7 Crore+ Customers

Affordable Premium

7 Crore+ Customers

Affordable Premium

The Indian Government has been instrumental in addressing the nation's poverty with effective policies and schemes. In this context, Antyodaya Anna Yojana was introduced to reduce hunger among India's Below Poverty Line (BPL) population. Launched in December 2000, the AAY scheme targeted more than 1 crore low-income families in India.

Are you wondering about the objectives and benefits of this scheme?

This article will give you a detailed account of the same!

One can trace the origin of Antyodaya Anna Yojana to the Targeted Public Distribution System (TPDS) formation in 1997. The Government of India resorted to focusing on the poverty-stricken population by introducing TPDS. On 25th December 2000, the NDA Government first implemented the Antyodaya Anna Yojana in Rajasthan, India.

Using the Antyodaya Anna Yojana scheme, low-income families can purchase food items at a highly subsidised cost. It identified poor people by conducting surveys in respective rural development facilities across India. As a result, these families could purchase rice at about ₹3 per kg, wheat at ₹2 per kg, and other coarse grains at ₹1 per kg.

The States/UTs undertook distribution and transportation costs of food items. The scale of the issue was initially 25 kg per family, which later increased to 35 kg. In 2003-2004, the Indian Government added 50 lakhs of new BPL families to the Antyodaya Anna Yojana scheme, covering about 23% of the entire BPL population.

The Antyodaya Anna Yojana was introduced to strengthen TPDS and make it more beneficial for Indian citizens.

Its primary objectives include:

Some standard information about Antyodaya Anna Yojana shows its efforts to help low-income families get at least a one-time meal at a subsidised cost. However, analysing its general features will be helpful to understand this concept in-depth.

The PM Antyodaya Anna Yojana provides food and other commodities to all beneficiaries at subsidised pricing. Apart from rice and wheat, AAY families received 1 kg of sugar for ₹18.50 per kg via ration shops.

The officials selected beneficiaries in the AAY scheme with surveys. After identifying the eligible AAY families, government officials provided them with a ration card. These cards differ based on states and regions. For instance, AAY eligible people in Kerala receive a yellow ration card, with which they can avail the scheme's benefits.

The Government had initially set a limit to the quantity of food grains allocation. While the AAY families could previously avail of up to 25 kg grains, it was later increased to 35 kg per family. The authorities roughly allocate around 8.51 lakh tons of food grains every month for meeting some basic requirements of Antyodaya Anna Yojana.

The Indian Government has focused on addressing the hunger-related necessities of the poverty-stricken population by introducing Antyodaya Anna Yojana. Families eligible for this scheme can enjoy its benefits. Some of these benefits are as follows.

A beneficiary of the Antyodaya Anna Yojana (AAY) is an individual or family from the poorest segments of society who are eligible for subsidised food grains. Under this scheme, eligible households receive a higher quantity of food grains at very low prices compared to other welfare programs.

These beneficiaries are provided with subsidised food grains to improve their food security and overall well-being.

Some specific eligibility criteria were set while planning Antyodaya Anna Yojana. This helped them ensure that the food grains reach only such citizens who are in dire need of them.

Primary professions eligible for this scheme include households from both urban and rural areas. These can consist of agricultural labourers without land, rural artisans, craftsmen, weavers, carpenters, potters, tanners, blacksmiths and marginal farmers. Daily wage earners include rag pickers, snake charmers, coolies, rickshaw pullers, hand-cart pullers, cobblers, etc.

If the family heads are terminally ill or physically disabled, the Indian Government considers certain families as AAY families. It can also include people aged more than 60 years or widows without any assured societal support.

The AAY scheme will apply to people without a proper family. For example, if an individual is terminally ill, physically disabled, more than 60 years of age or widowed without social support, they will be considered under this scheme.

All tribal households can be eligible for this scheme. However, anyone applying for utilising its benefits should be a part of the BPL population. Moreover, their family income should not exceed Rs. 15,000 annually.

