7 Crore+ Customers

Affordable Premium

What is GSTR-4: Documents Required & Filing Procedure

GSTR 4 is a GST return that must be filed by composition dealers registered under Section 10 of the CGST Act. It came into action with the Third Amendment of 2019 to GST Rules 2017. This article covers all the essential aspects that one must keep in mind while filing GSTR-4.

Read on to learn more about what GSTR-4 is.

What Is GSTR-4?

Good and Service Tax, popularly known as GST, serves as a replacement for other common indirect taxes, such as excise duty, VAT, and services tax. Though the Parliament passed GST on 29th March 2017, it came into action on 1st July 2017.

Unlike other GST returns, GSTR-4 is required to be filed annually, not quarterly. It keeps a record of their outward and inward supplies. To make the meaning of GSTR-4 simpler, the contents of its form have been discussed followingly:

- Table 1-3: Includes auto-filled basic information, such as name, valid GSTIN, accumulated turnover of the former fiscal year, and ARN, along with its date.

- Table 4: One should provide details regarding inward supplies that are received from a GST-registered supplier.

- Table 4A: List of inward supplies under both intrastate and interstate transactions that are not eligible for reverse charges.

- Table 4B: Facts of inward supplies involved with both intrastate and interstate transactions that must attract taxability on reverse charges.

- Table 4C: Information about interstate or intrastate inward supplies received from unregistered suppliers.

- Table 4D: Details regarding all taxable import services where reverse charges are applicable.

- Table 5: The list of self-evaluated liabilities, as mentioned in the GST CMP-08 form under the given financial year, gets auto-populated in this table. It contains the details of reverse-chargeable inward supplies as well as outward supplies, along with paid interest and tax.

- Table 6: Here, one must furnish all the tax-rate values of outward and inward supplies attracting reverse charges. It also comprises the total taxable value along with auto-filled CGST, SGST IGST, and Cess amounts.

- Table 7: Taxpayers should mention the deducted TDS amount along with the GSTIN of e-commerce operators or deductors and the gross value of the invoice. The table automatically fills up the received amount of TDS/TCS.

- Table 8: All details about payable and paid tax, interest, and late fees go in here.

- Table 9: This table allows one to claim a refund in case of excess tax paid. The refund amount is divided into interest, penalty, fee, tax and others.

Since GSTR-4 is clear, let us move to the next aspect.

Who Is Eligible for Filing GSTR-4?

To be eligible to file GSTR-4, one has to:

- Be registered for the Composition Scheme and pursue the same for the fiscal year.

- Get enrolled under the Composition Scheme before the beginning of the financial year.

- Enlist himself/herself for the Composition Scheme and later, withdraw from it during the same economic year.

Apart from Composition Scheme, vendors also need to meet the following regimes:

- Annual turnover must stand within 1.5 Crores. For the composite vendors of Himachal Pradesh and North-Eastern states, the annual turnover has to be less than 75 Lakhs.

- Only intrastate composite traders are entitled to file GSTR-4.

- All relevant import and purchase details must be kept handy.

What Are the Required Documents For Filing GSTR-4?

For a prompt and hassle-free GSTR-4 filing, a composite vendor must keep the below documents within reach:

- GSTIN of taxpayer

- Types of invoice

- Number of invoices

- Supply place

- Rate of GST

- Taxable value

- List of invoices (B2B and B2C)

- The applicable amount of SGST, CGST, IGST and GST Cess

- Details of HSN-rated summary

- Uniform information on intrastate and interstate sales

- Summary of relevant documents, like, debit and credit notes

What Is the Online Procedure to File GSTR-4?

