Road Tax in Manipur & Vehicle RTO Charges in 2026

Manipur, known as the "Jewel of India," is a mesmerising blend of natural beauty and vibrant culture. If you own a vehicle in this state, understanding the road tax rules is crucial to keep your vehicle compliant with local laws.

Manipur is surrounded by forests and hills, which brings unique challenges in building and maintaining roads. This task becomes even more demanding during the monsoon season when there are regular landslides. As a result, the Manipur government collects road tax to manage the expenses of road upkeep.

By reading this article, you will understand how road tax in Manipur is calculated, the latest RTO charges, and how you can pay your road tax in 2026—online or offline.

Table of Contents

What is Road Tax?

In India, the government levies road tax on every new vehicle purchased, with the funds directed toward improving the state’s roads and infrastructure. In Manipur, this falls under the Motor Vehicles Taxation Act of 1998. The growing number of vehicles across India has created a pressing need for better roads and regular maintenance.

While the central government maintains national highways, the upkeep of state highways and local roads falls on the state. Manipur charges to cover these costs when you register a new vehicle.

Road Tax for Two Wheelers in Manipur

In Manipur, two-wheeler road tax is calculated based on factors like the engine capacity and the vehicle's ex-showroom price. Bikes with smaller engine sizes generally attract lower tax rates, while motorcycles with higher engine capacity or premium models face higher charges.

Check the table below for detailed information on the vehicle tax for two-wheelers in Manipur:

| Type of Two-wheeler | Annual/Lifetime Road Tax (in ₹) | Tax per 5 years after 15 years (in ₹) |

| 2 wheelers over 50 cc and <= 100 cc | ₹150 or ₹1,700 | ₹800 |

| 2 wheelers over 100 cc and < 200 cc | ₹250 or ₹2,700 | ₹1,500 |

| 2 wheelers over 250 cc and <= 350 cc | ₹300 or ₹3,000 | ₹1,500 |

| Vehicles adapted and used for invalids | ₹100 or not applicable | Not applicable |

| Used vehicle registered from other states | One-time tax after deducting 10% depreciation | Not applicable |

Road Tax for Four Wheelers in Manipur

Regarding four-wheelers, the road tax in Manipur considers various elements such as the vehicle’s weight, type, make, and age. Personal-use cars are taxed according to these factors.

Refer to the table below for the tax brackets applicable to four-wheelers in the state:

| Type of Two-wheeler | Annual/Lifetime Road Tax (in ₹) | Tax per 5 years after 15 years (in ₹) |

| Original Cost of 4 Wheeler <= ₽ 300,000 | 3% of Original Cost | ₹5,000 |

| Original Cost of 4 Wheeler between ₹ 3,00,000 <= ₹ 600,000 | 4% of Original Cost | ₹8,000 |

| Original Cost of 4 Wheeler between ₹600,000 <= ₹ 1,000,000 | 5% of Original Cost | ₹10,000 |

| Original Cost of 4 Wheeler between ₹1,000,000 <= ₹ 15,000,000 | 6% of Original Cost | ₹15,000 |

| Original Cost of 4 Wheeler between ₹ 15,000,000 <= ₹ 20,000,000 | 7% of Original Cost | ₹20,000 |

| Original Cost of 4 wheeler > ₹20.000,000 | 8% of Original Cost | ₹25,000 |

| A used vehicle that has been registered for use from other states | One Time tax after deducting 10% depreciation | NA |

Road Tax for Commercial Vehicles in Manipur

Commercial vehicles are subject to a higher road tax than personal vehicles due to the greater wear and tear they cause on roads. The tax amount depends on the vehicle’s weight, seating capacity, and specific commercial use.

You can check the table below for the Manipur road tax charges for commercial vehicles:

| Loading Capacity of Commercial Vehicle | Annual Road Tax |

| Up to 1 tonne | ₹800 |

| Between 1 tonne to 3 tonnes | ₹2,080 |

| Between 3 tonnes to 5 tonnes | ₹3360 |

| Within 7.5 tonnes to 9 tonnes | ₹6,640 |

| Between 8 and 10 tonnes | ₹6,560 |

| More than 10 tonnes | ₹6,560 plus ₹640 per additional tonne |

Road Tax for Three Wheelers in Manipur

The intended use of the vehicle primarily determines the road tax for three-wheelers in Manipur. For a detailed breakdown of the applicable charges, please refer to the table below:

| Type of Two-wheeler | Annual/Lifetime Road Tax (in ₹) | Tax per 5 years after 15 years (in ₹) |

| 2 wheelers over 50 cc and <= 100 cc | ₹150 or 1,700 | ₹800 |

| Trailer/Sidecars of two-wheelers | ₹100 or 1,100 | ₹500 |

| Tricycle or three-wheelers | ₹300 or 3,000 | ₹1,500 |

Road Tax for Other State Vehicle in Manipur

Vehicles registered in other states but operating in Manipur are taxed based on their length of stay and specific vehicle attributes. Generally, the tax amount corresponds to the original tax paid during registration in the home state.

