Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

What is UAN Number, Full Form & How to Find UAN Number Online/Offline?

What is UAN and how is it related to salaried individuals?

Individuals must have UAN to access all the previous and present PF (Provident Fund) accounts.

Stay with us and learn about the importance of UAN, its benefits, and activation process and much more. Read along!

A universal account number (UAN) is important for all the employees in India. UAN helps all employees access their previous and present provident funds. This specific number simplifies financial transactions and retirement planning.

It’s now easy to find your UAN online and take charge of your economic destiny. This guide will explain the importance of UAN and how to find it online.

Table of Contents

What is an UAN Number?

UAN is a 12 digit unique number provided to each employee contributing to the Employees Provident Fund. This unique number is generated and assigned by the Employee Provident Fund Organisation (EPFO). The Ministry of Labour and Employment authenticates UAN under the directives of the Government of India.

This number remains the same for each employee throughout their life, irrespective of the number of times they have joined new organisations.

Apart from knowing what a UAN number is, individuals must learn about the various related things to use this UAN more efficiently.

What is the Full Form of UAN?

UAN stands for Universal Account Number. It’s a special identity given to employees contributing to India's EPF (Employee Provident Fund). It simplifies access to provident fund services and enables centralised management of employee provident fund accounts.

How to Find UAN Number Online?

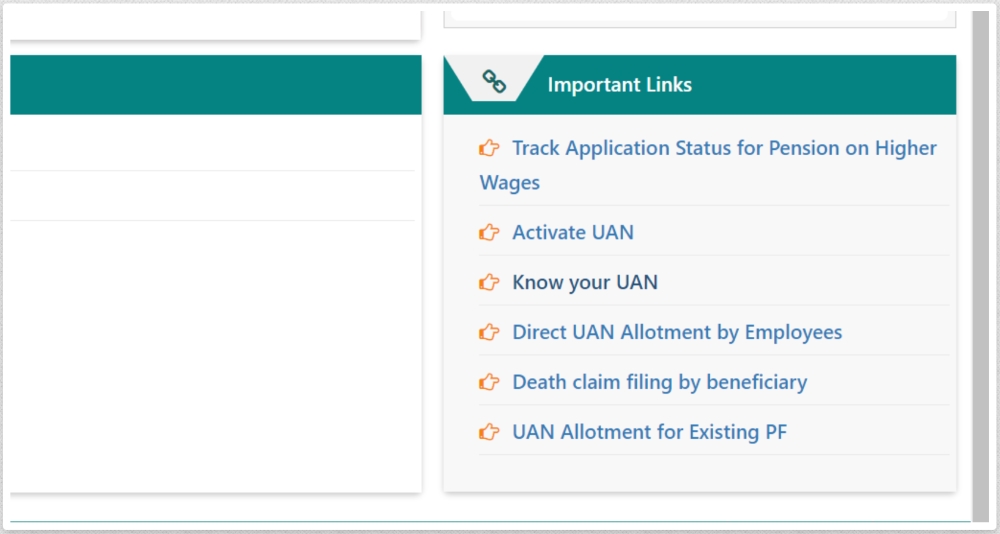

Step 1: Go to the EPFO’s Unified Member Portal.

