Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

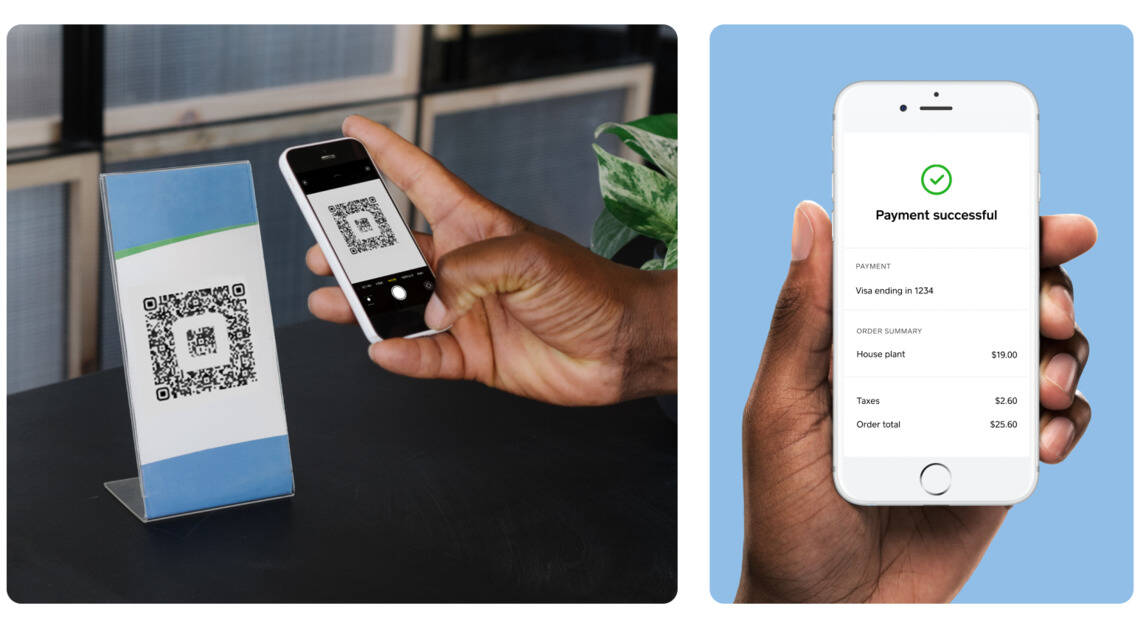

How to Make Payments Through QR Codes?

Digital payments have become a part of everyone's daily lives, and one of the most commonly accepted online payment solutions has been QR codes. This is because payments through QR codes allows the contactless and cashless transaction, reduces the chances of financial fraud and is easy to use; a user only needs a smartphone with a camera to scan the code.

Keep reading if you are new to this payment ecosystem and want to learn more about it.

What Is QR Code and Its History?

QR or Quick Response is a two-dimensional code patterned as a black square and arranged in a square grid with a white backdrop. You can use imaging devices like your smartphone to read this QR code. Unlike barcodes, QR codes can store more data per unit area.

The history of a QR begins during the 1990s, when a Japanese company, Denso Wave, discovered it. Initially, it was used in the automotive industry, primarily for tracking, production and shipping. However, gradually, people adopted this code working outside the automotive industry for marketing and product identification.

Several experts suggest that QR codes did not reach the apex as expected from their performance in the initial years.

How Does QR Code Work for Payments?

You either need a barcode reader that can scan QR codes or a smartphone and tablet with a camera. Several applications are also available that can scan QR codes. All you need to do is to open a camera, point it to a QR code, and it will scan and recognise the code and send you a notification. You need to open this notification to complete the payment process.

You can further download banking and payment applications online to transfer funds from your account to another.

Mentioned below are some of the ways to make payment using a QR code:

Merchants Scanning QR Code on Consumer's Smartphone

You can open a payment application once the total payable amount is set in a merchant's PoS system. The QR code-enabled payment application shows a QR code that recognises your payment card details. Then, the merchant uses a scanner to scan the QR code to complete the transaction process.

Scanning QR Code of a Receiver With a Smartphone

You need to open your phone camera or QR code-enabled application. Then, scan the code displayed on a bill, product or at the payment counter to complete the payment process. Furthermore, you can avail various loyalty points and lucrative offers if you make payments through a store-specific payment application.

App-to-app Payments

In this payment process, both recipient and you, as a sender, open applications. You scan a QR code displayed on a recipient's application. Finally, you specify and verify the amount payable to complete the payment through a QR code.

What Are the Types of QR Codes Used to Make Payments?

