Road Tax In Jharkhand & Vehicle RTO Charges In 2025

Every state in India is responsible for collecting road tax, which varies from state to state. The tax proceeds are essential because they are used to repair public roads. The Jharkhand state government collects road tax and uses it for public works. It has no separate road tax regime for other state vehicles driving in Jharkhand.

Road tax rates are highly variable and depend on numerous factors discussed in this article. Continue reading to know more details regarding the road tax in Jharkhand.

Table of Contents

What is Road Tax?

Under the law, the state government must appropriate the road taxes on different vehicles running in the state to ensure the efficient functioning of public roads. The proceeds from the tax collected must be used to manage public road infrastructure.

The Jharkhand Motor Vehicles Taxation Act of 2001 governs road tax mandates in Jharkhand. An additional yet effective green tax of 10% is charged in Jharkhand on the total payable tax amount for personal vehicles with a period of usage above 15 years and transport vehicles with a period above 12 years.

Road Tax for Two-Wheelers in Jharkhand

The road tax in Jharkhand is calculated based on the two-wheeler's engine capacity and other factors, such as its ex-showroom price.

Listed below is the road tax structure for two-wheelers in the state of Jharkhand:

| Vehicle’s Registration Stage | Percentage of One-Time Payable Tax |

| Newly registered or under 1 year of age | 6% of the total price of the vehicle (excluding GST charges) |

| 1 to 2 years after the registration of vehicle | 95% of the tax paid during registration |

| 2 to 3 years after the registration of vehicle | 90% of the tax paid during registration |

| 3 to 4 years after the registration of vehicle | 85% of the tax paid during registration |

| 4 to 5 years after the registration of vehicle | 80% of the tax paid during registration |

| 5 to 6 years after the registration of vehicle | 75% of the tax paid during registration |

| 6 to 7 years after the registration of vehicle | 70% of the tax paid during registration |

| 7 to 8 years after the registration of vehicle | 65% of the tax paid during registration |

| 8 to 9 years after the registration of vehicle | 60% of the tax paid during registration |

| 9 to 10 years after the registration of vehicle | 55% of the tax paid during registration |

| More than 10 years after the registration of vehicle | 50% of the tax paid during registration |

Road Tax for Four-Wheelers in Jharkhand

For a four-wheeler vehicle, like a car, the road tax in Jharkhand is 6% of the vehicle's ex-showroom price, excluding the GST charges. However, an additional 3% is charged to the vehicle owner for a second-hand car, while 15% is charged on vehicles priced above ₹15 Lakhs, excluding their GST charges.

Following are the road tax rates for the four-wheeler vehicle category in the state of Jharkhand:

| Duration Of Registration Of Vehicle | Tax Rate Applicable During Registration |

| Within 1 to 2 years of registration | 95% tax rate |

| Within 2 to 3 years of registration | 90% tax rate |

| Within 3 to 4 years of registration | 85% tax rate |

| Within 4 to 5 years of registration | 80% tax rate |

| Within 5 to 6 years of registration | 75% tax rate |

| Within 6 to 7 years of registration | 70% tax rate |

| Within 7 to 8 years of registration | 65% tax rate |

| Within 8 to 9 years of registration | 60% tax rate |

| Within 9 to 10 years of registration | 55% tax rate |

| More than 10 years of registration | 50% tax rate |

Road Tax for Commercial Vehicles In Jharkhand

Commercial purpose vehicles that run in a state attract a separate road tax structure as these vehicles are heavier and serve a different purpose. These vehicles cause damage to public roads, which leads to frequent repair work on public roads.

Below is the table that mentions the road tax charges for commercial vehicles in the state of Jharkhand:

| Type Of Vehicle | One-Time Road Tax Rates In Jharkhand |

| Vehicles with carrying capacity of up to 1000 kgs and registered for 1 year | ₹9,000 |

| Vehicles with carrying capacity of up to 1000 kgs and registered for more than 10 years | ₹9,000 |

| Vehicles with carrying capacity of 1000-3000 kgs and registered for 1 year | ₹7,500 /ton |

| Vehicles with carrying capacity of 1000-3000 kgs and registered for more than 10 years | ₹7,500 /ton |

| Motor cabs/ omni buses | 7% of the price of the vehicle (excluding GST charges) for 12 years. Additional 40% one-time tax with 10% green tax for 5 years |

| Tractors | 4% of the price of the vehicle (excluding GST charges) for 12-20 years. Additional 40% one-time tax with 10% green tax for 5 years |

Road Tax for Three-Wheelers in Jharkhand

Under the state government's road tax regime, three-wheelers are categorised separately and bifurcated based on the number of people they can accommodate, excluding the driver.

