9000+ Cashless Hospitals

Up to 20% Discount

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

What is the Yeshasvini Health Insurance Scheme by the Government of Karnataka?

Rural workers in the informal sector, like farmers, are deprived of several government healthcare benefits extended to formally employed individuals. The Karnataka government launched the Yeshasvini Health Insurance Scheme to help these individuals access affordable medical facilities amidst the adverse financial crisis.

Are you wondering if this initiative can benefit you?

Keep reading to understand this insurance scheme in detail.

Table of Contents

What is the Yeshasvini Health Insurance Scheme?

The Yeshasvini health insurance scheme is a community-based medical coverage scheme that aims to help workers belonging to middle and lower-middle-income groups in the informal sector in Karnataka.

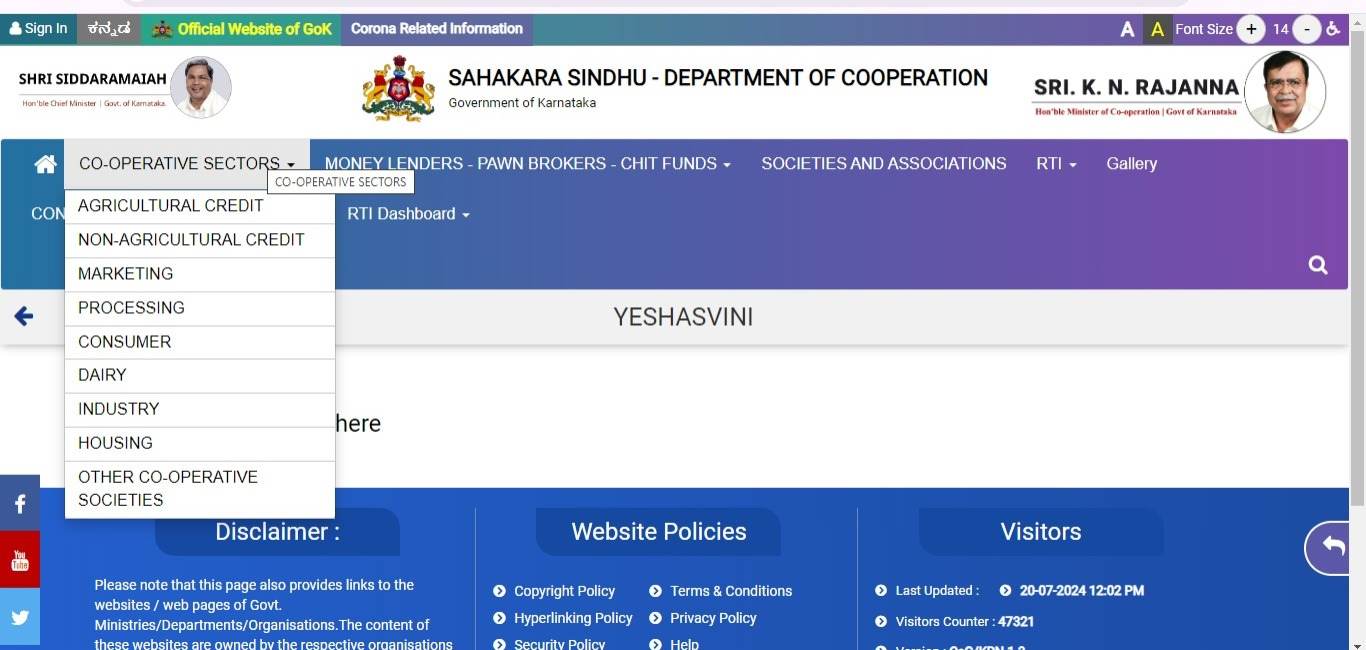

The Department of Cooperatives implements this scheme in partnership with the Government of Karnataka. It uses the capital raised by cooperative societies via the Yeshasvini trust so that rural informal workers can enjoy required healthcare facilities at a reduced cost.

