What is Business PAN Card, Eligibility Criteria & How to Apply?

The most significant reason companies need a PAN card for business is to file their income tax returns and avail rebates.

Further, a PAN card is required to track all company transactions and open bank accounts in a firm’s name.

Therefore, a PAN card for a company is an essential document that should be obtained at the earliest. Find out below how to apply for a PAN card for a company.

Which type of Business Needs a PAN Card?

As mentioned above, there is a PAN card for proprietorship firms and a partnership PAN Card. These are the following businesses that need a PAN card:

Entities that need a PAN card –

- Companies

- HUF

- Firm

- Limited Liability Partnership firms

- Partnership firms

- Local authority/body of individuals/association of persons/artificial juridical person

- Trusts

How to Apply for a Business PAN Card?

There are two common methods to apply for a company PAN card – online and offline. All corresponding steps of both ways will be discussed below.

Offline Application Method to Get PAN Card

The offline application method for a PAN card for business is as follows:

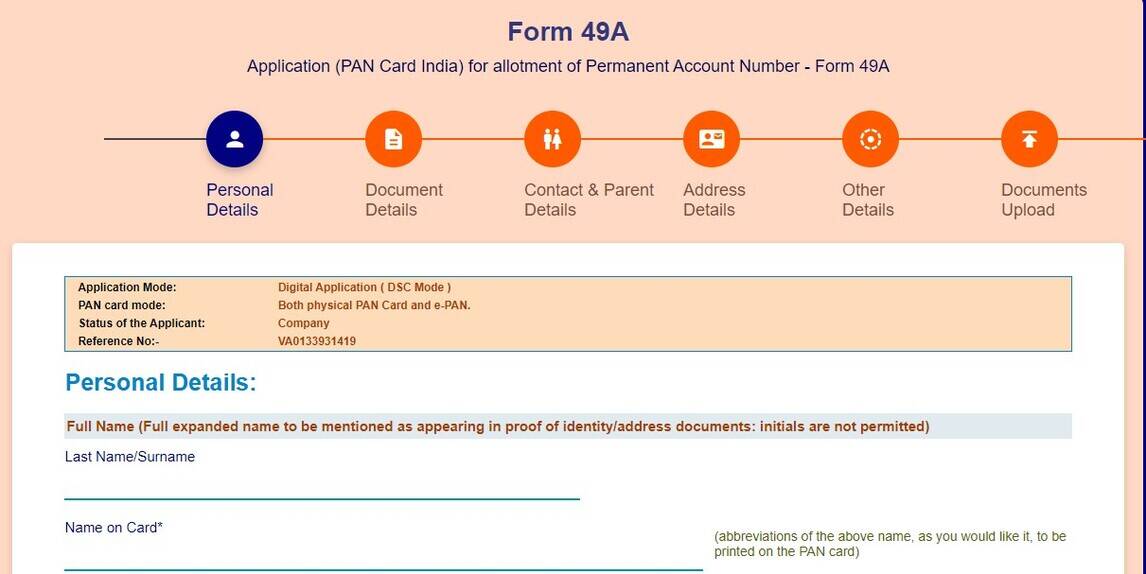

Step 1: First, the owner will need to get a copy of Form 49A. It has to be downloaded from either the NSDL website or the UTIITSL website.

Step 2: Next, all the supporting documents, such as proof of address, Certificate of Registration, have to be added.

Step 3: Form 49A and its supporting documents must be submitted to the nearest NSDL centre.

Step 3: Thereafter, NSDL will issue an acknowledgement number. It acts as proof that the documents were submitted.

Step 4: Moreover, you can also track the status of a PAN card with this acknowledgement number.

Step 5: After NSDL checks these documents, they will issue a PAN card for a company.

Step 6: The PAN card will be dispatched to the registered address of a company.

By following this offline method, any business can apply for a PAN card. Moreover, there is an online method for getting a PAN card for a partnership firm.

See below!

Online Application Method to Get PAN Card

Online PAN card applications for a company can be made via NSDL or UTIITSL. Below are the steps to apply online.

- NSDL Website

Visit the official portal to apply for a company’s PAN number.