The following table lists the road tax in Jharkhand for three-wheelers with a seating limit of 4 people, excluding the driver:

| Vehicle Category | Road Tax Rate |

| Newly registered three-wheeler vehicle | One-time tax of ₹9,000 for 15 years |

| All three-wheelers registered for 1 year | One-time tax of ₹6000 for 10 years |

| All three-wheeler vehicles registered for more than 10 years | One-time tax of ₹6000 for 5 years |

The following table lists the road tax in Jharkhand for three-wheelers with a seating limit of 7 people, excluding the driver:

| Vehicle Category | Road Tax Rate |

| Newly registered three-wheeler vehicle | One time tax of ₹13,500 for 15 years |

| All three-wheelers registered for 1 year | One time tax of ₹9,000 for 10 years |

| All three wheeler vehicles registered for more than 10 years | One time tax of ₹9,000 for 5 years |

Road Tax for Other State Vehicles in Jharkhand

The Jharkhand state government does not have a specified road tax mandate for other state vehicles, so they have no defined road tax structure.

How is Road Tax Calculated in Jharkhand?

Road tax in Jharkhand varies for different kinds of vehicles, depending on factors like fuel type, vehicle utility, engine capacity, and seating limit. Following is the list of factors that determine the road tax in Jharkhand:

1. Vehicle Classification

Different types of vehicles are taxed differently, as the tax slabs for two-wheelers are less than that for four-wheelers. Similarly, goods carriages are taxed differently depending on their goods-carrying capacity. Four-wheelers like SUVs, cars, etc., and heavy-weight vehicles are taxed more as they cause more damage to the public roads daily.

2. Utility of the Vehicle

Depending on their usage, vehicles are classified into different categories, such as private and commercial-purpose vehicles. Commercial vehicles are taxed more than private ones as they cause more wear and tear on public roads and thus require frequent maintenance.

3. Engine Capacity

Smaller vehicles like two-wheelers have engines less than 125 cc. In contrast, heavy vehicles like transport buses, suitable carriages, etc., have high-capacity engines that cause environmental pollution by releasing harmful gases into the atmosphere. Therefore, road tax in Jharkhand is calculated depending on the vehicle's engine capacity.

4. Model of Different Vehicles

Vehicles come in different types and models, ranging from sports to luxury cars, which is an essential factor in calculating the road tax rates in Jharkhand. Luxurious and high-end vehicles are charged hefty road taxes as they have higher cost prices and maintenance charges.

5. Type of Fuel Used

The road tax rates in Jharkhand also depend on whether your vehicle runs on petrol, diesel, electric, or hybrid engines. Electric vehicles attract lower tax rates because they are eco-friendly and do not cause pollution, while diesel-run cars are charged higher.

6. Ex-Showroom Price of the Vehicle

The vehicle's ex-showroom price excludes the GST charged on the new vehicle and is a determining factor in the road tax rates in Jharkhand. Expensive cars attract higher road tax than vehicles with lower ex-showroom prices.

7. Seating Limit

When calculating the road tax rates in Jharkhand, a vehicle's seating capacity is also considered. Vehicles with a higher seating capacity attract higher road taxes as they tend to cause more damage to the public roads, resulting in the state authorities' frequent repair and maintenance of these public roads.

How to Pay Road Tax in Jharkhand Online?

