9000+ Cashless Hospitals

Up to 20% Discount

Buy Health Insurance, Up to 20% Discount

Port Existing Policy

What is Employees State Insurance Corporation (ESI Scheme)?

Due to the hectic pace of today's society, healthcare expenses incurred to the people can be a major issue. This is where an insurance plan becomes very important. To this effect, the Indian government launched the ESI scheme. ESI full form is Employees State Insurance.

This scheme is managed by Employee State Insurance Corporation (ESIC) and offers financial and medical assistance to the employees, thus relieving them from the burden of health care costs in case of emergencies. Continue reading to know more about how the ESI scheme can benefit you.

Table of Contents

What is the Employee State Insurance Scheme (ESI)?

A multidimensional social security scheme, the Employee State Insurance scheme aims to offer socio-economic protection to the population employed in the organised sector and their dependent members. Under this insurance scheme, individuals can avail of financial assistance during medical emergencies due to occupational hazards, sickness, and maternity.

The corporate body responsible for administering this integrated program is called the Employee State Insurance Corporation (ESIC).

This scheme is enforced under the Employees State Insurance Act, whereby every employer must ensure a new employee’s enrolment under this programme.

Overview of the Employee State Insurance Act

The Parliament of India introduced the Employees State Insurance Act in 1948 and first launched it in 1952 in Delhi and Kanpur, covering approximately 1.20 lakh employees. After this initial implementation, the state governments took up this initiative to include more parts of the country in several phases.

This act defines several terms and conditions related to the scheme’s validity, including insured employees’ eligibility and duties and responsibilities of the Employees’ State Insurance Corporation (ESIC).

It also specifies certain requirements for a family member to become a dependent of the insured individual under the ESI scheme. According to this Act, eligible dependents include:

- Any parent, including a widowed mother.

- Sons and daughters, including any adopted or illegitimate offspring.

- A widowed or unmarried sister.

- A minor brother

- A paternal grandparent in case his/her parents are dead.

- A widowed daughter-in-law.

- A minor offspring of a predeceased son or a predeceased daughter provided no child parent is alive in the latter case.

The Employees State Insurance Act 1948 also specifies 2 contribution periods and 2 cash benefit periods, which are marked as follows:

Depending on an employee’s contributory days during a contribution period, they can avail of compensation in the succeeding cash benefit period accordingly.

What are the Features of The ESI Scheme?

If you are curious to get down to the nitty-gritty of this government-sponsored insurance scheme, here are some key characteristics of the same:

All these features of this health insurance scheme allow you to avail a number of benefits.

Benefits of the ESI Scheme

The Employee State Insurance (ESI) Scheme offers comprehensive coverage for workers, including medical benefits, disability support, and financial aid. It ensures protection and assistance in various contingencies, enhancing worker welfare and security.

You can avail of the following benefits at an ESI hospital/dispensary if you are enrolled under the ESI scheme.

1. Sickness Benefits

Insured employees can enjoy cash compensation worth 70% of their wages for periods of certified illness, valid up to 91 days per year. To claim such benefits, individuals need to contribute for at least 78 days during a contribution period.

Individuals with long-term illnesses can avail of greater compensation rates of 80% for up to 2 years under extended sickness benefits of the Employees State Insurance Act 1948.

2. Medical Benefits

The insured and his/her dependent family members can avail of complete medical and surgical care under this scheme, including doctor consultation, medication, and ambulance services.

There is provision of immunisation and vaccination service at all the ESI centres implemented in the state. The scheme does not specify any maximum limit for such expenses.

3. Disablement (Temporary and Permanent) Benefits

Insured workers can avail 90% of their wages as compensation if they face temporary disability from an employment injury.

This benefit is admissible from day 1 of employment, notwithstanding the fact if you have paid any contribution or not.

Compensation is provided for the entire period of loss of earning capacity, provided the disability lasts for more than 3 days after the date of the accident.

