Road Tax in Mizoram & Vehicle RTO Charges in 2025

Situated in Northeast India, Mizoram is a land where rolling hills, lush green forests and rich cultural heritage all come together in one amazing powerhouse.

If you are planning to explore Mizoram as per your vehicle there, then it is a must that your vehicle is legally compliant. One such aspect is the road tax that must be paid for every vehicle in the state. Below is a guide that will simplify how to pay road tax in Mizoram so that you can enjoy the beautiful terrains of the state hassle-free.

Read on to understand how road tax in Mizoram is calculated, the latest RTO charges, and how you can pay your road tax in 2025—whether online or offline.

Table of Contents

What is Road Tax?

In India, the government imposes a road tax on every new vehicle purchased, and the money is spent on improving the state’s roads and infrastructure. In Mizoram, the regulation is done under the Motor Vehicles Taxation Act 1998. Given the increasing number of vehicles, India needs better roads and regular maintenance.

The central government centrally runs national highways, and state highways and local roads are the responsibility of the state government. Road tax is imposed to offset these expenses while registering a new vehicle in Mizoram. If you move to another state with your vehicle, you will have to re-register the car and pay road tax based on the rules of that particular state.

Road Tax for Two Wheelers in Mizoram

The road tax for two-wheelers in Mizoram is based on certain factors, such as the age of the vehicle and its engine capacity. Smaller-engine bikes tend to pay lower, while motorcycles with higher capacity or premium models are charged higher.

Check the table below for detailed information on the vehicle tax for two-wheelers in Mizoram.

Table 1 : For Engine Capacity Less Than 200 cc

| Age of Vehicle | Up to 100cc | Above 100 cc |

| New up to 1 year | ₹1,500 | ₹3,000 |

| 1 to 2 years old | ₹1,400 | ₹2,800 |

| 2 to 3 years old | ₹1,300 | ₹2,600 |

| 3 to 4 years old | ₹1,200 | ₹2,400 |

| 4 to 5 years old | ₹1,100 | ₹2,200 |

| 5 to 6 years old | ₹1,000 | ₹2,000 |

| 6 to 7 years old | ₹900 | ₹1,800 |

| 7 to 8 years old | ₹800 | ₹1,600 |

| 8 to 9 years old | ₹700 | ₹1,400 |

| 9 to 10 years old | ₹600 | ₹1,200 |

| 10 to 11 years old | ₹500 | ₹1,000 |

| 11 to 12 years old | ₹400 | ₹800 |

| 12 to 13 years old | ₹300 | ₹600 |

| 13 to 14 years old | ₹200 | ₹400 |

| More than 14 years | ₹100 | ₹200 |

Table 2: For Engine Capacity Less Than 200 cc

| Age of Vehicle | Above 200 cc | Above 300 cc |

| New up to 1 year | ₹4,500 | ₹6,000 |

| 1 to 2 years old | ₹4,200 | ₹5,600 |

| 2 to 3 years old | ₹3,900 | ₹5,200 |

| 3 to 4 years old | ₹3,600 | ₹4,800 |

| 4 to 5 years old | ₹3,300 | ₹4,400 |

| 5 to 6 years old | ₹3,000 | ₹4,000 |

| 6 to 7 years old | ₹2,700 | ₹3,600 |

| 7 to 8 years old | ₹2,400 | ₹3,200 |

| 8 to 9 years old | ₹2,100 | ₹2,800 |

| 9 to 10 years old | ₹1,800 | ₹2,400 |

| 10 to 11 years old | ₹1,500 | ₹2,000 |

| 11 to 12 years old | ₹1,200 | ₹1,600 |

| 12 to 13 years old | ₹900 | ₹1,200 |

| 13 to 14 years old | ₹600 | ₹800 |

| More than 14 years | ₹300 | ₹400 |

Road Tax for Four Wheelers in Mizoram

When it comes to four-wheelers, the road tax in Mizoram takes into account various elements such as the vehicle’s weight, type, make, and age. Personal-use cars are taxed according to these factors.

