7 Crore+ Customers

Affordable Premium

GSTR-1: Eligibility, Documents Required & Filing Procedure

GST or Goods and Services Tax is an indirect tax. It came into force on July 1, 2017. GST has replaced other prevalent indirect taxes like VAT, excise duty, and services tax and ideated from the concept of maintaining uniformity in a tax structure.

Taxpayers registered under the Goods and Services Tax Act must file GST returns, whichever is applicable based on the nature of their business. This article highlights all the crucial aspects of how to file GSTR-1 that are pivotal to consider while filing this form.

What Is GSTR-1?

GSTR-1 is a return that contains the compilation of sales constituting outward supplies of a taxpayer. This return is filed either monthly or quarterly by an individual registered under the GST Act and has a valid GSTIN number. The meaning of GSTR-1 can be broken down into 13 main sections and 5 sub-sections, which are:

- Table 1: Provide GSTIN. In case a taxpayer doesn't have a GSTIN number, he/she can mention a provisional id.

- Table 2: The legal name of the taxpayer registered under the GST Act. Please note that the name of a taxpayer will automatically show on the screen during logging into the actual GST portal.

- Table 3: Mention aggregate turnover in the previous Financial Year.

- Table 4: Details about taxable outward supplies which are made to the registered persons. This section specifies all Business-2-Business sales.

- Table 4A: All invoice-wise heads will be mentioned except invoices under reverse charge and sales from e-commerce operators.

- Table 4B: In this sub-section, outward supplies with reverse charge will be mentioned.

- Table 4C: Supplies made through e-commerce operators where TCS is applicable will fall under this section.

- Table 5: Taxable supplies related to outward inter-State supplies whose invoice amount exceeds ₹2.5 lakh. In this section, all supplies to unregistered dealers will be specified.

- Table 5A: In this sub-section, invoices related to B2B supplies to an unregistered dealer will be mentioned.

- Table 5B: In this sub-section, invoices related to B2C supplies through e-commerce operators will be mentioned.

- Table 6: Provide details of invoices related to zero-rated supplies with deemed exports

- Table 7: Mention details of other taxable supplies net of debit notes and credit notes to an unregistered person.

- Table 8: Mention exempted, nil rated and non-GST outward supplies.

- Table 9A: Any amendments related to taxable outward supplies that include credit notes, debit notes, and refund vouchers issued during the current time.

- Table 9C: Mention credit and debit notes issued to a registered person.

- Table 11A & 11B: In this section, advances are adjusted or received in the current taxation period. It may also contain amendment information that is applicable in the previous taxation period.

- Table 12: This section contains information about all outward supplies, which is based on the Harmonised System of Nomenclature (HSN) code.

- Table 13: In this section, all the details about the documents are mentioned that were issued during that period.

What Is the Eligibility to File for GSTR-1?

Under the Goods and Service Tax Act, it is mandated to file GSTR-1 by every dealer who is registered under the Act. This is irrespective of whether there are any transactions or sales for a particular month. As per the provisions of this Act, here are the types of dealers who are exempted from filing GSTR-1 are:

- Input Service Distributors

- Composition Dealers

- OIDAR or suppliers of Online Information and Database Access or Retrieval Services, as specified u/s 14 of the IGST Act

- A taxpayer with a liability to collect TCS

- A taxpayer with a liability to deduct TDS

- Non-resident taxable person

Apart from the list mentioned above of dealers, every registered person dealing with all outward supplies must know how to file GSTR-1.

How to File GSTR-1 Online?

Here is the complete guide highlighting how to file GSTR-1 online for a taxpayer looking for the same:

Step 1: First step of filling the GSTR-1 return starts with logging into the GSTIN portal by providing a username and password.

Step 2: In this step, click on "Services" present on top of the homepage bar. On clicking the "Service" option, you must select "Return" from the dropdown.

