What is Pan Card, Eligibility Criteria & How to Apply Online?

A study conducted by the Tax Justice Network shows that India lost 57.4% of its total revenue from Income Tax due to corporate tax evasions by MNCs as of 2020. The remaining 42.6% was lost due to private tax abuse, summing up to over Rs.3 hundred thousand crore income tax loss (1).

If that isn’t reason enough to urge an individual to Google “how to apply for a PAN card”, this document’s applicability in other areas has increased manifold in the past few years. This now makes it almost impossible to go about without a PAN card.

Haven’t gotten yours already?

Take a look at what it is and how to apply for one.

What is a PAN Card?

If you didn’t know already, PAN stands for Permanent Account Number and is a 10-digit alphanumeric code used for unique identification. The Income Tax department is responsible for providing this number to every potential taxpayer to curb tax evasion.

This is made possible since PAN is an electronic system that tracks the financial transactions of every tax paying citizen. Here two individuals cannot have the same number. This unique identification number is allotted to every individual via a laminated card called the PAN card.

Now, you might be wondering, “What is a PAN card used for?”

Well, a lot of things. Read on to know more!

What are the benefits of a PAN Card?

Besides the very prominent Aadhaar card and Voter ID, the PAN card serves as an extremely significant identity proof in several procedures. Besides, it is a mandatory document to have for completion of several following procedures including, but not limited to the ones in the following list.

- Probably the most important time when a PAN card is necessary is during IT return filing.

- Furnishing your PAN card can help you save on TDS since financial institutions deduct 20% more TDS on Rs.10000+ earned interest if PAN is not quoted.

- Linking your bank account to PAN can help you claim a refund if TDS deducted is more than actual tax.

- The PAN card is a mandatory identity proof required while opening a new bank account.

- Buying and selling immovable assets like property and car worth more than Rs.10 lakh.

- Financial transactions worth more than Rs.50000 mandate producing the PAN card.

- If you are planning to make investments like those in mutual funds, bonds, and stocks, know how to apply for a PAN card at the earliest if you don’t have one already.

- This identification document is indispensable for cash deposits over Rs.50000 in a day.

- Payment of life insurance premiums crossing Rs.50000 in a financial year.

That was a list of activities and circumstances where having a PAN card is beneficial for a taxpayer. However, it does not stop there.

An increase in the number of individuals owning a PAN card also benefits Income Tax authorities in the following ways.

- PAN cards aid in keeping a record of an individual’s financial transactions and tax liability, hence plugging in more loopholes in the system.

- It helps authorities determine the tax rate for every individual based on their income more effectively.

- Overall, it helps make more accurate calculations of the total revenue earned from tax in the country.

Individuals without a PAN card, opting for any activity where this document is necessary, can declare the same in Form No.60. However, follow it up with a PAN card application as soon as possible. Before that, check your eligibility for the same.

What is the Eligibility criteria for PAN Card?

If you are still contemplating your PAN card application, here is a list of entities who qualify for PAN card eligibility under Section 139A of the Income Tax Act.

- Every individual with a total annual income exceeding the limit for non-taxable income.

- A business owner with more than Rs.5 lakh annual turnover.

- Every Hindu Undivided Family (HUF), where the Karta or family head is the signatory.

- Any company, whether a sole proprietorship, LLP, AOP/BOI, etc.

- Any charitable organisation, trust, or association.

Other than this, any minor, who is a potential future taxpayer, has to apply for a PAN card for the minor. From this, you can get a clear idea that there is no bar to application. Almost all Indian citizens and NRIs are required to get this document.

However, with so many different categories of PAN card holders, authorities have come up with certain segregations to differentiate PAN card types.

What are the types of PAN Card?

Depending on the type of taxpaying entity, PAN cards are divided into several categories. This category can be understood by the 4th character of every PAN, which varies for different entities. Here’s a quick overview of some of the possible alphabets and what they stand for.

- G: Government Agency

- J: Artificial Juridical Person

- P: Individual

- C: Company

- A: Association of Persons (AOP)

- E: Limited Liability Partnership (LLP)

- B: Body of Individuals (BOI)

- F: Partnership Firm

- T: Trust

- H: Hindu Undivided Family (HUF)

- L: Local Authority

If you are looking for ways on how to apply for a PAN card, know that different application forms are available for different entities mentioned in the list. To know in detail about the application procedure, keep reading!

