Road Tax in Assam & Vehicle RTO Charges in 2026

Nestled in Northeast India, Assam is renowned for its breathtaking landscapes, rich cultural heritage, and historical significance. It is often referred to as the "Land of Blue Hills and Red River." A vital aspect of Assam’s infrastructure is its transportation system, which facilitates seamless movement across the state and beyond.

As we enter 2026, understanding road tax and vehicle registration fees in Assam becomes crucial for vehicle owners. Governed by the Motor Vehicles Taxation Act of 1936, road tax varies based on vehicle type and weight, affecting personal and commercial users.

This article will explore the updated rates of RTO tax in Assam for two-wheelers and four-wheelers and provide insights on payment methods to help you navigate the complexities of vehicle ownership in Assam while ensuring compliance and financial planning.

Table of Contents

Road Tax in Assam

Road tax, also known as motor vehicle tax or VAHAN tax, is a fee imposed by state and central governments in India for vehicle ownership. It primarily maintains and expands road infrastructure, including safety measures and amenities like streetlights.

The tax amount varies depending on factors such as vehicle type, engine capacity, and usage purpose. Road tax is typically paid at the time of vehicle registration and can be settled online or offline through the Regional Transport Office (RTO).

Road Tax for Two Wheelers in Assam

In Assam, the road tax for two-wheelers is determined by engine capacity and the vehicle's ex-showroom price. Bikes with smaller engines generally incur lower taxes, while high-capacity or premium motorcycles are subject to higher rates.

The table below here shows the Assam vehicle tax on two-wheelers:

| Weight Class | Tax Liable |

| Lighter than 65 kg | ₹1,500 |

| 65 kg to 90 kg | ₹2,500 |

| 90 kg to 135 kg | ₹3,500 |

| Heavier than 135 kg | ₹4,000 |

| Two-wheelers with sidecars | ₹1,000 (additional) |

| Old vehicle which are transferred from other state and need to be registered in Assam | After depreciation of 7% per annum on the tax payable in the other state, the tax in Assam is calculated |

The owners of the two-wheelers should note that this tax payment is valid for 15 years after the vehicle's registration. From then on, owners would have to service either Rs.700 or Rs.1000 at intervals of 5 years according to the light category of the bikes.

Road Tax for Four Wheelers in Assam

For four-wheelers, road tax in Assam is calculated based on several elements, including the vehicle's weight, type, make, and age. Below is a table displaying the tax brackets for personal-use four-wheelers:

| Vehicle Cost | Tax Rate (% of vehicle’s cost) |

| Less than Rs.3 lakh | 3% |

| Between Rs.3 lakh and Rs.15 lakh | 4% |

| Between Rs.15 lakh and Rs.20 lakh | 5% |

| More than Rs.20 lakh | 7% |

| Old vehicles that need to be registered in Assam on transfer from another state | One-time tax is fixed, taking a 7% depreciation of the current value of the car |

After five years, road tax would receive between ₹5,000 to ₹12,000 by vehicle owners as service for road taxes considering the actual ex-showroom price.

Road Tax for Commercial Vehicles in Assam

Commercial vehicles are subject to higher road taxes than personal vehicles due to their heavier impact on the roads. The tax amount is based on the vehicle’s weight, seating capacity, and intended commercial purpose.

See the table below for the applicable charges for transport or commercial vehicles Assam road tax charges:

| Vehicle Type | Yearly Road Tax | Quarterly Instalment |

| Passenger cars with a seating capacity of up to 3 individuals | ₹1,000 | ₹300 |

| Passenger cars with a seating capacity between 4 and 6 individuals | ₹2,000 | ₹600 |

| 4 wheeler cars with a seating capacity 6 or less person licensed to drive in one city or region | ₹2,750 | ₹750 |

| 4 wheeler cars with a seating capacity 6 or less person licensed to drive all over the state | ₹5,000 | ₹1,350 |

| Passenger cars with a seating capacity between 7 and 12 individuals | ₹6,000 | ₹1,600 |

| Passenger vehicles with a seating capacity between 13 and 30 individuals | ₹8,000 | ₹2,200 |

| Passenger vehicles with a seating capacity for more than 30 individuals | ₹8,000 + ₹90 for every additional seat after 30 | ₹2,200 + ₹23 for every additional seat beyond 30 |

| Tourist omnibus | ₹14,000 | ₹3,500 |

| Deluxe Express Buses with a seating capacity of more than 30 individuals | ₹10,000 + ₹100 for every additional seat beyond 30 | ₹2,500 + ₹25 for every additional seat beyond 30 |

| All Assam Super Deluxe contract carriage | ₹5,000 | ₹12,500 |

Road Tax for Three Wheelers in Assam

In Assam, the road tax for three-wheelers is primarily determined by the vehicle's purpose. Refer to the table for more detailed information:

