7 Crore+ Customers

Affordable Premium

GSTR-7: Meaning, Documents Required & Filing Procedure

The government of India introduced the Goods and Services Tax (GST) to levy a tax on the prices of goods and services for domestic consumption in this country. However, not all taxpayers are required to bear the tax amount. As a result, they can deduct this tax at source with forms like GSTR-7.

Are you curious to know what GSTR-7 is? Keep reading this article to get a comprehensive overview of this form.

What Is GSTR-7?

GSTR-7 is an important form for monthly returns. Individuals who need to deduct tax at source while making payments to vendors and suppliers need to fill up and submit this form. It applies to those who get to deduct TDS as per their income slab. If you are curious to know the meaning of GSTR-7, this form contains all the details, such as TDS amount, TDS paid or payable, refund, etc.

What Is the Eligibility for Filing GSTR-7?

Before knowing how to file GSTR-7, it is important to find out the eligibility criteria. Here are the prerequisites for filing GSTR-7:

- Applicants must be registered taxpayers under the GST regime.

- They must have a valid GSTIN.

- Their aggregate business turnover should be more than ₹20 lakhs.

- They must record the transaction for deducting or paying their taxes.

Furthermore, following the GST law, the following individuals or entities can claim a deduction in the TDS:

- A local authority.

- A department of State or Central Government.

- Other government agencies.

- People under the Council’s recommendation.

- Authorities or boards with 51% equity owned by the government.

- Public sector undertakings.

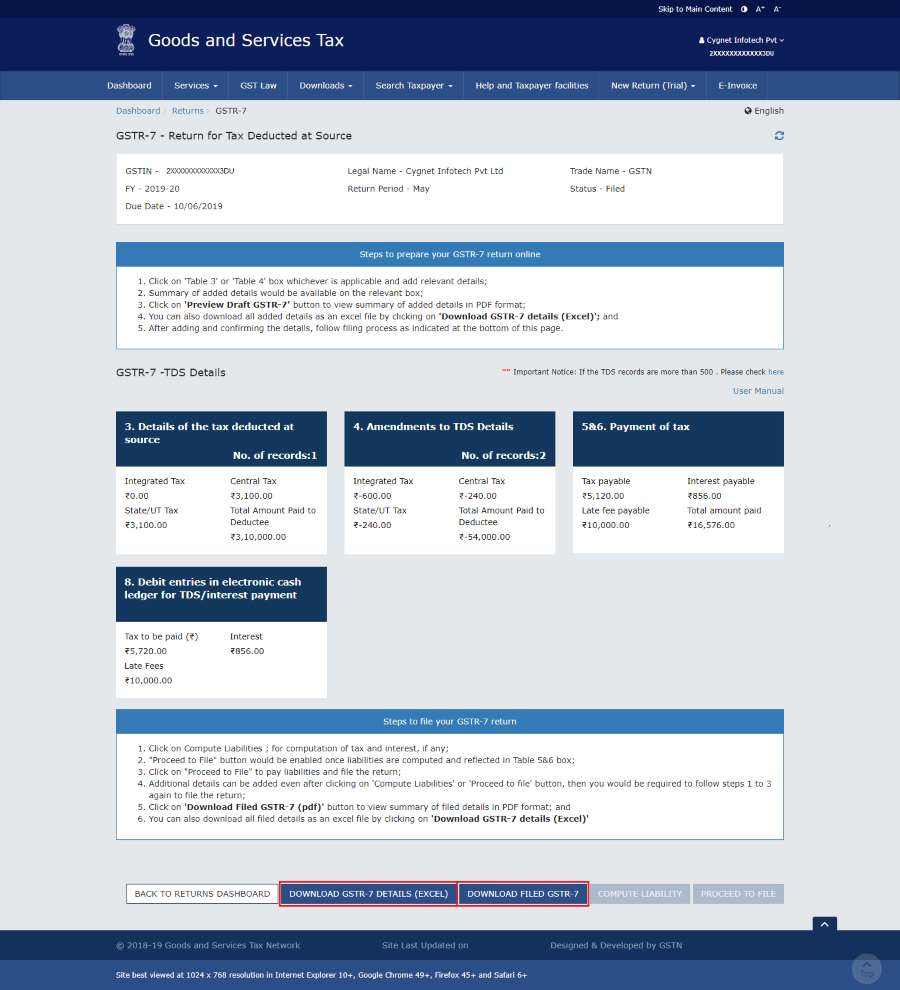

How to File GSTR-7 Online?