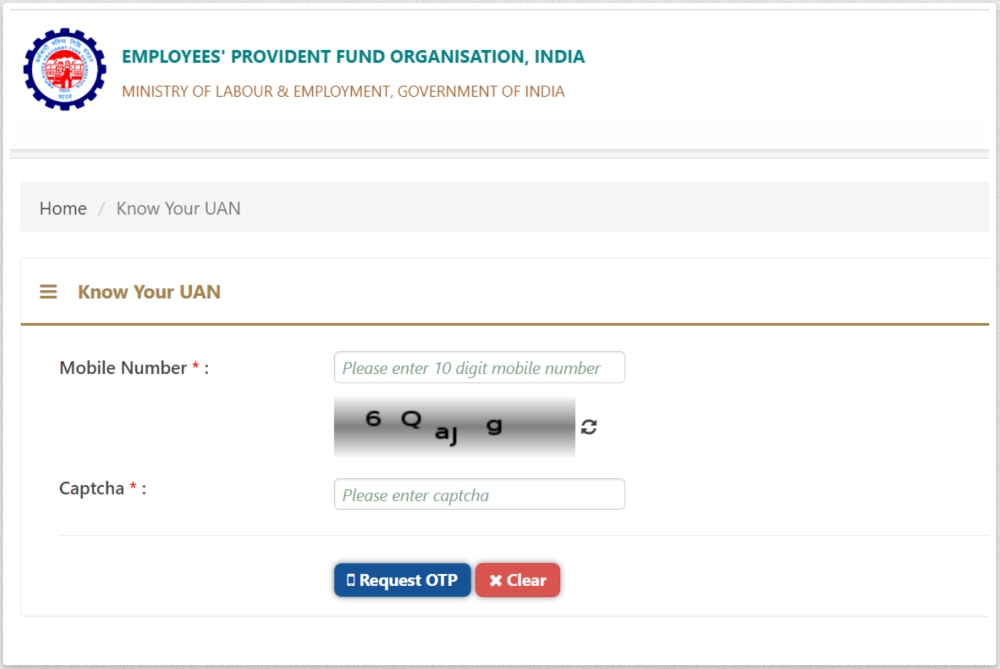

Step 2: Next, click on the ‘Know Your UAN Status' option from the important links section.

Step 3: Individuals will receive an authorisation PIN on the registered mobile number after submitting details.

Step 4: Now, individuals have to enter the PIN.

Step 5: After entering this, UAN will be sent to the registered email account and mobile number.

How to Find UAN Number Offline?

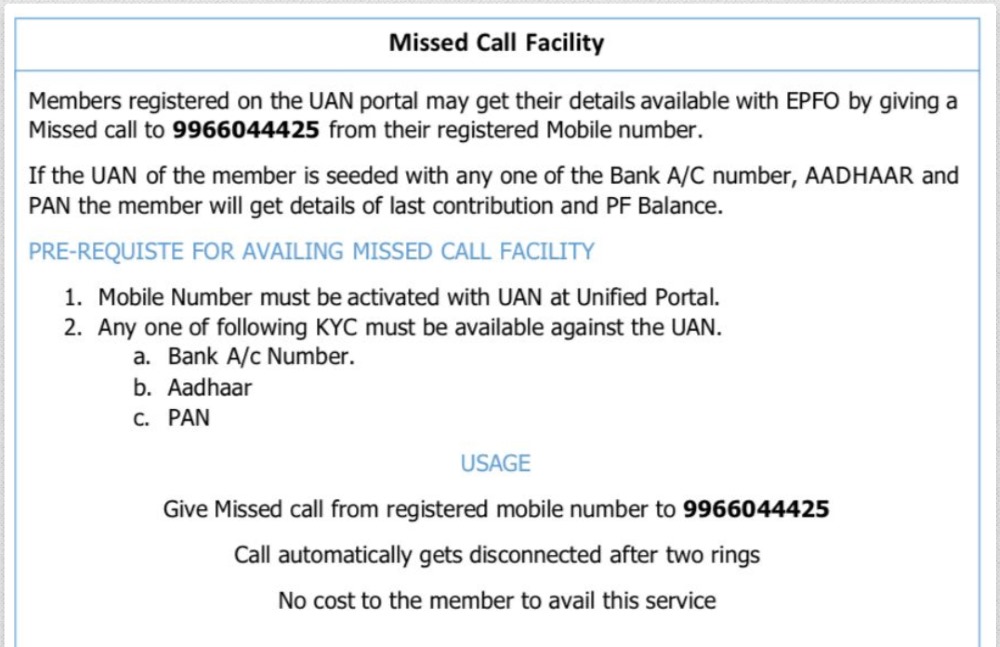

Members/individuals registered on the UAN portal can get complete details with a missed call facility. The process is straightforward. Read along!

Why is UAN Needed?

The Universal Account Number (UAN) is needed to streamline and simplify the management of Employees' Provident Fund (EPF) accounts. It provides a centralised identification system for employees across different employers and offers various benefits.

Consolidates EPF Accounts: UAN links all your EPF accounts from different employers into one unified account.

Simplifies Transfers: Transferring funds between EPF accounts is easy when you change jobs.

Access to Online Services: UAN allows you to access various online EPFO services, such as checking your EPF balance and downloading your passbook.

