How to Apply for PAN Card Online/Offline in 2025?

Whether you have a taxable income or not, the idea of a PAN card is something a majority of the population is acquainted with. Now comes the question of applying for one.

Although it is only mandatory for Indian taxpayers, almost anyone can apply for one, even minors. So, if you are someone who is thinking of walking along this line but do not know how, this guide is for you!

Read on to know about this legal document in detail, PAN card online application process, and the mandatory documents required.

Let’s start, shall we?

What is a PAN card?

PAN stands for Permanent Account Number. It is a unique ten-digit alphanumeric combination that every taxpayer receives from the Income Tax Department. A PAN card is a laminated card containing your PAN number along with other details like name, address, and date of birth. It is an indispensable document for all financial transactions as it helps the authorities track all such activities of any individual.

If you are willing to apply for the same, you must first check your eligibility for the same.

PAN Card Eligibility Criteria

You can avail of a successful online or offline PAN card application if you belong to any of the following categories of taxpayers.

- Individual

- Company

- Partnership firm

- Hindu Undivided Family (HUF)

- Minor

- Foreigner

- Limited Liability Partnership (LLP)

- Trusts

- AOP/BOI

From this list, you must have understood that there is no such eligibility restriction for applying for a PAN card. However, if you do not know how to get a PAN card yet, here is a step-by-step guide to help you understand the application procedure.

How to get a new PAN card – Application Procedure

Following are the steps to apply for a PAN card online.

PAN card online application process

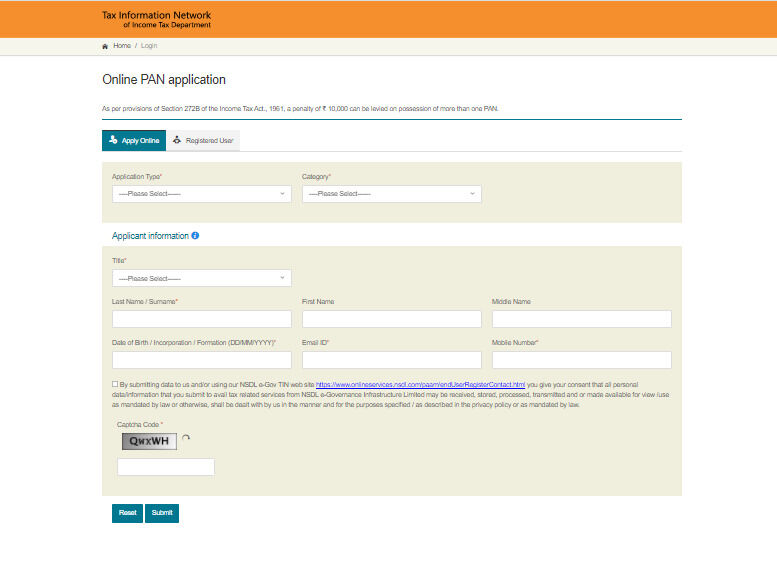

- Step 1: Go to the official website of NSDL.

- Step 2: Since you are seeking a new PAN card application online, click on “Apply Online” under “Online PAN Application”.

