How to Link PAN with Aadhaar on the Income Tax Portal?

According to the government’s circular from last year, it is compulsory for all citizens to link their PAN cards with their Aadhaar cards. This is a completely online process available to all registered and unregistered users.

This step will also help the government prevent financial scams by tracking all the transactions made by each individual.

Hence, this blog explores how to link your Aadhaar to your PAN card and how to check the link status.

Table of Contents

What are the Prerequisites for Linking PAN to Aadhaar?

The prerequisites for linking PAN to Aadhaar are mentioned in the following section:

Valid PAN number: The applicant must hold a valid government-issued PAN card.

Valid Aadhaar number: The Aadhar card must be kept up-to-date.

Valid Phone number: Ensure the mobile number works and receives calls and messages.

How to Link PAN with Aadhaar on the New Income Tax Portal?

The steps to link PAN with Aadhaar on the new Income Tax portal are mentioned below:

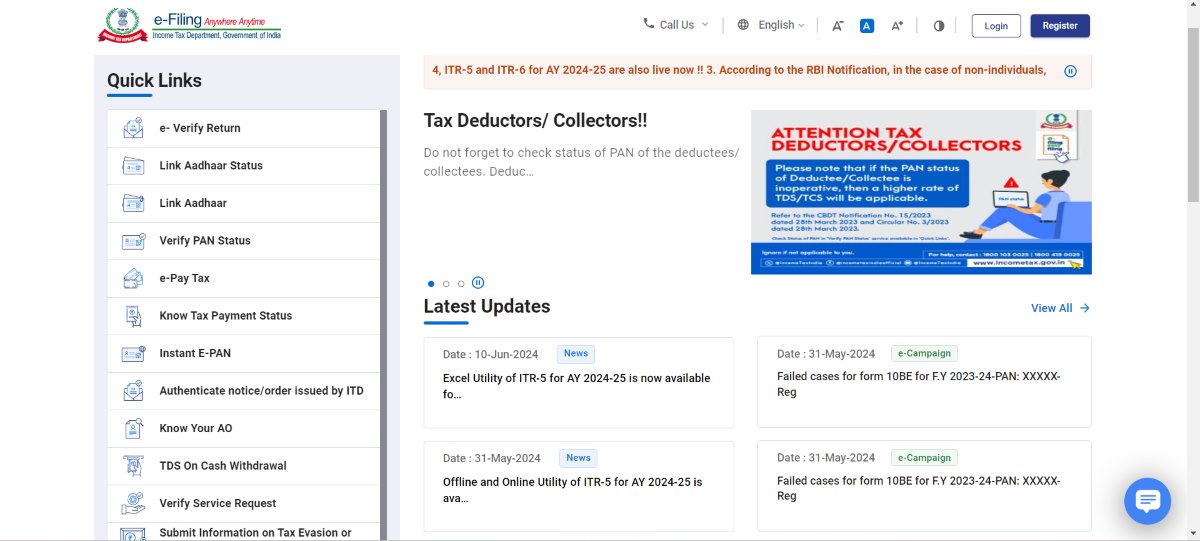

Step 1: Visit the new e-filing portal 2.0.

Step 2: Look to the left-hand side and spot the “Quick Links” tab.

Step 3: Click on “Link Aadhar”, and a new window will open on your screen.