4. Maternity Benefits

Women employees can claim cash benefits in case of any health complications arising out of pregnancy, miscarriage, medical termination of pregnancy, premature birth, or confinement.

The maximum period for compensation varies between 6-12 months, depending on the type of medical requirement, and can be extended by another 1 month.

Note that you can only benefit if you have made contributions for at least 70 days in the 2 successive contribution periods prior to your cash benefit period.

Know about: Health Insurance Plans with Maternity Coverage

5. Death Benefits

In case an insured employee expires from an occupational hazard, his dependent family members can avail of monthly compensation worth 90% of the deceased individual’s salary.

While dependent spouses and parents can enjoy these benefits until death, dependent offspring can benefit from 25 years of age.

6. Funeral Expenses

If you are a dependent family member, you can claim up to Rs. 15,000 to perform the final rites of the expired individual.

The money is paid in cash to the family of the deceased. This benefit helps to alleviate the financial burden on the family of the deceased by covering part of the funeral costs.

7. Post-retirement Benefits

If you have been covered under employee state insurance for at least 5 years, you and your spouse can continue enjoying medical benefits even after your retirement.

Note that you will need to pay a nominal fee of Rs.120 every year to avail of scheme benefits. Additionally, it's important to ensure that your coverage remains active by renewing the nominal fee annually to avoid any lapse in benefits.

8. Provision for Unemployed Individuals

If you become unemployed due to retrenchment, shutting down the workplace, or permanent disability, after having been an insured employee for at least 3 years, you can still enjoy specific benefits under the Rajiv Gandhi Shramik Kalyan Yojana.

These benefits include medical care and an unemployment allowance worth 50% of your pay for up to 1 year.

Unemployed beneficiaries can also claim cash compensation under the Atal Beemit Vyakti Kalyan Yojana. Policyholders will receive 25% of their monthly wages for three months under Section 2(9) of the ESI Act.

Besides the above benefits of the ESI scheme, individuals can also avail compensation of up to Rs.5000 if confined in any place other than ESI hospitals/dispensaries. However, such claims are only admissible up to 2 times.

9. The Extent of Coverage Under the Employee State Insurance Scheme

This scheme applies to all business institutions across India with more than or equal to 10 employees under the Shops and Establishment Act or the Factory Act.

If you wish to understand in detail what the ESIC coverage includes, refer to the following list.

- Section 2(12) under the Employees State Insurance Act 1948 covers all non-seasonal factories.

- Section 1(5) makes this scheme applicable to all restaurants, cinemas, shops, newspaper establishments, road-motor transport undertakings, and hotels. Subsequent extensions have been made to include private educational and medical institutions under the ESI scheme.

As already mentioned, workers with up to Rs.21000 gross salary can subscribe to this insurance scheme, while the salary limit for those with disabilities is up to Rs.25000.

What is Not Covered Under the Employee State Insurance Scheme?

Employee State Insurance (ESI) provides comprehensive coverage, but there are specific exclusions and limitations within the scheme. Here’s what is generally not covered under the ESI:

Who is Eligible for the ESI Scheme?

The Employee State Insurance (ESI) Act provides social security and health insurance benefits to employees working in various sectors. Here’s an overview of the eligibility criteria:

List of Long-term Diseases Covered by Employee State Insurance Scheme

Employees facing long-term illnesses struggled when regular sickness benefits ended after 91 days. To help, the Extended Sickness Benefit allows them to receive payments for up to 2 years within a 3-year period if they remain unwell.

