7 Crore+ Customers

Affordable Premium

Understanding E-Way Bill Under GST in West Bengal

An e-Way bill or an electronic bill is a must-have for inter and intra-state commodity transportation. It helps to monitor the flow of goods under GST regulations to repel the risk of tax evasion.

In West Bengal, the e-Way bill has come into action since 2018. Implementation of e-Way bills results in snappier turnaround times. Moreover, it has unbelievably improved nationwide logistics networks reducing the chances of traffic congestion. To know more about e-Way bill login in West Bengal, keep on reading this article.

Different Ways to Generate e-Way Bill in West Bengal

Taxpayers must register themselves to create new e-Way bills. One can opt for either of the following two ways for a hassle-free generation process:

Via e-Way Bill System

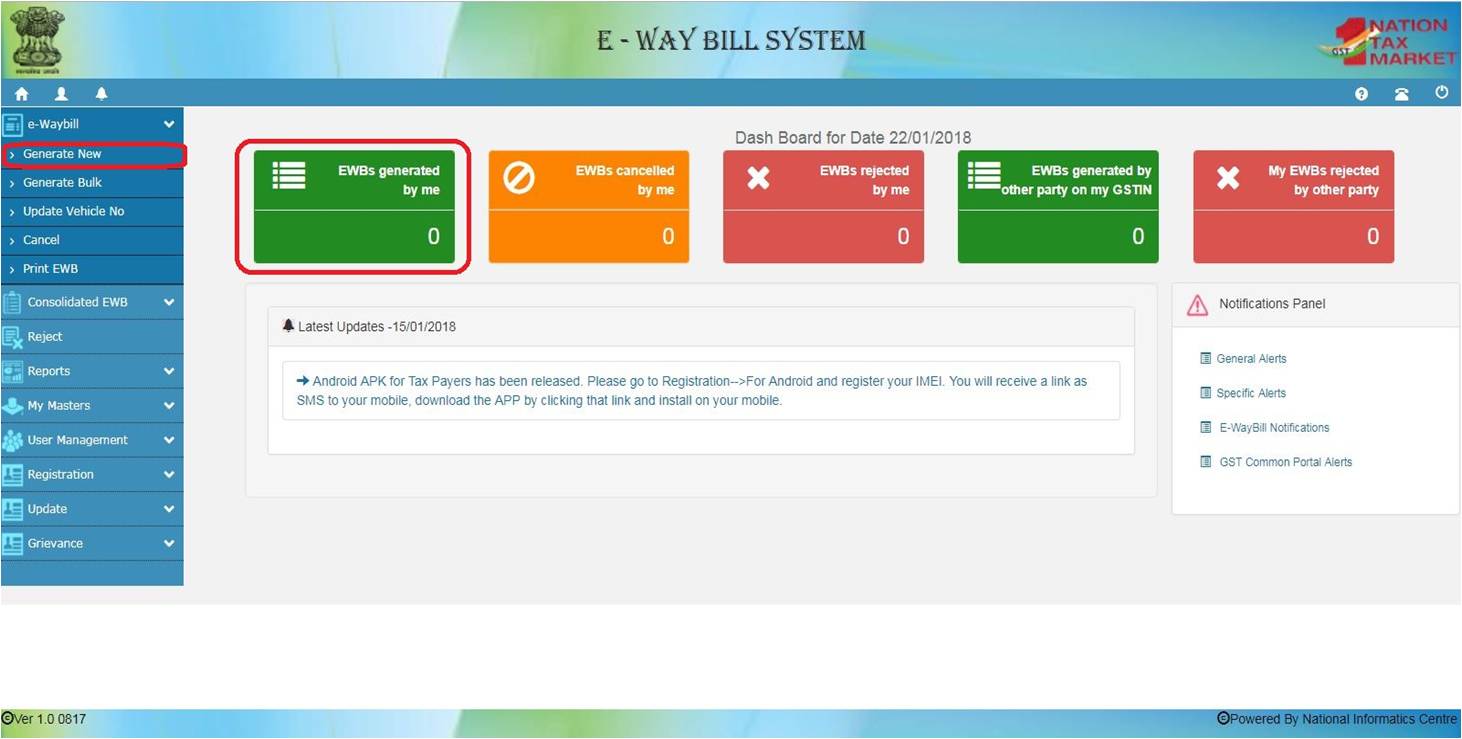

Step 1: Sign in to the e-Way Bill System in West Bengal using your pre-set credentials.

Step 2: Navigate to “e-Waybill” and proceed with the option “Generate New”.

Step 3: Enter relevant details in the following fields:

- Transaction Type: Input ‘inward’ if you are at the receiving end and ‘outward’ if you are at the supplying end.

- Sub Type: As per the transaction type, this option will appear. Fill in the fields with appropriate details.

- Document Type: Choose among bill/challan/invoice/bill of entry/credit note. If nothing looks applicable, then proceed with "Others".

- Document No.: Invoice or challan number will go here.

- Document Date: Drop in the date of the invoice or challan.

- From/To: Fill this portion depending on whether you are a supplier or a recipient.

- Item Details: Fill in the details of your consignment.

- Transporter Details: Add the details of the transportation of the consignment (Mode, distance, and vehicle number).

Step 4: Once filled, click on the submit option.

Step 5: The system will initiate the validation process and reflect errors, if any.