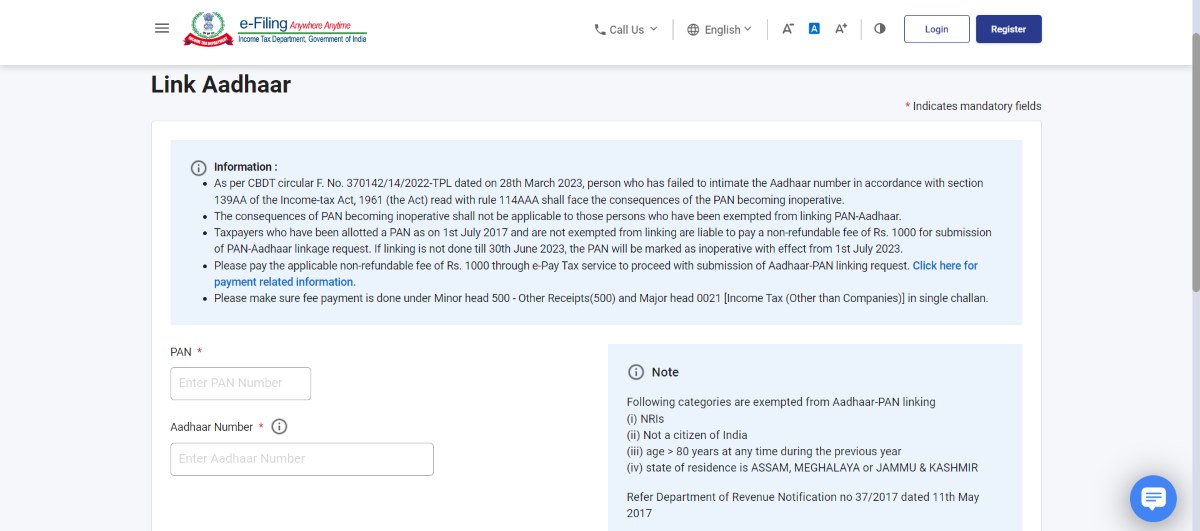

Step 4: Fill in the required details, such as PAN number, Aadhaar number, mobile number, etc.

Step 5: Agree to validate the Aadhar details by clicking on the check box.

Step 6: You will get a 6-digit OTP on your provided mobile number.

Step 7: Enter the OTP and click on validate.

Step 8: Your request to link your PAN to Aadhar has been submitted.

How to Check PAN-Aadhaar Link Status Pre-Login?

Follow the mentioned steps to check PAN-Aadhaar Link Status pre-login:

Step 1: Open the new e-filing portal 2.0.

Step 2: On the left-hand side, you will find the “Quick Links” section.

Step 3: Click on “Link Aadhaar Status”.

Step 4: Enter the PAN and Aadhaar numbers in the provided space.

Step 5: Click on “View Link Aadhaar Status”.

Step 6: A pop-up will appear on your screen showing the PAN-Aadhaar link status.

How to Check PAN-Aadhaar Link Status Post-Login?

You can check the PAN-Aadhar link status post-login by following the steps mentioned below:

Step 1: Use your username and password to log into your account.

Step 2: Your profile page will appear on your screen.

Step 3: Click on “My Profile”.

Step 4: A new page with all your personal details will appear on your screen. Your link status will be written just beside your Aadhar number.

What is the Penalty for Delayed Linking of PAN and Aadhaar Card?

As per the government circular, the last date for linking PAN to Aadhaar was 30 June 2023. Hence, taxpayers who fail to link their PAN to Aadhaar within the mentioned date have to pay a penalty of ₹1,000. However, the individual must have a valid Aadhar and PAN number to pay the required penalty.

The government collected over ₹600 crores from defaulters all over India as a penalty for not linking PAN to Aadhaar.

What are the Benefits of Linking PAN to Aadhaar?

As of April 1, 2023, the government has made it compulsory to link PAN to Aadhaar to avail of several benefits from government schemes. The benefits of linking PAN to Aadhaar are:

Multiple PAN Cards: By Linking PAN to Aadhaar, one cannot hold multiple PAN cards and can only hold one PAN card per person.

Reduced Fraudulence: A person's identity is more accurately perceived by the government after PAN links to Aadhaar, which consequently reduces the risk of scams and identity theft.

Combats Black Money: As linking keeps track of all the transactions, it is very easy to track any trail of black money in the Indian economy.

Direct Benefit Transfer: Linking PAN to Aadhaar helps individuals to apply online for any kind of direct benefit transfer.

Better Audit Trails: Linking PAN to Aadhaar provides the Income Tax department with a reliable audit trail of all transactions and helps them track any discrepancies easily.

Simplified Tax Filing: When filing Income Tax Returns, one must not submit receipts or e-signatures. Hence, linking PAN to aadhaar has simplified the complete process.

Drawback Enquiry: Linking PAN to Aadhaar allows citizens to avail themselves of the benefit of drawback enquiries with the CBIC ( Central Board of Indirect Taxes and Customs).