Road Tax in Delhi & Vehicle RTO Charges in 2026

Delhi, being in the centre of India, is a nice place to visit. Traditional and modern aspects coexist without much conflict. For vehicle owners driving on the streets of Delhi, it is necessary to learn the relevance of paying road tax. These taxes ensure the maintenance of the cities to support one of the most advanced transport systems in the nation.

Enshrined in the Motor Vehicles Act, of 1988, road tax is paid to reimburse the upkeep and development of internal infrastructure.

In this guide, we are going to cover the details of road tax in Delhi and RTO charges in 2026 so that there is no information gap on your part. Keep reading to know more and ensure you’re up to date!

Table of Contents

What is Road Tax?

Every state has its road tax structure and for vehicle owners in Delhi, these are particularly important. Delhi road tax payment is for registered vehicle owners under the Law to maintain safe and good quality roads.

Road tax collected by Delhi’s government improves the overall structure and safety of roads enabling the smooth flow of traffic within the city. Such tax rates differ depending on some elements such as owning a motorcycle or car, its intended purpose such as private use and rented services, engine size etc.

Road Tax for Two Wheelers in Delhi

In Delhi, the road tax for two-wheelers is influenced by factors like engine capacity and the ex-showroom price of the bike. Motorcycles with smaller engines generally attract lower taxes, while high-end or high-capacity bikes fall into higher tax brackets.

The table below shows the applicable vehicle tax rates for two-wheelers in Delhi:

| Type of Two-wheeler | Annual Road Tax |

| Motorcycle < 50 cc (Auto cycles, mopeds) | 650 |

| Scooters and motorcycles > 50 cc | 1,220 |

| Motorcycle accompanying sewing trailer | ₹1,525 + ₹465 |

Road Tax for Four Wheelers in Delhi

For four-wheelers, several factors come into play when calculating road tax in Delhi. These include the weight, type, make, and even the age of the vehicle.

Refer to the table below for a breakdown of the tax brackets for personal-use four-wheelers:

| Type of Four-wheeler | Annual Road Tax |

| Motor cars < 1000 kg | ₹3,815 |

| Motor Cars which are above 1000 kg but less than 1500 kg. | ₹4,880 |

| Motor Car exceed more than 1500 kg but does not exceed 2,000 kg. | ₹7,020.00 |

| Motor Car more than 2,000 kg. | ₹7,020 + ₹4,570 + at ₹2,000 for every 1,000kg additional |

Road Tax for Commercial Vehicles in Delhi

Commercial vehicles, given their heavier impact on road infrastructure, are charged higher road taxes compared to personal vehicles. The tax is determined by factors like vehicle weight, seating capacity, and the nature of its commercial use.

The table below highlights the Delhi road tax charges applicable for commercial or transport vehicles in Delhi:

| Loading capacity of commercial vehicle | Annual Road Tax |

| Below a tonne | ₹665 |

| More than 1 tonne but within 2 tonnes | ₹940 |

| Above 2 tonnes but less than 4 tonnes | ₹1,430 |

| Above 4 tonnes but under 6 tonnes | ₹1,915 |

| Above 6 tonnes but less than 8 tonnes | ₹2,375 |

| Above 8 tonnes but less than 9 tonnes | ₹2,865 |

| Above 9 tonnes but less than 10 tonnes | ₹3,320 |

| Above and beyond 10 tonnes | ₹ 3,320+ ₹470 per extra tonne |

Road Tax for Three Wheelers in Delhi

In the case of three-wheelers, road tax in Delhi is primarily calculated based on the vehicle’s purpose, whether it's for personal or commercial use.

