Waiting Period in Health Insurance

The waiting period in health insurance is an important concept that directly impacts when policy benefits can be used. It refers to a defined time frame during which some medical conditions or treatments are not covered after purchasing a health insurance policy.

While a health insurance policy may become active immediately after buying but coverage for specific illnesses, pre‑existing conditions, maternity benefits, or planned treatments usually begins only after the waiting period is completed. Understanding the waiting period will help you buy the health insurance policy at the right time.

I agree to the Terms & Conditions

Get Exclusive Porting Benefits

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

9000+

Cashless Hospitals

2.5 Crore+

Lives Insured

4.5 Lacs+

Claims Settled

You’re probably here because you noticed there’s something called a waiting period in health insurance and like many others who are buying a health insurance policy for the first time, you aren’t sure what it means, and if there is something called a waiting period- how long is it and what does it include?

Well, keep your doubts at bay and read on for everything you need to know about waiting periods in your health insurance.

Table of Contents

What is Waiting Period in Health Insurance?

As the name suggests, the waiting period is quite literally the amount of time you need to wait. In health insurance, it refers to the amount of time you need to wait, from the start of your policy, to be able to use the benefits.

For example: One of the most common types of waiting period is the time you need to wait to be able to use special benefits such as a Maternity Cover; in this case most health insurers will include a waiting period of 2-4 years i.e. before you can benefit from the maternity cover, you should have your policy for at least 2 years (the amount of time is dependent on the health insurance policy you buy).

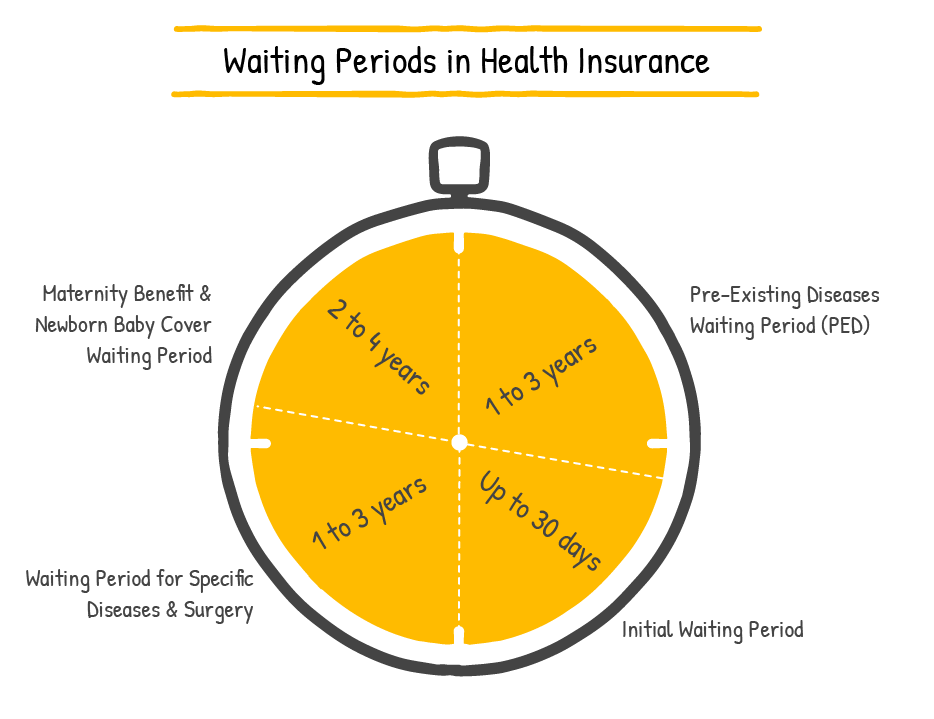

Types of Waiting Periods in Health Insurance & Their Duration

There are various kinds of waiting periods present in every health insurance policy. Let’s have a look at what they imply, what the industry average is, and what is Digit’s Health Insurance waiting periods in context to them all.

1. Initial Waiting Period

An initial waiting period, also known as the cooling period in health insurance, refers to the amount of time you’ll have to wait from the date of issue to actively start using your health insurance policy and benefiting from it.Today, the industry standard for initial waiting periods is up to 30 days for all health insurance policies.

2. Pre-Existing Diseases Waiting Period (PED)

Typically, when you buy a health insurance policy, you will be asked about pre-existing diseases and/or will also be asked to take a few medical tests that may reveal the same.

According to the IRDAI, a pre-existing disease refers to any condition, ailment, injury, or disease that was diagnosed up to 36 months before buying a health insurance policy.

