Pradhan Mantri Shram Yogi Maandhan Yojana

Every working individual is obligated to a pension that helps maintain living standards and manage immediate expenses after retirement. However, this facility is restricted to organised sectors.

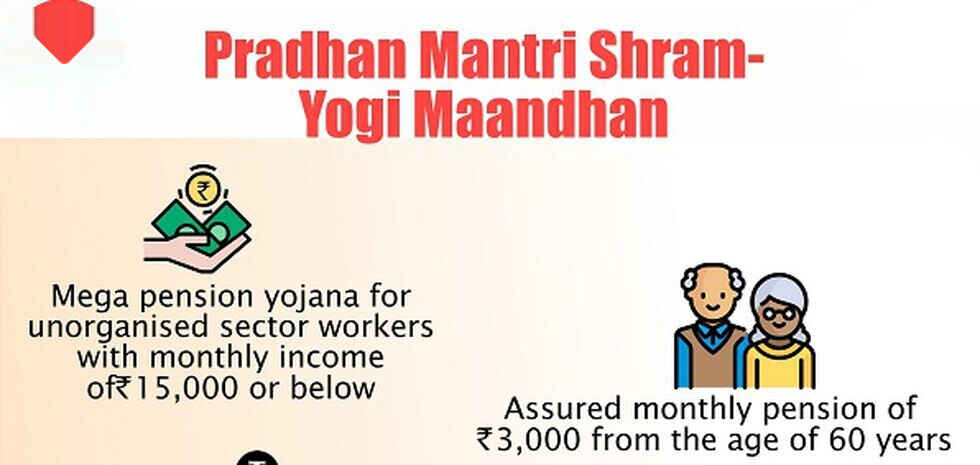

The Indian Government launched the Pradhan Mantri Shram Yogi Maandhan Yojana or PM SYM scheme to remove this concern.

This scheme takes care of the social security and financial protection of unorganised workers in their old age. Keep reading to learn more about this scheme and its application procedure.

What Is Pradhan Mantri Shram Yogi Maandhan Yojana?

PM SYM came into effect to financially support individuals working in the unorganised sector in their old age.

This group includes leather domestic workers, rickshaw pullers, washermen, workers, cobblers, kiln workers, mid-day meal workers, street vendors, etc.

Individuals should know that the Ministry of Labour and Employment manages the scheme. However, the implementation will take place through the Life Insurance Corporation and Common Services Centres of India.

Ideally, this is a contributory and charitable pension Yojana, which allows beneficiaries to receive a confirmed pension worth ₹3000 monthly after retirement. The recipient has to be at least 60 years old to receive the benefits.

In case of death, the beneficiary's spouse will receive their pension’s 50%. This feature is applicable under family pension.

Let’s check the eligibility set against Pradhan Mantri Shram Yogi. This will help streamline the application.

What Is the Eligibility Criteria for PM Maandhan Yojana?

The eligibility parameters for Pradhan Mantri Shram Yojana are as follows -

- The applicant must fall in the age bracket of 18-40 years.

- Individuals must have a minimum income of ₹15,000 or less.

- Applicants should be a recipient of Employees’ State Insurance Corporation, Provident Fund Organisation and National Pension.

- Every applicant has to pay tax and show proof for the same

- An individual needs to have a registered mobile number, saving account and Aadhaar card.

Let’s check the advantages of Pradhan Mantri Shram Yogi Maandhan Yojana for eligible applicants.

What Are the Advantages of Pradhan Mantri Shram Yogi Maandhan Yojana?

Beneficiaries can receive the below-given benefits against this scheme -

- If an individual regularly contributes to the pension scheme but dies before 40 or becomes permanently disabled, his/her spouse is allowed to continue this scheme. They can make a regular contribution or decide to exit.

- Beneficiaries of the PM Shram Yogi Maandhan Yojana will receive a pension of ₹3,000 per month once they have reached 60 years of age.

- When a recipient passes away during the pension tenure, the spouse can gain the pension’s 50%. However, just the spouse will qualify to gain this benefit.

- In case an individual exits this scheme before the tenure of ten years from the joining date is complete, he/she will get the amount contributed returned with a savings bank rate of interest payable.

- Individuals who exit after completing ten years or above from the joining date before reaching 60 years will get their contribution share. They will also receive the accumulated interest earned on the pension fund.

Let’s check how this scheme works for a clear understanding.

How Does the PM SYM Yojana Work?

This PM SYM scheme is voluntary in nature and functions on the beneficiary contribution. Here the Government makes a 50% contribution.

This contribution increases as the subscriber grows old. Recipients also receive a Yojana card with unique ID numbers.

Let’s check what are the steps of applying for the PM SYM scheme.

How to Apply for the Pradhan Mantri Shram Yogi Maandhan Yojana?

The steps to make an application for PMSYM Yojana through a VLE are as follows.

- Step 1: Eligible applicants have to visit their nearest CSC centre and make an initial contribution of funds to the Village Level Entrepreneur.

- Step 2: This VLE will register the subscriber’s name, Aadhaar number, birth date, etc.

- Step 3: A VLE will fill in the form with mobile number, bank details, spouse details, nominee, etc., and complete the online registration for Shram Yogi Maandhan Yojana.

- Step 4: The system auto-calculates monthly contributions according to an applicant’s age.

- Step 5: A subscriber must pay 1st amount in cash to VLE and sign the auto-debit or enrolment form. A VLE will upload the same in the system.

An applicant will receive a Shram Yogi card and a unique Shram Yogi Pension Account Number.

Individuals who are comfortable with an online application can connect with CSC for the PM Yogi Maandhan Yojana scheme application.

- Step 1: Visit official PM Shram Yogi Mandhan Pension Yojana portal and click on “Apply Now” option.

- Step 2: Redirect to Digital Seva Connect portal operated by a CSC or common service operator.

- Step 3: He/she will enrol a beneficiary detail and instalment based on age. CSC will pay 1st instalment online while an applicant has to pay him/her cash.

Beneficiaries will receive a Shram Yogi Pension Number and an acknowledgement form. CSC will scan and upload signed documents and hand over printout cards to an applicant. The debit card activates after receiving a confirmation from the bank via SMS.

Let’s check how to claim the benefits of the Maandhan scheme.

How to Claim the Benefits of Pradhan Mantri Maandhan Yojana?

As discussed earlier, an applicant needs to visit his/her nearest CSC with their Aadhar card and bank account details to register.

They will receive a Shramyogi card and a unique Shram Yogi Pension Account Number after paying their first contribution in cash to CSC.

A CSC will register beneficiary details on the official portal. Individuals can gain actual benefit of the yojana after they retire or reach 60 years of age.

These are essential details on PM SYM and its application procedure. Individuals should check the official website for detailed and updated information.