Road Tax in Chandigarh & Vehicle RTO Charges in 2025

Chandigarh is a city in northern India that serves as the capital of the Haryana and Punjab states. Road tax is an indispensable aspect of car ownership and guarantees that all the roads in Chandigarh will be in perfect working order for motorists.

Most of the tax revenue is spent on maintaining local roadways. At the same time, some is also invested back into enhancing transportation systems within the city.

In this article, we simplify the complexity of the road tax system in Chandigarh, helping you understand the rates, factors affecting them, and even the exemptions available to facilitate your swift vehicle registration.

Table of Contents

What is Road Tax?

Road taxes are within the state's purview under Article 280 of the Motor Vehicle Act 1988. In Chandigarh, this tax applies to private and commercial vehicles once purchased and registered. Such resources are essential for maintaining roads and ensuring the safety of passengers.

In Punjab, road tax is imposed on every vehicle regardless of its seating capacity, specifications, cargo, etc. This tax is raised for building new roads and repairing old ones, thus enhancing safety for all road users.

In this context, Punjab, too, has accepted this hi-tech development. It became the first state in the country to fully adopt VAHAN and SARATHI, which involve computerising transport activities and enhancing vehicle and driver registration.

Road Tax for Two Wheelers in Chandigarh

In Chandigarh, the road tax for two-wheelers is influenced by engine capacity and the vehicle's ex-showroom price. Typically, bikes with smaller engines incur lower taxes, whereas larger or premium models are subject to higher rates.

| Cost of the Two-wheeler | Road tax Applicable on the Vehicle Cost |

| Upto ₹60,000 | 3% of the cost or up to ₹1,800 |

| Between ₹60,000 and ₹90,000 | 3% of the cost or up to ₹2,980 |

| Between ₹90,000 and ₹1,25,000 | 4% of the cost or up to ₹5,280 |

| Between ₹1,25,000 and ₹3,00,000 | 4% of the cost or up to ₹12,280 |

Road Tax for Four Wheelers in Chandigarh

For four-wheelers, road tax is determined by several factors, including the vehicle's weight, type, make, and age. The table below shows that personal-use four-wheelers fall under various tax brackets:

| Cost of the vehicle | Road tax applicable on the vehicle cost |

| Upto ₹4 lakhs | 6% of the cost or up to ₹24,000 |

| Between ₹4 lakhs and ₹8 lakhs | 6% of the cost or up to ₹48,000 |

| Between ₹8 lakhs and ₹12 lakhs | 6% of the cost or up to ₹72,000 |

| Between ₹12 lakhs and ₹18 lakhs | 6% of the cost or up to ₹1,08,000 |

| Between ₹18 lakhs and ₹25 lakhs | 6% of the cost or up to ₹2,00,520 |

| Between ₹25 lakhs and ₹45 lakhs | 6% of the cost or up to ₹3,60,000 |

Road Tax for Commercial Vehicles in Chandigarh

Commercial vehicles are charged a higher road tax due to the increased wear and tear they cause to the roads. The tax amount is calculated based on the vehicle's weight, seating capacity, and commercial usage.

Details regarding charges for transport vehicles can be found in the table below:

| Motor Vehicle Category | Applicable Road Tax |

| Three-wheelers | 6% of the cost of the vehicle |

| Ambulances | 6% of the cost of the vehicle |

| Buses with 12+1 seating capacity | 6% of the cost of the vehicle |

| Buses with 13+1 seating capacity or above | ₹200/seat annually |

| Light/Medium/Heavy Goods Vehicle (weighing not more than three tonnes) | 6% of the cost of the vehicle |

| Vehicle weight between 3 tonnes and 6 tonnes | ₹3,000 annually |

| Vehicle weight between 16.2 tonnes and 25 tonnes | ₹7,000 annually |

| Vehicles weighing above 25 tonnes | ₹10,000 annually |

Road Tax for Three Wheelers in Chandigarh

For three-wheelers, the road tax in Chandigarh is primarily based on the vehicle's intended use. A more detailed breakdown of these charges is provided in the table below:

| Vehicle Group | Annual Road Tax |

| Three-wheelers | 6% of the cost of the vehicle |

Road Tax for Other State Vehicle in Chandigarh

Vehicles registered in other states but operating within Chandigarh are taxed based on their duration of stay and other specific factors. The tax usually reflects the original registration fee paid in their home state.