You can pay your road tax in Jharkhand at the Regional Transport Office (RTO) near you. However, for your convenience and a hassle-free payment of road tax in Jharkhand, you must consider paying your road tax online by following the steps given below:

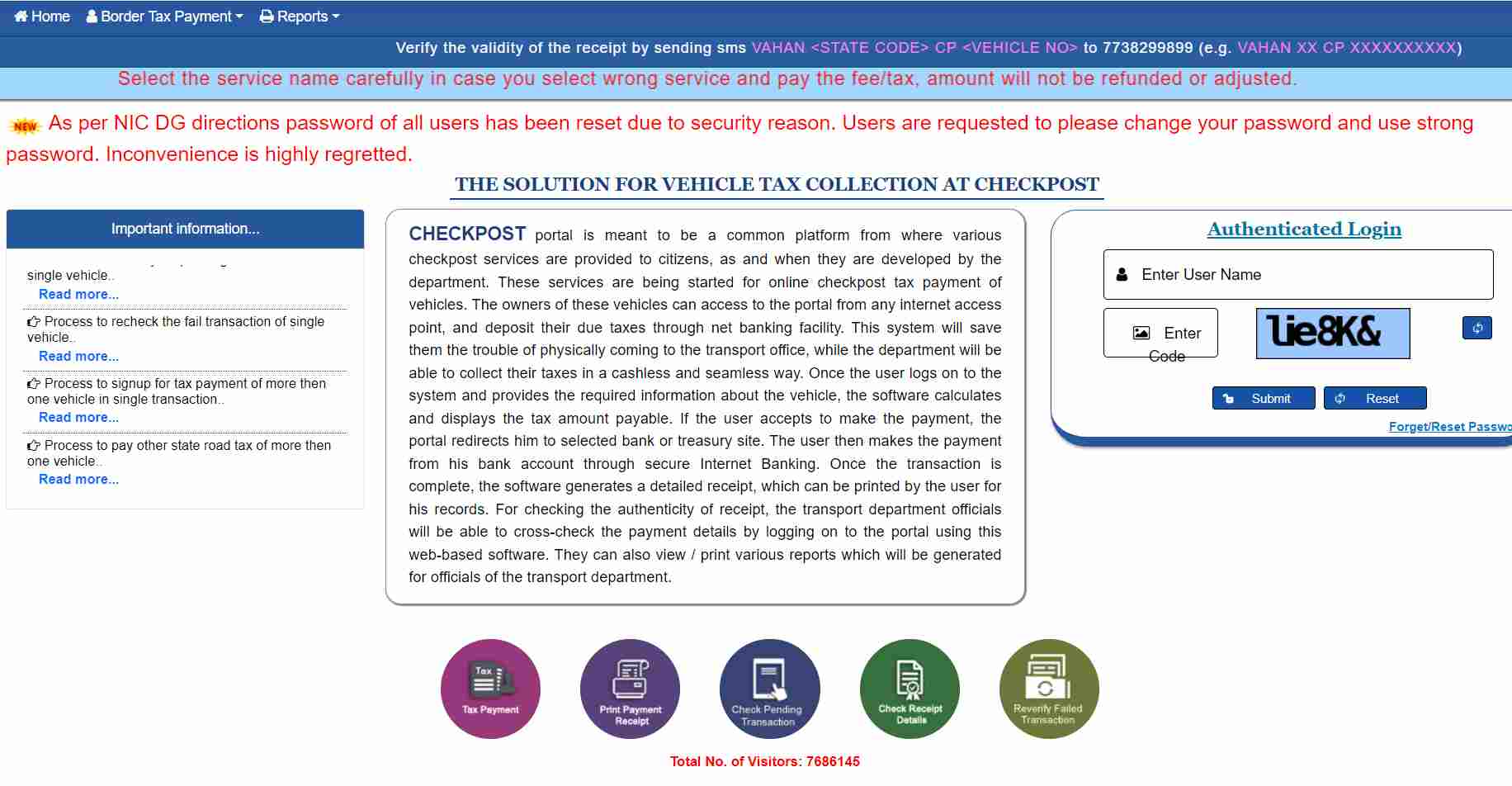

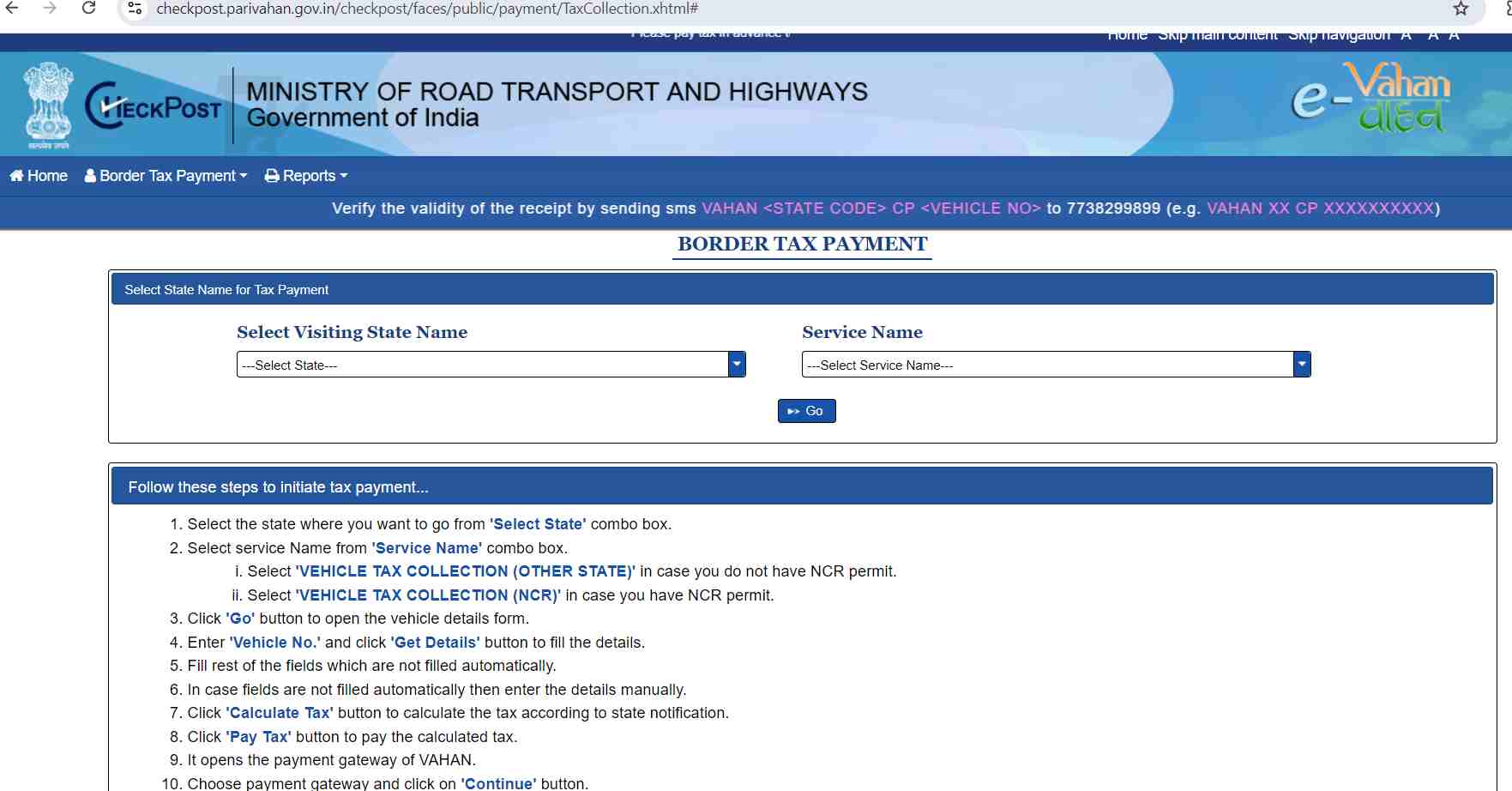

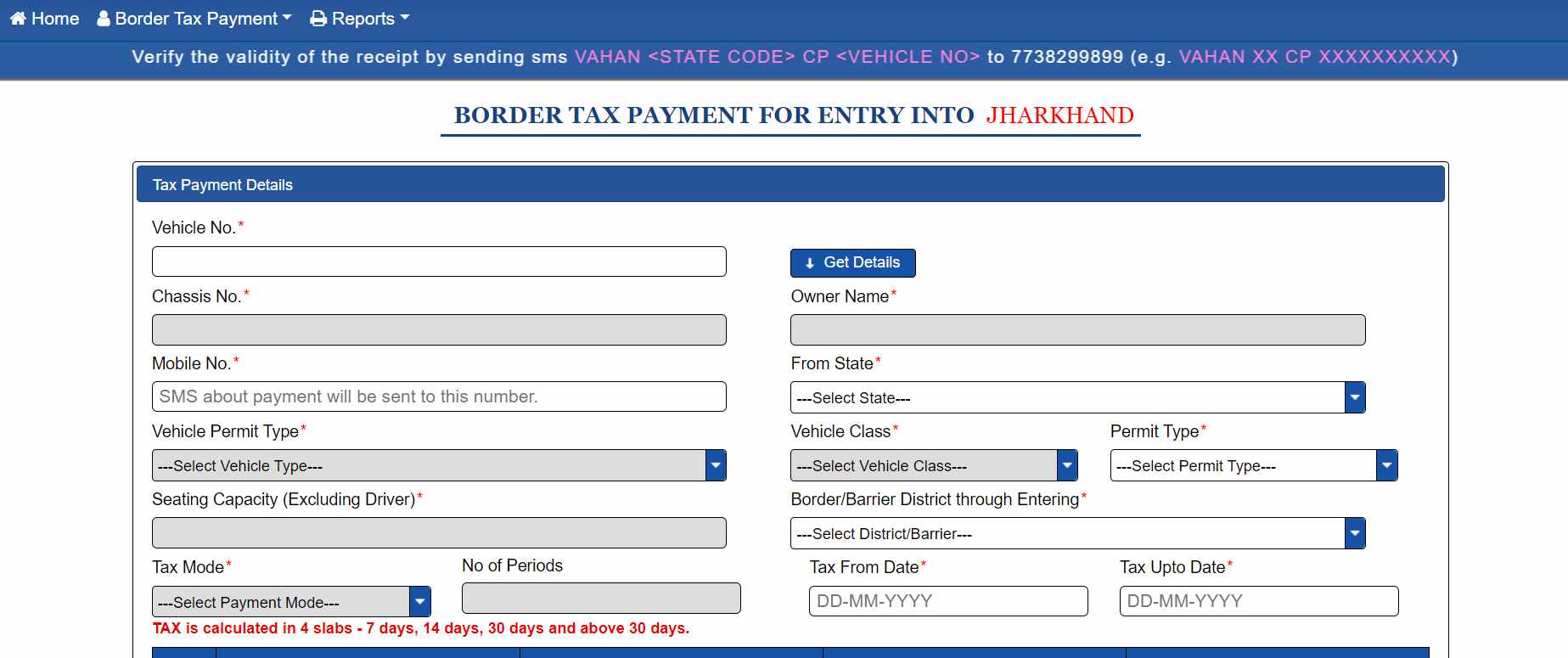

Step 1: Visit the official page of e-Vahan, the portal operated by the Ministry of Road Transport and Highways, and choose the option to pay taxes.

Penalty for Non-Payment of Road Taxes in Jharkhand