Please note: This final step will generate an e-Way bill in the EWB-01 form with a distinctive 12-digit number.

Via SMS

Step 1: Log into the e-Way Bill Portal with credentials.

Step 2: Navigate to Registration > For SMS.

Step 3: Post-selection, a new page will open up where your registered mobile number will be displayed partially. Click on “send OTP” to verify the number. Enter the OTP received on your registered mobile number and email.

Step 4: Once verified, you are eligible to access the e-Way bill generation facility via SMS.

Step 5: Write the details of the following codes in chronological order and send the same to 7738299899.

|

Code |

Definition |

|

EWBG |

e-Way Bill Generation |

|

Tran Type |

Transaction Type |

|

Rec GSTIN |

GST Identification Number |

|

Del Pin Code |

Pin code of the delivery address |

|

Inv No |

Invoice Number |

|

Inv Date |

Invoice Date |

|

Total Value |

Total Value of services and products |

|

HSN Code |

HSN code of the goods |

|

Appr Dist |

Distance between places of supplier and recipient |

|

Vehicle |

Vehicle Number |

Please note: Ensure to give a space between each code. For example, “EWBG TranType RecGSTIN DelPinCode", etc.

Documents Required for Generating e-Way Bill in West Bengal

Please make sure to keep the below documents within reach while generating e-Way bill in West Bengal:

- Relevant invoice/ supply bill/ challan of the consigned goods.

- The number of the vehicle or transporter ID if the consignment is being transported by road.

- Transporter ID, document number, and date of the transport if the transportation process is rail/ air/ ship.

Validity of e-Way Bill in West Bengal

Please note: The validity of the e-Way bill can be extended 8 hours after or prior to its expiry. However, the extension can only be considered if unprecedented incidents like natural disasters, public riots, accidents, etc, have occurred.

Transport type |

Distance covered | Validity of EWB |

|---|---|---|

| Other than Over Dimensional Cargo (ODC) | Upto 200 km | 1 day |

| For every 200 km from there | Additional 1 day | |

| Over Dimensional Cargo (ODC) | Less than 20 km |

1 day |

For every 20 km therefrom |

Additional 1 day |

Please note: The validity of the e-Way bill can be extended 8 hours after or prior to its expiry. However, the extension can only be considered if unprecedented incidents like natural disasters, public riots, accidents, etc, have occurred.

Procedure to Reject e-Way Bill in West Bengal

A vendor can reject e-Way bills generated by third parties on his/her GSTIN within 24 hours. The steps are as follows:

Step 1: Launch the e-Way bill portal and log in.

Step 2: On the left of the dashboard, go to “reject” and click.

Step 3: Enter the date on which EWay bill was generated. A list of eway bills generated on the date will be displayed below.

Step 4: Check the box situated beside the concerned bill and Click on ‘Reject’.

Cancellation of e-Way Bill After Its Generation

The generator of e-Way bills can cancel it within 24 hours. Following are the steps to do so:

Step 1: Sign in to the e-Way bill portal and navigate to “cancel”.

Step 2: Enter the e-Way bill number and proceed with “go”.

Step 3: Provide relevant reasons for the cancellation to cancel the bill.

E-Way Bill for Sending Goods Within West Bengal

The e-Way bill in West Bengal for the intra-state movement was imposed on 3rd June 2018 for all consignments exceeding the value of ₹50,000. However, as per the updated notification issued on 06.06.2018 by the Directorate of Commercial Taxes, West Bengal, consignments surpassing a value of ₹1,00,000 need to generate an e-Way bill.

As per the report, West Bengal has seen a 30% to 40% growth in revenue post-implication of the e-Way bill system for intrastate goods transportation.

e-Way Bill for Sending Goods Outside West Bengal

On the other hand, the e-Way bill under GST in West Bengal for inter-state has come into action from 1st April 2018. Merchants are required to generate the bill for all taxable goods where the total value stands for ₹50,000 or more.

From the day of its implication, West Bengal witnessed approximately 15% of growth in revenue collection, which has undoubtedly strengthened the financial structure of the state.

Common Issues Faced by Dealers of West Bengal for e-Way Bill

Dealers must have a clear knowledge of e-Way bill login in West Bengal. Here is a list of common issues that they face while generating e-Way bills.

- A single e-Way bill for multiple challans or invoices: While creating an e-Way bill for a bulk of consignments, taxpayers tend to merge numerous invoices in one e-Way bill leading to unnecessary errors and hassles. Please note that it is essential to generate a unique e-Way bill for every invoice.

- Incorrectly furnished vehicle number: Most of the time, users fail to furnish vehicle numbers in a valid format. Due to this, vendors are unable to track their consignments.

- Not adding Transporter ID: Records state that dealers tend to skip the transporter ID column if the consignment is being performed by a third-party transporter. It leads to further confusion. Please note that it is imperative to provide a transporter ID to generate an e-Way bill.

- Facing errors in Bulk Generation Facility: The Bulk Generation of e-Way bills requires attention more than ever. Most users find it difficult to use. At times, they end up implying a used template similar to previous entries, which leads to errors.

Here is all about e-way bills under GST in West Bengal that you must know. If you have gone through this piece, you know how it has helped in the overall growth of business in the state. This is completely due to the growth of revenue collection, which in turn strengthens the financial pillar of the state.