Improves Transparency: You can track your contributions and interest credits in real time.

Enhances Security: UAN protects your account information and transactions with secure authentication.

Why is UAN Important for Employees?

The Universal Account Number (UAN) is crucial for employees because it simplifies the management of their provident fund accounts. Employees can easily track their contributions and interest accruals in real-time by linking all EPF accounts across different employers under a single UAN.

This streamlines the retirement savings process, as they no longer need to worry about consolidating multiple accounts or losing track of funds when changing jobs.

Additionally, UAN enhances the security and transparency of employees' EPF accounts. With access to the EPFO Member e-Sewa portal, employees can perform various actions online, such as updating KYC details, checking account balances, and even withdrawing funds.

This saves time and effort and provides peace of mind, knowing that their retirement savings are being managed efficiently and securely.

How to Generate UAN?

Now that individuals know what a Universal Account Number means, its importance, and its benefits, they must know how to generate it.

Follow the steps mentioned below to generate a UAN number.

Step 1: Log in to the EPF Employer Portal using the Establishment ID and password.

Step 2: Move to the ‘Member’ tab and click ‘Register Individual.’

Step 3: Provide employee’s details such as Aadhaar, PAN, bank details, etc.

Step 4: After checking all the details, click on the ‘Approval’ button.

Step 5: EPFO will generate a new UAN.

Once the new UAN is generated, new employers can easily link employees' Provident Fund accounts to that UAN.

Documents Required to Generate UAN

Here is a list of all the documents required to generate UAN.

- Identity proof- Driving license, passport, Voter ID, etc.

- Address proof- Recent utility bill rental or lease agreement, Ration card, etc.

- Bank account details- Account number and IFSC Code

- PAN card

- Aadhaar card

- ESIC card

How to Get the Previous UAN Number?

If you need to retrieve your previous Universal Account Number (UAN), there are a few methods you can try:

Contact your Previous Employer: Reach out to your previous employer's HR department for assistance. They can provide you with your UAN.

Check your Salary Slips: Your UAN may be listed on your previous salary slips or pay stubs.

EPFO Portal: Log in to the EPFO Member e-Sewa portal with your current UAN and check if you can access information about previous UANs linked to your account.

Check Old PF Statements: Your old PF statements may contain your previous UAN. Look through any documentation you have related to your provident fund account.

Following these methods, you can retrieve your previous UAN and manage your EPF accounts more effectively.

Importance of Universal Account Number (UAN)

UAN is important for several reasons listed below:

The unique UAN remains the same until the retirement of an employee.

UAN is essential for checking the credits and debits in the PF account.

Through UAN, individuals can withdraw and transfer funds without relying on the employer.

The online processing of PF accounts helps employees to access the account freely.

With UAN, employees can track monthly deposits. However, the respective employee has to be registered on the EPFO.

The section mentioned above clarifies what a Universal Account Number is and why it is needed. Now, let’s focus on the various advantages its uses offer.

What is UAN Card?

A UAN card is a physical or digital document that contains the Universal Account Number (UAN) assigned to an employee by the Employees' Provident Fund Organisation (EPFO). The UAN is a unique identification number that remains the same throughout an individual's career, even if they change jobs.

The UAN card serves as proof of the employee's membership in the EPFO and is used to track the employee's EPF accounts across different employers. It simplifies managing and transferring EPF funds when changing jobs and allows employees to access their EPF information online.

How to Download UAN Card?

To download your UAN card, log in to the EPFO Member e-Sewa portal with your UAN and password. Once logged in, follow these steps:

Step 1: Navigate to the 'View' menu on the portal.

Step 2: Click on 'UAN Card' to download your card in PDF format.

Step 3: Save the card on your device for future reference.