Refer to the table below for the tax brackets applicable to four-wheelers in the state:

Table 1: For Engine Capacity Up to 1000 cc

| Age of Vehicle | Up to 800cc | From 801 cc to 1000cc |

| New up to 1 year | ₹11,250 | ₹12,750 |

| 1 year to 2 years old | ₹10,500 | ₹11,900 |

| 2 to 3 years old | ₹9,750 | ₹11,050 |

| 3 to 4 years old | ₹9,000 | ₹10,200 |

| 4 to 5 years old | ₹8,250 | ₹9,350 |

| 5 to 6 years old | ₹7,500 | ₹8,500 |

| 6 to 7 years old | ₹6,750 | ₹7,650 |

| 7 to 8 years old | ₹6,000 | ₹6,800 |

| 8 to 9 years old | ₹5,250 | ₹5,950 |

| 9 to 10 years old | ₹4,500 | ₹5,100 |

| 10 to 11 years old | ₹3,750 | ₹4,250 |

| 11 to 12 years old | ₹3,000 | ₹3,400 |

| 12 to 13 years old | ₹2,250 | ₹2,550 |

| 13 to 14 years old | ₹1,500 | ₹1,700 |

| More than 14 years | ₹750 | ₹850 |

Table 2: For Engine Capacity Up to 3000 cc

| Age of Vehicle | 1001 cc to 2000 cc | 2001 cc to 3000 cc |

| New up to 1 year | ₹15,000 | ₹17,250 |

| 1 year to 2 years old | ₹14,000 | ₹16,100 |

| 2 to 3 years old | ₹13,000 | ₹14,950 |

| 3 to 4 years old | ₹12,000 | ₹13,800 |

| 4 to 5 years old | ₹11,000 | ₹12,650 |

| 5 to 6 years old | ₹10,000 | ₹11,500 |

| 6 to 7 years old | ₹9,000 | ₹10,350 |

| 7 to 8 years old | ₹8,000 | ₹9,200 |

| 8 to 9 years old | ₹7,000 | ₹8,050 |

| 9 to 10 years old | ₹6,000 | ₹6,900 |

| 10 to 11 years old | ₹5,000 | ₹5,700 |

| 11 to 12 years old | ₹4,000 | ₹4,600 |

| 12 to 13 years old | ₹3,000 | ₹3,450 |

| 13 to 14 years old | ₹2,000 | ₹2,300 |

| More than 14 years | ₹1,000 | ₹1,500 |

Table 3: For Engine Capacity Above 3000 cc

| Age of Vehicle | Above 3000cc |

| New up to 1 year | ₹19,500 |

| 1 year to 2 years old | ₹18,200 |

| 2 to 3 years old | ₹16,900 |

| 3 to 4 years old | ₹15,600 |

| 4 to 5 years old | ₹14,300 |

| 5 to 6 years old | ₹13,000 |

| 6 to 7 years old | ₹11,700 |

| 7 to 8 years old | ₹10,400 |

| 8 to 9 years old | ₹9,100 |

| 9 to 10 years old | ₹9,800 |

| 10 to 11 years old | ₹6,500 |

| 11 to 12 years old | ₹5,200 |

| 12 to 13 years old | ₹3,900 |

| 13 to 14 years old | ₹2,600 |

| More than 14 years | ₹1,300 |

Road Tax for Commercial Vehicles in Mizoram

Commercial vehicles are subject to a higher road tax than personal vehicles due to the greater wear and tear they cause on roads. The tax amount depends on factors like the vehicle’s type, seating capacity, and specific commercial use.

You can check the table below for the Mizoram road tax charges for commercial vehicles.

| Vehicle Type | Road Tax |

| Light Commercial Vehicle (LCV) | ₹500 |

| Medium Commercial Vehicle (MCV) | ₹1,000 |

| Heavy Commercial Vehicle (HCV) | ₹2,000 |

Road Tax for Three Wheelers in Mizoram

In Mizoram, taxation on three-wheelers is primarily determined by the fuel type and condition of the vehicle. Please refer to the table below for a detailed breakdown of the applicable charges.

| Type of Three-wheeler | Fuel Type | Tax Rate |

| New vehicle | Petrol | ₹500 |

| New vehicle | Diesel | ₹1,000 |

| Old vehicle | Petrol | ₹300 |

| Old vehicle | Diesel | ₹600 |

Road Tax for Other State Vehicle in Mizoram

According to the Centre Motor Vehicles Act, 1988, vehicles registered in other states but operating in Mizoram are taxed based on their length of stay and specific vehicle attributes. Generally, the tax amount corresponds to the original tax paid during registration in the home state.

