7 Crore+ Customers

Affordable Premium

A Detailed Guide to GSTR-8 & Steps to File It

Every e-commerce company must file GSTR-8 on or before the 10th of each month. An organisation that operates, owns and manages an electronic or digital platform or facility for e-commerce is an e-commerce company under GST, such as Amazon, Flipkart, etc. An e-commerce business provides a platform to sellers to reach out to their large customer base and sell their goods or services.

It is mandatory for e-commerce companies to obtain GST and tax collection at source (TCS) registration. This article is going to briefly discuss what GSTR-8 is, how to file it online, and other important aspects related to it.

What Is GSTR-8?

The simple answer to “What is GSTR-8” is that, it is a return that an e-commerce company has to file, that has an obligation to deduct TCS under GST. GSTR-8 contains details regarding amounts of TCS for each supplier that has been effected through an e-commerce platform. Every e-commerce seller should verify the TCS information and transactional details on the GST platform while filing GSTR-2A on or before the 15th of each month.

Meaning of Tax Collection at Source (TCS)

The meaning of TCS is somewhat similar to TDS. This is a tax-collecting mechanism, where on behalf of the Government, an e-commerce operator secures and remits tax when a supplier dispenses products through its portal.

For example, in a case on an e-commerce platform, a customer purchases a product of ₹ 20,000, suppose if the TCS rate is 10%, the platform has to deduct ₹ 200 and remit it to the Government.

What Is the Eligibility for Filing GSTR-8?

There are some prerequisites for filing GSTR-8. Let's look at these conditions:

- Only the e-commerce operator should collect the TCS amount.

- E-commerce operations must have GSTIN that is active.

- He or she has to be registered to be able to submit the tax return.

- Each e-commerce operator must have a class 2 or class 3 digital signature (DSC).

- The DSC should have a mobile number that is registered on the portal.

- An e-commerce operator has to have a valid user ID and password.

How to File GSTR-8 Online?

Let’s take a close look at this 12-step guide on how to file GSTR-8 online:

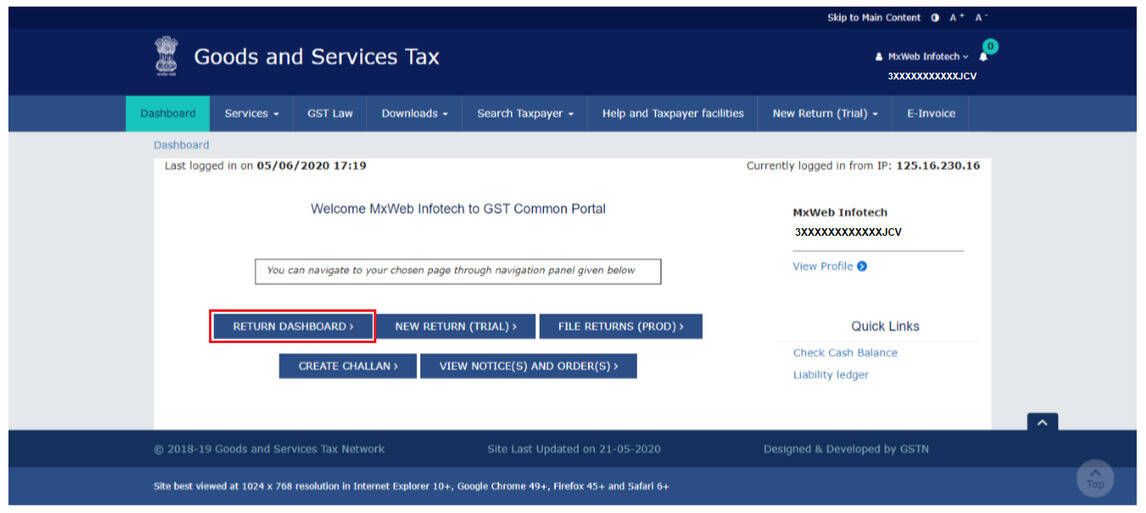

Step 1: Visit the GST portal.

