7 Crore+ Customers

Affordable Premium

Know everything about GST Invoice Bill

Implementation of the Goods and Services Tax (GST) is probably one of the most significant tax reforms our country has seen, and there have been many discussions on the topic ever since.

Some of the prominent queries here can be surrounding the GST invoice bill – the building block of this tax system. Here we provide a brief insight into what this document is and the several guidelines involving it. Read on!

What is the GST invoice?

If you are a GST-registered business, you are probably familiar with what a GST invoice is. However, for all the customers, here is a quick brief.

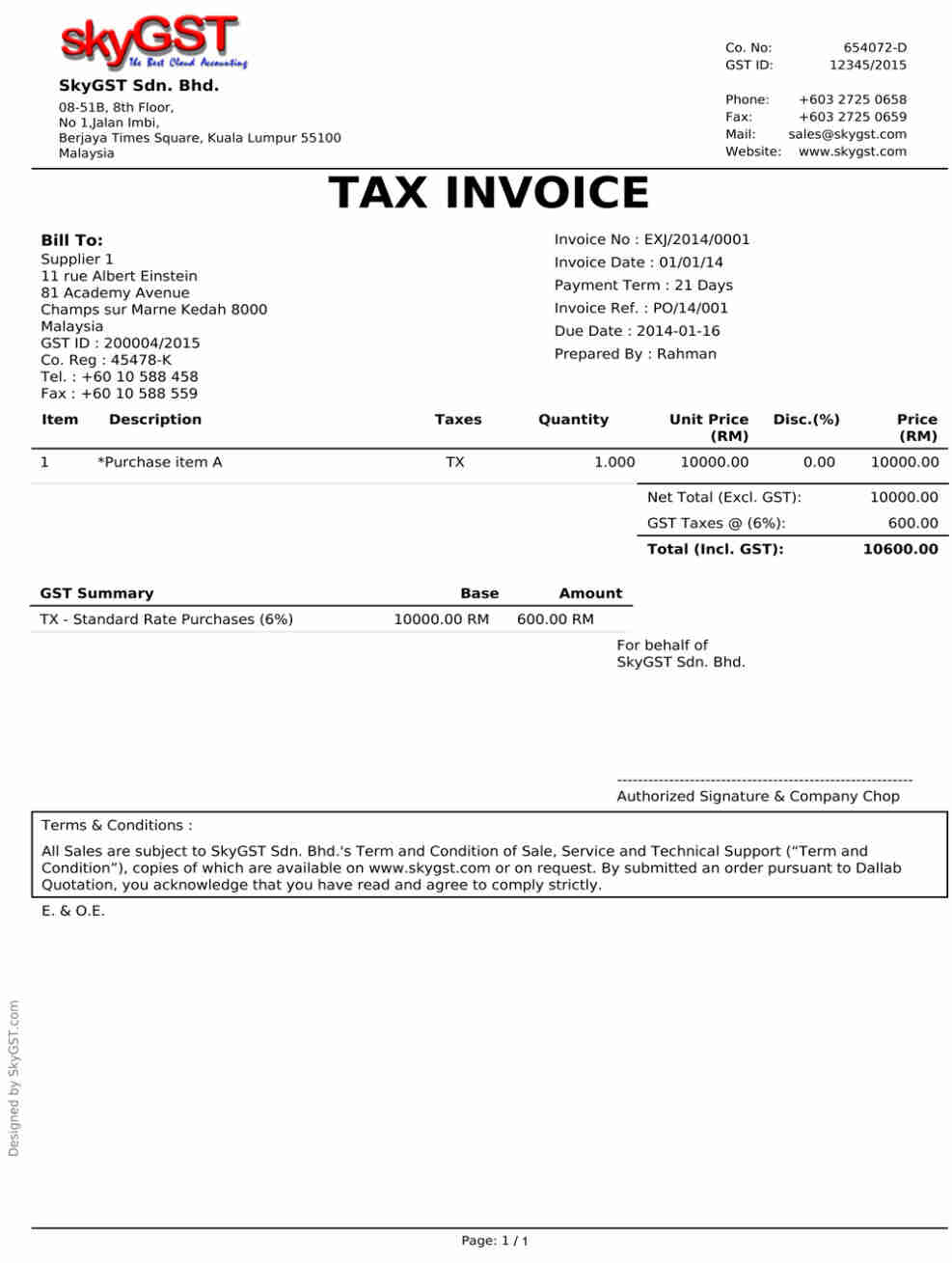

A GST-compliance purchase invoice contains the details of the parties involved in the mentioned transaction and lists all goods and services sold, with their prices. This bill also displays the percentage of discounts and taxes charged on each item, besides other details.

Do all businesses need to issue GST invoices?

A GST invoice must be issued without fail by businesses that hold a GST registration. Other enterprises, however, do not need to issue these particular invoices.

Mandatory fields in GST invoice

Here is a list of particulars that must be present in a GST tax invoice specified under Rule 54 of the CGST Act of 2017.

Name, GSTIN, and address of the supplier

Invoice number

Date of issuance

Invoice type

Shipping and billing address

Name of the customer

Address of the recipient

Address of Delivery

State name and State Code

GSTIN of the customer if registered

Details of products and services provided, including description, quantity, etc.

SAC code or HSN code

Rate of CGST, IGST, UTGST, and SGST charged

Total tax amount and discounts, if any

Reverse charge

Signature of the invoice issuer

Here, have a look at how it looks on paper.

Now you might be wondering if it is necessary to enclose every single of these details in a GST invoice bill. Well, it is mandatory when there are laws to enforce it.

GST tax Invoice Rules

When following the above guidelines in terms of invoice contents, issuers need to consider certain rules that specify the “what” and “how” of these details.

GST invoice serial number rules

Following are the mandates that issuers need to follow as per Rule 46 (b).