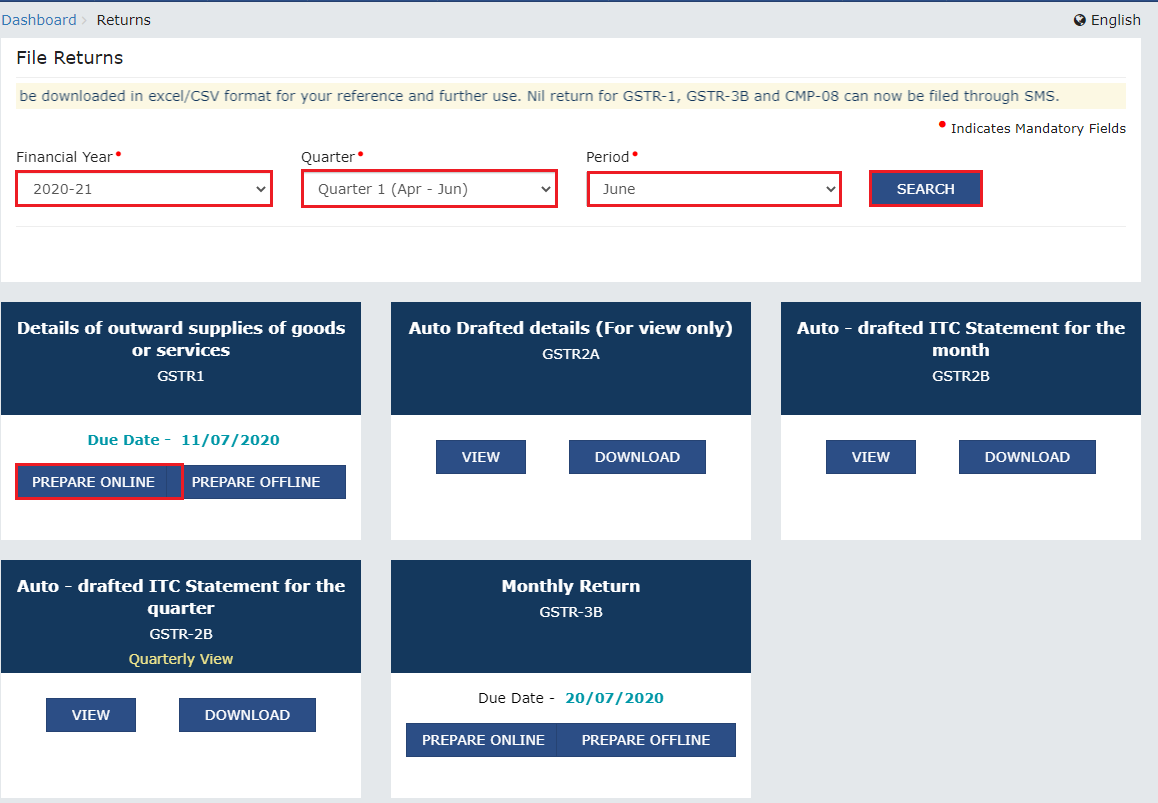

Step 3: On clicking the return option, it will redirect you to the ‘Return’ dashboard page. On this page, the taxpayer needs to select the financial year and month for which he or she is filing the return. Upon filling these details, the month's revenue will appear on that page in the tile position.

Step 4: On this page, select the GSTIN-1 tile. In this particular tile, the taxpayer needs to fill up all the information as mentioned in the 13 sections.

Step 5: This step to filing GSTR-1 involves adding all the heads of receipts or invoices. If the taxpayer wants, he or she can upload all invoices for convenience.

Step 6: Upon completion of adding all invoices, click on the "Generate GSTR1 Summary" option. However, to avoid the occurrence of any mistakes, it is important to validate the information that has been filled in the form.

Step 7: If the details provided by a taxpayer are accurate, click on the "PROCEED to FILE/SUMMARY" option. Furthermore, a taxpayer will need to click on File Statement and verify the same using digital signature or E-Sign to complete this process.

Step 8: In this final step, a taxpayer will be able to see a confirmation message popped-up. In addition, there will be an option to agree to or deny the pop-up. Upon pressing the "Yes" button, the taxpayer will get an Acknowledgement Reference Number (ARN).

This ARN number serves as proof that a respective taxpayer has filled in the GSTR-1 number.

What Are the Documents Mandatory for Filing GSTR-1?

Generally, applicants do not need to attach documents while filing GST returns. However, information related to the issuance of B2B invoices, B2C invoices, debit notes, credit notes and HSN summaries of sold goods must be uploaded.

Here is the following information that a taxpayer must submit:

- A consolidated report of intra-state sales as categorised by GST rates

- Intra-state sales made through an e-commerce operator

- Inter-state sales based on the state and GST rates

- Details of the export bills containing information like customer GSTIN, type of invoice, invoice number, date of invoice, shipping bill date, etc.

- Information related to the HSN-wise report of goods sold during the month, like HSN code, UQC, total quantity and value, total taxable value, description, etc.

- Consolidated documents that are issued during the tax period.