Some examples of pre-existing diseases include diabetes, hypertension, thyroid, etc. Therefore, if you do have a pre-existing disease, you will have to wait for the prescribed waiting period before you can claim any hospitalisation or treatment that is related to the disease.

Usually, the waiting period for pre-existing diseases health insurance is 1 to 3 years, depending on your health insurer and the type of health insurance plan chosen.

3. Waiting Period for Specific Diseases & Surgery

The title is perhaps self-explanatory, i.e., waiting periods for specific diseases and surgeries imply that you will need to wait for the prescribed amount of time when it comes to claiming treatment and hospitalization related to a list of specific diseases and surgeries.

Generally, the waiting period for these situations is 1 to 3 years.

Here’s the list of diseases:

4. Maternity Benefit & Newborn Baby Cover Waiting Period

As part of most health insurance policies for individuals and families, there is an option to also include a maternity benefit and newborn baby add-on for those planning a family soon, and apart from just planning for the baby, it is wise to also plan financially for the expenses that arise during and post labor.

Typically, the waiting period with most health insurance policies ranges from one year to four years.

This means you can only claim for maternity-related expenses once you’ve completed two years of your policy.

Therefore, if you’re planning on starting a family sometime soon and want to ensure your health insurance policy covers it, then take into consideration the 9 months of the pregnancy term, plus the rest 15 months to complete your two-year waiting period.

The maternity benefit add-on covers delivery expenses and the baby for its first 90 days; including its necessary vaccinations and any other medical care required otherwise.

Know more about:

5. Waiting Period for Accidental Hospitalization

Accidents can cause the most unexpected injuries and other medical concerns. Therefore, given the nature of accidents, all health insurers, including Digit, do not account for any waiting period when it comes to accidental hospitalizations. This means one can claim for accidental hospitalizations even just days into their new health insurance policy. The initial waiting period doesn’t apply here either.

*The 30-day waiting period is available through an add-on cover Initial Waiting Period Modification.

Note: These durations can vary slightly based on the insurer and the specific terms of the policy, so it is always advisable to review individual policy documents for precise details.

How Does Waiting Period in Health Insurance Work?

The waiting period is the time you need to wait before you can use your health insurance policy for specific treatments or conditions. For example, if your policy has a waiting period of 30 days, you can’t claim benefits for any illness or injury that occurs during this 30-day period. Waiting periods vary based on the insurance plan and the specific condition.

Let’s Explore How Waiting Periods in Health Insurance Work through a Practical Example

According to his policy, the initial waiting period is 30 days. This means Kiran cannot make a claim for any illness or medical condition that occurs within the first 30 days after purchasing the policy.

On January 15th, Kiran develops a cold and needs to see a doctor. Since this illness occurred within the 30-day waiting period, it is not covered by his insurance policy.

He pays for the treatment out of his own pocket.

On February 1st, the 30-day waiting period ends. Kiran’s policy is now active for all covered illnesses and medical treatments.

If Kiran develops another illness or requires medical treatment after February 1st, he can make a claim under his policy, provided the treatment is covered and adheres to other policy conditions.

Suppose Kiran has diabetes, which he had before purchasing the policy. His policy has a 3-year pre-existing disease waiting period.

Kiran can’t claim benefits for diabetes-related treatments until 3 years have passed from the policy start date.

If he requires treatment for diabetes in the first 2 years, he will need to cover those expenses himself. After the 3-year waiting period, he can claim benefits for his diabetes treatment as long as it’s covered by the policy.

Why Do Health Insurance Plans Have Waiting Periods?

What is the Zero Waiting Period in Health Insurance?

A zero waiting period means that you can start using your health insurance benefits for the specified illnesses immediately after buying the policy without having to wait for a specified period. This is usually found in specific plans or for certain types of coverage, like accidents.

How Does Zero Waiting Period Work?

With a zero waiting period policy, you don’t have to wait any time at all to make a claim. As soon as your policy is active, you can use it for covered treatments or expenses. However, zero waiting periods are often applicable to only certain types of coverage, like emergency treatments, and may not cover pre-existing conditions or specific diseases immediately.

Let’s understand with an example:

Riya buys a health insurance policy on April 1st. Her policy includes a zero waiting period for accidental injuries.

On April 5th, Riya unfortunately has a minor accident and requires emergency medical treatment. Since her policy has a zero waiting period, she can immediately file a claim for the treatment expenses.

Riya submits her claim to the insurance company and receives reimbursement for her medical bills according to the policy terms.

This is how it works!

Is It a Good Idea to go with a Zero Waiting Period Health Insurance?

A zero waiting period health insurance plan is generally a good idea as it offers immediate coverage for pre-existing diseases, which is a significant advantage.

