Road Tax in Arunachal Pradesh & Vehicle RTO Charges in 2025

In Arunachal Pradesh, registering a vehicle or renewing it requires road tax payment. The RTO can set fees and plays a crucial function in improving and sustaining the state's roads.

In 2024, the state revised the road tax structure and RTO fees to improve vehicle registration while adhering to national transport guidelines. Whenever you consider buying a new vehicle or changing registration, it is crucial to know the specific charges to prevent legal issues.

Read on for a detailed explanation of road taxes in Arunachal Pradesh, along with related vehicle RTO charges.

Table of Contents

What is Road Tax?

Vehicle owners must pay a road tax at the state level to access public roads. This fee, a one-time expense or an ongoing charge, should be paid along with vehicle registration.

State authorities spend these funds on enhancing and expanding road infrastructure in the area. Tax payment fluctuates depending on the type and weight of the vehicle and state-specific laws.

Road Tax for Two-Wheelers in Arunachal Pradesh

In Arunachal Pradesh, the road tax for two-wheelers is based on the vehicle’s ex-showroom price and varies depending on whether it is domestically manufactured or imported.

Here’s an overview of the vehicle tax on two-wheelers in Arunachal Pradesh:

Weight of the Vehicle |

One-time tax for 15 years |

For every 5 years after 15 years |

Up to 65 kg |

₹1,200 |

₹300 |

65 kg to 90 kg |

₹2,000 |

₹500 |

30 kg to 135 kg |

₹3,000 |

₹800 |

Above 135 kg |

₹3,500 |

₹800 |

An old vehicle from another state is being transferred to Arunachal Pradesh |

Arunachal Pradesh calculates the tax by reducing the tax of other provinces by 7% per annum |

Arunachal Pradesh calculates the tax by reducing the tax of other provinces by 7% per annum |

Road Tax for Four-Wheelers in Arunachal Pradesh

Road tax for four-wheelers in Arunachal Pradesh depends on the vehicle’s purchasing cost and fuel type. Find the applicable rates in the table below:

| Cost of the Vehicle (₹) | Rate of one-time tax for 15 years (₹) (Calculated on the original cost) | Tax for every 5 years after 15 years (₹) |

| Up to ₹3 lakh | 2.50% | ₹3,000 |

| Between ₹3 lakh and ₹5 lakh | 2.70% | ₹3,500 |

| Between ₹5 lakh and ₹10 lakh | 3% | ₹4,000 |

| Between ₹10 lakh and ₹15 lakh | 3.50% | ₹4,500 |

| Between ₹15 lakh and ₹18 lakh | 4% | ₹5,000 |

| Between ₹18 lakh and ₹20 lakh | 4.50% | ₹5,500 |

| More than ₹20 lakh | 6.50% | ₹6,000 |

| Old vehicles that need to be registered in Arunachal Pradesh on transfer from another state | One-time tax is fixed, taking a 7% depreciation of the current value of the car | ₹10,000 |

Road Tax for Commercial Vehicles in Arunachal Pradesh

The road tax for commercial vehicles in Arunachal Pradesh is based on the vehicle type and ex-showroom price. As such, commercial automobiles use more roads and thus have higher applicable rates compared to personal vehicles.

Listed below are the road tax charges in Arunachal Pradesh for commercial or transport vehicles:

| Seating capacity of vehicle | Annual Tax | Quarterly Tax |

| Up to 3 passengers | ₹800 | ₹250 |

| Between 4 and 6 passengers | ₹1,600 | ₹500 |

| Four-wheeled vehicles with a passenger-carrying capacity of 6 or fewer licenced to operate in one city or region | ₹2,400 | ₹700 |

| 4-wheeler vehicle with passengers carrying capacity of 6 or less persons licence to operate all over the state | ₹4,000 | ₹1,200 |

| Between 7 and 12 passengers | ₹5,000 | ₹1,500 |

| Between 13 and 30 persons | ₹7,000 | ₹2,000 |

| More than 30 passengers | ₹7,000 + ₹80 for every seat above 30 | ₹2,000 + ₹20 for every seat above 30. |

| Deluxe Express buses with passengers carrying capacity more than 30 | ₹8,000 + ₹80 for every seat above 30 | ₹2,000 + ₹20 for every seat above 30 |

| Super Deluxe bus with A/C facilities with seating capacity more than 30 | ₹40,000 | ₹11,000 |

Road Tax for Three-Wheelers in Arunachal Pradesh

For three-wheelers in Arunachal Pradesh, the road tax is determined by the fuel type of the vehicle.