| New Vehicle to be Registered for the First Time | Rate of Onetime Tax | Tax for every 5 years After 15 years |

| Less than 65 Kgs. | ₹1,500 | ₹500 |

| unladen weight | ||

| From 65 Kgs. to 90 Kgs. | ₹2,500 | ₹700 |

| Unladen weight. | ||

| From 90 Kgs. to 135 Kgs. | ₹3,500 | ₹1,000 |

| Unladen weight. | ||

| More than 135 Kgs | ₹4,000 | ₹1,000 |

| Three Wheelers | ₹3,500 | ₹1,000 |

| Trailers/Side cars attached to 2/3 wheelers | ₹1,000 | |

| Old vehicle, required to be registered in Assam on transfer from another State | A one-time tax is to be fixed after allowing a depreciation of 7% per annum of the tax payable for a new vehicle of the same category at the current cost price. |

Road Tax for Other State Vehicle in Assam

Vehicles registered in other states and operating in Assam are taxed according to their duration of stay and specific characteristics. The tax amount is often proportional to the original registration tax paid in the home state.

Check the table below for further details:

| Vehicle Cost | One-Time Road Tax Rate |

| Up to ₹3 lakh | 3% |

| ₹3 lakh to ₹6 lakh | 4% |

| ₹6 lakh to ₹12 lakh | 5% |

| ₹12 lakh to ₹20 lakh | 6% |

| Over ₹20 lakh | 7% |

How is the Road Tax in Assam Calculated?

Road tax in Assam depends on the following factors:

1. Type of Your Vehicle

The type of vehicle you own plays a significant role in calculating the road tax. If it is a two-wheeler, four-wheeler, or any other registered vehicle in other states, the rates are different:

Two-wheelers: They have a lower tax rate than heavier vehicles.

Four-wheelers: This includes SUVs and cars, depending on the weight and size of the engine.

Three-wheelers, vehicles from other states: The tax rate differs depending upon its category.

2. Usage by the Owner Personal or Commercial

The quantum of tax is also ascertained based on the usage by the owner of the vehicle, personal or commercial:

A personal car or a bike gives the exchequer the most negligible quantum of tax.

Commercial vehicles like buses, taxis, and trucks give more quantum to the exchequer because they wear out the public roads more readily.

3. Engine Size

Another essential factor used in terms of taxation is engine capacity, which is measured in cubic centimetres or cc. The more powerful the engine capacity, the higher tax on it is:

Two-wheelers with less than 125 cc attract relatively low rates of taxes.

Four-wheelers with big engines, such as SUVs and luxury sedans, pay due to their common usage on roads and increased environmental influences.

4. Type of the Model of Your Vehicle

The model of the car, be it standard, luxury, or sports, determines the level of tax put on its registration. It was noticed that aside from the most readily available models, other luxuries and premium models attract tax rates for their registration high due to their market value. At the same time, they create much friction on the roads.

5. Fuel Type

The nature of fuel that propels your car also influences the road tax. Cars running with different types of fuels such as petrol, diesel, electricity or hybrid technology have different rates:

The type of fuel that your vehicle uses determines the road tax. The rate of taxing cars with the different types of fuels such as petrol, diesel, electricity, and hybrid is shown below;

Diesel motor cars are often heavily taxed to ensure the conservation of the environment

EVs can benefit from tax deductions or immunity as they motivate 'green alternatives'.

6 Ex-showroom Price

The ex-showroom is a very good calculation factor when it comes to road tax since it refers to the cost of the vehicle before adding tax and insurance. That is why more costly cars, such as super luxury cars and expensive bikes, attract more taxes than less expensive ones.

7. Seating Capacity

The number of seats in a vehicle, essentially commercial vehicles, usually determines road tax. For example, buses or passenger vans with higher seats are taxed more because they tend to cause more road wear and usually have commercial use.

How to Pay Road Tax in Assam Online?