However, these plans often come with higher premiums, so it's essential to weigh the benefits against the cost. If you have pre-existing conditions or a family history of serious illnesses, a zero waiting period plan might be a worthwhile investment.

But, it might not be the most cost-effective choice if you buy it at an early age. Since you're young and likely have fewer health concerns, the chances of needing immediate coverage for pre-existing conditions are lower.

Reasons to Check Waiting Period in Health Insurance

Below are the reasons why you should check the waiting period before finalising a health insurance policy.

How to Reduce the Waiting Period in Health Insurance?

Opting for a Policy with a Waiting Period Waiver:

A waiting period waiver is often an add-on or a special feature within a health insurance policy that can reduce or completely remove waiting periods for certain types of coverage. For example, some insurers provide a PED waiting period waiver that reduces the waiting period for pre-existing diseases from 3 years to 2 years.

Choosing a Top-Up Plan:

Some insurers offer top-up plans or riders that can provide additional coverage with reduced waiting periods. These plans can be added to your existing policy for enhanced coverage.

Negotiating with the Insurer:

In some cases, you can negotiate with the insurer to adjust waiting periods, especially if you have a good health history or are a long-term customer.

Pre-existing Condition Exclusions:

Suppose you have a specific pre-existing condition that is not covered by standard policies. In that case, some insurers offer specialized plans with reduced waiting periods for such conditions, though these may come at a higher cost.

Opting for Co-payment:

Co-payment also reduces waiting periods by sharing treatment costs between you and the insurer, which mitigates the insurer’s risk and can lead to more immediate coverage options. This trade-off often results in shorter waiting periods for benefits.

What is the Survival Period in Health Insurance?

The survival period in health insurance is the minimum duration an insured must survive after being diagnosed with a covered critical illness to be eligible to receive insurance benefits. This period ensures that the insured survives a certain length of time post-diagnosis, which is essential for making a claim on critical illness policies.

This period can last anywhere between 14 to 90 days, based on the illness and the insurer.

Only after this period can you get the lump sum amount from your insurer, as mentioned in the critical illness cover. This period is calculated based on the first diagnosis of the critical illness and is in addition to the regular waiting period.

Example: If a health insurance policy for critical illnesses has a survival period of 30 days, the policyholder must live for at least 30 days after being diagnosed with a critical illness like cancer before they can claim the benefits.

Difference Between Survival Period and Waiting Period in Health Insurance

What is a Cooling-Off Period in Health Insurance?

A cooling-off period is a specified duration after any treatment, during which you cannot buy health insurance. It can range from weeks to months and differ from policy to policy.

However, in other words, cooling-off period (also free look-up period) is the time duration after purchasing a health insurance policy during which a policyholder can review the policy terms and conditions and decide whether to continue with it.

If the policyholder is not satisfied, they can cancel the policy within this period and receive a refund after nominal deductions. Generally, this period ranges between 30 to 90 days.

For example, Riya buys a health insurance policy online on 1st July and receives the policy document on 3rd July. From this date, her cooling‑off period begins. For the next 15-30 days (depending on the insurer), Riya can carefully read the policy details and decide if she wants to continue with the policy or not.

Difference Between Waiting Period and Cooling‑Off Period in Health Insurance

Although the waiting period and the cooling‑off period in health insurance serve completely different purposes, they are often misunderstood. Here are the key differences between the two concepts:

Important Points about the Waiting Period in Health Insurance

- Health insurance policies typically include a waiting period for pre-existing conditions, which is usually 1 to 3 years.

- Most health insurance policies have an initial waiting period of 30 days from the date of policy commencement.

- If an individual is diagnosed with a disease for the first time during the waiting period, this condition will not be considered a pre-existing disease. Consequently, the policy will provide coverage for this ailment.

- When transferring from one insurer to another (portability), the waiting period for pre-existing conditions may be carried over from the old policy.

- Waiting periods are generally reset with new policies or renewals unless otherwise specified.

- Insurers are required to clearly disclose waiting periods in the policy document and during the sales process.

Disclaimer: This information is based on general guidelines and standards set by the Insurance Regulatory and Development Authority of India (IRDAI). Always check the specific details of your health insurance plan to understand its waiting period, survival period, and coverage.

Understanding the waiting period in health insurance is crucial for every policyholder. It not only sets realistic expectations about claim eligibility but also emphasises the importance of early policy purchase. Whether it's the initial waiting period, disease-specific, or pre-existing disease, being informed helps avoid claim rejections and ensures better financial planning.

Overall, understanding the waiting period empowers you to plan wisely, anticipate coverage timelines, and avoid surprises when you need support the most. 🙂