Vehicle owners who fail to pay their road tax in Jharkhand on time are penalised by the state authorities. The state decides upon the penalty for delayed payment of road tax, but it must be within the limit of 100% of the tax amount due.

This implies that if a vehicle owner has attracted a penalty of Rs. 1000, the state authority cannot levy a penalty of more than Rs. 1000 over the taxed amount.

List of RTOs in Jharkhand

Following is the list of RTOs that are located across the state of Jharkhand:

| RTO Code | RTO Location |

| JH-01 | Ranchi |

| JH-02 | Hazaribagh |

| JH-03 | Daltonganj |

| JH-04 | Dumka |

| JH-05 | Jamshedpur |

| JH-06 | Chaibasa |

| JH-07 | Gumla |

| JH-08 | Lohardaga |

| JH-09 | Bokaro Steel City |

| JH-10 | Dhanbad |

| JH-11 | Giridih |

| JH-12 | Koderma |

| JH-13 | Chatra |

| JH-14 | Garhwa |

| JH-15 | Deoghar |

| JH-16 | Pakur |

| JH-17 | Godda |

| JH-18 | Sahibganj |

| JH-19 | Latehar |

| JH-20 | Simdega |

| JH-21 | Jamtara |

| JH-22 | Saraikela-Kharsawan |

| JH-23 | Khunti |

| JH-24 | Ramgarh |

Being a responsible citizen of a state, you must pay your taxes on time and without any delays. Road tax is essential for the maintenance and smooth functioning of public roads, thus ensuring seamless traffic within the state.