Thereafter, follow these steps for a company’s PAN card application online:

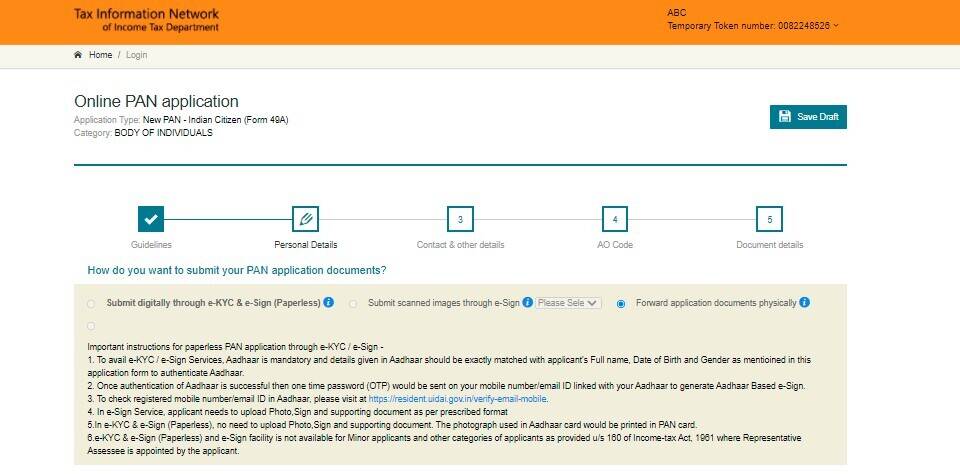

Step 1: Read the instructions before filling up the form.

Step 2: Next, choose the option for Form 49A.

Step 3: Select the type of business you run from an association of persons/body of individuals/trust/Limited Liability partnership or firm.

Step 4: Fill up the company name, date of incorporation, email ID, and contact number.

Step 5: Enter a captcha code, submit this form and a token will be generated.

Step 6: Save this token, and you can continue with the application.

Step 7: To get a PAN card for business, the firm will need to enter personal details, contact and other pieces of information, and the AO code. The AO code is for the Assessing Officer from your jurisdiction.

Step 8: Companies can use the Registration Certificate issued by the Registrar of Companies for ID and address proof.

Step 9: NDSL will ask for an applicant’s relationship with this company. Only a director or an authorised signatory can apply for a PAN Card for business.

Step 10: After filling out this form, they have to upload scanned copies of documents. Review the form and check for errors.

Step 11: Submit this form after proofing the form. Pay the fees for the PAN card, which varies based on the company’s location, either domestic or international.

Step 12: A receipt will be generated after an applicant has paid the PAN fees. He/she can note down the acknowledgement number mentioned on this receipt to track the PAN card status.

Step 13: Sign this acknowledgement and send it to the NSDL office with registration certificate copy and demand draft, if paying by the same.

The steps for the business PAN card application are now complete.

Important points to note for PAN application on NSDL:

1. This is the address to send the printed acknowledgement to:

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

2. When mailing, remember to superscribe the envelope with ‘APPLICATION FOR PAN— # Acknowledgement Number’. It should reach the authorities within 15 days from the submission date. Moreover, any application with a demand draft will be processed only on receipt of payment.

3. For a PAN card for business, applicants cannot send this application document online. Instead, it has to be forwarded physically.

UTIITSL Website

Here’s how to get a PAN card for business from the UTIITSL website.

Step 1: Visit the official portal.

Step 2: Click on the “PAN card Services” button and navigate to the “PAN card as an Indian citizen/NRI” option.

Step 3: Next, select the “PAN card as an Indian citizen/NRI” option. An applicant can either download a blank form for offline application or apply online.

Step 4: Next, one has to select the company type, which is either a firm, a company, an LLP, a trust, or an association of persons. For companies, only the physical submission mode is applicable. Digital mode of submission or signing is not available.

Step 5: Upload the various documents such as company details, incorporation date, name, email ID, phone number, and address, among others.

Step 6: After uploading the necessary documents, pay the processing fee and get the acknowledgement number.

Step 7: Use the acknowledgement number to track the progress of the company PAN card.

Step 8: Finally, send the printed acknowledgement form to the UTIITSL office with copies of supporting documents.

