lost a loved one. That’s a big jump from ₹351.52 million a few years ago, showing how much we have grown and how seriously we take our promise.

Every payout represents a family supported, a future safeguarded, and a promise fulfilled. We make sure claims are settled quickly and clearly, with zero confusion, so families don’t have to worry during tough times.

15,000+ Claims Settled in FY 2024-25

Solvency Ratio for Digit's Life Insurance in FY 2024-25 is 3.85

At Digit, being financially strong isn’t just a goal; it’s how we earn your trust. Our solvency ratio has grown from 2.07 to 3.85, which means we are more than ready to keep every promise we make.

This number shows we have more than enough funds to pay claims and support families, even in tough times. In fact, our ratio is nearly double the required limit, giving you extra peace of mind.

Because when you choose life insurance, you are not just buying protection; you are trusting us with your family’s future. And we take that seriously.

Disclaimer: This report offers an overview of Digit Life Insurance’s performance, highlighting the growth in premiums, solvency ratio, and claims settlement metrics (CSR, claims paid, and claims settled), based on the company’s FY 2024-25 internal data. The information is intended for general awareness only and should not be considered financial advice. Past performance may not reflect future outcomes.

How Efficiently Digit Life Insurance Settles Claims?

While this data reflects another life insurance product, it demonstrates Digit Life Insurance’s strong track record in settling claims quickly and fairly, an important factor when choosing any life cover, including term insurance.

Two important metrics that reflect efficiency:

1. End-to-End Turnaround Time (TAT)

This is the total time taken, from the day we first get the death claim to the day we complete it.

Formula: Claim Closing Date - Claim Registration Date

2. Last Document Received (LDR) TAT

Sometimes, claims take time because we’re waiting for all the required documents. This number indicates how quickly we process a claim once we receive the final document from the claimant.

Formula: Claim Closing Date - Date Last Document Received

Industry-Leading Speed

On average, Digit Life Insurance settles claims within 13 days of registration, ensuring families receive timely financial support.

Note: If there are any discrepancies or missing documents, the process might take longer. It’s always a good idea to keep in touch with the insurance company and provide any additional information they might need promptly.

Reasons for Term Insurance Claim Rejection

Certain factors might lead to rejection when applying for a term insurance plan. Knowing these can help you prepare and address any issues before applying.

- Suicide: Most insurance policies include a suicide clause, stating that if the policyholder commits suicide within the first one or two years, the claim won’t be paid. If the insurer suspects the application is an attempt to exploit this, they might reject it.

- Self-Inflicted Injuries: Policies often exclude coverage for death due to self-inflicted injuries. If there's evidence that the applicant has a history of self-harm or attempted suicide, the insurer may deny coverage.

- Criminal Activities: Death resulting from criminal activities is usually not covered. If you have a criminal record, insurers may reject your application to reduce their risk.

- Pre-existing Medical Conditions: Severe or multiple pre-existing conditions like diabetes, heart disease, or cancer make you a higher risk for insurers. They might reject your application or offer coverage with exclusions and higher premiums.

- Non-Commercial Aviation: Engaging in aviation activities, like being a pilot or frequently flying in non-commercial aircraft, increases the risk of accidents. Insurers may reject your application or raise premiums if you’re involved in such activities.

- War and Terrorism: If your profession or location is at high risk for war or terrorism, the insurer may deny coverage to avoid large potential claims.

How Term Plan is Different From Other Life Insurance Plans?

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Pension Plan

Term Life Insurance Vs Endowment Plan

Term Life Insurance Vs Unit Linked Insurance Plan (ULIP)

Term Life Insurance Vs Savings Plan

Explore Essential Term Life Insurance Tips

City-Based Term Insurance Guide: How Lifestyle Affects Coverage Needs

Terminologies Related to Life Insurance Policy

Policyholder

The Policyholder is the person who buys the insurance and pays regular premiums.

Coverage

The amount of money the policyholder can get from the insurance.

Life Assured

The person whose life is insured. This may or may not be the same person as the policyholder.

Nominee

The person who receives the death benefit or sum assured in case of an unfortunate demise of the policyholder. The policyholder chooses the nominee when taking the policy; however, they can always be changed during the policy term.

Sum Assured

This is the amount of money a nominee receives in case of the policyholder's demise, and it is one of the major factors determining a policy's premium.

Policy Term

The Policy Term is the period during which a policy is active. An insurance policy's benefits and life cover are valid during this period, which differs across policies.

Insurer

The insurer is the insurance provider who offers life insurance plans and handles claims.

Insured

The person who is covered by the insurance policy.

Insurability

Factors affecting a person’s health or life expectancy make them more or less likely to get injured or sick.

Premium

Premium is the amount of money you pay to the insurance company in return for the insurance. It can be paid in various modes: annual, half-yearly, or even monthly.

Death Benefit

The total amount an insurance provider gives to the nominee in case of demise of the life assured. This mostly equals the Sum Assured; however, it might be more when riders are added.

Add-on Benefits (Riders)

Add-on benefits or Riders are additional coverages on your policy that cover specific conditions like critical illness, accidental death, etc. They come at an additional cost over and above your standard premium.

Claim

In the case of the life assured's demise, the nominee should file a claim with the insurance company. It is an intimation to the insurance company about the unfortunate event and the demand for insurance coverage payment.

Maturity Date

When the insurance policy ends and any benefits are paid out.

Maturity Claim

The amount the policyholder receives when the policy ends if it includes a maturity benefit.