Check out the table below for more information on the applicable road tax for out-of-state vehicles:

| Type of Vehicle | Taxation per year |

| Two-wheelers | 5% of vehicle’s price |

| Private cars | 5% of vehicle’s price |

| Commercial vehicle | 8% of vehicle’s price |

How is the Road Tax in Mizoram Calculated?

Road tax in Mizoram depends on the following factors:

1. Type of Your Vehicle

The type of vehicle greatly influences the road tax amount. Whether it's a two-wheeler, four-wheeler, or a vehicle from another state, the rates differ:

Two-wheelers usually attract lower taxes compared to larger vehicles.

Four-wheelers, including cars and SUVs, are taxed higher depending on their weight and engine size.

Three-wheelers and vehicles from other states have their tax rates according to their category.

2. Purpose of Usage: Personal or Commercial

The vehicle’s purpose—whether for personal use or commercial operations—also impacts the tax rate:

Personal vehicles, such as family cars or motorbikes, are taxed at a lower rate.

Commercial vehicles like buses, taxis, and trucks are taxed more because they pay a heavier toll on public roads.

3. Engine Capacity

Engine capacity, measured in cubic centimetres (cc), is another crucial factor in determining the tax:

Two-wheelers with engines below 125cc incur lower tax rates.

Larger-engine vehicles, such as SUVs and luxury sedans, face higher road taxes due to their greater road usage and environmental impact.

4. Type of the Model of Your Vehicle

The classification of the vehicle into basic, luxury, and sports variants also influences the road tax. Premium or high-performance models, particularly luxury cars, are subjected to higher taxation because they are highly valued in the market and exert more pressure on the roads.

5. Fuel Type

The type of fuel your vehicle uses is another factor in calculating road tax. Vehicles that use petrol, diesel power, electric motion or hybrid measures are taxed as follows:

Diesel cars have an average tax cost because the high taxes are imposed by the government to prevent the use of diesel.

As taxes relate to electricity production, Electric Vehicles may incur less or no taxes as they are less harmful to the environment.

6. Ex-Showroom Price of Your Vehicle

Last but not least, the ex-showroom price, excluding taxes and insurance, can also be cited as a determinant for calculating the road tax. Higher-end models of cars or super luxury and superbikes are more tax-burdened on consumers than cheaper models in the economies.

7. Seating Capacity

Seating capacity is a key factor in the road tax calculation for commercial vehicles. Vehicles with more seats, like buses and passenger vans, are taxed at higher rates as they cause more road wear and are typically used for commercial purposes.

How to Pay Road Tax in Mizoram Online?