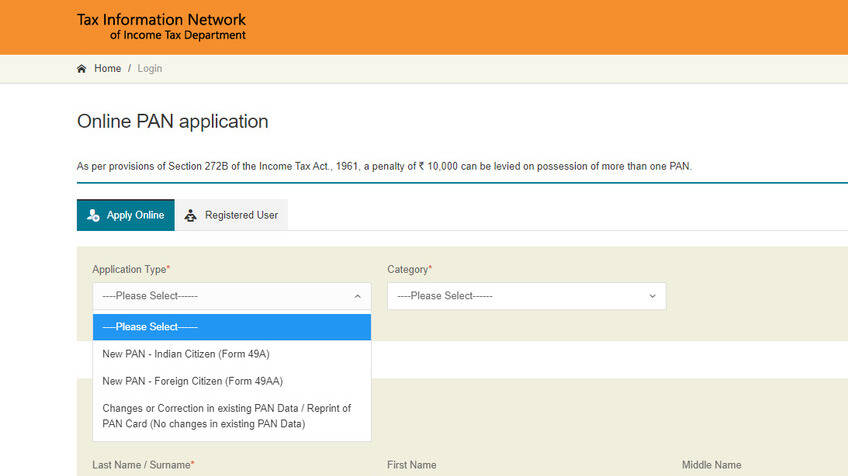

- Step 3: Under “Application Type,” choose from “New PAN - Indian Citizen (Form-49A)” and “New PAN - Foreign Citizen (Form-49AA)” depending on your citizenship.

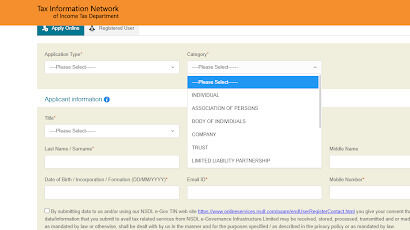

- Step 4: Now, select from the options under “Category,” depending on the type of taxpayer you belong to.

- Step 5: Fill in the rest of the mandatory fields under “Applicant Information” with accurate details.

- Step 6: Check the box beside the message confirming your consent to let the website access and use your provided data. Enter the security code and hit “Submit”.

- Step 7: The next screen will display a message containing your token number. Select the “Continue with the PAN Application Form” option below the message to complete the process.

- Step 8: You will land on a new page displaying the online PAN card application form.

- Step 9: First, you will need to attach your digital KYC documents and/or scanned copies of your physical KYC documents. Also, choose from “Yes” and “No” under “Whether Physical PAN Card is Required?” and enter the last 4 digits of your UID.

- Step 10: Next, you need to enter your name, DOB, and gender under “Personal Details.” Here, you will also need to type the registration number or token number previously displayed on the screen, which you can also find in your provided email ID.

- Step 11: On the next page, you will need to provide your address details, including area code, AO type, range code, AO no., state, city, etc. After filling in these details, click on “Submit.”

- Step 12: On the final page, you need to upload documents required for a PAN card online, including ID proof, address proof, and proof of DOB. Also, complete the declaration, enter place and date, and click on “Submit.”

- Step 13: If you have chosen “Yes” under the requirement for a physical PAN card in step 9, you will be redirected to the payment section. Here, choose your suitable payment mode between demand draft and bill desk.

- Step 14: Upon successful payment, download and save the generated receipt and note the acknowledgement number displayed.

Once this process is completed, the NSDL will verify all documents and process the application accordingly. You can also complete this application process via the UTIITSL portal in a similar manner.

PAN card offline application process

In case you do not have the means to avail of a PAN card online application, you can also choose to apply via the offline process as follows.

- Step 1: Go to the official portal of UTIITSL or NSDL.

- Step 2: Download Form-49A and print the PAN card application form online for the offline process. There isn’t any option to acquire a PAN card application form offline.

- Step 3: Fill in the form with required personal and obligatory information, similar to the way described for the online process. Note that all information must be written in “Block” letters.

- Step 4: Attach all necessary documents and affix 2 of your recent passport-sized colour photographs.

- Step 5: Now, insert this form along with the documents into an envelope and write “APPLICATION FOR PAN-N-Acknowledgement Number” on top of it. Send this to your nearest UTIITSL PAN service centre or NSDL head office.

- Step 6: Also pay the application fees via demand draft or online payment mode to the NSDL.

After a successful application, the authorities will process and generate your PAN and send it to your registered email ID and mobile number. Thereafter, you will also receive your laminated PAN card delivered to your address.

What are the Documents required for a PAN Card Application?

Now that you know about the application process, you might be wondering which documents you need to attach for a successful application. To help you out, here is a list encapsulating all mandatory documents needed for a PAN card application.