Refer to the table below for further information:

| Type of Vehicle | Tax Rate |

| Four-wheelers costing up to ₹20 lakh | 6% of the cost of the vehicle |

| Four-wheelers costing more than ₹20 lakh | 8% of the cost of the vehicle |

| Two-wheelers costing less than ₹l lakh | 3% of the cost of the vehicle |

| Two-wheelers costing el lakh to ₹4 lakh | 4% of the cost of the vehicle |

| Two-wheelers costing more than ₹4 lakh | 5% of the cost of the vehicle |

How is the Road Tax in Chandigarh Calculated?

Road tax in Chandigarh is determined by various factors, including:

1. Type of Your Vehicle

The type of vehicle you own greatly influences the computation of road tax. Rates vary depending on whether it's a two-wheeler, four-wheeler, or a car registered in another state:

Two-wheelers are relatively cheaper in tax liabilities than big haulage trucks and larger vehicles.

Four-wheelers, like cars and SUVs, have higher tax rates based on factors like weight and engine capacity.

Three-wheelers and vehicles registered from other states are tax assessed differently since each state has its taxing policies and jurisdictions.

2. Purpose of Usage: Personal or Commercial

The purpose for which the vehicle is intended to be used, either personal or commercial, also has implications on the road tax:

Personal cars and motorcycles, such as those for family usage, attract reduced road taxes compared to standard commercial vehicles.

Commercial vehicles such as buses, cabs, trucks, and other miscellaneous vehicles are more tax-liable than personal vehicles due to the rate of contamination and depreciation they cause on roads.

3. Engine Capacity

Engine capacity, measured in cubic centimetres (cc), is another critical factor in road tax calculation:

For two-wheelers, the taxation for engine size falling under 125cc is subject to lower taxes.

Four-wheelers with larger engines, such as SUVs and luxury cars, are taxed higher because they have a greater impact on roads and the environment.

4. Type of the Model of Your Vehicle

Even the model and type of vehicle—standard, luxury, or sport—affects the tax rate, and they must differ. Standard vehicles pay normal rates, whereas luxury and premium ones pay higher rates because of their higher market value and increased strain on road infrastructure.

5. Fuel Type

Fuel type is another important factor in determining road tax. The rates vary depending on whether the vehicle runs on petrol, diesel, electricity, or hybrid technologies:

Diesel vehicles tend to have higher taxes to promote environmental conservation.

Electric vehicles (EVs) may benefit from tax incentives or exemptions to encourage eco-friendly transportation.

6. Ex-Showroom Price of Your Vehicle

High ex-showroom prices that cause more regarding taxes and insurance play a key role in assessing road tax. High-end vehicles like luxury sedans and premium motorcycles attract more taxes than cheaper varieties.

7. Seating Capacity

Seating capacity plays a major role in tax calculation for commercial vehicles. Larger vehicles, such as buses or passenger vans, are taxed more due to their size, wear on roads, and commercial nature.

How to Pay Road Tax in Chandigarh Online?

Paying road tax online is a simple and convenient way to avoid lengthy and tiring queues. You can quickly complete your payment by following these steps:

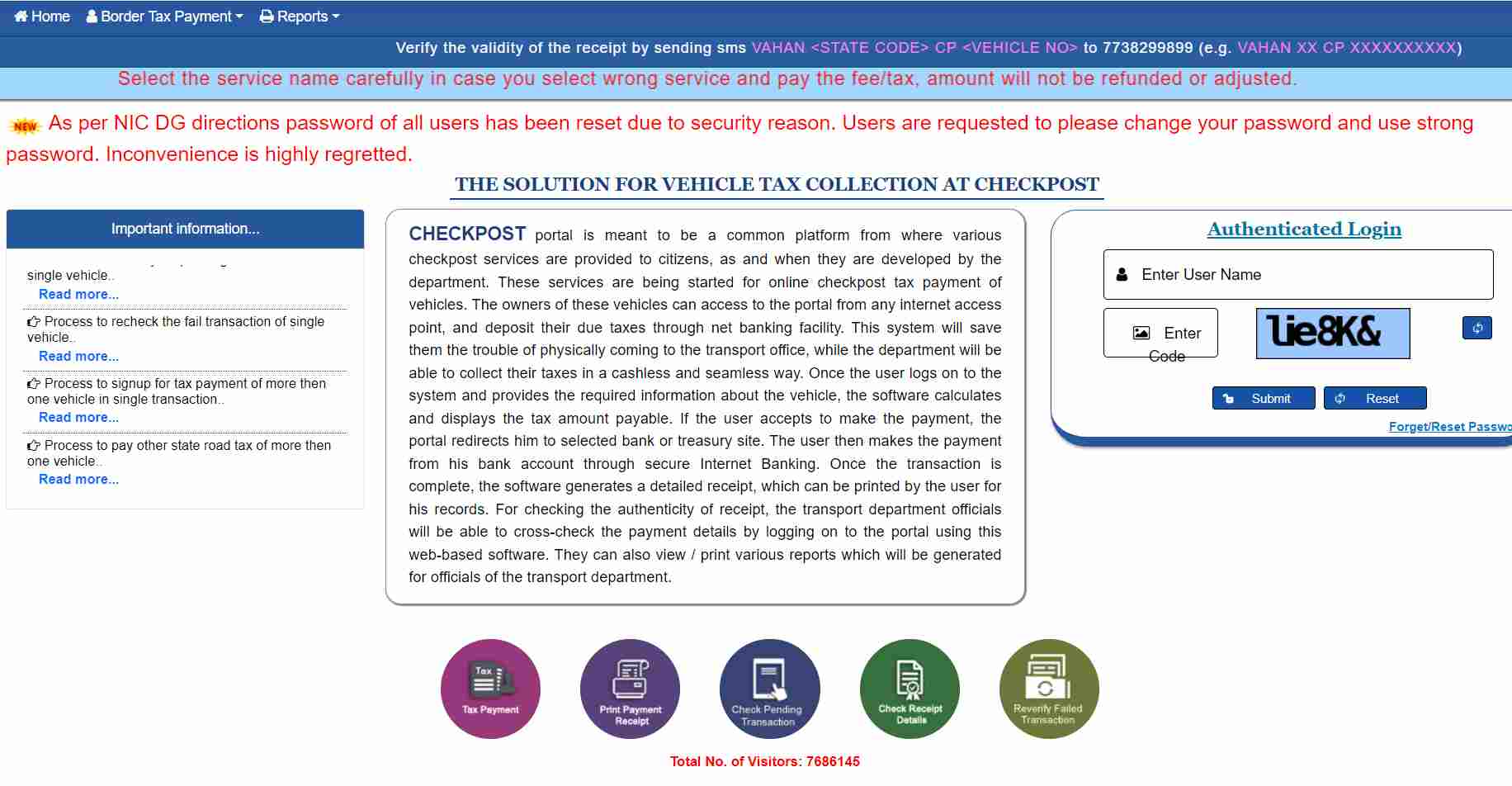

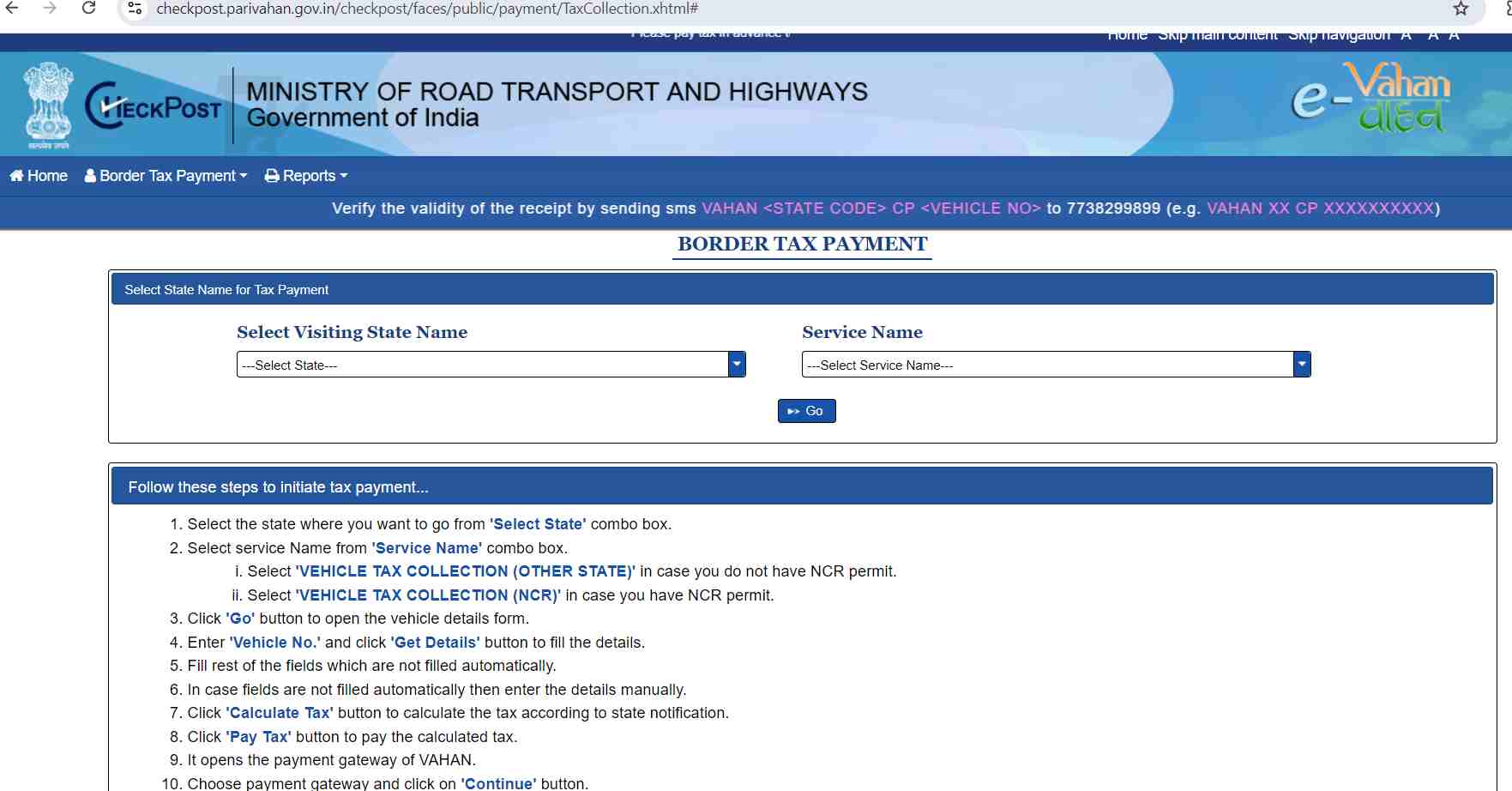

Step 1: Visit the official e-Vahan portal and navigate the ‘Tax Payment’ section. This marks the beginning of your online tax payment process.

Penalty for Not Paying Road Tax in Chandigarh

There is a civil penalty for not paying the road tax in Chandigarh, which usually varies between amounts of ₹1000 to ₹5000 and extends to intensity and number of days of nonpayment of the tax. Besides these penalties, the vehicle owners must pay the default amount of tax.

With such penalties and legal matters looming, it becomes necessary to clear any road tax dues. Paying up road tax on time helps encumber all issues associated with the law and works on improving and constructing the motor roads in the City of Chandigarh that cater to the general public and the city’s workers.

List of RTOs in Chandigarh

Here is a list of RTOs in Chandigarh where you can make road tax payments:

| RTO Code | RTO Location |

| PB-01 | Chandigarh |

| PB-02 | Amritsar |

Paying your road tax on time is vital to avoid penalties. For greater convenience, you also have the option to pay road tax online in Chandigarh. Stay compliant with your road tax obligations and support the government's infrastructure development efforts.