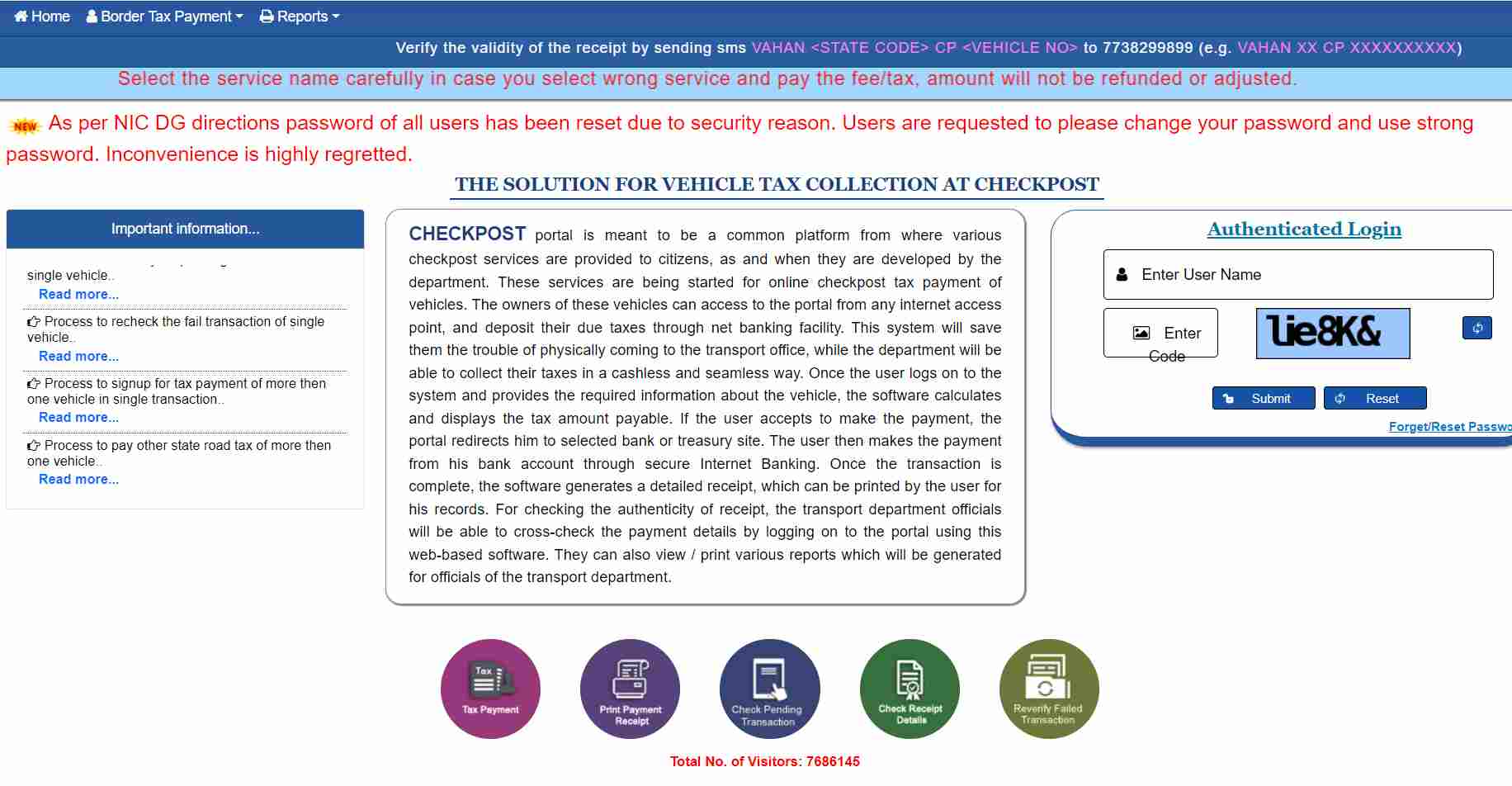

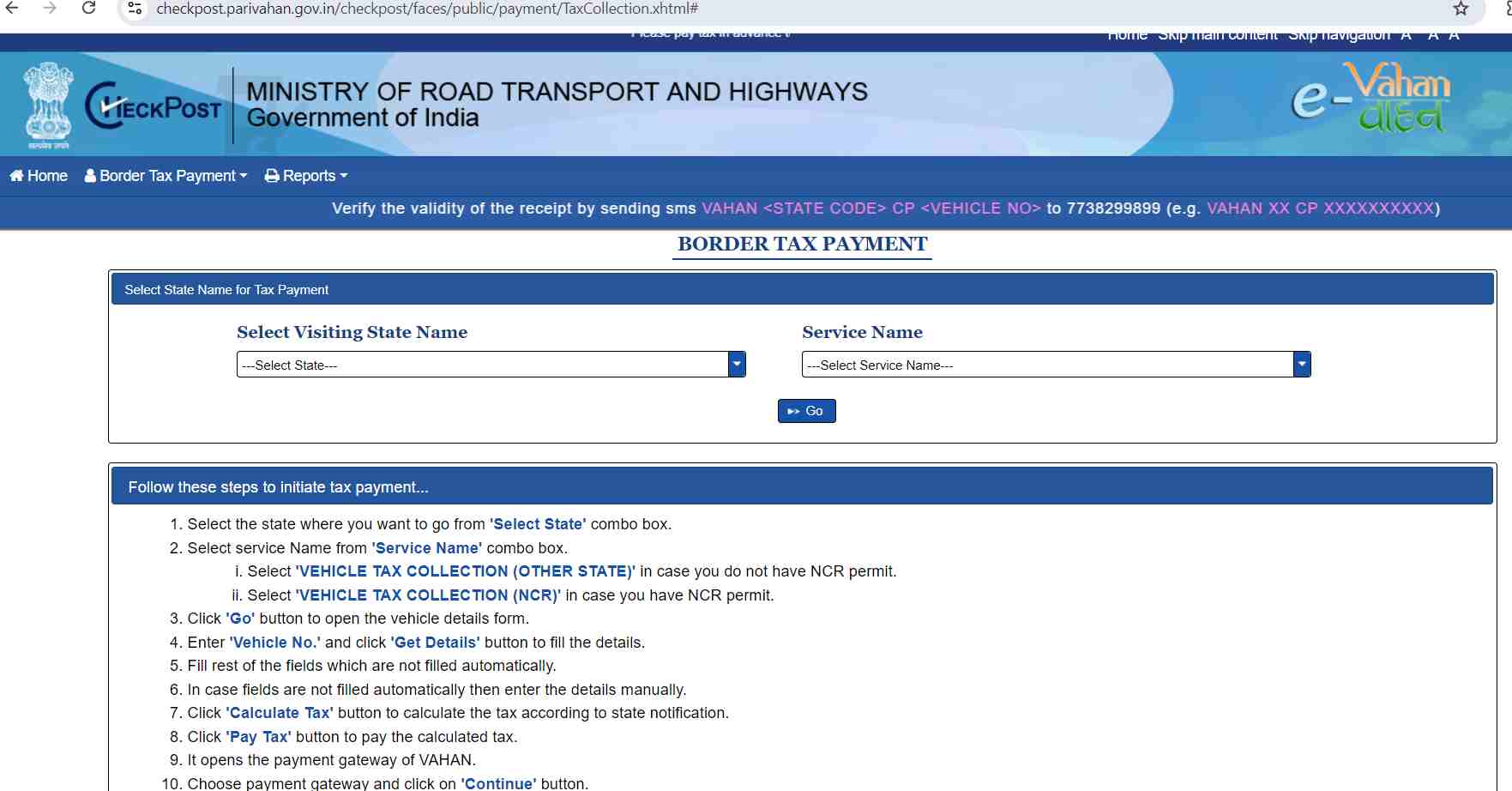

Paying your road tax online is a smart way to skip the long, exhausting queues. You can easily follow these steps for online road tax payment in Assam:

Step 1: Visit the official website of e-Vahan, under the Ministry of Road Transport and Highways, and select the option for tax payment.

Step 3:. Enter your ‘Vehicle No.’ and click 'Get Details'.

Step 4: Press the 'Calculate Tax' button to identify your vehicle's tax bracket. Once confirmed, click 'Pay Tax' to begin the payment process.

Step 5: Select your preferred payment method and proceed to the next steps. After completing the transaction, the bank will redirect you to the Checkpost application.

Be sure to print the receipt generated by the Checkpost after processing your payment.

Penalty for Non-payment of Road Taxes in Assam

You can pay the Assam road tax in one go by 15th April of every year or in four equal installments in April, July, October, and January. Failure to pay these taxes would attract hefty penalties of up to 50% of the outstanding tax amount.