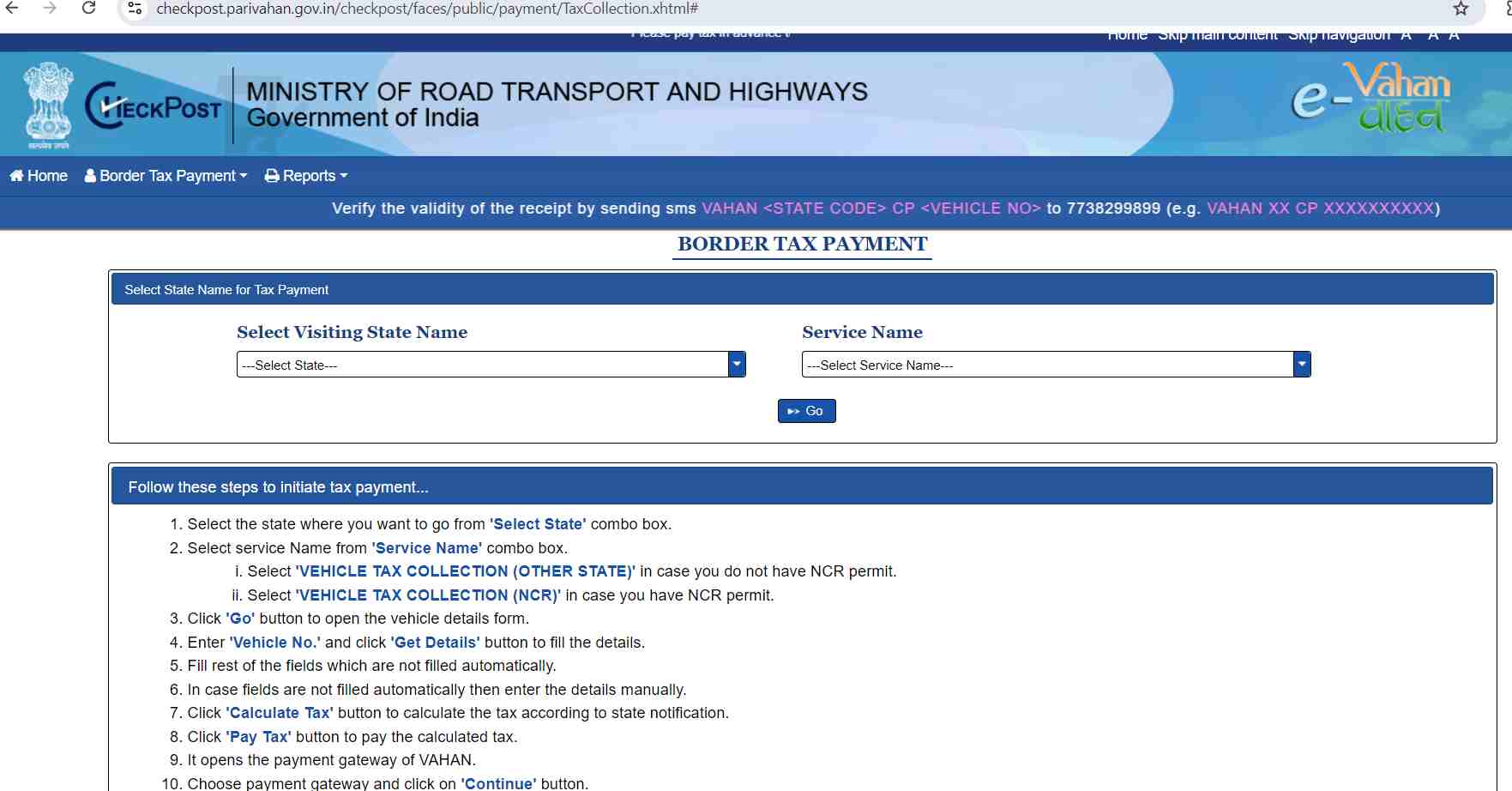

Paying your road tax online is a convenient way to avoid long queues. Just follow these simple steps for a hassle-free payment process in Mizoram:

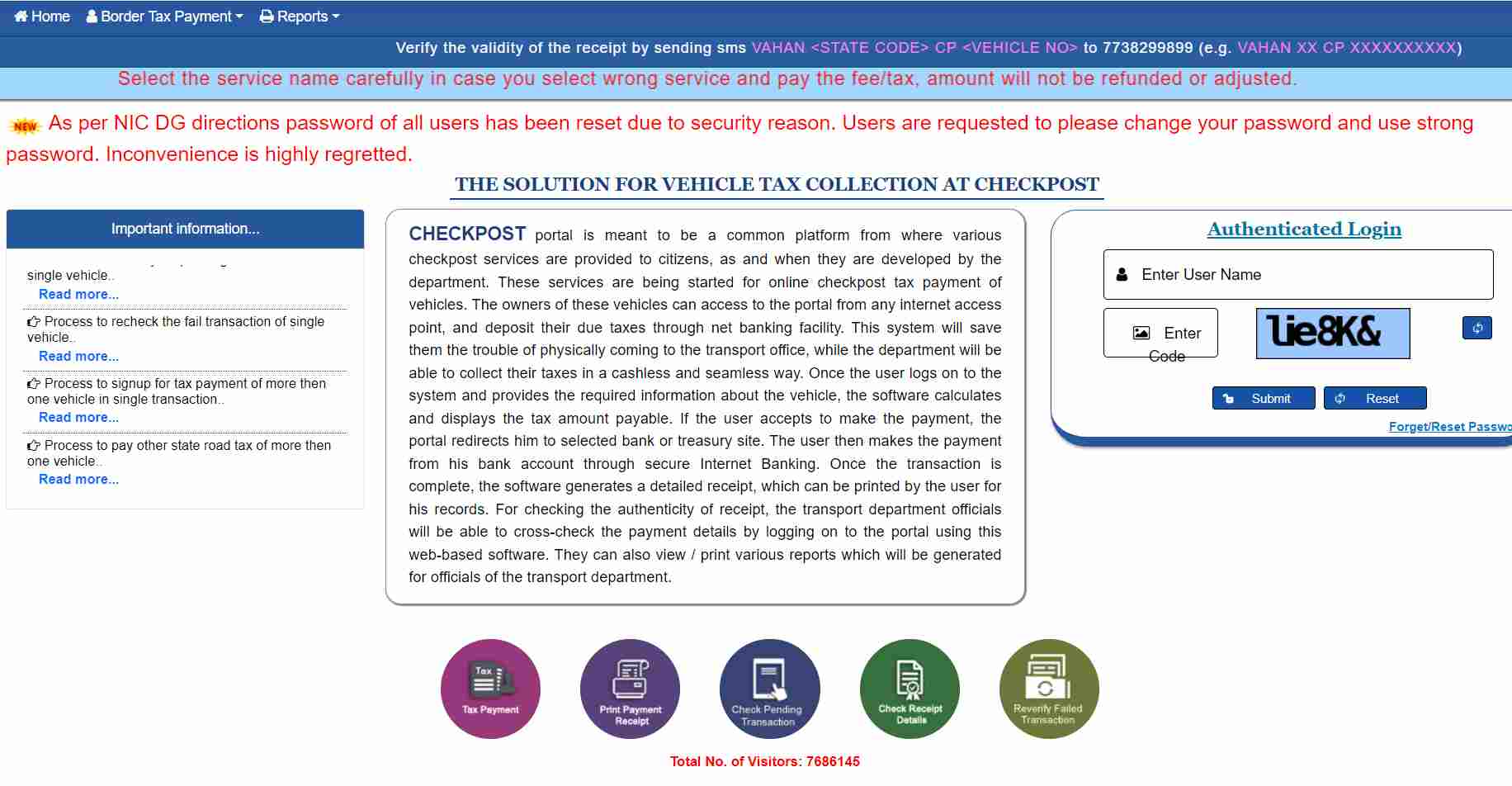

Step 1: First, visit the official Parivahan Sewa website.

Penalty for Not Paying Road Tax in Mizoram

If you fail to make your road tax payment in Mizoram, you will have to pay a penalty. The penalty will vary based on the type of vehicle and the duration for which the tax has not been paid, as indicated in the table below:

| Type of vehicle | Penalty Rate |

| Two-wheeler | ₹200 monthly and any part of the month for the days overdue |

| Three-wheeler | ₹500 monthly and any part of the month for the days overdue |

| Four-wheeler (medium motor vehicles) | ₹1,000 monthly and any part of the month for the days overdue |

| Four-wheeler (heavy motor vehicle) | ₹1,000 monthly and any part of the month for the days overdue |

List of RTOs in Mizoram

The list has information on RTOs across the state to pay the Mizoram road tax:

| RTO Code | RTO Location |

| MZ-01 | Aizawl |

| MZ-02 | LungleiSaiha |

| MZ-03 | Saiha |

| MZ-04 | Champhai |

| MZ-05 | Kolasib |

| MZ-06 | Serchhip |

| MZ-07 | Lawngtlai |

| MZ-08 | Mamit |

| MZ-09 | Aizawl (Rural) |

To avoid penalties, it is important that you pay your road tax on time. As a convenience, you can choose to pay road tax in Mizoram online. Also, avoid defaulting your road tax just for you; it helps count towards our government.