Detailed information is available in the table below:

| Type of Three-wheeler | Annual Road Tax |

| Tri cycles | ₹1,525 |

| Goods Vehicles | ₹665 per less than 1 Tonne to ₹3,320 per more than 10 Tonne thereafter ₹470 for additional tonne |

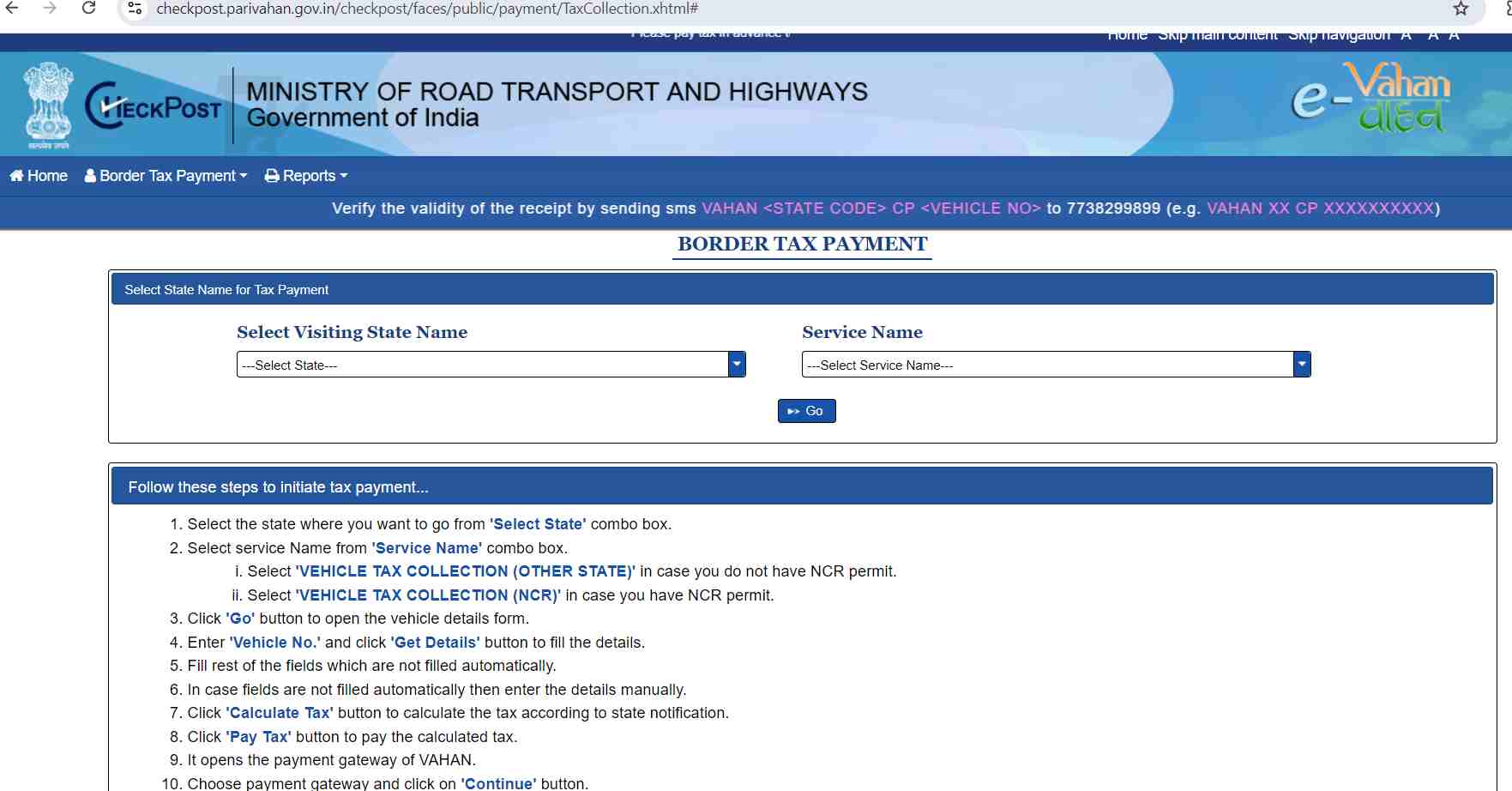

Road Tax for Other State Vehicle in Delhi

Vehicles owned by currently unreserved individuals outside Delhi who bring their vehicles into Delhi shall be charged for the number of days. Typically, where there is a levy, the Tariff is the amount that a vehicle is payable at the time of registration in the state where the owner resides.

Like if you drive a vehicle in your state and have already paid some tax in your state then for 90 days you can drive in Delhi without paying any tax. Thereafter, the tax must be paid as per the RTO of Delhi.

How is the Road Tax in Delhi Calculated?

