Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

How to Unfreeze NPS Account & Activate it Online/Offline?

If you're experiencing challenges accessing your NPS (National Pension System) account, your account has likely been frozen for specific reasons. However, there's no need to worry, as there are ways to address this issue.

Read this guide and delve deeper into the potential causes of NPS account freezes, explore the procedures for unfreezing your account online and offline, and provide additional insights to help you better understand and navigate the process effectively.

So, dig into the details and find solutions to get your NPS account back on track.

Table of Contents

Why Did Your NPS Account Freeze?

Your NPS (National Pension Scheme) account may freeze for various reasons, impacting your retirement savings progress. Let's delve into each major reason for NPS account freezing:

Non-Submission of Physical Form to POP or CRA: Failure to submit physical forms, such as withdrawal requests or account update forms, to your Point of Presence (POP) or Central Recordkeeping Age can lead to account freezing

Non-Compliance with KYC Requirements: KYC norms are essential for verifying the identity of NPS account holders and preventing fraudulent activities. Your account may be frozen if you fail to comply with KYC requirements, such as providing necessary documents or updating personal information.

Outstanding Contribution Arrears: Unpaid contribution arrears, resulting from insufficient funds or delayed payments, can freeze your NPS account. This measure ensures that all contributions are accounted for and prevents discrepancies in your retirement savings.

Suspected Fraud or Suspicious Activity: Suspicion of fraudulent activity or unusual transactions associated with your NPS account may prompt authorities to freeze it temporarily. This precautionary measure protects your account from unauthorised access and safeguards your retirement savings.

Inactivity or Dormancy: Extended periods of account inactivity or dormancy, where no contributions or transactions occur, may trigger the freezing of your NPS account. This measure helps prevent misuse of dormant accounts and ensures the security of your retirement funds.

How to Check if your NPS Account is Frozen?

Being an NPS account holder, if you get an error message stating that you are not eligible for making subsequent contributions, you can be certain that your account’s status is inactive or frozen at the moment.

An NPS subscriber is alerted via an email or SMS 1 month before the freezing of an NPS account and also on the account freezing. You may be intimated over an email from PFRDA notifying you that the status of your NPS account has changed to ‘Frozen.’

For cases where an intimation hasn’t been received yet, it is most likely that an email is on the way to the account holder.

What are the Consequences of NPS Account Freezing?

Having your NPS account frozen can lead to various consequences, impacting your retirement savings and financial planning. Given below are the potential repercussions of a frozen NPS account:

Disruption in Retirement Planning: A frozen NPS account can disrupt your retirement planning efforts, halting contributions and hindering the growth of your pension corpus. This interruption may delay your retirement goals and affect your financial security in later years.

Loss of Tax Benefits: With a frozen NPS account, you may lose out on valuable tax benefits associated with NPS contributions. Contributions made by both employees and employers may no longer be eligible for tax deductions, impacting your overall tax planning strategy.

Risk of Account Deactivation: Prolonged account freezing may increase the risk of account deactivation, where your NPS account is closed permanently. This could result in the loss of accumulated funds, jeopardising your retirement savings and future financial stability.

Limited Access to Funds: During the period of account freeze, you may have limited or no access to the funds accumulated in your NPS account. This restriction can prevent you from withdrawing or utilising your pension savings when needed, causing financial strain during emergencies.

Potential Penalties or Fines: Failure to promptly address the reasons behind a frozen NPS account may result in penalties or fines imposed by regulatory authorities. These additional financial burdens can exacerbate the impact on your retirement planning and overall financial well-being.

What are the Ways to Unfreeze the NPS Account?

The Pension Fund Regulatory and Development Authority (PFRDA) can freeze your NPS account for various reasons. However, reactivating your NPS account is vital to keep your retirement planning on track. Here are steps to unfreeze your NPS account:

1. Online Minimum Contribution

Visit the eNPS portal and go to the contribution page.

Make a minimum monthly contribution of ₹500 for the period your account was frozen, along with any applicable penalties.

After payment confirmation via email, your NPS account will unfreeze, allowing you to resume yearly contributions.

2. Offline Contribution

Reactivate your account offline through a bank or Point of Presence (PoP) facility.

Visit the nearest PoP and submit a DD or cheque in favour of the PoP agency.

Upon making the required contribution, your NPS account will be registered with the PRAN mentioned on the NCIS.

3. Address KYC Rejection

Obtain the registration form and attach your photo.

Visit the nearest PoP for physical verification along with your PAN details, identity, and address verification.

Complete and sign the registration form, ensuring it includes your employee ID.

Submit the form at the PoP after successful verification.

How to Activate the Frozen NPS Account Online?

