Road Tax in Jammu Kashmir & Vehicle RTO Charges in 2026

Jammu and Kashmir, once a princely state, is now a Union Territory of India, established on October 31, 2019. This region is known for its stunning landscapes, rich cultural heritage, and complex history, marked by disputes over its status between India and Pakistan.

Road tax in Jammu and Kashmir is a mandatory fee for vehicle owners to fund road maintenance and infrastructure development. As of 2026, the tax is calculated at a flat rate of 9% or 10% of the vehicle's cost, depending on its type. This system was revised in 2019 to simplify payments, allowing one-time or instalment payment options.

In this article, we simplify the complexity of the road tax in Jammu Kashmir, helping you understand the rates, factors affecting them, and even the exemptions available to facilitate your swift vehicle registration.

Table of Contents

What is Road Tax?

Road tax is a method the state government uses to charge vehicle owners for maintaining road infrastructure in India, even in Jammu and Kashmir. In Jammu and Kashmir, the road tax is generally calculated at 9% of the overall cost incurred in automobile manufacturing. It is compulsorily paid during vehicle registration and can be paid periodically.

Road tax in Jammu and Kashmir is 9% or 10% of the vehicle expense, depending on the type of vehicle. The road tax law was wholly amended in 2019, shifting from being highly articulated to a simple percentage of the ex-showroom price. The tax is payable by owners of both vehicles online and offline.

Road Tax for Two Wheelers in Jammu Kashmir

In Jammu Kashmir, the road tax for two-wheelers is influenced by engine capacity and the vehicle's ex-showroom price. Typically, bikes with smaller engines incur lower taxes, whereas larger or premium models are subject to higher rates.

The table below illustrates the applicable road tax for two-wheelers in Jammu Kashmir, revised in 2019:

| Description of the Vehicle | Quarterly Tax | One-Time Tax |

| Scooters with attachments | ₹60 | ₹2,400 |

| Motorcycle | ₹100 | ₹4,000 |

| Motorcycle with sidecar | ₹150 | ₹4,000 |

Road Tax for Four Wheelers in Jammu Kashmir

For four-wheelers, road tax is determined by several factors, including the vehicle's weight, type, make, and age. The table below shows that personal-use four-wheelers fall under various tax brackets:

| Horse Power of the Vehicle | Rate of Quarterly Tax | One Time Tax |

| Motorcars of upto 14 HP | ₹150 | ₹6,000 |

| Motorcars of more than 12 HP | ₹1,000 | ₹20,000 |

| Motor car with trailer | ₹150 | - |

| Invalid carriage | ₹60 | ₹2,400 |

Road Tax for Commercial Vehicles in Jammu Kashmir

Details regarding charges for transport vehicles can be found in the table below:

| Seating Capacity | Quarterly Tax |

| Upto 5 persons | ₹250 |

| More than 5 persons | ₹375 |

| Trailers | ₹250 |

Road Tax for Three Wheelers in Jammu Kashmir

For three-wheelers, the road tax in Jammu Kashmir is primarily based on the vehicle's intended use. A more detailed breakdown of these charges is provided in the table below:

| Vehicle Type | Quarterly Road Tax | One-Time Tax |

| Auto Rickshaw (up to 5 seats) | ₹250 | Not Applicable |

| Auto Rickshaw (more than 5 seats) | ₹375 | Not Applicable |

Road Tax for Other State Vehicle in Jammu Kashmir

Vehicles registered in other states but operating within Jammu Kashmir are taxed based on their duration of stay and other specific factors. The tax usually reflects the original registration fee paid in their home state. Refer to the table below for further information:

| Vehicle Type | Ex-showroom Price Condition | Applicable Road Tax |

| All vehicles (except motorcycles) | Exceeding ₹1.5 lakhs | 9% of the ex-showroom price (pro-rata basis) |

| Motorcycles | Exceeding ₹1.5 lakhs | 10% of the ex-showroom price (pro-rata basis) |

How is the Road Tax in Jammu Kashmir Calculated?