Check out the table below for more information on the applicable road tax for out-of-state vehicles:

| Type of Vehicle | Taxation per year |

| Vehicle weight < 1,000 kg | One-time taxation and deduction of 10% depreciation |

| Vehicle weight > 1,000 kg and < 1,500 kg | ₹4,500 + ₹2,925 for every additional 1000 kilos |

| Vehicle weight > 1500 kg and < 2000 kg | ₹4500 + ₹2,925 for every additional 1000 kilos |

| Vehicle weight > 2,250 kg | ₹4500 + ₹2,925 for every additional 1000 kilos |

| Trailer with unloaded weight <= 1 metric tonne | ₹250 annual or ₹2,850 one time |

| Trailer with unloaded weight > 1 metric tonne | ₹450 annual or ₹5,100 one-time |

How is the Road Tax in Manipur Calculated?

Road tax in Manipur depends on the following factors:

1. Type of Your Vehicle

The type of vehicle greatly influences the road tax amount. Whether it's a two-wheeler, four-wheeler, or a vehicle from another state, the rates differ:

Two-wheelers usually attract lower taxes compared to larger vehicles.

Four-wheelers, including cars and SUVs, are taxed higher depending on their weight and engine size.

Three-wheelers and vehicles from other states have tax rates according to their category.

2. Purpose of Usage: Personal or Commercial

The vehicle’s purpose—whether for personal use or commercial operations—also impacts the tax rate:

Personal vehicles, such as family cars or motorbikes, are taxed at a lower rate.

Commercial vehicles, such as buses, taxis, and trucks, are taxed more because they pay a heavier toll on public roads.

3. Engine Capacity

Engine capacity, measured in cubic centimetres (cc), is another crucial factor in determining the tax:

Two-wheelers with engines below 125cc incur lower tax rates.

Larger-engine vehicles like SUVs and luxury sedans face higher road taxes due to greater road usage and environmental impact.

4. Type of the Model of Your Vehicle

Classifying vehicles into basic, luxury, and sports variants also influences road taxes. Premium or high-performance models, particularly luxury cars, are subjected to higher taxation because they are highly valued in the market and exert more pressure on the roads.

5. Fuel Type

The type of fuel your vehicle uses is another factor in calculating road tax. Vehicles that use petrol, diesel power, electric motion, or hybrid measures are taxed as follows:

Diesel cars have an average tax cost because the government imposes high taxes to prevent the use of diesel.

As taxes relate to electricity production, Electric Vehicles may incur less or no taxes as they are less harmful to the environment.

6. Ex-Showroom Price of Your Vehicle

Last, the ex-showroom price, excluding taxes and insurance, can also be cited as a determinant for calculating the road tax. Higher-end car models or super luxury and superbikes are more tax-burdened on consumers than cheaper models in the economies.

7. Seating Capacity

Seating capacity is a key factor in the road tax calculation for commercial vehicles. Vehicles with more seats, like buses and passenger vans, are taxed at higher rates as they cause more road wear and are typically used for commercial purposes.

How to Pay Road Tax in Manipur Online?

Paying your road tax online is a convenient way to avoid long queues. Just follow these simple steps for a hassle-free payment process in Manipur:

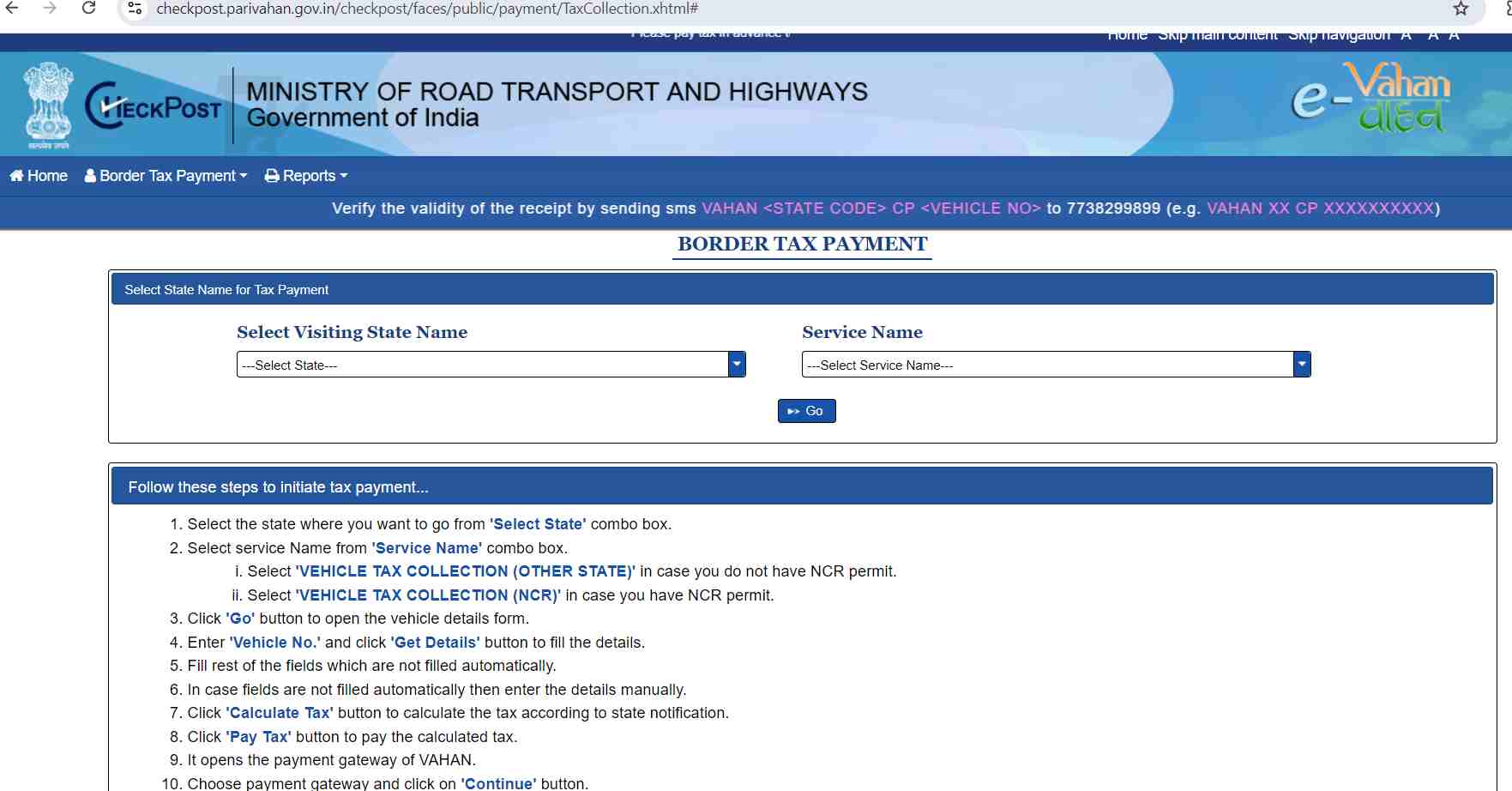

Step 1: Head over to the official Parivahan Sewa and find the ‘Tax Payment’ section. This will be the starting point for your transaction.

Step 3: On the next page, enter your vehicle’s registration number in the ‘Vehicle No.’ field and click ‘Get Details’. The system will then fill in the rest of the necessary information.

Step 4: After filling out the form, click on the ‘Calculate Tax’ button to see the applicable tax bracket for your vehicle. Once the tax amount is displayed, proceed by selecting ‘Pay Tax’.

Step 5: Choose your payment method, and upon completing the transaction, you’ll be redirected to the Checkpost application through your bank’s system.

Step 6: Ensure you either print or save a screenshot of the receipt as proof of payment. This can be useful for future reference or inquiries.

The online system offers a stress-free, time-saving alternative to physically visiting the RTO, making the process seamless and efficient.

Penalty for Not Paying Road Tax in Manipur

Failing to pay road tax on time will result in penalties, which increase based on how many days you are late:

Delay up to 30 days: 5% penalty on the tax amount

Delay up to 60 days: 10% penalty

Delay up to 90 days: 15% penalty

Delay up to 120 days: 20% penalty

Delay beyond 121 days: 25% penalty

It's always better to stay on top of your road tax to avoid these extra charges!

List of RTOs in Manipur

The list has information on RTOs across the state to pay the Manipur road tax.

| RTO Code | RTO Location |

| MN-01 | Imphal West |

| MN-02 | Churachandpur |

| MN-03 | Kangpokpi |

| MN-04 | Thoubal |

| MN-05 | Bishnupur |

| MN-06 | Imphal East |

| MN-07 | Ukhrul |

| MN-08 | Senapati |

It is essential to pay road tax on time to avoid penalties. You can choose to pay road tax online in Manipur for your convenience. Moreover, avoid defaulting your road tax for yourself only as it contributes to our government.