- The invoice numbers must be sequential or consecutive.

- They must be unique for a financial year, containing an alphanumeric combination.

- A serial number must not exceed 16 characters.

- GST should be split into CGST, SGST, and IGST. It must not be charged as a whole.

- In the case of any transactions made outside the issuer’s state, a separate tax called IGST has to be charged. On the other hand, SGST and CGST should be charged against sales within the same state.

GST invoice signature rules

The CGST rules make the issuer's signature one of the mandatory fields in a GST invoice. Specifications of a valid signature are as follows.

- The bill can be signed by hand or digitally, provided it is affixed as per the mandates of the Information Technology Act, 2000.

- The GST invoice bill must be signed by the supplier or his/her authorised representative.

As per section 116 (2), his/her ‘authorised representative’ can be a company secretary, a practising advocate, a chartered accountant, a retired officer of the Commercial Tax Department, or a regular employee appearing on the supplier’s behalf.

GST invoice payment rules

Another mandate under the CGST Act concerns a scenario where a GST-registered individual makes purchases from a seller who is not registered. There can be 2 cases here.

- If the registered individual buys from an unregistered entity, the former has to issue a tax invoice.

- If the registered individual receives supplies exempted from GST, he/she needs to issue a bill of supply instead of an invoice bill.

Now, you might be wondering that it might get difficult to always issue an invoice following such extensive guidelines right upon purchase every time.

To ease this process, the Indian government has also provided outlines regarding the time of issue of invoice under GST.

When to issue a GST invoice?

For goods

- Normal supply: In such cases, the GST invoice bill must be issued on or before the purchased item’s removal. Removal is defined under Section 2 (96) of the principal Act as directly collected by a recipient or dispatched by the supplier for delivery.

- Continuous supply: Here, the date of issue of invoice under GST must be on or before receiving payment or the generation of the account statement.

For services

- General case: The issue of invoice under GST must be done within 30 days of rendering such services.

