9000+ Cashless Hospitals

Up to 20% Discount

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

What is Karunya Arogya Suraksha Padhathi (Karunya Health Insurance Scheme)?

With improved infrastructure and facilities, the cost of treatments, hospitalisation, medications, etc., will likely gradually increase across India.

Keeping that in mind, the Indian Government, in association with the states, has launched several health insurance schemes to facilitate the underprivileged. Among them, the Karunya Insurance Scheme was a special initiative taken by the Kerala Government to provide quality healthcare to the poverty-stricken section of society.

Wondering how this will help you? Scroll down to know.

Table of Contents

What is the Karunya Health Scheme?

Back in 2012, the UDF Government launched this healthcare scheme for the first time. Here, the sole purpose was to help people suffering from critical illnesses with substantial treatment coverage. Under the Karunya Health Scheme, each family should receive a health cover of ₹5 lakhs per year for secondary and tertiary care hospitalisation.

Do you know how such a huge amount is arranged for this health insurance scheme?

Well, the funding comes from the Kerala lottery so that beneficiaries can pay a nominal premium charge to avail of the benefits.

What are the Features of the Karunya Health Scheme?

The Karunya Health Scheme comes with many important features. Some of the prime features of the Karunya Health Scheme include:

These are some of the salient Karunya Health Scheme features.

What are the Benefits of the Karunya Health Insurance Scheme?

The Karunya Arogya Suraksha Padhathi (KASP) provides several services to guarantee complete health coverage for those with serious illnesses. Here are some compelling benefits of the Karunya Health Scheme that you need to know:

- One key advantage of this scheme is that you will receive reimbursement for your treatment charges even if they exceed the estimated amount.

- The government provides financial help up to Rs. 5 lakh for all beneficiaries and there is no cap on family size or age of members.

- Reimbursement is available to beneficiaries in the event that the final estimate of treatment costs for a critical disease is higher.

- Through the program, each recipient can get treatment benefits for a minimum of five family members, and each person is given a unique card for use as identification and to access services.

Critical Health Diseases Covered by Karunya Health Insurance Scheme

The Karunya Health Insurance Scheme provides coverage for some of the critical diseases, for instance:

What are the Objectives Of Karunya Insurance?

The Karunya Insurance is launched for the welfare of people. Here are the main objectives of Karunya Insurance:

What Does the Karunya Health Insurance Scheme Cover?

Plans like Karunya Insurance ensure that people who struggle to pay for expensive medical procedures can obtain the support they want to get the care they require. These are the coverages offered by the Karunya Health Insurance plan:

- Coverage for diagnostic, therapeutic, and consultative medical services coverage for three days before the initial admission day.

- Covers three days of pre-hospitalisation and 15 days of post-hospitalisation expenses.

- Costs for diagnostics and lab work are reimbursed.

- Payment for the price of implant coverage for issues that could surface while a patient is in the hospital.

- Coverage for services in both non-intensive and intensive care.

Eligibility for Karunya Health Insurance Scheme

The Government of Kerala has set certain eligibility parameters for the Karunya Health Insurance Scheme. For instance:

- Only applicants below the poverty line can apply for the scheme. All the APL and BPL families with annual income below ₹3 lakhs will be eligible for this.

- Those who are applying for this healthcare plan should keep the required documents handy.

- The applicant must be a resident of Kerala to avail of these aforementioned benefits.

Make sure to go through the Karunya Health Scheme eligibility criteria and check if you meet these parameters before considering the scheme.

How to Register for the Karunya Health Insurance Scheme?

With easy access to internet facilities, applying for any health insurance scheme has become pretty convenient. In this case, you can easily apply through the official website launched by the Kerala Government.

Here are the steps you need to follow.

- Step 1: Visit the online portal to begin your application process.

- Step 2: Right on the home page, you will find a section called ‘How to Apply,’ click on it to download the application form.

- Step 3: Make sure to provide your details carefully and submit them along with the necessary documents.

You can also use the ‘Application Tracking’ option to keep checking your application status. Alternatively, you can check your name on the home page's ‘List of Beneficiaries’ option.

Which Documents Should be Submitted While Applying?

During the Karunya Arogya Insurance registration process, you will need to submit the following list of documents:

Apart from these, a copy of your Ration card, passport-size photo, and estimate of the total amount spent at the hospital should also be submitted along with your application form.

How to Register for Karunya Health Insurance Card Online?