Filing GSTR-7 can be complicated without proper guidance. If you are wondering how to file GSTR-7 return online, here are the steps you can follow:

Step 1: Visit the login portal of GST. Log in with your username and password.

Step 2: Bring your cursor to the "Services" section and click on "Returns". Go to "Returns Dashboard".

Step 3: From the "File Returns" tab, choose the financial year and the period for return filing. Click on "Search".

Step 4: Choose the "Prepare Online" option. It will display GSTR-7 on your screen. Read all the instructions and fill out its sections.

Step 5: Preview GSTR-7 form, check for errors and rectify these. Sign a certificate to state that the provided information is accurate.

Step 6: Click on “Submit”.

How to File GSTR-7 Offline?

If you are unable to complete the process online, you can also file GSTR-7 form offline. It is important to know how to download GSTR-7 form for this process. Here are a few steps to guide you here:

Step 1: Visit the official website of GST. Bring your cursor to the "Downloads" section and then on "Offline tools".

Step 2: Click on “GSTR-7 Offline Utility” from the drop-down list. On the next page, click on "Download".

Step 3: Click on "Proceed" in the warning box. It will download a zip file named "GSTR7_offline_utility". Extract it.

Step 4: Open this file and choose “Enable editing”. Fill up the form and click on “Validate Sheet”.

Step 5: Check for any errors and ensure your information is accurate. Click on "Get Summary" and then on "Generate JSON File to Upload" to save this form on your device.

Step 6: Visit the login portal of GST and log in. Go to “Returns Dashboard”.

Step 7: From the “File Returns” tab, choose the financial year and the period for return filing. Click on “Search”.

Step 8: Click on “Prepare Offline” and then go to “Choose File”. Upload your JSON file and click on “Proceed to File”. Verify your details with Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

What Are the Details or Documents Mandatory for Filing GSTR-7?

It is important to know the details of the GSTR-7 form before you start filling it out. You must keep these details or documents handy while filling out this form. Here are a few details required to fill in the different sections of the form:

- GSTIN: Each taxpayer receives a state-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN), which is auto-populated at the time of filing the form.

- Tax Deducted at Source: This includes TDS details, like the amount of tax deducted, TDS amount, etc.

- Changes to TDS details: The form should include details of any revision or correction made to the data previously submitted in TDS.

- Tax Deducted and Paid: The form includes details of the TDS amount actually paid to the government and the amount deducted from the taxpayer.

- Late Fees: ₹100 per day under CGST and ₹100 per day under SGST (total ₹200/day), subject to a maximum of ₹5,000. Interest at 18% per annum is also applicable on the TDS amount for the delay period.

- Refund Claims: You must include TDS refund details if you are eligible for a refund from your electronic cash ledger. The bank details should also be included where the refund will be credited.

What Are the Benefits of GSTR-7?

Now that you know how to file GSTR-7 return, it will be helpful to learn more about the features and benefits of this form. The following section discusses the same:

- This form includes all the details of the amount of TDS deducted, TDS paid and payable. It, therefore, serves the role of an effective document.

- GSTR-7 is essential if you need to claim a refund for your deducted TDS amount from the concerned government departments.

- If you are eligible, you can claim your deducted TDS as Input Tax Credit (ITC) and use it to pay your output tax liability.

- After filing GSTR-7, every taxpayer can have access to the TDS details electronically in PART ‘C’ of their Form GSTR-2A.

- It is not possible to file this form without full payment of the previous tax amount. This helps to ensure the complete payment of the taxes on time.

What Is the Due Date for Filing GSTR-7?

It is mandatory to file GSTR-7 form at a specific time every month. The due date is the 10th of every month. This means that the taxpayers must file this form within this date every month to avoid penalties. While occasionally, the government offers an extension for filing this form, and it is advisable to file it within the 10th of every month to stay on the safer side.

What Is the Penalty for Not Filing GSTR-7?

If you are unable to file your GSTR-7 form within the due date, there will be consequences and penalties for the same. There will be a total penalty of ₹200 per day, ₹100 under CGST and ₹100 under SGST. There is no late fee on IGST in this case. However, it is important to make sure that the late fee does not exceed ₹5000.

Apart from that, taxpayers must pay an additional interest of 18% per annum if they are late to filing GSTR-7. This amount is calculated based on the TDS paid. Interest calculation starts from the day after the missed due date.

Hopefully, that gives you a better understanding of what GSTR-7 is. It is an important form of GST which helps you claim a TDS refund. However, it is mandatory to file it within the 10th of every month to avoid the penalties of late fees and interest. This form is effective in keeping track of the TDS amount and claiming refunds through this form.