When was the Yeshasvini Health Scheme Launched?

The former Chief Minister of Karnataka, S.M. Krishna, launched this medical insurance scheme on 1st June 2003 and discontinued in 2018. However, the scheme was relaunched in 2022. Since then, farmers have been allowed to enroll themselves under this scheme and avail of its several benefits from network hospitals. This can be termed as the genesis of the Yeshasvini Health Insurance Scheme.

Features of the Yeshasvini Health Insurance Scheme

Before delving into the various benefits of the Yeshasvini Health Insurance Scheme, let’s first understand some of its salient features:

Benefits of the Yeshasvini Scheme

Now that you are aware of what the Yeshasvini Health Insurance Scheme entails, it is time to know about the various advantages you can enjoy once you make it through its requirements:

Now, you might be wondering how a self-help scheme can provide such immense benefits.

The answer is in how the financial reservoir funding this scheme is maintained.

What is Yeshasvini Cooperative Farmers Health Care Trust?

The Yeshasvini Cooperative Farmers Health Care Trust is the financial reservoir that ensures the seamless implementation of this health insurance scheme. It was established and registered under the Indian Trust Act 1882. While the Chief Minister of Karnataka is the chief patron of this Trust, the Minister of Cooperation is also a contributor.

Besides these 2 designations, there are renowned doctors, 5 senior officers, and a principal secretary forming this trust’s governing body.

In addition to citizen contributions, the Karnataka government also makes significant donations to this trust. This helps deliver all the benefits to the individuals insured under this scheme.

The Department of Cooperation under the Government of Karnataka issues the guidelines to monitor these enrollment and renewal requirements every year. The Deputy Registrar of Cooperative Societies and Cooperative Development Officers are responsible for conducting the enrollment process and contribution collection.

They then send the total collected premium to the District Central Cooperative Banks, which further transfer the amount to the Apex Bank of Bangalore.

This amount is then used to finance the medical coverage required by policyholders. However, to benefit from the scheme’s offerings, you must first meet its eligibility requirements.

Are You Eligible for the Yeshasvini Health Insurance Scheme?

It is important to register for the scheme to be eligible for it. Here is a list of eligibility requirements for this scheme you need to meet to enroll.

These factors determine your eligibility for the Yeshasvini Health Insurance Scheme.

Who is Not Eligible for the Yeshasvini Health Insurance Scheme?

The individuals on this list are not qualified to sign up for the Yeshasvini Health Insurance Scheme.:

- This benefit is not available to married daughters who reside outside the coverage area of this health plan and are not members of the designated Co-operative Societies.

- Employees' Cooperative Society members are not qualified.

- Members of Co-ops that have been liquidated or dissolved are not eligible.

- Those who work for a private company that pays salaries or for the government are not eligible to apply.

Which Medical Procedures are Covered Under the Yeshasvini Health Insurance Scheme?

It is natural for you to be curious about which medical facilities you will receive by investing in this scheme. To help clarify your doubts, here is a list of health care procedures included in Yeshasvini Health Insurance Scheme coverage.

- Up to 823 surgical for the scheme to be eligible procedures, including general surgery, ophthalmology surgery, cardiac and cardiothoracic surgery, paediatric surgeries, genitourinary surgeries, orthopaedic surgeries, neurosurgery, vascular surgery, surgical gastroenterology, angioplasty, and surgical oncology.

- Medical emergencies like accidents caused while operating agricultural equipment, electric shocks, snake bite, dog bite, and drowning.

- Other procedures requiring hospital stays like gynaecology and obstetrics, normal delivery, and neonatal intensive care.

You can use the Yeshasvini card facility to avail treatment at affordable rates against any of the above-mentioned medical inconvenience. Since 2008, applicants are provided with Unique Health Identification enrollment forms comprising the details of the main beneficiary and his/her family members, which act as proof of enrollment.