Step 2: Select “Services” and find “Returns” and click on it.

Step 3: On “Return Dashboard” select the relevant financial year and month.

Step 4: There will appear a “Prepare online” section in a dialogue box below GSTR-8, click on it.

Step 5: Three tiles (Tile 3, Tile 4, and Tile 5) will appear on-screen. Fill in with necessary details in each tile:

In Tile 3, one can fill in documents regarding the TCS of the current month. Through Tile 4, one can use this to amend any details of previous files except the first year. Tile 5 is for viewing interest that one has to pay for delays in tax payment.

Step 6: In Tile 3 (Details of Supplied attracting TCS) fill in details such as the gross value of supplies produced and returned by registered and unregistered persons to the Supplier, the Supplier’s GSTIN, the amount of TCS under IGST/ CGST/ SGST heads.

Step 7: If there happen to be any erroneous entries in previous months, you should enter the correct information in Tile 4 (Amendment to details of Supplies attracting TCS) and click on “save”.

Step 8: Verify the data that you have provided by clicking on “Preview GSTR-8”.

Step 9: After verification, click on “Proceed to File,” you have to wait until you see an update in status to “Ready to File”. This will bring forth Tile 6, 7 (Payment of Tax) and enable Tile 5 (Details of interest).

Step 10: Click on Tile 5 and enter information regarding tax payments for that month.

Step 11: One can acknowledge the GSTR-8 filing declaration after previewing its draft.

Step 12: Complete the filing procedure with the help of an electronic Verification Code (EVC), and Digital Signature Certificate (DSC) by clicking on “File GSTR-8”.

Documents Required for Filing GSTR-8

GSTR-8 details are divided into 9 sections, in 6 of them one has to provide details. Let’s look at them one at a time through these pointers:

- One has to provide GSTIN. However, if one does not have a GSTIN, one can use a provisional ID.

- The mechanism auto-populates the names of taxpayers when they log into the GST portal.

- One has to provide information about supplies that happened via an e-commerce platform. For example, one has to mention the gross values of products that they have supplied to individuals who have registration and to those who do not. One also has to mention the gross values of products that those individuals have returned using the e-commerce portal.

- There is also information such as interest build-up if one has failed to pay TCS amount on time. The calculation of interest will be on the outstanding tax amount.

- This file includes a section that displays the total amount of tax one has to pay and distributes it to sections for IGST, CGST and SGST.

- The database also includes debit entries (after submission of return and payment of tax) in cash ledger for interest or TCS payment.

What Is the Due Date for Filing GSTR-8?

Taxpayers need to contact their e-commerce operators, who will furnish and process GSTR-8 every month. The due date is usually the 10th of every succeeding month for a tax period. Here are some of the upcoming due dates.

What Are the Benefits of GSTR-8?

GSTR-8 is beneficial due to various reasons. Here follows a list of them:

- It secures information about tax collected at the source of all the supplies.

- GSTR-8 information furnishes all about the supplies that the supplier has used the e-platform for.

- After an e-commerce operator completes their GSTR-8 filing, the goods providers can get an input tax credit of the tax that is collected as TCS.

What Are the Penalty and Consequences for not filing GSTR-8?

In case of failure to file GSTR 8 on time, a penalty of Rs. 100 under CGST and Rs. 100 under SGST shall be levied per day. The maximum amount of penalty is Rs. 5000. There is no late fee prescribed on IGST for delayed filing.

Along with the late fee, an interest of 18% p.a. has to be paid from the next day of filing to the date of payment.

Conclusion

GSTR-8, once filed, cannot be revised. Any mistakes must be rectified in the subsequent month's return. For example, an error in October GSTR-8 can be corrected in November GSTR-8.

The GST system continues to evolve with significant changes in 2025 aimed at enhancing compliance and transparency. E-commerce operators should ensure they're using the updated GSTR-8 format and adhering to the new TCS calculation and filing deadline rules to avoid penalties and maintain smooth business operations.