The table below represents the road tax for three-wheelers per annum:

| Fuel Type of Vehicle | Annual Road Tax |

| Petrol/CNG three-wheelers | ₹1,000 |

| Diesel three-wheelers | ₹2,000 |

Road Tax for Other State Vehicle in Arunachal Pradesh

For vehicles registered in other states but operating in Arunachal Pradesh, the road tax rate depends upon the duration of their stay. Scroll down for the applicable rates:

| Vehicle Type | Applicable Road Tax |

| Light Motor Vehicle (LMV) | ₹700 |

| Medium Motor Vehicle (MMV) | ₹1,200 |

| Heavy Motor Vehicle (HMV) | ₹2,000 |

How is the Road Tax in Arunachal Pradesh Calculated?

Road tax in Arunachal Pradesh is calculated based on the following parameters:

1. Vehicle Type

A primary factor determining road tax calculation is the vehicle type. As a result, the amount of road tax you need to pay usually depends upon whether you have a two-wheeler, three-wheeler, car, or vehicles registered in other states:

Two-wheelers are generally taxed based on their engine capacity, and their rates are usually lower than those of larger vehicles.

Four-wheelers (cars and SUVs) are taxed depending on fuel type and purchasing costs.

Three-wheelers are taxed based on their seating capacity.

Vehicles from other states are taxed based on their stay in Arunachal Pradesh.

2. Engine Capacity

A vehicle’s engine capacity, measured in cubic centimetres (cc), is another essential factor when calculating road tax in Arunachal Pradesh. In this regard, vehicles with higher engine capacity generally attract higher taxes. Thus:

Two-wheelers with engine capacity below 125 cc usually have lower road tax.

Four-wheelers with larger engine capacities, like SUVs and luxury sedans, generally have higher road taxes.

3. Usage: Personal or Commercial

The amount of road tax payable also depends upon whether the vehicle is for personal or commercial usage:

Personal vehicles, such as family cars, bikes, scooters, etc., have lower road tax rates and are payable on a one-time basis.

Commercial vehicles like buses, taxis and trucks have higher tax rates that are payable annually.

5. Fuel Type

The road tax rates also tend to differ based on the vehicle’s fuel type. Thus, the tax rate will vary depending on whether your bike/car runs on petrol, diesel, CNG/LPG, or electricity. In this regard:

Diesel-powered vehicles have higher road tax rates due to environmental concerns.

Electric vehicles (EVs) usually get road tax exemption at registration due to the Government’s efforts to encourage eco-friendly transportation.

5. Type of Model

The model of your vehicle (standard, sports, or luxury) also tends to impact the road tax amount. Due to their high market value, luxury and high-end vehicle models usually attract higher taxes than standard models.

6. Seating Capacity

Some commercial vehicles' road tax amount depends on their passenger carrying capacity. Thus, automobiles with higher seating capacities, like buses and multi-passenger vans, generally have a higher road tax rate as they are primarily used for commercial purposes and cause higher wear and tear on public roads.

7. Ex-Showroom Price

Another crucial determinant of road tax is the vehicle’s ex-showroom price. As a result, higher-priced automobiles, such as high-end luxury cars and imported motorcycles, have higher road tax rates.