However, like all other insurance plans, the Yeshasvini Health Insurance Scheme comes with certain exclusions.

Which Treatment Procedures are not Covered Under the Yeshasvini scheme?

The Yeshasvini health care scheme does not cover the following medical requirements:

- Cosmetic surgeries like implants, skin grafting, prosthesis, etc.

- Other surgical procedures including heart transplant, kidney transplant, dental surgery, and joint replacement surgery

- Treatment for autoimmune diseases, chemotherapy, and inpatient medical treatment

- Follow-up treatment post-surgery

- Road accidents

- Diagnostic investigations

- Burns

- Dialysis

- Vaccination or inoculation

- Cost of tonics, vitamins, or sanitary items

How to Claim Yeshasvini Health Scheme?

The following is how the Yeshasvini Health Insurance Scheme allows you to make benefit claims:

- Step 1: Visit a network hospital among the Yeshasvini scheme's network hospitals.

- Step 2: The Third-Party Administrator (TPA) at the hospital will verify whether you are a Yeshasvini beneficiary and if the necessary operation or treatment is covered by the program. You can move forward with the required medical examinations after confirmation.

- Step 3: The network hospital will submit an online pre-authorisation request to the Management Services Provider (MSP) along with the required paperwork.

- Step 4: The hospital's request will be reviewed by the MSP, who should act on it within a day.

- Step 5: The doctors can begin therapy at the network hospital as soon as they are approved. Following therapy, the MSP will confirm and reimburse the hospital appropriately.

Know about:

What are the Documents Needed for Registration?

To enrol in the Yeshasvini Health Insurance Scheme, you typically need to provide the following paperwork:

How Can You Register For Yeshasvini Health Insurance Scheme Online?

This is the online registration process for the Yeshasvini Health Insurance Scheme:

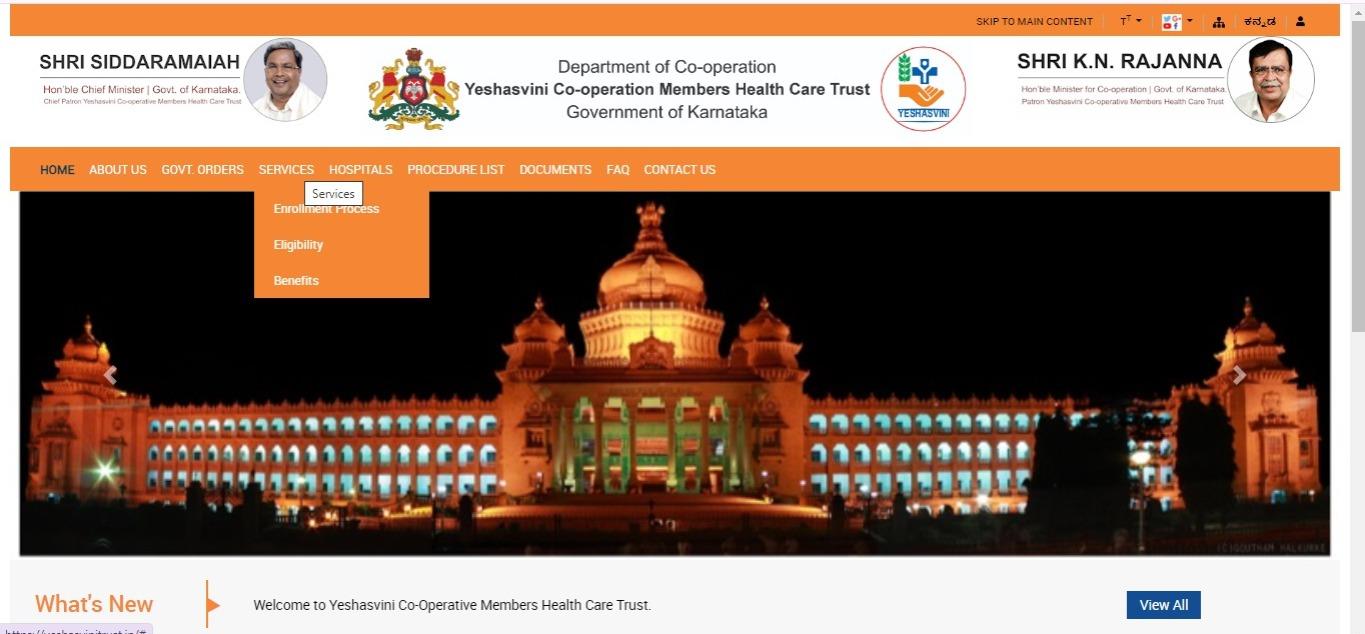

- Step 1: Go to the official website. By going to the Karnataka Cooperative Department's or the Yeshasvini Health Insurance Scheme's official website, you can begin the registration procedure.

- Step 2: Locate the area devoted to enrollment or new registrations. It may have the label "Register" or "New Enrollment."

- Step 3: Complete the registration form with all the necessary information. This often consists of your contact details, membership information in cooperative societies, and details about your family.

- Step 4: Upload the necessary files and other essential documents, including identification documents and proof of membership in cooperative societies.

- Step 5: You can submit the form online once you've filled it out and uploaded the necessary files.

- Step 6: You have the option to pay any necessary premiums online. Just be sure to obtain a payment confirmation or receipt.

- Step 7: Following the submission of your registration, you should watch for your email or message of confirmation. This will confirm that you have registered and may contain information about your policy and registration number.

- Step 8: You will receive a membership card following the completion, processing, and approval of your registration. You can use this to access the benefits of the scheme, and it will be sent to you online or by mail.

How to Get a Yeshasvini Health Card?

Having a Yeshasvini Health Card is important for beneficiaries. It's easy to obtain a Yeshasvini Health Card by following these easy steps:

- Step 1: Go to the official website and register as a Karnataka cooperative organisation.

- Step 2: Locate and select the "Register for the Cooperative Society" option.

- Step 3: Locate and click on the link that says "Apply Online for Yeshasvini Health Card."

- Step 4: Complete the online registration form by entering all necessary information and submitting it. Return to the main page.

- Step 5: Enter your credentials and log in to the website.

- Step 6: You'll be taken to the Yeshasvini Health Card application.

- Step 7: To finish your application, complete the form, make sure all the information is correct, and submit it.

Network Hospitals Under Yeshasvini Health Scheme

Around 800 hospitals are part of the Yeshasvini Health Insurance Scheme, which is spread throughout several Karnataka districts. Receiving healthcare services is made easier for beneficiaries by this extensive network, especially in an emergency. Numerous beneficiaries are served by these hospitals, which are spread across rural and urban areas.

Medical Packages Under Yeshasvini Health Insurance Scheme

There are many packages offered by the Yeshasvini Health Insurance Scheme. Check the list below to see the details of packages:

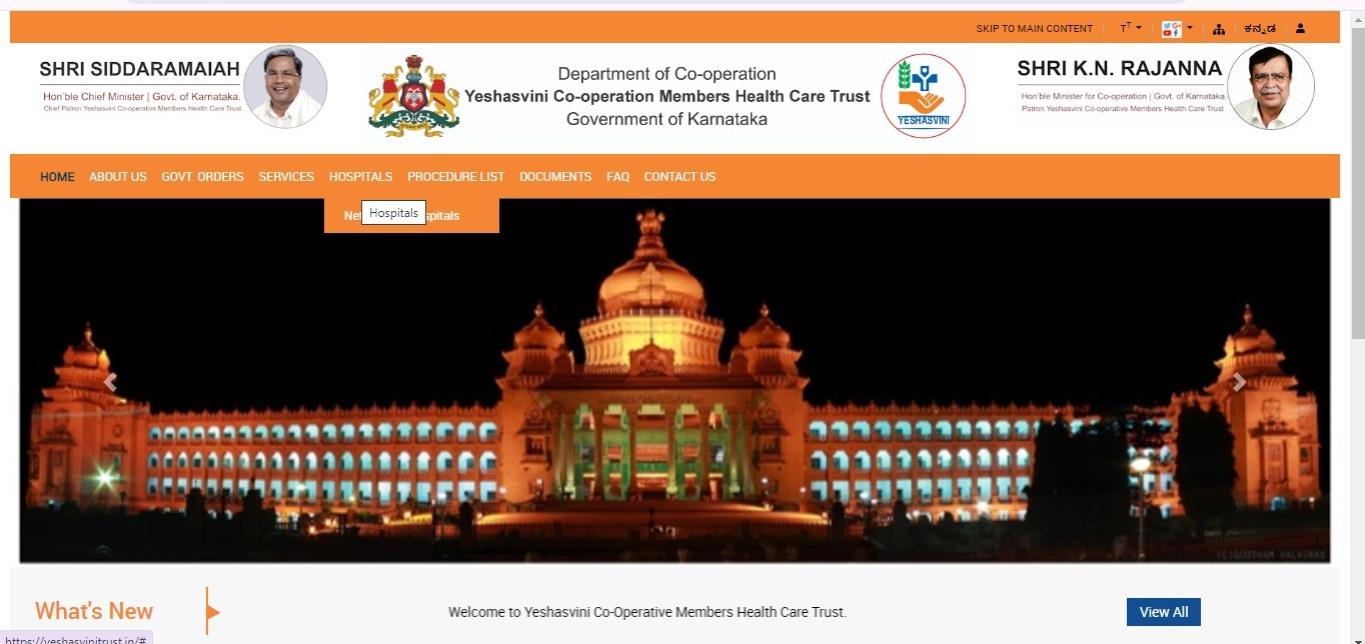

How to Find a Hospital Under Yeshasvini Health Insurance Scheme?

To find a hospital under the Yeshasvini Health Insurance Scheme, follow these steps:

- Step 1: Visit the Official Website: Go to the Yeshasvini Health Insurance Scheme's official website. They often have a list of network hospitals or a search tool.

- Step 2: Contact the Scheme's Helpdesk: Reach out to the Yeshasvini helpline or customer service for assistance. They can provide you with a list of participating hospitals.

- Step 3: Check with Local Health Departments: Visit or call local health departments or district health offices. They usually have information about network hospitals in your area.

- Step 4: Speak to Your Healthcare Provider: Sometimes, your current healthcare provider or local clinics can provide information on hospitals that accept Yeshasvini coverage.

Ensure that you verify the details and confirm with the hospital directly to avoid any issues when seeking medical care.

Hospitalisation Process Under Yeshasvini Health Insurance Scheme

To undergo hospitalisation under the Yeshasvini Health Insurance Scheme, first ensure your enrollment is active and find a network hospital. For planned admissions, secure pre-authorisation from the hospital’s insurance desk. Present your Yeshasvini card upon admission, and the hospital will handle the billing with the scheme.

Typically, you’ll only need to pay for non-covered expenses. After treatment, review the final bill and discharge summary. Always verify the specific process with the hospital and the scheme to ensure a smooth experience.

Contact Details and Address of Yeshasvini Scheme Headquarters

For any issues, it is important to know where to contact first. Here are the contact details for the Yeshasvini Scheme:

Headquarters: Office of the Registrar of Cooperative Societies, 1, Ali Asker Road, Vasant Nagar, Bangalore-560052

Phone: 080 22269637 / 22251238

This concludes the comprehensive guide on everything involved in the Yeshasvini Health Insurance Scheme. After you have enrolled under this plan, make sure to know about the detailed claim procedure, which you can easily complete upon hospital admission. It ensures you experience no delay in receiving treatment under this insurance scheme during an emergency.