How to apply for a PAN Card?

Here is a step-by-step guide on the procedure to apply for a PAN card online.

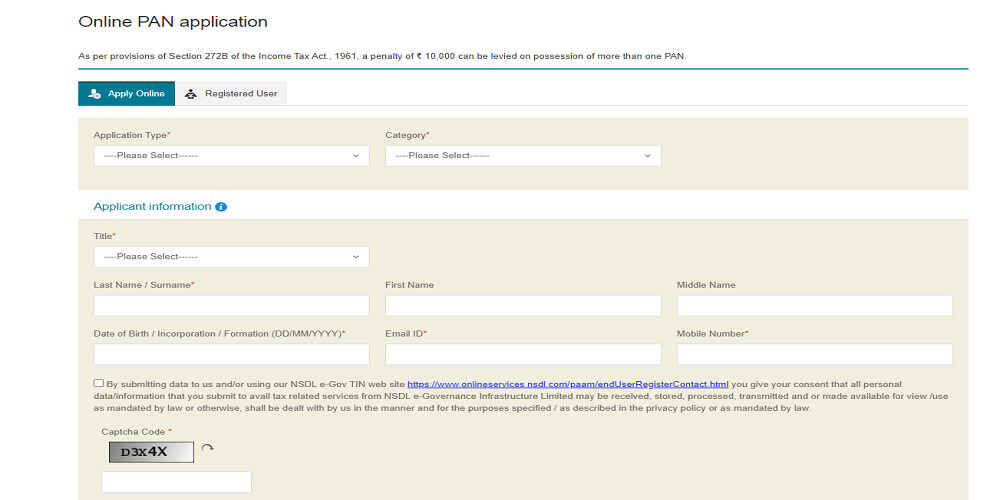

- Step 1: Go to the official portal of UTIITSL or NSDL.

- Step 2: Click on “Apply online”.

- Step 3: Now, click on “Application Type” and choose from Form 49A or Form 49AA from the drop-down list. Note the former is for Indian applicants while the latter is for foreign applicants.

- Step 4: Next, select the category matching your identity from the types discussed previously.

- Step 5: Fill in the remaining mandatory fields, enter the security code and click on “Submit”.

- Step 6: On the next screen, click on “Continue with the PAN Application Form”.

- Step 7: Next, you will be redirected to your selected type of application form. Fill this in with accurate details.

- Step 8: Upload copies of all required documents and select “Submit”.

- Step 9: Make the necessary payment of PAN card fees, download the receipt and click on “Continue”.

- Step 10: Next, you will need to authenticate your Aadhaar number, after which you will receive an OTP on your registered mobile number.

- Step 11: Enter the OTP to complete your application.

After completing the above procedure, you will get an acknowledgement slip in PDF format. Don’t get confused if it needs a password to open because your date of birth is in DD/MM/YY format.

Now, for any of you wondering how to apply for a PAN card without internet access, here is an alternative offline process.

- Step 1: You can visit any district-level PAN agency to get your required PAN card application form.

- Step 2: Fill in all mandatory fields. If you are applying as an individual entity, affix 2 passport-size photographs in the space given in the acknowledgement.

- Step 3: Attach all mandatory documents and insert all the paperwork in an envelope with “APPLICATION FOR PAN-N-Acknowledgement Number” written on top of it.

- Step 4: Send the sealed envelope to the NSDL’s Income Tax PAN Services Unit.

- Step 5: Make the necessary payment to “NSDL – PAN” via demand draft.

Now that you know the detailed procedure of PAN card application, it is important to keep all the mandatory documents handy to facilitate a seamless procedur

The mandatory documents required when applying for this important document vary according to the type of taxpaying entity. To know about the required documents for your category, refer to the following table.

|

Taxpaying entity |

Documents required |

|

Individual |

ID proof, Address proof |

|

Companies |

Registration Certificate issued by the Registrar of Companies |

|

AOP |

Registration Certificate Number / Agreement copy provided by Charity Commissioner or Registrar of Co-operative Society |

|

LLP |

Registration Certificate issued by the Registrar of Companies, Partnership deed |

|

Trusts |

Registration Certificate Number issued by Charity Commissioner |

|

HUF |

An affidavit stating details of all coparcener, issued by the Karta |

|

Foreign applicants |

ID proof like OCI, PIO, copy of passport, etc., Address proof |

Once you have all the required documents and know how to apply for a PAN card, there’s no going back.