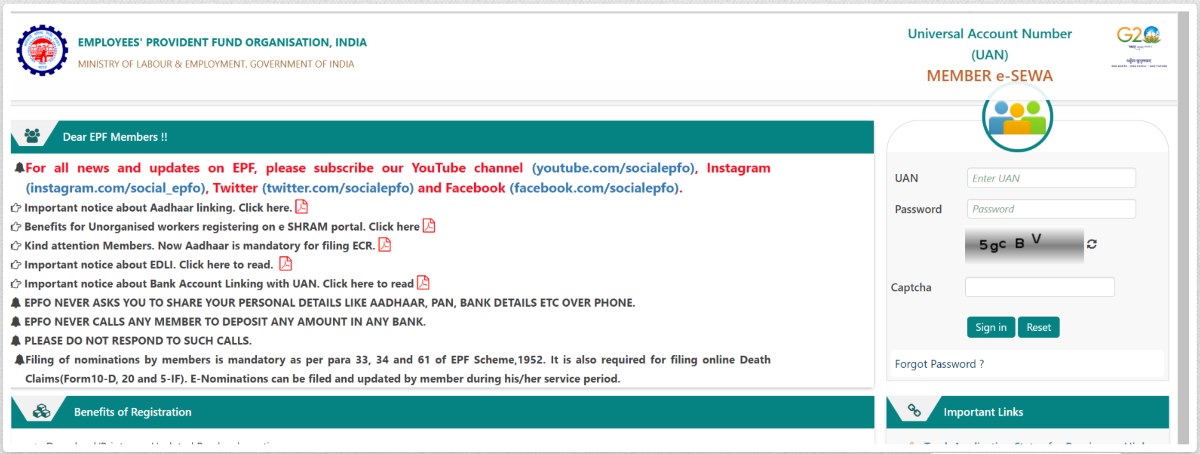

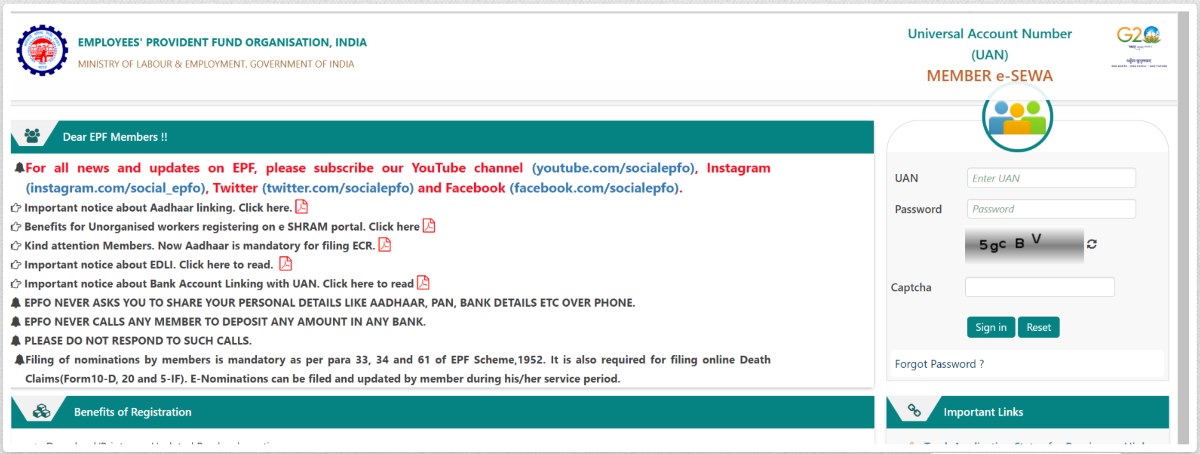

How to Login to UAN Portal?

To log in to the UAN portal, follow these steps:

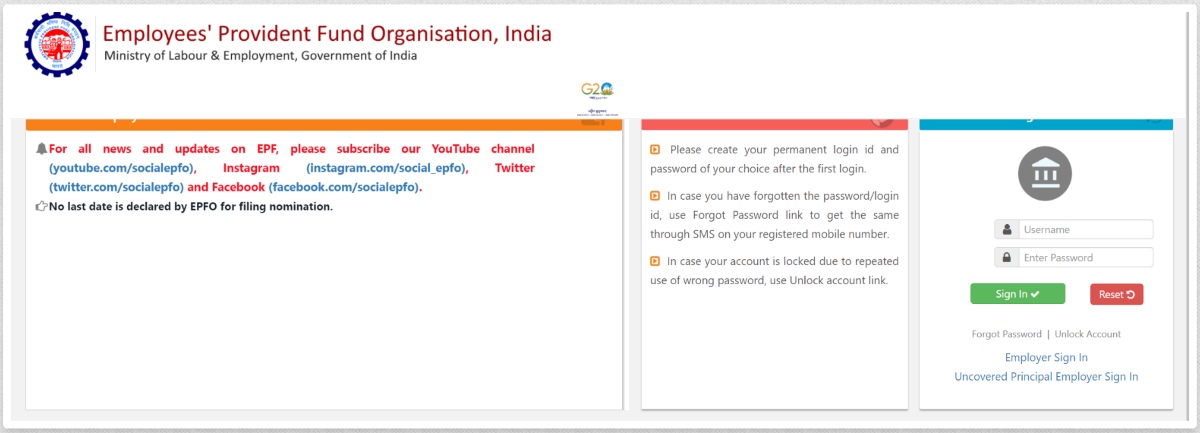

Step 1: Visit the EPFO Member e-Sewa Portal: Go to the EPFO Member e-Sewa portal's official website.

Step 2: Enter your UAN: Input your Universal Account Number (UAN) in the appropriate field.

Step 3: Provide your Password: Enter the password associated with your UAN account.

Step 4: Enter the Captcha code: Complete the security verification by entering the displayed Captcha code.

Step 5: Click on 'Sign In': Once you have entered your details, click the 'Sign In' button to access your UAN account.

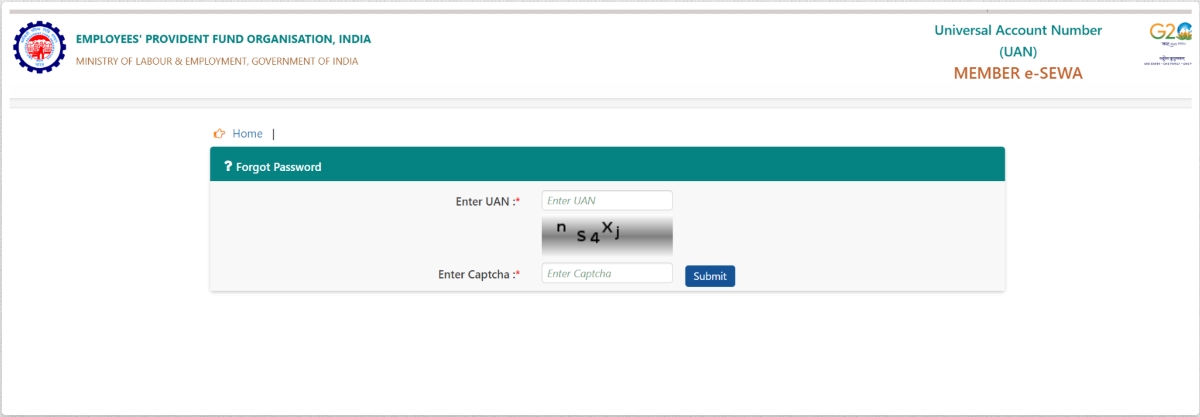

How to Reset UAN Portal Password?

To reset your UAN portal password, follow these steps:

Step 1: Visit the EPFO Member e-Sewa portal: Go to the official website of the EPFO Member e-Sewa portal.

Step 2: Click on 'Forgot Password’: On the login page, click on the 'Forgot Password' link.

Step 3: Enter your UAN: Provide your Universal Account Number (UAN) in the field provided.

Step 4: Verify your identity: You may need to verify your identity by providing your registered mobile number or email address. An OTP (one-time password) will be sent to your registered contact details.

Step 5: Enter the OTP: Input the OTP you received on your registered mobile number or email address.

Step 6: Create a New Password: Once your identity is verified, you can create a new password. Make sure it meets the password requirements for security.

Step 7: Confirm the New Password: Enter the new password again to confirm it.

Step 8: Save your Changes: After confirming the new password, save your changes. You can now use the new password to log in to your UAN account.

UAN Login Portal Services

The UAN login portal provides employees with a centralised and convenient platform to manage their Employees' Provident Fund (EPF) accounts. Through the portal, individuals can access various services and information related to their retirement savings and EPF accounts.

Services and information available in the UAN portal include:

EPF Account Information: Access your EPF account balance and transaction history.

EPF Passbook: Download your EPF passbook to view detailed information on contributions and interest credits.

KYC Updates: Update your KYC (Know Your Customer) details, such as Aadhaar, PAN, and bank account information.