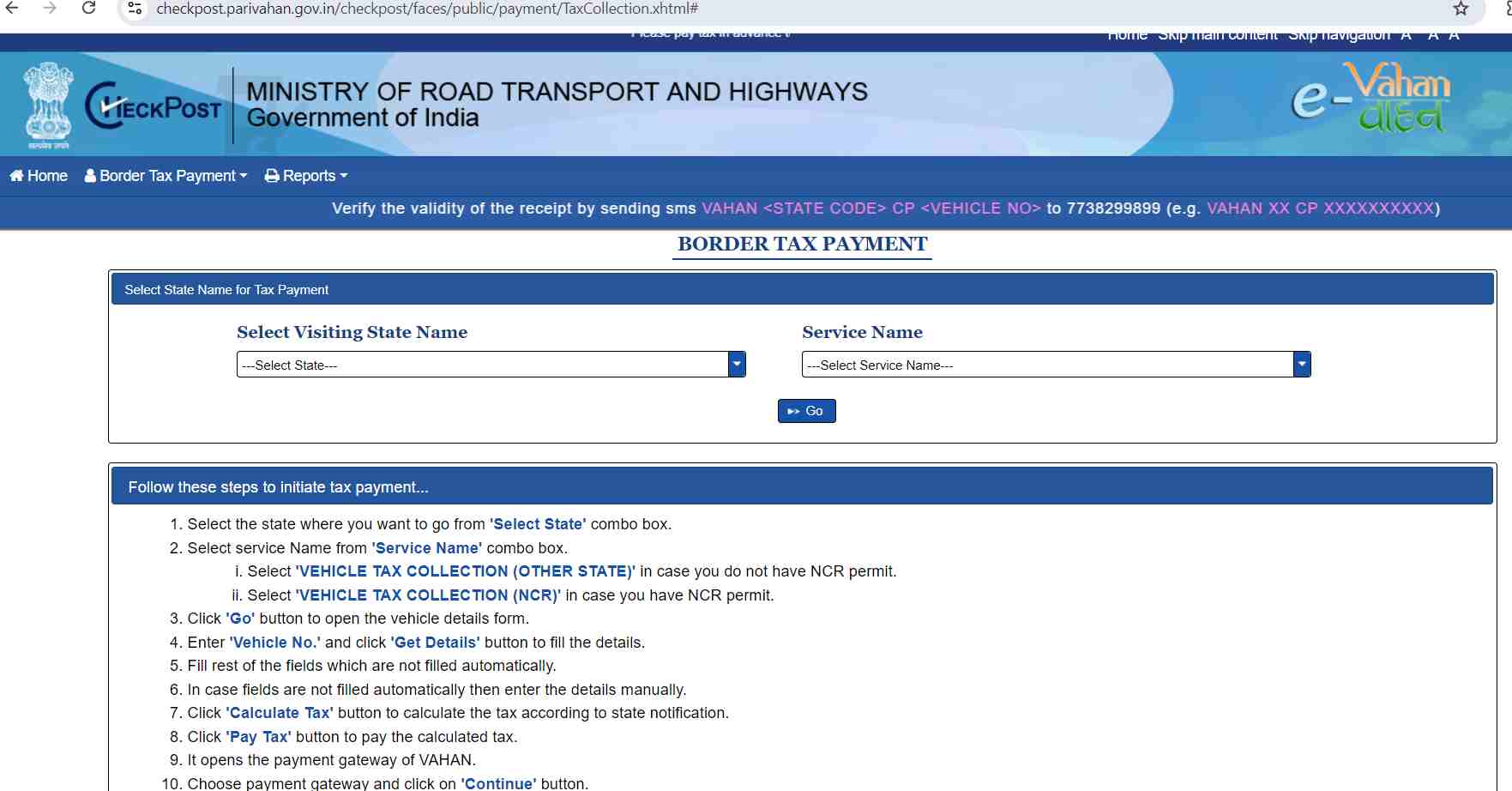

How to Pay Road Tax in Arunachal Pradesh Online?

To pay road tax online in Arunachal Pradesh, follow the steps listed below:

Penalty for Not Paying Road Tax in Arunachal Pradesh

In Arunachal Pradesh, you must pay the road tax within 30 days of registering your vehicle. If you fail, you are liable to pay a penalty.

For first-time offenders, the fine ranges from ₹500 to a one-time tax for that vehicle category. However, the penalty may rise to even ₹5,000 for repeat offenders.

List of RTOs in Arunachal Pradesh

Here is a list of RTOs where you can pay road tax in Arunachal Pradesh:

Paying road tax in Arunachal Pradesh on time is essential whenever you buy a new vehicle or renew the registration of your existing automobile. Otherwise, it can attract hefty penalties, which can get significantly higher if you delay.

So, if your vehicle’s road tax is due, you can quickly pay it online by following the steps mentioned above or visiting your nearest RTO. This way, you will keep legal hassles at bay and contribute to the Government’s maintenance.