The ESI Covers the following long-term diseases:

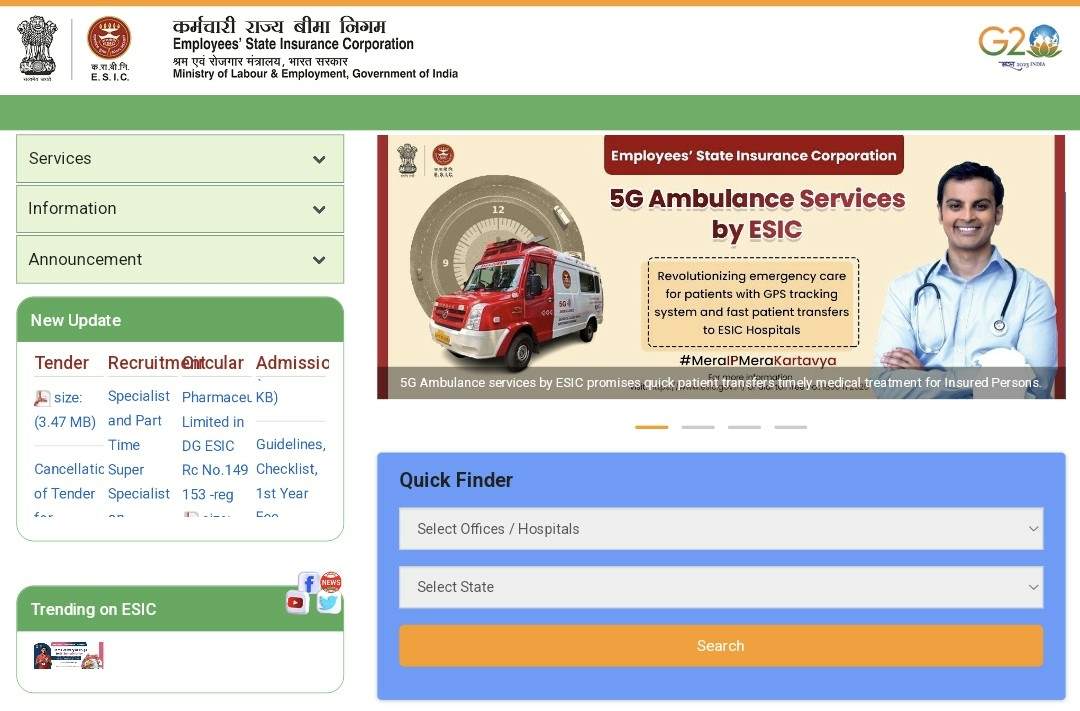

How to Register for ESIC Online?

If you own a company and want to register the same under ESIC, here is a step-by-step guide:

Step 1: Visit the official ESIC portal and click on “Sign Up.”

Step 2: Fill in the form on the next screen with accurate details and submit.

Step 3: Next, you will receive a confirmation mail containing your username and password details on your registered e-mail ID.

Step 4: Using your received username and password, log in on the ESIC portal and click on “New Employer Registration.” Choose a “Type of Unit” from the drop-down menu and select “Submit.”

Step 5: Now duly fill in the “Employer Registration Form 1” and submit it along with all mandatory documents.

Step 6: You will be redirected to a page titled “Payment of Advance Contribution,” where you need to enter the amount for 6 months’ advance contribution and choose the payment mode.

Post completion of payment, you will receive a Registration Letter (C-11) containing a 17-digit ESIC registration number.

What are the Documents Required for ESIC Registration?

Before proceeding with online registration under ESIC, make sure to keep the following documents handy.

- Registration certificate or licence under the Shops and Establishment Act or Factory Act.

- Partnership deed for partnership firms and Certificate of Registration for Private Limited Companies.

- List of all workers with their monthly compensation details.

- Address proof and PAN card of all employees as well as the business entity.

- List of shareholders, partners, and directors of the establishment.

- Employee attendance registers.

Once business owners successfully register themselves under this scheme, they can enrol new employees as and when they join the institution. After successful enrolment, every worker will receive an ESIC or Pehchan card, which they need to produce every time they want to avail of this scheme’s benefits against medical treatments.

How to Find a Hospital List Under Employees' State Insurance Corporation (ESIC)?

To find the list of hospitals empanelled under the Employees' State Insurance Corporation (ESIC), you can follow these detailed steps:

Step 1: Visit the Official ESIC Website: Open your browser and go to the ESIC hospitals page by navigating to https://www.esic.gov.in/ssts.

