9000+ Cashless Garages

1.2 Cr+ Policies Sold

Car insurance Online, Up to 90% Discount

It's a Brand New Car

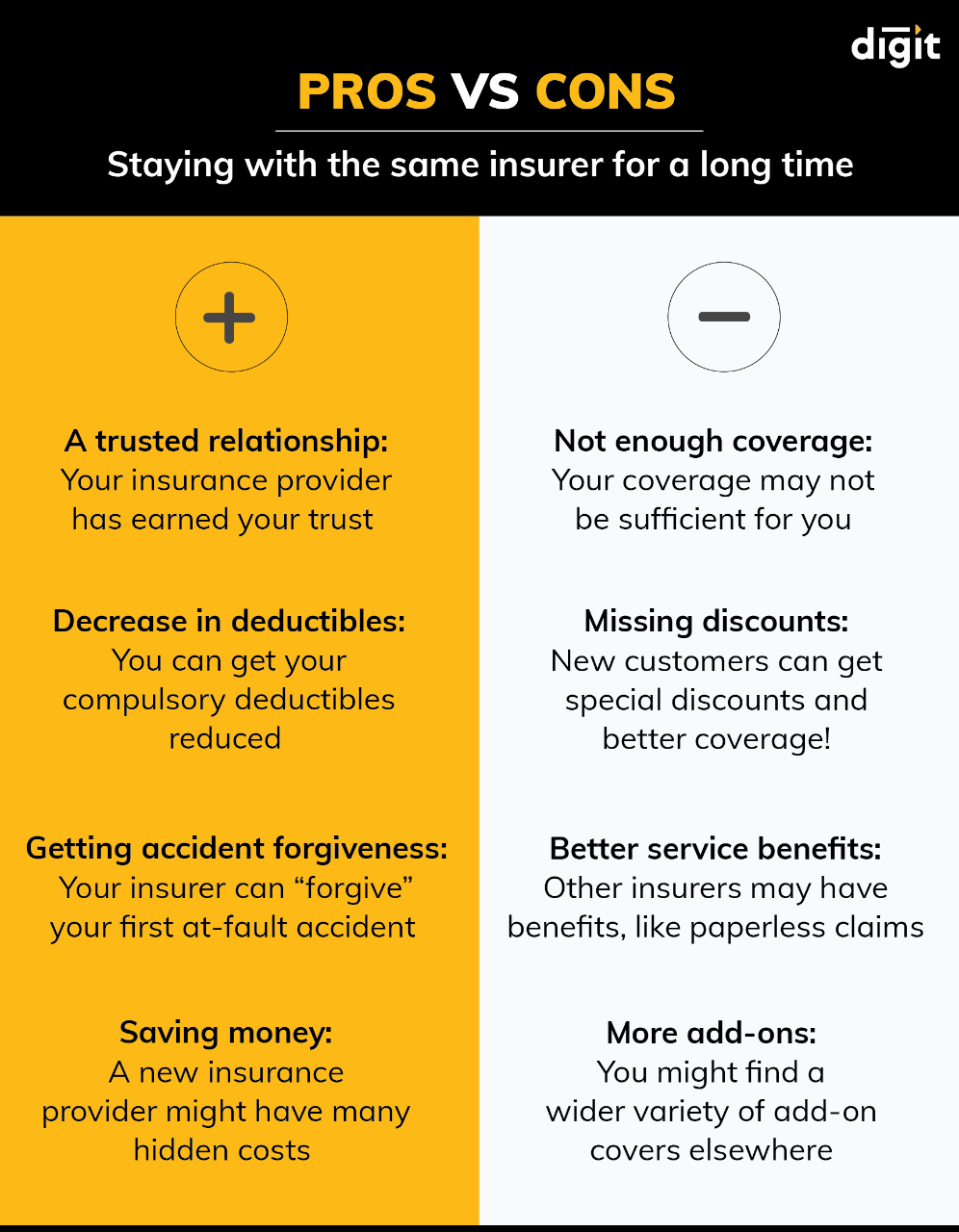

What are the Pros and Cons of staying with the same Insurer for Years?

Since having a motor insurance is mandatory in India*, it’s very likely that you find it easy to just renew an existing plan each year.

You probably have a very busy life and don’t want to deal with the hassle of searching for a new plan at the time of renewal.

There are a lot of benefits of continuing with the same insurance plan for a long time – such as loyalty perks and rewards offered by insurance companies. But there are also some drawbacks that come with this.