For example, if your outstanding tax is ₹2,000, a delay in servicing can increase your payable taxes to ₹3,000.

List of RTOs in Assam

Below is the list of RTOs across Assam to pay the Assam road tax:

| RTO Code | RTO Location |

| AS01 | Guwahati, Kamrup |

| AS17 | Dhubri |

| AS02 | Nagaon |

| AS18 | Goalpara |

| AS03 | Jorhat |

| AS19 | Bongaigaon |

| AS04 | Sibsagar |

| AS20 | Assam |

| AS05 | Golaghat |

| AS21 | Marigaon |

| AS06 | Dibrugarh |

| AS22 | Dhemaji |

| AS07 | Lakhimpur district |

| AS23 | Tinsukia |

| AS08 | Dima Hasao |

| AS24 | Hailakandi |

| AS09 | Karbi Anglong |

| AS25 | Kamrup Rural |

| AS10 | Karimganj |

| AS26 | Chirang |

| AS11 | Cachar |

| AS27 | Udalguri |

| AS12 | Sonitpur |

| AS28 | Baksa |

| AS13 | Darrang |

| AS29 | Assam new series |

| AS14 | Nalbari |

| AS30 | Assam |

| AS15 | Barpeta |

| AS31 | Assam |

| AS16 | Kokrajhar |