EPF Withdrawal: Apply for EPF withdrawal or advances directly from the portal.

Transfer Requests: Initiate and track requests to transfer EPF accounts from one employer to another.

Nominee Details: Add or update nominee information for your EPF account.

Profile Management: View and update your personal profile details, such as contact information and password.

Claim Status: Check the status of any claims or withdrawals you have made.

View UAN Card: Download and view your UAN card for reference.

Raise Complaints: Lodge grievances or complaints regarding EPF services.

The UAN portal streamlines the management of EPF accounts by providing employees with easy access to all necessary information and services related to their provident fund accounts.

How to Link Multiple EPF Accounts with UAN?

To link multiple EPF accounts under your Universal Account Number (UAN), you can follow these steps:

Step 1: Inform your New Employer: When you change jobs, provide your UAN to your new employer during onboarding. They will link your new EPF account to your UAN.

Step 2: Verify Linking: Once your new employer links your EPF account to your UAN, check your EPF account information on the EPFO Member e-Sewa portal to confirm that the new account is linked.

Step 3: Raise a Transfer Request: If you have existing EPF accounts that are not linked to your UAN, you can request account consolidation on the EPFO portal.

Step 4: Submit the Transfer Request: Provide the details of your previous EPF account(s) to complete the transfer request. Your employer may assist you in this process.

Step 5: Track the Transfer Request: Monitor the status of your transfer request on the EPFO portal to ensure that all accounts are linked under your UAN.

Step 6: Verify Successful Linking: Once the transfer request is processed and all your EPF accounts are linked, verify that the accounts are consolidated under your UAN by checking your EPF passbook on the EPFO portal.

By linking multiple EPF accounts under a single UAN, you can streamline the management of your retirement savings and track your contributions more effectively.

How to Change/Update Personal Details in the UAN Portal?

To change or update your details in the UAN portal, follow these steps:

Step 1: Log in to the EPFO Member e-Sewa Portal: Visit the EPFO Member e-Sewa portal and log in using your Universal Account Number (UAN) and password.

Step 2: Navigate to the 'Profile' Section: Once logged in, go to the 'Profile' section on the portal.

Step 3: Select 'Update Profile': In the profile section, choose to update your profile details.

Step 4: Edit the Necessary Information: Update your details, such as your name, date of birth, gender, or contact information. Ensure the details are accurate and match your official records.

Step 5: Save the Changes: Save the changes once you have made the necessary updates.

Step 6: Submit for Employer Approval (if required): Sometimes, your employer may need to approve the changes. The portal will guide you on any necessary next steps.

Step 7: Check the Status: Monitor the status of your update request on the portal to ensure the changes are applied correctly.

How to Update Mobile Number in UAN Portal When You Have Forgotten Your Password?

If you need to update your mobile number in the UAN portal but have forgotten your password, you can follow these steps:

Step 1: Visit the EPFO Member e-Sewa Portal: Go to the portal's login page.

Step 2: Click on 'Forgot Password': On the login page, click the 'Forgot Password' link.

Step 3: Enter your UAN: Provide your UAN in the designated field.

Step 4: Verify your Identity: You must verify your identity using the options provided. Typically, this includes receiving an OTP (one-time password) on your registered mobile number or email.

Step 5: Update your Mobile Number: If you no longer have access to your registered mobile number, you may need to follow the process for updating your KYC information, including your mobile number. If necessary, contact your employer for assistance with this process.

Step 6: Reset your Password: Once you've verified your identity, follow the instructions to reset your password.

Step 7: Log in with your New Password: Once you've successfully reset your password, log in to the UAN portal using your UAN and new password.

Step 8: Update your Mobile Number: Navigate to the 'Profile' section in the portal and update your mobile number. Save the changes.

How to Link UAN with Aadhaar Card?

Linking your Universal Account Number (UAN) with your Aadhaar is an important step to effectively manage your Employees' Provident Fund (EPF) account. Here's how you can link your UAN with Aadhaar both online and offline:

Online Method:

Step 1: Visit the EPFO Member e-Sewa Portal: Go to the EPFO Member e-Sewa portal and log in using your UAN and password.

Step 2: Navigate to 'KYC' Section: Once logged in, go to the 'KYC' section on the portal.