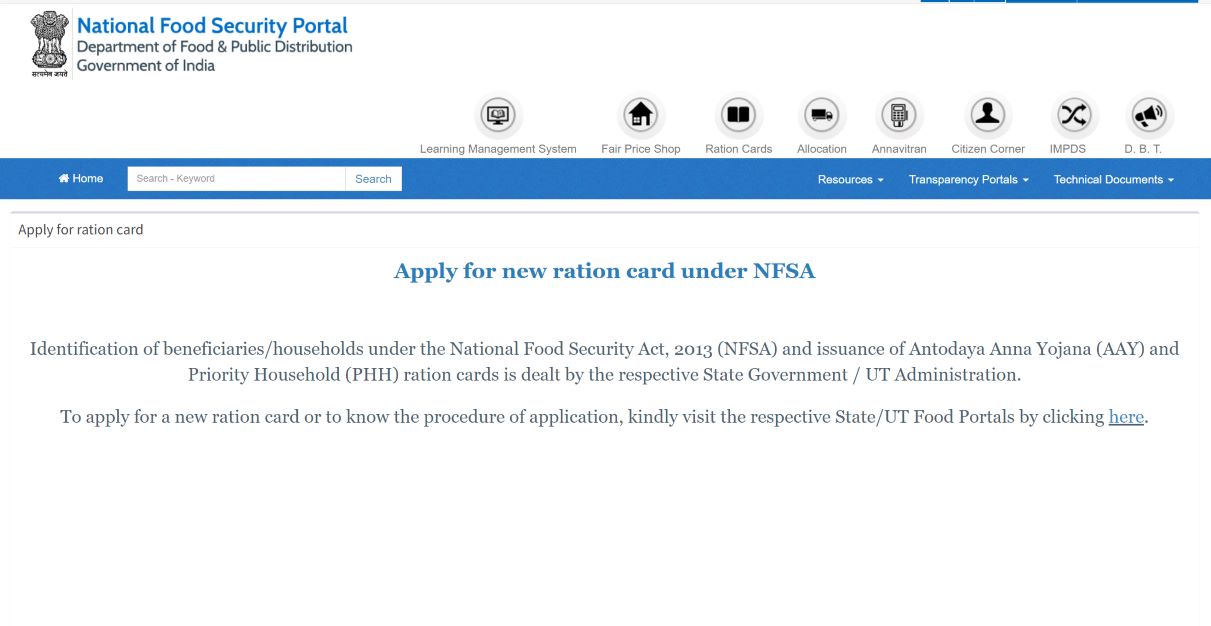

If you wish to apply for the AAY scheme online, follow the steps mentioned below.

You should follow these steps when applying for Antyodaya Anna Yojana benefits for you and your family members.

A beneficiary of a rural area will have to visit the Urban Development Department for applying to this scheme. State Government or UT administrations will then conduct their research to identify the poor families under the BPL population and distribute information to the Panchayat and Municipality.

The Office of Revenue prepares a tentative list of eligible families, and a meeting in the Gram Sabha will inform them about their approval. In urban areas, the Chief Executives of urban local bodies are responsible for identifying the appropriate beneficiaries. Then, designated authorities issue an AAY card after identifying them, and families can avail ration using the cards.

Alternatively, you can go to the nearest Common Service Center (CSC). Ask the CSC operator to apply for AAY and provide the necessary details, such as name, address, and Aadhaar number. Pay any application fee if needed and the operator will fill out the form and attach the necessary documents. Once through with this step then give them back by submitting them at your nearby Foods and Supply Offices.

To avail of the benefits under the Antyodaya Anna Yojana (AAY), the following documents are usually needed:

| Identity Proof | A valid ID, such as a driver’s license, Military ID card, or National social-grant identification ball. |

| Proof of Address | Uhuru Kenyatta, in this case, a utility document such as a gas bill, or a ration card. |

| Income Certificate | It covers the family’s income and social standing. It could be a certificate from a revenue officer or a self-declaration regarding the family's income. |

| BPL Ration Card | Environment attested BPL Ration card or Evidence of BPL |

| Photographs | Family members’ recent photographs must be in passport size. |

| Caste Certificate | For SC/ST or other reserved category beneficiaries, if applicable. |

These documents are crucial for articulating your qualifications and ensuring that potential beneficiaries receive what they are supposed to. If there are any further provisions or changes, inquire about local authorities.

Antyodaya Anna Yojana (AAY) is a saviour to the poorest people in India as it offers low prices for minimum food. More families stand to benefit from this assistance if they learn how to apply and who can apply. It helps reduce hunger and increase the nutritional status of many who cannot support themselves. As a policy, AAY indicates the degree to which the state prefers to support the sustainable development of the underprivileged.