There are two types of QR codes that retailers can use to allow customers to make payments:

1. Dynamic QR Code

Dynamic QR codes allow auto-fill the payable amount so a retailer can issue several codes for different products. Besides, one of the main advantages of a dynamic QR code is that a retailer can change the information in it to update current data.

Additionally, it has features like password protection, access management and device-based redirection and scans analysis. With the help of a dynamic QR code, a retailer can know about a customer's location, type of device used and other essential data.

2. Static QR Code

This type of code is programmed with one trigger action. So, once customers scan a QR code, they will be redirected to another webpage with a payment option, and accordingly, they make the payment.

However, unlike dynamic QR codes, the information in the static QR code cannot be edited. Besides, in a static QR code, customers have to enter the payable amount, and a retailer verifies it further, unlike a dynamic QR code, which provides a better payment experience.

Where Are QR Codes Used to Receive Payments?

Listed below are a few cases and businesses that deploy QR codes to receive payments from customers:

- E-ticket Booking: The E-ticket booking applications allow you to book tickets for flights, trains, buses, and movies in just a few clicks. There are several payment modes, and a QR code payment mode is one of them.

- Fuel Retailers: Fuel retail wallets allow you to fuel your cars by providing the required fuel amount. You can pay for the fuel purchased via scanning a QR code.

- Toll Payments: Toll payment wallet applications are available for facilitating a cashless transaction. Multiple online payment options are available; among them, QR code payment mode is also available for an easy payment solution.

- Street Vendors: Street vendors print a QR code for their products with prices and descriptions. You only need to scan a QR code to pay for the products purchased.

- Parking Payments: Parking payment applications allow you to look for and book a parking space. Once you book a parking space, scan a QR code displayed at a parking garage to pay the charges.

- Restaurants: With the ongoing digitalisation trend, restaurant owners often use digital tablets where QR codes are often embedded. You can also find them at checkout counters. You can scan such QR codes to pay your bill at the restaurant.

- Small and Medium Businesses: Merchants print QR codes for vendors, and to make payments, you need to scan a QR code of a vendor. The latter sends a receipt from a cash register to your phone. Finally, you verify the amount payable to complete the process.

- Micro-businesses: Micro-businesses also use QR codes for receiving payments from customers. Here, a merchant creates an invoice of a specific amount and a QR code. He or she then exhibits this QR code on a smartphone. You need to scan this QR code using a mobile wallet application as a customer.

What Are the Benefits of Using QR Codes for Payments?

Making payments through QR codes offers several benefits, and they are as follows:

- Fast Payments : One major benefit of QR code is that it ensures quick payments, unlike other payment modes. All you need to do is open a QR code-enabled application, scan a QR code and verify the payment. The fund will be credited to a recipient's bank account within a few seconds.

- Simple to Use: The set-up of the QR code is simple. You only need a QR code, either electronic or printed, and a smartphone with a camera. Using QR codes to make payments eliminates the need to invest in Point-of-Sale machines or other special machines used for payments.

- Ensures Security: Making payments through a QR code ensures safety. This is because a QR code is simply a tool that exchanges data. Any data or information exchanged through a QR code is encrypted. Therefore, payments remain secured.

- Reliable Payment Solution: Using a QR code removes the chances of errors while making payments. This code has a black box pattern containing special data that increases the reliability quotient in making payments through a code.

How to Maintain Safety While Making Payments Through QR Codes?

Consider the following tips before making payments through QR codes:

- Check the URL Carefully: You must check the URL carefully to see where it is redirecting you. If a URL is short, where the website's name is not visible or something unrecognisable, then avoid proceeding with that URL to complete your payment.

- Be Cautious of Tampered QR Codes: You should carefully check whether a QR code has been tampered with or not before scanning it. Tampering with a QR code happens when someone pastes a sticker over an original code. So, always verify such issues carefully to avoid inconvenience.

- Do Not Scan QR Codes Received via Email: You should not scan a QR code sent through a message or email address to make or receive payments. This is because when you scan a QR code it will eventually take you through some process and ultimately convince you to provide your credentials or details. This in turn breaches the email protection standards.

- Use Trusted Applications: You should use a reliable QR code-enabled payment application which allows you to verify the recipient's identity before making payments.

- Avoid Downloading Applications via QR Codes: If you find that scanning a QR code while making payments redirects you to download an application, then strictly avoid doing that. Such malicious applications can syphon your personal information and share them with hackers.

Several people across the globe are making payments through QR codes at an increasing rate due to the multiple benefits they offer. Therefore, given this latest trend, you must learn about them thoroughly and hopefully, this article has served this purpose.