- Identity proof

- Proof of residence

- Proof of date of birth

Now the documents accepted for the verification of each of these factors can vary depending on the category of applicant. For better clarity, we have made separate sections detailing requirements for each. Refer to the section that concerns you.

Documents Accepted as ID proof with PAN Card Application

Refer to the following table to know about the ID documents required for new PAN cards of individuals with and without Indian citizenship.

Individuals With Indian Citizenship

Self-attested copy of:

- Passport

- Voter ID

- Aadhaar card

- Driving license

- Ration card

- Pensioner’s card

- Arm’s license

- Any other photo ID issued by the Indian Government

Original of:

- A duly attested bank certificate containing the applicant’s bank a/c number and photo.

- An ID certificate signed by any MP, Gazetted Officer, MLA, or Municipal Councillor.

Individuals Without Indian Citizenship

Copy of:

- Passport

- PIO card allotted by Indian Government

- OCI card allotted by Indian Government

- Documents to be attested by the Apostille or any High Commission, Indian Embassy, or Consulate operational in the applicant's home country.

- Other citizenship ID number

- National ID number

- Taxpayer ID number

Documents Accepted as Proof of Residence

Indian and non-Indian individuals can provide the documents mentioned in the following table for residence proof. Thus, these are some of the documents required for a PAN card offline and online.

Individuals With Indian Citizenship

Copy of:

- Property registration documents

- Passport of self or spouse

- Any utility bill

- Any KYC document

- Bank account statements

- Credit card statements

- Passbook of post office account

- Most recent property tax assessment order

- Government-allotted domicile certificate

- Driving license

- Accommodation allotment letter issued by State or Central Government

Individuals Without Indian Citizenship

Copy of:

- Passport

- PIO card allotted by Indian Government

- OCI card allotted by Indian Government

- Statements of non-resident external bank account in India

- Registration certificate displaying applicant’s Indian address, issued by Office of Foreigner’s Registration

- Statements of bank account in the country of applicant’s residence

- Documents to be attested by the Apostille or any High Commission, Indian Embassy, or Consulate operational in the applicant's home country.

- Other citizenship ID number

- National ID number

- Taxpayer ID number

Documents Accepted as DOB Proof

If you are an Indian citizen applying for a PAN card as an individual, you need to provide the following DOB documents required for a PAN card application.

- KYC documents like Aadhaar card, passport, and driving license

- Certificate of birth issued by the Indian Consulate

- Certificate for passing 10th standard

- Marriage Certificate issued by Marriage Registrar’s Office

- Domicile certificate issued by State or Central Government of India

- Pension payment order

- An affidavit displaying the applicant’s DOB

- Any other photo ID issued by the State or Central Government, stating the date of birth

Health Service Scheme photo card

Now, there are different document requirements for those who are applying as an entity other than “Individual.” Read on to know about it in detail.

Documents needed to Apply for PAN card – for Entities other than an Individual

If you are opting for a PAN card online application as an organisation, you do not need to submit DOB proof. What you do need to submit are documents valid as both address and ID proof. The respective requirements for different types of organisations are as follows.

- Company: Registration Certificate issued by the Registrar of Companies

- Trust: Trust deed or Registration Certificate issued by Charity Commissioner

- Partnership firm: Partnership deed or Registration Certificate issued by the Registrar of Firms

- Limited Liability Partnership (LLP): Registration Certificate issued by Registrar of LLPs

- Association of Person (AOP)/Body of Individuals (BOI): Agreement, Registration Certificate issued by Charity Commissioner/Registrar of cooperative society, or any ID document issued by Central Government or State Government.

Here you go with all the details required to apply for a PAN card. It is always a good idea to get your PAN card at the earliest so that you do not need to go through any hassle filing ITR and carry out other transactions when the need arises. So, grab all documents and follow the steps given in this guide if you haven’t submitted that application already!