Here is the registration process to obtain the Karunya Health Insurance Card Online:

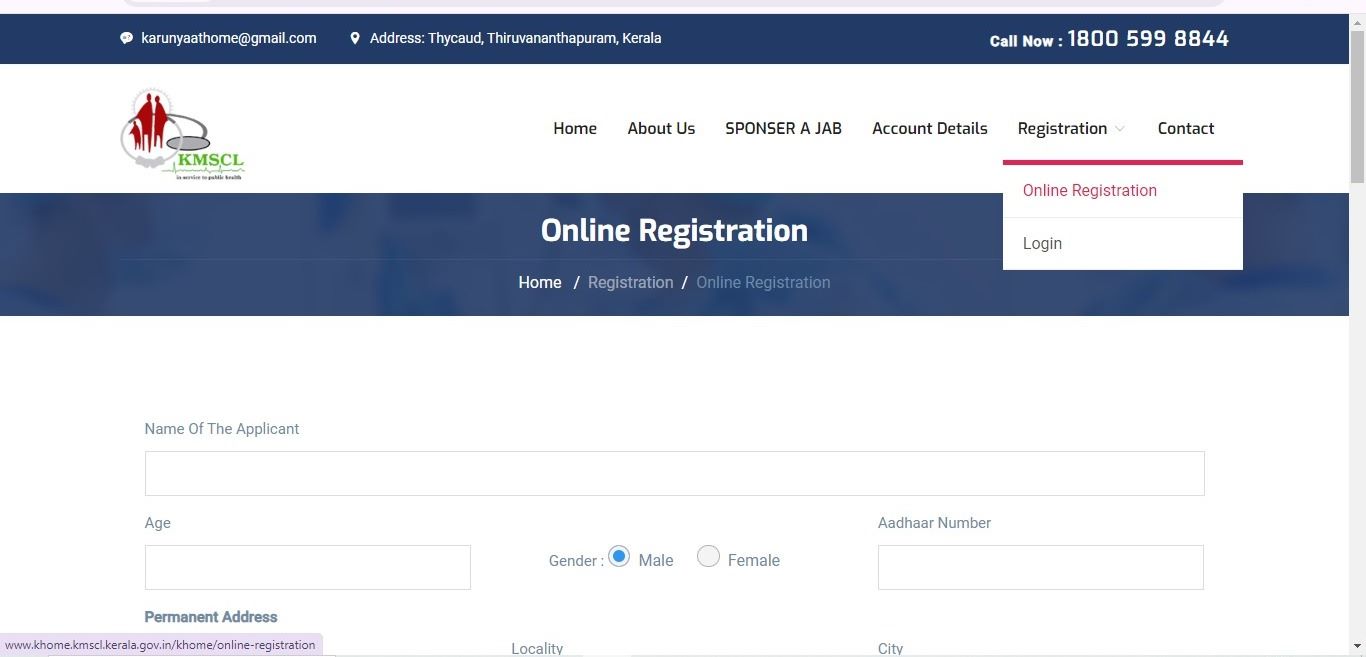

- Step 1: Check out the Karunya Health Insurance website.

- Step 2: Select ‘Online Registration.'

- Step 3: Fill in the form with accurate details and upload scanned copies of necessary documents.

- Step 4: After completing the form, submit it electronically.

After your application is accepted, you can download the KASP insurance card.

How to Find a Hospital Under the Karunya Health Insurance Scheme?

These steps should help you locate a hospital that accepts the Karunya Health Insurance Scheme:

- Step 1: Visit the Official Website: Go to the official website of the Kerala State Government’s health insurance scheme or the relevant health insurance provider.

- Step 2: Check the List of Network Hospitals: Look for a section that lists network hospitals or empanelled hospitals. This list is usually available under sections like "Hospital List," "Empanelled Hospitals," or similar headings.

- Step 3: Contact Customer Service: If you can't find the information online, contact the customer service of the Karunya Health Insurance Scheme. They can provide you with a list of hospitals or guide you on accessing this information.

- Step 4: Visit Local Health Offices: You can also visit local health offices or the district health department to inquire about hospitals covered under the scheme.

- Step 5: Consult Your Insurance Agent: If you have an insurance agent or a contact person for the scheme, they can provide a list of covered hospitals.

Hospitalisation Process Under the Karunya Health Insurance Scheme

Under the Karunya Health Insurance Scheme, the hospitalisation process typically involves several key steps. First, you must ensure the hospital is empanelled under the scheme. Once confirmed, present your Karunya Health Insurance card or details at the hospital's admissions desk. The hospital will verify your coverage and initiate the claim process.

During hospitalisation, necessary treatments will be covered as per the scheme’s guidelines. For any pre-authorisation or documentation requirements, coordinate with the hospital’s insurance or billing department to ensure a smooth claims process.

Know about:

Contact Details of Karunya Health Insurance Scheme

Here is the contact address of the Karunya Health Insurance Scheme:

Address: State Health Agency Kerala (SHA), 5th and 8th Floor, Artech Meenakshi Plaza, Opposite Government Women And Children's Hospital Thycaud, Thiruvananthapuram, 695 014

Contact Number: 0471 4063121

Helpline DISHA: 1056

Email ID: karunyabf@gmail.com or statehealthagencykerala@gmail.com

India’s healthcare system is slowly improving with the emergence of so many government-backed schemes and advanced infrastructure. Schemes like the Karunya Insurance plan ensure that people struggling to arrange funds for such expensive treatments can get proper assistance to get through such situations.

However, you need to be a little technologically active in order to apply for the scheme and check all the necessary details available on their official website. So, go ahead, fill out your form, and make proper use of Karunya Health Scheme benefits.