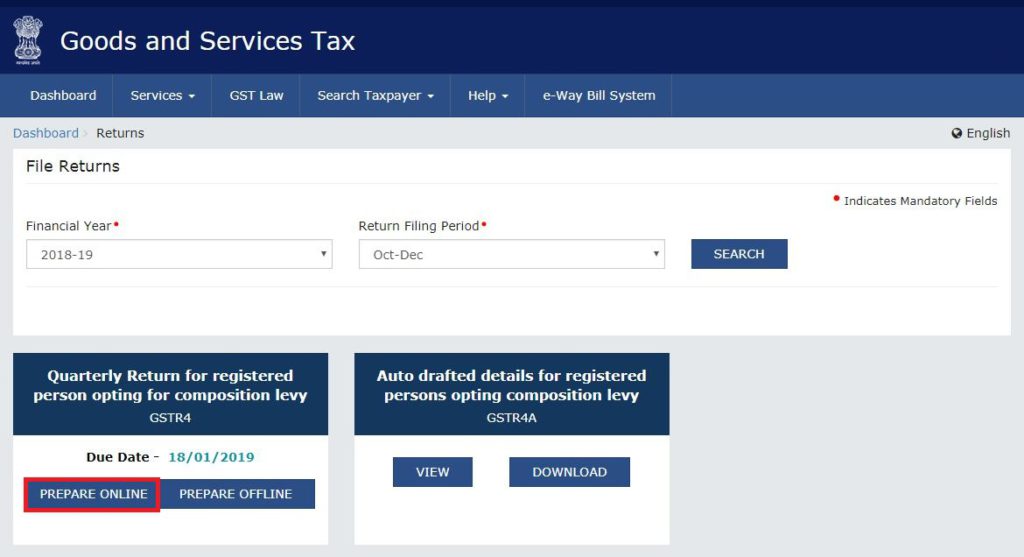

Here is a rundown of filing GSTR-4 online:

Step 1: Sign in to the GST Portal and follow the navigation from “Service” to “Return” to “Annual Return”.

Step 2: Choose the relevant financial year.

Step 3: Mindfully read the instructions and click on “Prepare Online”.

Step 4: Enter the evaluated turnover value of the former fiscal year and proceed to the save button. In case of no turnover, enter zero into the space to avoid leaving it blank.

Step 5: This step is for filing nil GSTR-4. If not needed, one can simply skip this step. However, to apply for a nil GSTR-4, taxpayers have to click on "Proceed To File".

Step 6: Furnish applicable details to all the tables by selecting them one by one from the dropdown list of “Select tables to add/view details”.

Step 7: After carefully entering the information, click “Proceed To File” for a quick preview of the saved return. Once done, keep a copy of it by pressing “Download GSTR-4 Summary (PDF)” or “Download GSTR-4 (Excel)”. Proceed to the next step with a click on “Continue”.

Step 8: Input details of tax, interest, and late fee irrespective of the fact that whether they are payable or paid. Choose your preferred payment mode from:

- NEFT or RTGS

- Over the Counter

- Net Banking

And proceed with "Generate Challan".

If Electronic Cash Ledger comprises enough balance, the amount will automatically be adjusted, reflecting zero in the "Additional Cash Required" column. This step permits you to review the GSTR-4 return one more time before sailing off to the final step.

Step 9: Here, taxpayers must confirm the declaration checkbox. Also, he or she has to select the authorized signatory.

Click on the "File GSTR-4 Button." Post-clicking, a warning message will pop up. Ensure to enter yes to successfully file GSTR-4 with either DSC or EVC.

Completion of the final step will lead to the following outcomes:

- The return status converts into “filed”.

- For additional proof, the ARN or Application Reference Number gets created.

- The taxpayer receives a confirmation update via SMS and email.

When Should One File GSTR-4?

GSTR-4 is an annual return that must be filed by taxpayers registered under the GST Composition Scheme. As per the latest update from the 53rd GST Council Meeting and CGST Notification No. 12/2024, the due date for filing GSTR-4 has been extended to 30th June of the following financial year. For example, GSTR-4 for the financial year 2024-25 must be filed by 30th June 2025.

Failure to file GSTR-4 by the due date attracts a late fee of ₹50 per day (₹25 under CGST and ₹25 under SGST), subject to a maximum of ₹2,000. For nil returns, the late fee is ₹20 per day, capped at ₹500. Additionally, GSTR-4 cannot be filed after three years from its original due date, effective from July 2025 onwards.

What Are the Penalties For Late GSTR-4 Filing?

If one fails to file by the due date, ₹200 is imposed per day, which can reach a maximum of ₹5000.

However, according to the state-of-the-art update, the payable late fee has been lessened to ₹50 per day with a maximum of up to ₹2000. The maximum late fee for filing nil GSTR-4 has become ₹500.

What Are the Recent Updates About GSTR-4?

Central Board of Indirect Taxes and Customs, or CBIC, has published an additional provision under one of their earlier notifications issued on 29th of 2017.

Updated Notification 73:

Any late payable fee under section 47 of the CGST Act 2017 that stands higher than ₹250 shall be waived completely. This amendment applies to those:

- Who have not filed GSTR-4 within the due date for quarters between July 2017 to March 2019.

- Who has missed filing GSTR-4 for FY 2019-20 to 2021-22 by the due date.

Composite vendors who fall within this category must apply for the return from 1st April 2023 to 31st August 2023.

What Are the Perks of Timely Filing GSTR-4?

Now that we clearly understand what GSTR-4 is and its filing process. Let us take a short tour of its advantages:

- Annually filling out GSTR-4 saves you from the burden of late fees.

- It keeps a detailed track of services, lessening the hassle of record keeping.

- Not only does it reflect the accountability of the taxpayer, but it also repels the risk of GST cancellation.