The calculation of road tax in Delhi is influenced by various factors like:

1. Type of Your Vehicle

The type of vehicle is a significant determinant in calculating road tax. The rates vary depending on whether it’s a two-wheeler, four-wheeler, or a vehicle registered outside Delhi:

Two-wheelers typically attract a lower tax compared to larger vehicles.

Four-wheelers, including cars and SUVs, are taxed higher, primarily based on their weight and engine capacity.

Three-wheelers and out-of-state vehicles are subject to distinct tax rates, depending on their classification.

2. Purpose of Usage: Personal or Commercial

The vehicle’s intended purpose also affects the tax rates. Whether it's for personal use or commercial, the tax varies:

Personal vehicles, such as family cars and bikes, incur lower taxes.

Commercial vehicles like buses, trucks, and taxis are taxed higher due to the increased wear they cause on public roads.

3. Engine Capacity

Engine capacity, measured in cubic centimetres (cc), is another vital factor in road tax calculation. Vehicles with larger engines generally pay more tax:

Two-wheelers with engines below 125 cc typically have lower tax rates.

Larger four-wheelers, such as SUVs and luxury sedans, face higher taxes due to their heavier road usage and environmental impact.

4. Type of the Model of Your Vehicle

The vehicle’s model irrespective of being a standard, luxury, or sporty outline involves evaluation in terms of road tax. Unlike regular models, where tax is imposed at normal rates, luxury and premium models incur higher tax levels on the basis of their market value and the added strain they impose on the roads.

5. Fuel Type

This fuel type that your vehicle operates on has a major influence on the tax rate that is applicable. Tax is applied differently in types of fuels the vehicle uses like petrol engines, diesel engines, electric engines, and hybrid engines:

Diesel vehicles are often subjected to higher taxes to promote environmental protection.

Electric vehicles (EVs) may enjoy tax benefits or even exemptions as they contribute to a cleaner environment.

6. Ex-Showroom Price of Your Vehicle

The ex-showroom price, which excludes tax and insurance, is a crucial factor in determining road tax. More expensive vehicles, like luxury cars and high-end bikes, attract higher taxes due to their elevated cost.

7. Seating Capacity

The seating capacity of a vehicle, particularly in the case of commercial vehicles is another factor that will be included when coming up with a total tax value. Higher taxes are levied on vehicles such as buses and passenger vans owing to the larger capacities that they possess since they are mainly utilized for commercial purposes and cause increased road wear.

How to Pay Road Tax in Delhi Online?

Opting for online road tax payment is a hassle-free way to bypass long and tiring queues. You can quickly make your payment by following these simple steps:

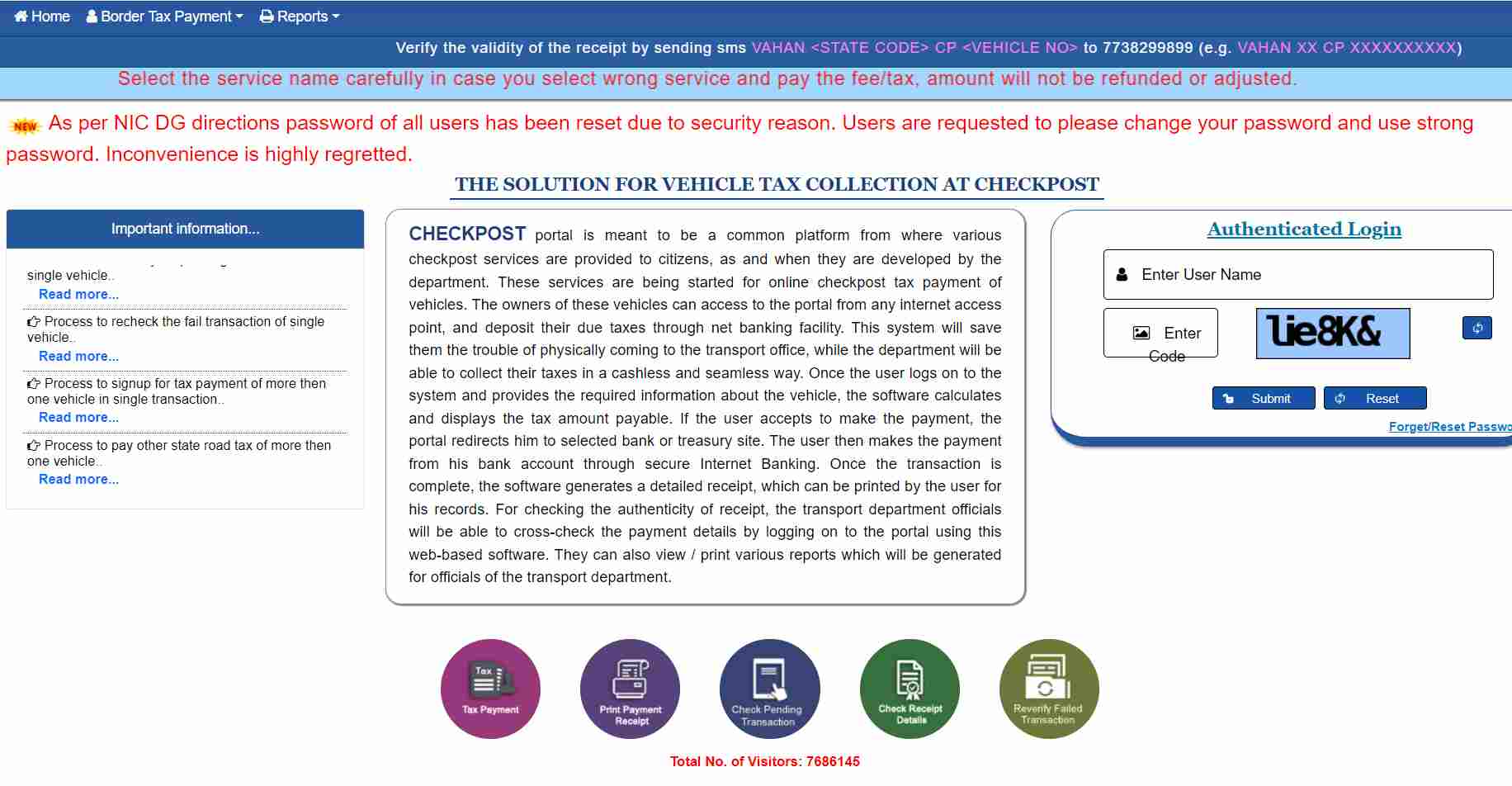

Step 1: Visit the official e-Vahan portal and locate the ‘Tax Payment’ section. This is where the process begins.

Penalty for Not Paying Road Tax in Delhi

In Delhi where it is compulsory for all registered owners to pay once road tax. Section 11 of the Delhi Motor Vehicles Taxation Act states that even a delay in making this payment can result in a lot of penalties and heavy fines.

Schemers in default also may be under a threat of imposition of additional charges which generally represent some percentage of the cost of their vehicles. Fortunately, now you are able to deal with any outstanding dues that you might have since customers can pay for road tax online.

Also, those people who paid the relevant road tax at their own state RTO for vehicles that are registered got 90 days period exempt from paying any taxes in Delhi.

List of RTOs in Delhi

Below is the list of RTO offices across Delhi where you can pay your road tax:

| RTO Code | RTO Location |

| DL-01 | Mall Road, Delhi North |

| DL-02 | Tilak Marg, New Delhi |

| DL-03 | Sheikh Sarai, South Delhi South |

| DL-04 | West Janakpuri, West Delhi West |

| DL-05 | Loni Road, North East Delhi |

| DL-06 | Sarai Kale Khan, Central Delhi |

| DL-07 | Mayur Vihar, East Delhi |

| DL-08 | Wazir Pur, North West Delhi |

| DL-09 | Janakpuri, South West Delhi |

| DL-10 | West Delhi |

| DL-11 | Rohini North West Delhi |

| DL-12 | Vasant Vihar, South West Delhi |

| DL-13 | Surajmal Vihar, Delhi |

| DL-14 | Sonipat |

| DL-15 | Gurgaon |

| DL-16 | Faridabad |

| DL-17 | Noida |

| DL-18 | Ghaziabad |

Ensuring timely payment is crucial to avoid penalties. For added convenience, you also have the option to pay Delhi road tax online. Moreover, by paying your road tax on time, you not only avoid fines but also contribute to the upkeep of public infrastructure and support the government's efforts in maintaining road safety.