Important points to note before Business PAN number application on UTIITSL

1. Send the completed form along with the copies of supporting documents to the nearest UTIITSL office.

The office addresses are given below:

- Mumbai

PAN PDC Incharge - Mumbai region

UTI Infrastructure Technology And Services Limited

Plot No. 3, Sector 11, CBD Belapur

NAVI MUMBAI – 400614

Kolkata

PAN PDC Incharge - Kolkata region

UTI Infrastructure Technology And Services Limited

29, N. S. Road, Ground Floor,

Opp. Gillander House and Standard Chartered Bank,

KOLKATA – 700001

- Chennai

PAN PDC Incharge - Chennai region

UTI Infrastructure Technology And Services Limited

D-1, First Floor,

Thiru -Vi-Ka Industrial Estate,

Guindy,

CHENNAI – 600032

- Delhi

PAN PDC Incharge - New Delhi region

UTI Infrastructure Technology And Services Limited

1/28 Sunlight Building, Asaf Ali Road,

NEW DELHI -110002

Next up, we will discuss the important documents required for a firm’s PAN card.

The company PAN card documents required for application are discussed below –

1. For an Indian Company

The documents required for various company types, including Hindu Undivided Family, are given below.

|

Type of Business |

Business PAN Card Documents Required |

|

Companies |

The company PAN card documents are: Certificate of Registration issued by the Registrar of Companies |

|

Firm |

The PAN card documents for a firm are the same as those required for partnership firms. |

|

HUF |

The documents required for a HUF PAN card are: ID proof (aadhaar, voter ID, driving license, passport, ration card, pensioner card), Address proof (aadhaar card, voter id, driving license, passport, post office book, property tax assessment, domicile certificate), Date of birth proof (aadhaar, voter ID, driving license, passport, birth certificate, matriculation certificate, domicile certificate) |

|

Limited Liability Partnership Firms |

The documents required for PAN cards for LLP firms are: Certificate of Registration issued by the Registrar of LLPs |

|

A local authority, a body of individuals, association of persons, artificial juridical person |

The documents required for a PAN card are: Agreement, Certificate of Registration, Any other document from the Central or State Government establishing the identity and addresses of the persons |

|

Partnership Firms |

The documents required for the PAN card of a partnership firm are: Partnership deed, Certificate of registration by the Registrar of Firms |

|

Trusts |

The documents required for PAN card of Trusts are: Trust deed, Certificate of registration by the Charity Commissioner |

2. Pan Card for a Foreign Business

The application procedure for a PAN card for a foreign company is the same as that given above, except you have to choose the “Foreign Country” option.

The documents required for a PAN card for a foreign company are specified below:

|

Type of Foreign Business |

Documents Required |

|

Company/LLP |

Certificate of Registration copy issued in the country where the applicant is located presently. It should be attested by: Apostille, Indian Embassy, High Commission/Consulate of that country, Copy of registration certificate issued in India, Documents concerning approval to set up an office in India by Indian authorities. |

How to Get the Documents Apostilled for a Foreign Company?

As per the apostille agreement, document apostillation is how a state authority notarises the document. So how does one get the documents apostilled?

Moreover, from where to get documents apostilled?

Any public state notary can start an apostille process and attest documents per the Apostille Convention.

The outcome of this verification is subsequently passed on to the respective state and then to the Ministry of External Affairs, which issues the requisite sticker.

To start this process, first, visit that authority that issues this certificate.

The documents can be sent to the following offices:

USA: Secretary of State Office

UK: The Legalisation Office, The Foreign and Commonwealth office

What Are the Benefits of a Business PAN card?

Some important uses of a company PAN card are as follows:

- Serves as a reference to track all financial transactions, which the Income Tax Department uses

- Without a PAN card, a company is liable to pay tax (and withholding tax) at the highest possible rate

- A TRN can be obtained only with a PAN card.

Some of the benefits of a firm PAN card are:

- A company cannot file income tax without a PAN card.

- Moreover, the PAN card for business is necessary for tax rebates.

The article discussed applying for a PAN that is more or less similar to a HUF PAN card application or an individual’s application for a PAN. The only difference is the Certificate of Registration, issued by some state or central authority.

Well, that was all about how to get a PAN card for business! Hope it was useful!