Road tax in Jammu Kashmir is determined by various factors, including:

1. Type of Your Vehicle

The type of vehicle that you own goes a long way in the computation of road tax. The charges vary between two-wheelers, four-wheelers or a car registered in another state:

Two-wheelers are relatively inexpensive in tax liabilities compared to big haulage trucks and larger-sized vehicles

Four-wheelers, including cars and SUVs, have higher tax rates payable based on criteria such as weight and engine capacity.

Three-wheelers and cars registered in other states are typically taxed differently since every state has its taxing policies and jurisdictions.

2. Usage: Private or Commercial

The use for which the car is meant, either private or commercial, also determines road tax:

Private cars and motorbikes, especially those used for family purposes, attract lesser road taxes than the regular road taxes on standard commercial vehicles.

Commercial vehicles, including buses, cabs, trucks, and other miscellaneous cars, are more tax-liable than personal vehicles because they cause a higher rate of contamination and depreciation on roads.

3. Engine Capacity

Engine capacity is measured in cubic centimetres or cc, which is another factor to be used in the calculation for road tax:

For two-wheelers, taxation for engine sizes less than 125cc attracts lower taxes.

For instance, four-wheelers with large engines, such as SUVs and luxury cars, are costly since they affect the roads and the environment more than small-sized four-wheelers.

4. Type of Your Vehicle Model

Even the model and type of vehicle- standard, luxury, or sport- impact the tax rate, so they cannot be the same. Standard vehicles pay normal rates, while luxury and premium ones pay higher rates due to their higher market value and increased pressure on road infrastructure.

5. Fuel Type

Fuel type is another critical factor in determining road tax. The rates vary with the vehicle running on whether it is either petrol, diesel, electricity, or hybrid technologies:

Diesel cars are charged higher taxes for conserving the environment.

Electrical Vehicles may be exempted or may have tax benefits so that pollution-free transportation is encouraged.

6. Ex-showroom Price of Your Vehicle

High ex-showroom prices, which are more problematic regarding taxes and insurance, play a significant role in computing road tax. Expensive motorcycles and luxury sedans attract higher taxes than inexpensive versions.

7. Seating Capacity

The tax is mainly computed based on the seating capacity of commercial vehicles. Large buses or passenger vans are normally charged more than any other due to their size, which causes wear and tear on roads and, of course, commercial usage.