- A consolidated report of debit notes or credit notes, receipts in advance, and amendments made.

Apart from this, documentation can vary depending on whether an individual has a valid GSTIN or not. It includes:

A taxpayer with a valid GSTIN and issuing B2B invoices must provide the following information:

- GSTIN of customer

- Type of invoice

- Invoice number

- Place of supply

- Date of invoice

- Taxable value

- Rate of GST

- The applicable amount of IGST (Integrated – GST)

- GST Cess applicable

- The applicable amount of CGST (Central – GST)

- The applicable amount of SGST (State – GST)

- GST reverse charge is applicable

Here is the information that a taxpayer must upload with no valid GSTIN filing for B2C invoice which is more than ₹2.5 lakh:

- Invoice number

- Date of invoice

- The total value of the invoice

- Taxable value

- Rate of GST applicable

- IGST amount to be applicable

- SGST amount to be applicable

- CGST amount to be applicable

- GST CESS to be applicable

- Place of supply

What Is the Due Date for Filing GSTR-1?

The due date for filing GSTR-1 depends on the yearly aggregate turnover of a taxpayer. The Goods and Service Tax Act says that:

- Taxpayers generating a turnover exceeding ₹1.5 crore must file GSTR-1 on the 11th of every month.

- A taxpayer whose turnover is up to ₹1.5 crore must file GSTR-1 on the 13th of the following month of the preceding quarter.

What Are the Recent Amendments of GSTR-1?

Some of the highlighted amendments that have come into effect from the recent taxation indirect tax regime which taxpayers searching for “how to file GSTR-1 return” are as follows:

July 2025

Taxpayers cannot file GSTR-1 after the expiry of a period of three years from the due date of furnishing the said return. For instance, returns for June 2022 are barred from being filed from 1st August 2025.

May 2025

HSN Code Reporting in Table 12: Manual entry of HSN codes has been replaced by choosing the correct HSN from a given drop-down menu. Furthermore, Table 12 has been bifurcated into two tabs, namely B2B and B2C, to report these supplies separately.

- Your Turnover (Previous Year) - New HSN Rule

- Up to ₹5 Crore - Must report 4-digit HSN codes

- More than ₹5 Crore - Must report 6-digit HSN codes

May 2025

- Table 13 Mandatory: As mentioned above, filing Table 13, which details documents issued during the tax period, is now mandatory and cannot be skipped.

- Ongoing - GSTR-1A for Corrections: A return once filed cannot be revised under GST. However, any mistake made in the return can be rectified in the GSTR-1A filed for the same period before filing GSTR-3B pertaining to the same period. This is gaining more importance as auto-populated data from GSTR-1 to GSTR-3B is becoming non-editable.

What Are the Benefits of Filing GSTR-1?

Here are some of the benefits that make filing GSTR-1 quintessential are:

- Filing monthly GSTR-1 regularly will allow one to get easy and real-time access to the consolidated summary of returns in GSTR-3B.

- GSTR-1 enables taxpayers to the visibility and accessibility of summarised data at an invoice level.

- In addition, one can convert into the form of an excel sheet this data or report of all outward supplies and share it with an organisation.

What Are the Penalties or Consequences for Not Filing GSTR-1?

As per the current provision of this Act, all registered dealers with outward supplies must file GSTR-1. In case of no outward supplies for a specific month, a taxpayer needs to file a nil GSTR-1 return for that period. Moreover, failure to file this GSTR-1 within the aforesaid time period will attract a maximum late fine of Rs. 200/Day.

In addition to this, taxpayer searching for “how to file a GSTR-1 return” must know the following pivotal updates regarding penalties:

- A taxpayer registered under the GST Act with a yearly aggregate turnover of up to ₹1.5 crore will be liable to pay the penalty of a maximum of ₹2,000 on the occasion of delay in return filing.

- A taxpayer registered under the GST Act earning an annual aggregate turnover of more than ₹1.5 crore. However, less than ₹5 crore will attract a penalty of a maximum of ₹5,000 due to late filing.

- Lastly, registered dealers generating annual aggregate turnover of more than ₹5 crore and failing to file GSTR-1 will be accountable for paying a late fee of a maximum of ₹10,000.

It is essential to note that these penalties do not apply to taxpayers who are filing NIL rate of GST return. Moreover, those eligible to file GSTR-1 must submit a return on time in order to avoid heavy penalties and further legal complications. Understanding all aspects and processes of how to file GSTR-1 will ensure the tax report of businesses is up-to-date.