Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

What is NPS Contribution and It's Types and Contribution Process?

NPS is one of the several retirement benefit plans the government of India has introduced to facilitate adequate financial aid post retirement. As a working individual, the idea of leading a comfortable life in old age after a lifetime of hustle is too appealing.

If you belong to this group willing to benefit from this scheme but do not know much about what NPS contribution is, this piece is for you!

Read on to get a detailed idea of this scheme.

What Is NPS Contribution?

National Pension Scheme or NPS is a retirement benefit plan under Pension Fund Regulatory and Development Authority (PFRDA) by the Central Government. This social security plan involves long-term and voluntary investment by individuals working in public, private, and unorganised sectors other than those in armed forces.

Individuals can enroll under this scheme and make periodical investments, called NPS contributions, throughout their employment. Post retirement, you can withdraw a specific percentage of their total investment. The remaining amount will be available as monthly payouts, akin to salary.

All Indian citizens can enroll under it and avail the benefits of NPS by making contributions.

If you are not sure of the exact procedure to make these contributions, here is a detailed guide for you.

How to Make an NPS Contribution?

The foremost requirement to make an NPS contribution is having a permanent retirement account number (PRAN). Government employees automatically get access to NPS enrollment and, eventually, this number.

Self-employed individuals and private sector employees, on the other hand, need to enroll themselves under this pension system on their own. In case you aren’t aware of the process, you can learn about the same in our piece on how to open an NPS account.

After signing up under this scheme, you can make an NPS contribution either online or offline.

How to make NPS Contribution Online

If you are wondering how to contribute to NPS online, here is a step-by-step guide.

Step 1: Go to the official portal of NPS Trust.

Step 2: Click on the “Online Services” tab.

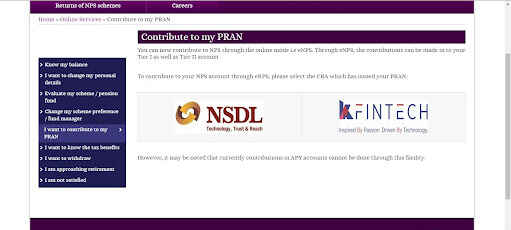

Step 3: Select the “Contribute to my PRAN” option from the drop-down menu.

Step 4: The next page will provide you with options for CRA. Choose the one that issued your PRAN.

Step 5: Depending on your choice, you will be redirected to either of the KFINTECH and the NSDL portal.

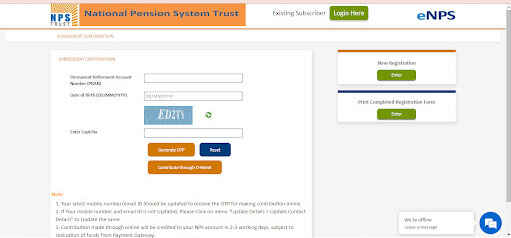

Step 6: On the KFINTECH portal, you need to enter your PRAN and DOB and security code. Thereafter, you can click on “Contribute through D-Remit” or “Generate OTP'' to make a contribution online.

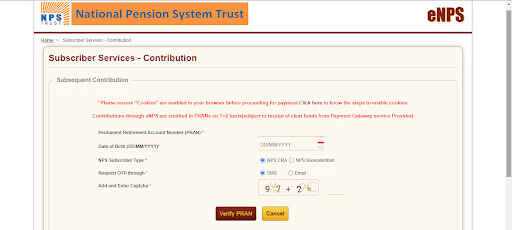

Alternatively, you can make the contribution online via the NSDL portal. Here, you need to enter your PRAN, DOB, and select NPS subscriber type. Thereafter, you can enter the security code and proceed to verify PRAN.

Note that the minimum contribution necessary to keep an NPS Tier 1 account active is ₹1000. This limit is not applicable for Tier 2 contributions. Also, there is no limit for the maximum number of contributions you can make in an FY for both accounts. However, tax benefits are only applicable on Tier 1 contributions. Tier 2 accounts can expect indexation benefits on redeeming long-term investments.

Individuals unable to avail this online method to make NPS contributions online can also complete the process offline.

How to make NPS Contribution Offline

Once you are aware of what is an NPS contribution but are not able to contribute online, here is a step-by-step procedure to do so offline.

- Step 1: Go to the official portal of NSDL and navigate to the “Form” page.

- Step 2: Under “NPS Account Maintenance,” click on “NCIS: NPS Contribution Instruction Slip.” The National Pension Scheme Contribution Instruction Slip (NCIS) will automatically be downloaded as a word document. Note that there are different forms for Tier 1 and Tier 2 accounts.

- Step 3: Fill in the form with accurate information on PRAN, subscriber name, employment details, and contribution amount.

- Step 4: Visit your nearest registered Point of Presence - Service Provider (POP-SP).

- Step 5: Submit the NCIS along with a check number, DD, or a cash deposit of the mentioned contribution.

Now that you are familiar with the detailed procedure of making an NPS contribution, it is time to learn about its different divisions.

What Is an NPS Employee Contribution?

NPS contribution comes from 3 different sources. One of them is the NPS employee contribution. This concerns every individual, and you, as a subscriber, must be aware of it.

Central government employees automatically have 10% of their basic salary deducted as a contribution towards this scheme. However, other individuals need to make contributions voluntarily. The above procedure of making contributions online and offline is for individuals other than government employees.

While making yourself aware of what is NPS contribution and contribution procedure is important, you must also know about the tax benefits available against these payments.

You can get a detailed idea about the same in our piece on tax benefits under NPS.

What Is an NPS Employer Contribution?

There is also another component called the employer’s contribution to NPS. Employers of salaried individuals can pay a specific amount as a contribution to this scheme. This is applicable for individual employers in the private sector, although it is somewhat less prevalent.

Generally, NPS employer contribution does not exceed 10-14% of a subscriber’s basic salary. This is also the maximum tax deductible amount. However, note that this tax benefit falls under the total tax exemption limit of ₹2 lakhs. This means that tax exemptions on employer’s contribution are not applicable over and above this limit.

What Is the Government's Contribution to NPS?

Public sector employees have the country’s government as their employer. Therefore, the employer’s contribution, here, becomes the NPS government contribution. The government makes a monthly contribution equivalent to the employee contribution.

This amount is 10% of your basic salary. Recently, the authorities increased the NPS govt contribution to 14% of basic salary.

What Is an NRI Contribution to NPS?

If you are a non-resident Indian and are wondering if this scheme is applicable for you, then the answer is yes!

NRIs can also subscribe to this pension scheme and avail its subsequent benefits. However, there are separate rules specifically applicable for such members. These are:

- Only NRIs aged between 18 and 60 years and complying with KYC norms can enrol themselves under this scheme.

- They can make contributions only via NRO or NRE accounts.

- NRIs need to deposit at least ₹500 upon enrolment, ₹500 per subsequent contribution, and ₹6,000 every year.

Note that if you are an OCI or a PIO, this scheme is not valid for you.

You must have developed a thorough understanding of what is NPS contribution with this detailed discourse. With this information, you can now easily proceed with enrolling yourself under this cost-effective scheme if you aren’t already a subscriber.

In the process, keep in mind that the retirement benefits from this scheme are based on the total volume of contributions you make in your lifetime as a working individual.