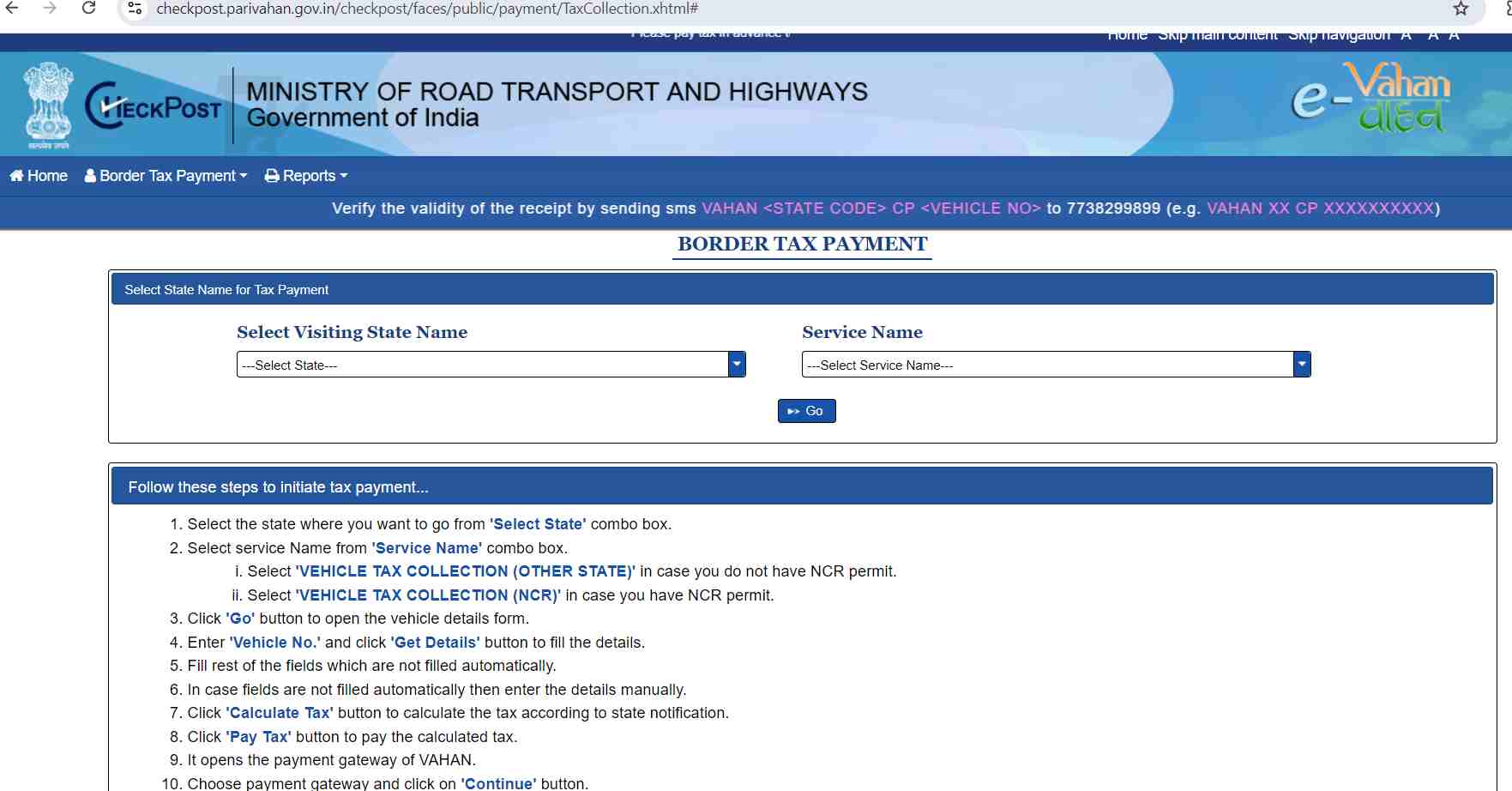

How to Pay Road Tax in Jammu Kashmir Online?

Paying road tax online is a simple and convenient way to avoid lengthy and tiring queues. You can quickly complete your payment by following these steps:

Step 1: Visit the official e-Vahan portal and navigate the ‘Tax Payment’ section. This marks the beginning of your online tax payment process.

Penalty for Not Paying Road Tax in Jammu Kashmir

In Jammu and Kashmir, failure to pay road tax invites an initial penalty of ₹100. If the tax remains unpaid for a long time, the penalty may escalate to vehicle seizure by the authorities. This concerns the Motor Vehicles Act 1988 provision, which requires road tax to be paid promptly to develop road infrastructure. Vehicle owners can pay the road tax online or at their local RTO to avoid these penalties.

List of RTOs in Jammu Kashmir

Here is a list of RTOs in Jammu Kashmir where you can make road tax payments:

| RTO Code | RTO Location |

| JK01 | Srinagar |

| JK12 | Poonch |

| JK02 | Jammu |

| JK13 | Pulwama |

| JK03 | Anantnag |

| JK14 | Udhampur |

| JK04 | Budgam |

| JK15 | Bandipora |

| JK05 | Baramulla |

| JK16 | Ganderbal |

| JK06 | Doda |

| JK17 | Kishtwar |

| JK07 | Kargil |

| JK18 | Kulgam |

| JK08 | Kathua |

| JK19 | Ramban |

| JK09 | Kupwara |

| JK20 | Reasi |

| JK10 | Leh |

| JK21 | Samba |

| JK11 | Rajouri |

| JK22 | Shopian |

| JK02 | Narwal Baba |

Paying your road tax on time is vital to avoid penalties. For greater convenience, you also have the option to pay road tax online in Jammu Kashmir. Stay compliant with your road tax obligations and support the government's infrastructure development efforts.