Step 2: Select Your State: On the ESIC hospitals page, you will find a drop-down menu or search field. Enter the name of your state or select it from the list provided.

Step 3: Initiate the Search: After selecting your state, click on the ‘Search’ button. This will prompt the system to display a list of hospitals that are empanelled in your region.

Step 4: Browse the Hospital List: Once the results are displayed, you can browse through the list of hospitals. Each hospital will have details about its specialisation, services offered, and coverage under the ESIC scheme.

By following these steps, you can easily access a comprehensive list of ESIC hospitals in your area, ensuring that you and your dependents receive the appropriate medical care covered by the ESIC scheme.

Know about: Digit's Cashless Network Hospitals

What is an Employee State Insurance Card or Pehchan Card?

If you are wondering what your proof of ESIS registration is, the ESI or Pehchan card is that document. It helps the hospital authorities identify the insured, trace his/her medical history, and display the following details.

- Name of the insured individual

- His/her insurance number

- Address details

- Insured individual’s date of birth

- Family photograph

As an employee, you will receive a temporary ID card valid for up to 90 days till the actual ESI card is issued. The latter is a permanent card that will remain the same throughout the rest of your life. However, note that you must get yourself registered in your new employer’s portal every time you switch jobs.

Haven’t you received your Pehchan card yet?

How to Download an ESI Card Online?

Ensure that your employer has registered your details correctly in the ESIC database before attempting to download the card. Here are the steps to download the card:

- Visit the ESIC Portal: Go to the official ESIC website and click on employee/beneficiary.

- Login: Use your credentials (user ID and password) to log in to the portal.

- Access Employee Details: Navigate to the 'Employee' section and select 'Employee Details'.

- Download ESI Card: Find the option to download the 'e-Pehchan Card' and click on it.

- Print the Card: Once downloaded, you can print the ESI card for use.

Medical Packages Under ESIC

The medical packages under the ESI scheme offer comprehensive coverage for scheme beneficiaries. Check the table below for the detailed package list:

Hospitalisation Process Under the Employee State Insurance Scheme

The Employees' State Insurance Scheme (ESIC) provides inpatient treatment (hospitalisation) to insured persons (IPs) and their family members in areas with "Full" medical care facilities.

The hospitalisation process under the Employee State Insurance (ESI) Scheme starts with visiting an ESI dispensary for an initial consultation. If hospitalisation is necessary, the dispensary doctor will provide a referral slip to an ESI hospital or an empanelled private hospital.

During emergencies, patients can directly visit an empanelled hospital without a referral but must notify ESI authorities within 24 hours. Once admitted, the ESI scheme covers most hospitalisation expenses, including treatments, surgeries, and medications.

After being discharged, patients should visit their ESI dispensary for any follow-up care, which is also covered under the scheme.

Know about: Pre-Post Hospitalization Expenses in Health Insurance

ESI Toll-Free Number and Address

For any assistance related to the Employees' State Insurance (ESI) scheme, knowing the toll-free number and address is crucial. This information helps you quickly connect with ESI representatives for queries or support.

- Toll-Free Number: 1800-11-2526

- Medical Helpline: 1800-11-3839

- Address: Employees' State Insurance Corporation (ESIC) Panchdeep Bhawan CIG Marg New Delhi - 110002 India

Regular Health Insurance Plan vs Employee State Insurance Scheme

Understanding the differences between regular health insurance plans and the ESI Scheme helps you choose the best option for your healthcare needs. Here's a comparison table between a Regular Health Insurance Plan and the Employee State Insurance Scheme:

Even the most basic of medical insurance policies seem to be unaffordable for most of our country’s population - a country with 33% of its population earning less than Rs.143 per day, the international daily wage benchmark.

Well, you can apply for one after you switch jobs and cast off all your worries regarding rising healthcare costs by being a part of the ESI scheme!