Surrender Value

The money the policyholder gets if they end the policy before the maturity date.

Vesting Age

The age at which the policyholder starts receiving regular payouts from an insurance-cum-pension plan.

Beneficiary

The person or entity designated to receive the death benefit from a life insurance policy.

Grace Period

The period after the premium due date, during which the policyholder can still make a payment without losing coverage.

Lapse

The termination of a policy due to non-payment of premiums.

Underwriting

The process by which an insurance company evaluates the risk of insuring a person and determines the premium.

Free Look Period

The policyholder can review the policy terms and cancel the policy without penalty.

Conversion Option

A feature allowing the policyholder to convert a term policy into a permanent one without undergoing a medical exam.

Reinstatement

Restoring a lapsed policy by paying the overdue premiums and meeting other requirements.

Term insurance offers pure, affordable financial protection for a specific period. It provides peace of mind, ensuring your loved ones are financially secure if the unexpected occurs without investment complexities. Buy early for lower premiums. Calculate adequate coverage (10-15x income is a guide) to cover debts and future expenses.

Choose a term that aligns with your longest financial responsibilities, like raising children or loan repayments. Compare plans across insurers, prioritising claim settlement ratios and customer service. Consider riders for enhanced protection, but always read the fine print.

FAQs about Term Insurance Policy in India

Is there an age limit to buying a Term Insurance Plan?

Can I change the nominee in my Term Plan, and how many times can I do so?

Can I get Term Insurance if I'm not in a job?

Can husband and wife both take Term Insurance?

What is the difference between Term Insurance and Accidental Insurance?

Why should I buy Term Insurance when I already have Life Insurance from my employer?

What if I do not want my Term Cover once I have taken it?

What is the Contestability Period in Insurance?

What is the difference between term insurance and life insurance?

Does term insurance have maturity?

Is there any age limit to getting a term insurance plan?

Why is term insurance essential at every stage of life?

What is the rule of term insurance?

Which is the most common type of term insurance?

Who can be a nominee in term insurance?

What are the eligible investments and expenses under Section 80C for tax deductions in India?

Can I buy more than 1 term insurance policy?

What would happen if a person has two term insurance policies?

Can Non-Resident Indians (NRIs) buy term plans in India?

What is the best kind of life insurance policy?

What is the policy term?

Do you get your money back at the end of the policy term?

What happens at the end of the policy tenure?

Do we get any return in Term Insurance?

How to get low premiums on term insurance plans?

What are the advantages and disadvantages of each premium payment option?

- The Single Premium Payment Option entails paying the full premium upfront, avoiding monthly hassles. However, due to its size, it can strain budgets.

- Regular Premium Payment Option allows for periodic payments (monthly, quarterly, half-yearly, or yearly), making it budget-friendly, though it might incur extra charges.

- Automatic payments ensure timely contributions and help avoid missed payments by requiring enough funds in your account to prevent late fees or coverage lapses.

- Lump-sum payments may attract discounts, benefiting upfront payers, but require careful financial consideration to prevent strain.

Is term insurance refundable?

Does the premium remain the same throughout the tenure of a policy?

On maturity, can a fresh policy be availed at the rate of the old premium?

If I stop smoking today, or maybe 6 months before taking a Term Insurance Policy, will I get a Non-Smoker rate?

Under which sections of the Income Tax Act can policyholders claim term insurance tax benefits?

Term insurance offers tax benefits under various sections of the Income Tax Act.

- Section 80C of Income Tax Act: Term insurance policyholders can claim a deduction of up to ₹1.5 lakh in premiums paid annually. This section also covers other investments like the Public Provident Fund, National Savings Certificates, ELSS, and tax-saving FDs.

- Section 80D of Income Tax Act: While this section primarily applies to health insurance plans, term insurance policyholders with additional covers (such as Critical Illness or Surgical Care) can also save taxes on premiums paid.

How to claim term insurance after death?

Please ensure that you remember the following steps to claim the assured sum as a nominee of the term insurance policyholder:

- Step 1 - As a nominee, notify the insurance company about the claim

- Step 2 - Keep your documents handy to ensure a smooth claim process.

- Step 3 - The insurance company will carefully evaluate your claim.

- Step 4 - Claim settlement

What are the types of deaths covered in Term Insurance?

The following types of deaths are considered valid by an insurance provider at the time of claim settlement:

- Natural Death

- Death due to any critical illness

- Accidental Death

- Death due to natural calamities like earthquakes, floods, etc.

- Suicide is covered if it happens after 12 months of buying the policy. However, if it occurs within 12 months, a certain proportion of the sum assured is paid to the nominee. This depends from one insurer to the insurer.

What types of deaths are not covered by insurance?

a. Any Death that involves self-harm or self-infliction of injury like suicide is not covered under insurance.

b. Death due to driving under the influence of alcohol or drugs is not covered.

c. Death due to participating in hazardous activities

d. Death due to the involvement in illegal activities when either the life insured was involved in any criminal activity or the nominee is criminal, and it is discovered that the life insured was killed with the nominee's involvement.

Should we take Riders along with Term Insurance?

What expenses are covered in my term plan?

How long should be the term of the plan?

Choosing the longest possible term insurance duration, depending on individual needs and responsibilities, is generally a good idea. Consider your current age, expected retirement age, your children's age, and any significant financial liabilities.

For example, if you are 30 years old and think you will only need life insurance for the next 30 years, opting for a 40-year tenure is still recommended.

Do I need to buy term insurance even if I am covered under my company's group policy?

Other Important Articles Related to Term Insurance