For example, when you do a bit of research and compare different policies with each other, you might actually find that you have been missing out on many great opportunities!

Let’s take a look at the pros and cons of staying with the same motor insurance plan for years:

What are the Pros of staying with the same insurer for years?

There are several rewards that your insurer may offer to you when you stay with them for a long time, and these can increase further, the longer you stay with them.

Here are the benefits of staying with the same insurance company for a long period of time:

1. You have a trusted relationship

It can take a long time for you to form a trusted relationship with your insurance provider. After all, your insurance provider has earned your trust over many years of protecting you and your vehicle, and it can be difficult to find that again.

You will find this trust especially helpful when you find yourself in a bad situation, like your vehicle breaking down in the middle of nowhere, or, even worse when you get into an accident and the situation becomes messy.

A long time insurer will be more familiar with your driving habits, and claim history and will be able to understand the situation a whole lot better.

2. A decrease in deductibles

Many insurance companies will reward you for loyally staying with them for many years (especially a number of claim-free years). They can offer you a reduction on your deductibles, or even go so far as to waive them off completely.

Deductibles are an amount of money that you need to pay out in the case of any claims before you receive any reimbursement from your insurance.

There are two types of deductibles – compulsory deductible and voluntary deductible. But here we’re talking about the compulsory deductible which does not affect your premium. However, it is still really beneficial as you might end up not having to pay any money from your side if you meet with an accident.

3. You can get an accident forgiveness option

This is a benefit that is offered to those loyal policyholders with a good driving record. Basically, your insurance company will “forgive”, or not consider your first at-fault accident.

So since your accident won’t be listed in their records, it will prevent your insurance premium from going up. Unlike a no claim bonus in car insurance, an accident forgiveness can’t be transferred to a new provider if you switch insurance companies.

4. You could actually be saving money

Apart from giving up all these perks, if you choose to shift to a new insurance provider, you will also face a number of hidden costs.

For a new policy, apart from the premium, you might also have to pay for things like policy fees and other hidden expenses that can make shifting plans more expensive than you might expect.

Are there any Cons of staying with the same insurer for years?

While it’s easy to just renew your existing motor insurance, sometimes it might be worth it to check what else is out there.

As they say, every coin has two sides, so let’s take a look at the negative side to staying with the same insurance provider for a long time

1. You might be missing out on discounts

When you renew the same motor insurance plan that you have always had, you basically stick with your current benefits.

However, if you explore the options that are out there, you might actually be able to find a policy with the same (or even better!) coverage in a more cost-effective manner. Additionally, many insurers offer special discounts to new customers that you can make the most of!

2. The same insurance coverage might not be enough

Each year when you renew your insurance, it’s important that you go through your policy document and check exactly what is and is not covered. This way you’ll know if your current plan continues to be sufficient for you.

This is especially true if you’ve just had some big change in your life – for example, in case you bought a new car, or you want to give an old bike to one of your children. At these times you might want to reevaluate your coverage and see if you might benefit from a change of insurer.

3. You could find more service benefits

In some instances, you might find that a different insurer offers much better service benefits. For example, with Digit, your claims process is totally paperless and digital.

With a lot of traditional insurance companies, these processes might require a lot of paperwork, and maybe even a physical surveyor.

4. You may find a wider range of add-ons elsewhere

Your current insurance provider may offer you many add-on covers with a comprehensive policy such as roadside assistance cover, passenger cover, and zero depreciation cover.

However, other insurers might have a much wider variety of add-on covers for you to choose from. While these may indeed increase your premium, they will give you more comprehensive protection for your vehicle.

So, the question is, is it worth it to stay loyal?

Well, to answer this in two words – it depends! You will need to compare the pros and cons of staying with the same motor insurance plan see which side is better for you in your own specific case. Then you can compare different insurance providers to see how competitive your insurance plan actually is and make your decision to change accordingly.

Some situations where you could consider changing your insurer are:

You just moved to a new city or state

Your vehicle will soon be getting a new driver (maybe you want to pass it on to your kids?)

You found an insurance company that offers much better benefits at a competitive cost

Your insurance company has increased the premium

It makes sense NOT to change your insurance if:

You are happy with the current company's benefits

Your current company has great customer service and claims service

You don’t want to lose your discounts

In general, you should understand that loyalty is often rewarded, but it might not be the best option for you in all situations!