Step 3: Select 'Aadhaar': In the KYC section, select 'Aadhaar' as the document type you want to update.

Step 4: Enter your Aadhaar Number: Input your 12-digit Aadhaar number in the provided field.

Step 5: Submit the Request: Submit the link request after entering your Aadhaar number.

Step 6: Employer Verification: Once you submit the request, your employer will receive a notification to verify the details. Once verified, your Aadhaar will be linked to your UAN.

Step 7: Confirmation: Once your employer verifies your details, you will receive a confirmation message. You can also check your UAN portal to verify the linkage.

Offline Method:

Step 1: Visit your Nearest EPFO Office: Go to your nearest EPFO office with your UAN and Aadhaar card.

Step 2: Fill Out the KYC Update Form: Request a KYC update form and fill it out with your personal information, including your UAN and Aadhaar number.

Step 3: Submit the Form: Submit the completed form along with self-attested copies of your Aadhaar card and any other required documents.

Step 4: Employer Verification: Once the EPFO office receives your form, they will process your request, and your employer may need to verify your details.

Step 5: Confirmation: Once the process is complete, you will receive a confirmation that your UAN has been linked with your Aadhaar.

Linking your UAN with Aadhaar allows you to streamline your EPF account management and access services more conveniently.

How Has UAN Made EPF Easy to Manage?

UAN has streamlined the management of EPF for employees, offering easy access to various services. It simplifies tracking contributions, updating personal information, and transferring funds between employers with a single account. UAN enhances convenience and efficiency in managing retirement savings.

Benefits of UAN

Consolidated Account Management: UAN allows employees to link all their EPF accounts under one identification number, making tracking and managing contributions across different jobs easier.

Online Access to Services: The UAN portal allows employees to access a range of EPF services online, including checking balances, updating personal details, and initiating transfers.

Enhanced Portability: UAN improves the portability of EPF accounts by facilitating the smooth transfer of funds when an employee changes jobs.

Transparent and Secure Transactions: Employees can monitor their EPF accounts in real-time, ensuring transparency and security in managing their retirement savings.

How to Transfer EPF Accounts Using UAN?

Transferring EPF accounts using your Universal Account Number (UAN) is a straightforward process that allows you to consolidate your retirement savings when you change jobs. Here's how you can transfer EPF accounts using UAN:

Step 1: Log in to the EPFO Member e-Sewa Portal: Visit the EPFO Member e-Sewa portal and log in using your UAN, password, and captcha code.

Step 2: Navigate to 'Online Services': Once logged in, go to the 'Online Services' section in the portal.

Step 3: Select 'Transfer Request': In the 'Online Services' section, choose 'Transfer Request' to begin the transfer process.

Step 4: Provide Previous EPF Account Details: Enter the details of your previous EPF account, including the PF account number and employer information.

Step 5: Verify Current Employer Details: Provide details of your current employer, including the PF account number and other relevant information.

Step 6: Review and Submit: Review the transfer request details and submit the form for processing.

Step 7: Track Transfer Status: On the EPFO portal, monitor the status of your transfer request. You will receive updates on the progress of the transfer.

Step 8: Confirm Transfer Completion: Once the transfer is complete, verify that your EPF funds have been successfully transferred to your current EPF account linked to your UAN.

UAN Customer Care Details

The Employees' Provident Fund Organisation (EPFO) provides customer care services to assist users with queries related to UAN and EPF. You can contact the EPFO customer care through the following channels:

Helpline Number: Call the official EPFO helpline at 1800-118-005. This toll-free number is available for customer support and queries.

Email Support: You can also reach out to EPFO via email for any specific queries. Visit the official EPFO contact page to find the appropriate regional email addresses.

Social Media: EPFO is active on social media platforms like Twitter and Facebook. You can use these channels to contact them and get updates on various services.

EPFO Member Portal: The EPFO Member e-Sewa portal also has a contact section for user support and assistance.

For more information, visit the official EPFO contact page, where you can find additional details such as regional office contact numbers and email addresses.

Understanding the Universal Account Number (UAN) is essential for managing your EPF account efficiently. The UAN streamlines tracking and transferring your EPF balance, providing greater control over your retirement savings. By activating and linking your UAN to your EPF account, you can easily access valuable benefits such as monitoring your balance and managing withdrawals.