- Financial services: For services provided by banks, NBFCs, and other financial institutions, the last date of issue of invoice under GST is the 45th day from the date of service supply.

- From April 1, 2025, businesses with an Annual Aggregate Turnover (AATO) of ₹10 crore and above must report their B2B e-invoices to the Invoice Registration Portal (IRP) within 30 days from the date of issue.

That was all about the important rules and regulations regarding tax invoices. Now, this is not the only type of invoice in practice.

Want to know about the other prevalent types under GST?

Keep reading.

What are other types of invoices under GST?

Bill of supply

The only difference between a bill of supply and a tax invoice is that a 0% or no GST is charged in the former. Therefore, this type of invoice can be issued in 2 cases.

- When a GST-registered supplier has chosen the composition scheme.

- When a GST-registered supplier is dealing in exempted services and goods.

As a result, the recipient does not have the provision to claim an input tax credit based on this document.

Also, a registered entity can issue an all-encompassing invoice-cum-bill of supply if it deals in both exempt and taxable services/goods.

Aggregate invoice

If a seller issues multiple invoices to an unregistered buyer, each less than Rs.200, he/she can issue a single invoice, summing up all the amounts. This is called a bulk or aggregate invoice.

Debit and credit note

Such commercial documents are issued when there is any discrepancy found in a previously issued tax invoice for a product or service.

A debit note is issued when any of these 2 conditions arise.

- The formerly issued tax invoice displays a lower taxable value than the correct amount.

- The amount of tax charged in this tax invoice is lower than the actual value.

On the other hand, a credit note is issued for the opposite reasons.

- The taxable amount or tax charged in the invoice is higher than the correct figures.

- There is a discrepancy in services or products provided, and the buyer returns them and asks for a refund.

Besides the above types of invoices in GST, there are several other documents and vouchers relating to such transactions, depending on several conditions.

Revising invoices issued before GST

There can be several instances of incorrect GST invoices being issued. Under current GST rules, such invoices can be revised.

If a supplier becomes liable for GST registration and applies within 30 days, the effective date of registration is the date of liability. Any invoices issued between the date of liability and the date of registration approval must be revised within one month from the date of issuance of the GST registration certificate.

The revised invoice must be clearly labelled as “Revised Invoice” and include all mandatory details such as GSTIN, invoice number, date, HSN/SAC codes, and place of supply.

As of September 22, 2025, GST rates have been revised under GST 2.0. Businesses must ensure that invoices reflect the correct rate based on the time of supply rules.

Additionally, revised MRP stickers on unsold stock are now optional, and businesses may pass on GST rate benefits through point-of-sale discounts or by updating their price lists.

For businesses with turnover above ₹5 crore, e-invoicing is mandatory, and invoices must be uploaded to the IRP within 30 days of issuance.

Conclusion

There you go! These are the relevant details regarding a GST invoice. Given the recent rate changes effective September 22, 2025, and the stricter e-invoicing timelines, it is crucial to ensure that your billing systems and software are updated to remain compliant. If you are a registered dealer, ensure that you issue such documents to avail of Input Tax Credit (ITC). If you are not GST-registered yet, consider getting a certificate to help your business benefit from such provisions.

How many copies of invoices should a supplier issue?

Since proof of transaction should remain with all parties involved, there are a specific number of invoice copies issued depending on the type of supply.

1. For goods

The dealer must produce 3 copies of the GST invoice bill issued.

- Original copy: Received by the buyer

- Duplicate copy: Received by individuals delivering the products from the supplier’s end to the recipient’s end

- Triplicate copy: Must be kept with the dealer

2. For services

In the case of services, the issuer needs to arrange 2 copies of the invoice.

- Original copy: Sent to the buyer

- Duplicate copy: Remains with the supplier for later reference.

There you go! These are the relevant details regarding a GST invoice bill. If you are a registered dealer, ensure issuing such documents to avail Input Tax Credit (ITC). If you are not GST-registered yet, consider getting a certificate to help your business benefit from such provisions.