7 Crore+ Customers

Affordable Premium

E-Way Bill Under GST in Haryana: Documents Required & Validity

An E-Way bill or electronic bill, introduced under the Goods and Service Tax Regime is a quintessential document that is used to track consignments or goods in transit. In Haryana, the concept and use of the E-Way bill have come into effect on 20th April 2018. Since its inception, the application of this bill has instigated a seamless and faster flow of goods through a hassle-free online portal payment system.

Hence, the concept E-Way bills in Haryana has cut the cascading effects of tax evasions and revenue leakages in the state and helped maintain fair trade practices.

What Are the Different Ways to Generate E-Way Bill in Haryana?

There are two methods that taxpayers can follow to generate an E-Way bill in Haryana. One can choose either of the two following methods based on their convenience.

1. Via E-Way Bill Online Portal

Here is the step-wise guide to generating the E-Way bill via the online portal:

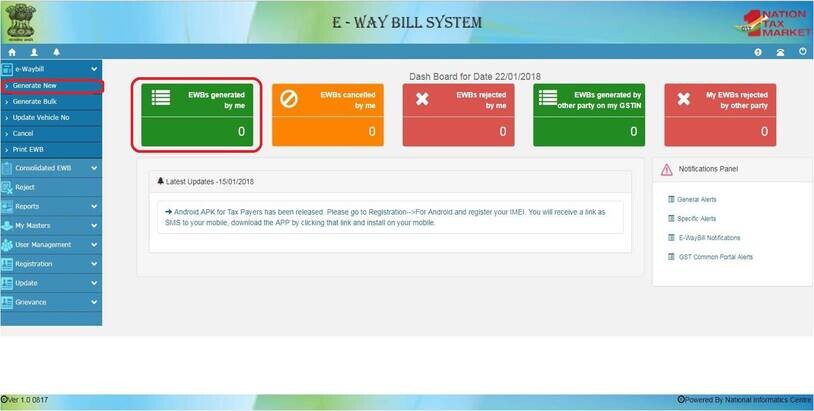

Step 1: Visit the official portal of the Goods and Services Tax E-Waybill System and sign in with your credentials.

Step 2: Select the “E-Way Bill” option and choose the option “Generate New”.

Step 3: Proceed further by providing the following details:

- Transaction Type: Choose the option “Inward” if you are receiving the goods or else “Outward” if you are supplying the goods

- Sub Type: You need to provide appropriate details on this field based on the transaction type

- Document Type: Select the option “bill/challan/invoice of entry or credit note. If you cannot find the document type that matches your criteria, choose “Others”

- Document Number: Input invoice or challan number

- Document Date: Put the date mentioned in the challan or invoice

- From/To: Provide information in this field based on whether you are a receiver or supplier

- Item Details: Give the details about the consignment

- Transporter Details: Include clear details about the transportation of the consignment which includes mode, distance, and vehicle number.

Step 4: Once done filling up the details, select the "Submit" option.

Step 5: The portal will start with the validation process and flag any errors if there are any.

Note: Know that once the validation process is completed, the portal will generate an E-Way bill in the EWB-01 form containing a 12-digit number.

2. Via SMS Mode

The generation of the E-Way bill can also happen via the SMS mode using the E-Way bill login in Haryana. Here are the steps to follow:

Step 1: Visit the official portal of the Goods and Service Tax E-Way Bill.

Step 2: Select the Registration tab and choose “For SMS”.

Step 3: On the redirected page, your registered mobile number will pop up. Verify the number by clicking on "Send OTP". Provide the OTP at the designated place and continue to the next process.

Step 4: The verification of this process shows that you are eligible to generate an E-Way bill through the SMS.

Step 5: Follow the correct format for the SMS which is –

E-Way Bill Generation > Transaction Type> GSTN> Pincode> Invoice Number> Invoice Date> Total Value> HSN Code> Approximate Distance in Kms> Vehicle.

Ensure to add a space in between every code. Send the SMS to 7738299899

Here is the list of E-Way bill codes and their implications for better understanding:

|

Code |

Definition |

|

EWBG |

e-Way Bill Generation |

|

TranType |

Transaction Type |

|

RecGSTIN |

GST Identification Number |

|

DelPinCode |

Pin code of the delivery address |

|

InvNo |

Invoice Number |

|

InvDate |

Invoice Date |

|

TotalValue |

Total Value of services and products |

|

HSNCode |

HSN code of the goods |

|

ApprDist |

Distance between places of supplier and recipient |

|

Vehicle |

Vehicle Number |

What Are the Documents Required for Generating E-Way Bill in Haryana?

E-Way bill registration in Haryana is an important activity that every dealer who is registered under the GST regime must abide by. Here is the list of documents required for generating an E-Way bill in Haryana:

- Challan, invoice, or bill of supply related to the consignment of goods

- If the goods are transported via roads, submit the vehicle number or Transporter ID

- If the goods are transported via rail, ships, and air, one needs to submit the transport document number, transporter ID, and date.

What is the Validity of E-Way Bill in Haryana?

Generally, the validity of the E-Way Bill is determined by the time and date of the E-Way Bill generation. In addition to this, an E-Way bill has the validity of the period mentioned below which is calculated based on the distance travelled by the goods with transit status.

| Type of Conveyance | Distance | Validity of the E-Way Bill |

Over Dimensional Cargo |

Below 200 Km | 1 Day |

| For every additional 200 Km or other part travelled | 1 Additional Day | |

Other than Over-Dimensional Cargo |

Below 20 Km | 1 Day |

| For every additional 20 Kms or any other part travelled | 1 Additional Day |

It is important to note that the validity of the E-Way bill can be extended within 4 hours before expiry or within 4 hours after the expiry of the E-Way bill.