Activating a frozen NPS (National Pension Scheme) account online is a convenient process. Follow these steps to reactivate your account:

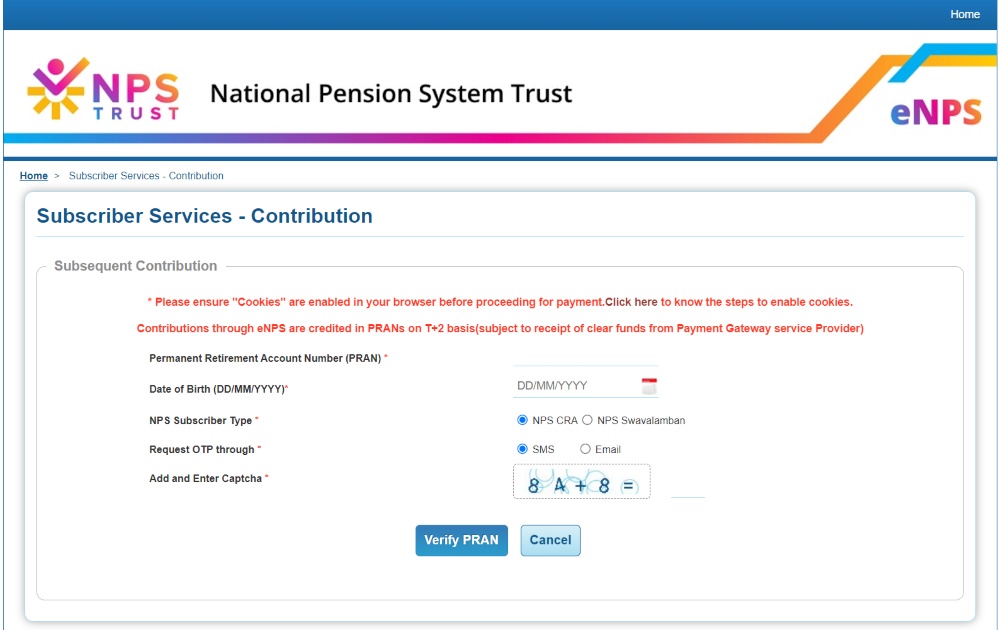

Step 1: Log in to eNPS Portal: Visit the eNPS portal on your web browser and log in using your registered credentials.

Step 2: Access Contribution Option: After logging in, locate and click on the 'Contribution Option' tab on the screen.

Step 3: Enter Details: Provide your PRAN (Permanent Retirement Account Number), Date of Birth, and NPS subscriber Type as requested.

Step 4: Make Financial Contribution: Proceed to make the mandatory minimum financial contribution of ₹500 on the following page.

Step 5: Authenticate and Submit: Complete the submission process by undergoing OTP-based authentication and entering the provided "Captcha."

Step 6: Confirmation Email: Once the CRA confirms the payment, you will receive a notification via email, signifying that your NPS account has been successfully unfrozen.

How to Activate the Frozen NPS Account Offline?

Reactivating a frozen NPS (National Pension Scheme) account offline is possible through certain procedures. Here's a step-by-step guide to help you activate your frozen NPS account offline:

Step 1: Visit the Nearest Point of Presence (PoP): Locate the nearest Point of Presence (PoP) facility authorised by the NPS. Ensure to carry all necessary documents and identification proofs for verification purposes.

Step 2: Submit Required Documentation: Upon reaching the PoP facility, submit the required documentation to reactivate your NPS account. This may include a duly filled reactivation form, KYC documents, and other paperwork specified by the PoP.

Step 3: Make Necessary Contributions: Provide the required contribution amount through a Demand Draft (DD) or cheque in favour of the PoP agency. The contribution amount may vary depending on the duration of the account freeze and penalties.

Step 4: Complete Verification Process: Undergo a physical verification process conducted by the PoP authorities to authenticate your identity and account details. Ensure to comply with all verification requirements to expedite the activation process.

Step 5: Receive Confirmation and PRAN Registration: Upon successful verification and contribution submission, your NPS account will be registered with the Permanent Retirement Account Number (PRAN) mentioned on the NCIS (NPS Contribution Instruction Slip).

Step 6: Resume Regular Contributions: After account activation, you can resume making regular contributions to your NPS account to continue building your retirement corpus. Ensure to adhere to the minimum contribution requirements.

How Much Time Does it take to Unfreeze an NPS Account?

Generally, it takes 5-7 days to unfreeze an NPS account. However, it can vary depending on factors such as the reason for the freeze, completeness of documentation, processing time by authorities, mode of submission, and the issue's complexity.

Stay informed about the status of your unfreezing request and follow up as needed until the issue is resolved.

Is There Any Penalty Applied if an NPS Account is Frozen?

Unfreezing a frozen National Pension System (NPS) account incurs a penalty of ₹100, per the Pension Fund Regulatory and Development Authority (PFRDA) regulations. This penalty applies to subscribers of both Tier 1 and Tier 2 accounts. Additionally, subscribers must fulfil the following financial requirements:

Pay the total minimum contributions for the frozen period.

Contribute the minimum required amount for the current fiscal year.

Deposit ₹500 per month for regular accounts, along with the ₹100 penalty for the year when the account was frozen.