However, once successfully applied, you might want to track the progress instead of waiting without any heads-up, isn’t it?

Let’s check how you can do so!

How to check the status of your PAN Card application?

There are several ways in which you can check your PAN card application status. Probably the most prominent way is to check with your 15-digit acknowledgement number, which you must have received upon successful application.

Here’s how to proceed with it.

- Step 1: Visit the official portal of NSDL.

- Step 2: Select the “Track PAN Status” option.

- Step 3: Click on “PAN-New/Change Request” under “Application Type”.

- Step 4: Now, type your 15-digit acknowledgement number.

- Step 5: Enter the security code and click on “Submit”.

The next screen will display your PAN application status.

Now, you might be interested to know what a physical card might look like after all the ordeal is over and you finally receive the document. Well, here we provide some details of that as well!

What information is available on a PAN card?

Here is a list of information available on the identity document for an individual.

- Name of cardholder

- Father’s name

- Date of birth

- 10-character PAN number

- Cardholder’s photo and signature

When it comes to a PAN card for business, there won’t be any photographs or a father’s name. Also, the date of birth is replaced with the date of company registration, while the cardholder's name is replaced with the company name.

Unfortunately, many times cardholders find discrepancies in the information on their PAN card. The good news, however, is the authorities offer provisions for correction of these details like a PAN card address change and a PAN card name change as well.

How to correct PAN Card information

To correct any wrong information on your issued PAN card, refer to the section discussing how to apply for a PAN card online. Follow the instructions up till Step 3, and then proceed as follows.

- Under “Application Type”, click on “Changes or Correction in the existing PAN card”.

- On the next page, fill in the PAN card correction form with accurate details.

- Upload all mandatory documents and click on “Submit”.

- Complete required payment.

Now, you will receive a new acknowledgement slip. Take a print of the same and post it to NSDL’s Income Tax PAN Service Unit.

Having a Pan card with wrong information is one thing, and completely misplacing it is another. And guess what? You now have a solution to that as well.

How to apply for a duplicate version if a PAN card is lost?

If you are worried about a lost or stolen PAN card, then stop! Instead, apply for a duplicate of this document in the following steps after Step 2 of how to apply for a PAN card online.

- Select “Reprint of PAN card (No changes in existing PAN data)” from the drop-down menu under “Application Type”.

- Fill in all mandatory fields with proper details, upload all documents and submit.

- Pay the required fees via provided payment gateways.

The process of issuing a duplicate PAN card is similar to that followed after your previous fresh application.

Now that you own a PAN card, original or duplicate, do not forget to link it with your bank account.

One can also initiate an offline process to acquire a duplicate PAN card. For this, simply collect a form from the PAN centers, TIN-Facilitation Centers or IT PAN Service Centers. Fill this form up, pay a nominal fee and submit your application.

How to Link PAN Card number with your bank account

Your bank account details provide all the insight into your financial transactions and this is where the IT department deducts taxes from as well.

Therefore, linking your PAN card to your bank account is a way to link a PAN card to income tax. This can be done in the following way.

- Step 1: On your bank’s online application, log in to your internet banking account using your user ID and password.

- Step 2: You will find options similar to PAN registration, Service requests, or Service. Select the most suitable option.

- Step 3: Next, select from options to update or link your PAN.

- Step 4: Now, enter your PAN number and other necessary details, if any.

Upon completing the above procedure, you can expect a successful linking of your PAN and bank account within 2-7 business days.

In addition to linking PAN to a bank account, the government also mandates every taxpayer to link a PAN card to an Aadhaar card under Section 139AA of the IT Act, introduced in the Union Budget 2017.

So, if you haven’ done that yet, hurry before the deadline expires!

For solutions to any further queries regarding this document, you can contact the PAN card customer care number available on the NSDL portal.