How to Reject E-Way Bill in Haryana?

Here is the step-by-step guide on how to reject the E-Way bill in Haryana:

Step 1: Visit the official portal of the Goods and Service Tax E-Way Bill System and choose the option “Reject”.

Step 2: On the redirected page, choose the appropriate date of E-Way Bill generation and click on “Submit”.

Step 3: Upon submitting the request, all the E-Way bills that have been generated on the given date will appear.

Step 4: On the side of this list, a checkbox option will be available. Tick mark the E-Way bills that you want to reject. Upon completing this step, a message of rejection will appear and the E-Way bill will be successfully rejected.

It is important to keep in mind that rejection and acceptance can be communicated within 72 hours of the processing of the E-Way bill. If not done within this timeframe, the following bill will automatically get accepted.

How to Cancel E-Way Bill After Its Generation?

The step-wise procedure to cancel the E-Way bill after it is generated is as follows:

Step 1: Visit the official portal of the Goods and Service Tax E-Way Bill System and sign in with your valid credentials.

Step 2: Navigate the option “Cancel” and select the same.

Step 3: On the redirected page, provide the E-Way bill numbers and choose the option “Go”.

Step 4: Choose the appropriate reason for cancellation of the E-Way bill in Haryana

Note: It is important to consider that the time limit to cancel an E-way bill after generating the same is within 24 hours. Additionally, once an E-way bill is cancelled, that bill is illegal for further usage.

Some of the most potent reasons for the cancellation of E-Way bills may be:

- Wrong entry of data

- Duplicate generation of an existing bill

- Other valid reasons

E-Way Bill for Sending Goods Within Haryana

Earlier, an order passed by the State Government of Haryana on 30th March 2018, stated that no individual is required to generate a bill from the E-Way bill system in Haryana for any transactions taking place within the state.

However, this provision has been revised after a new order was passed on 15th April 2018. According to these new provisions, it is mandatory to generate an E-Way bill in Haryana for the movement of goods within the geographical boundaries of the state if the total value of the goods exceeds the limit of ₹50000. This mandate came into effect on 20th April 2018 and applies to dealers.

In addition to the above-mentioned provisions, generating an E-Way bill is quintessential if a GST-registered individual is receiving any consignment from a non-GST-registered dealer. Not only this, an individual who is a transporter of goods and is commuting via rail, air or road must generate this bill if the supplier has not done the same.

E-Way Bill for Sending Goods Outside Haryana

According to the order passed on 7th March 2018 upon the Central Government's discretion, the inter-state or cross-border movement of goods will follow the guidelines and provisions as laid down in the National E-Way Bill system. This clause will come into effect from 1st April 2018.

Hence, as per this provision, for any transaction or movement of goods outside the borders of Haryana, it is mandatory to generate an E-Way bill through the official portal.

What is the Format of E-Way GST Bill in Haryana?

The format of the E-Way bill in Haryana contains two different parts. The first part or Part A of the GST E-Way bill includes details about the consignment. Here is a complete list of the invoice details that one needs to furnish:

- HSN code related to the transported items

- First two digits of the HSN code, if the profit is below ₹5 crore

- Invoice number or challan number

- Complete the HSN code, if the profit is more than ₹5 crore

- Pin code of the delivery location

- GSTN of the recipient

- Purpose of the good movement

- The total value of the consignment

- Transport document number

In addition to the Part A of the E-Way bill in Haryana, the second part or Part B of the bill includes details of the transporter, mainly vehicle number and Transporter’s ID.

What Are the Common Issues Faced by Dealers of Haryana for E-Way Bill?

It is quintessential for the dealers to understand how the E-Way bill system in Haryana works. Many times, they face some of the problems listed below while generating E-Way bills:

Generating E-Way Bill for Multiple Invoices

It is one of the common mistakes of the dealers while generating an E-Way bill for bulk consignment. They tend to merge multiple invoices in a single E-Way bill leading to unnecessary errors and complications. As per the mandate, every dealer must generate a separate E-way bill for every distinct invoice.

Presenting the Wrong Vehicle Number

While generating an E-Way bill in Haryana, most individuals tend to provide the wrong vehicle number or provide the information in an incorrect format leading to errors. This is one of the prime reasons why the vendors are unable to track the consignments with the vehicle number and tracking ID.

Missing Transporter’s ID

Many times it is found that the dealer skips the information that is required to be provided under the Transporter's ID column. This mainly happens when the invoice is being prepared by the third-party transporter which leads to further confusion and misplacement of the consignment. Hence, while generating an E-Way bill in Haryana, it is quintessential to provide all the information correctly.

Errors in Bulk Generation

While generating bulk E-Way bills, most users make grave mistakes and skip providing information correctly. Errors like information repetition, misplacement, etc. occur due to negligence during the bulk generation of E-Way bills.

This article highlights all the specific details and processes concerning the E-Way bills in Haryana. The maintenance and generation of this bill have been able to restore transparency in doing business and fair trade activities in the state. Proper registration and generation of this bill contribute to the greater part of the financial arena and overall growth of Haryana.