7 Crore+ Customers

Affordable Premium

GST Registration Certificate: Meaning, Types & Registration Process

A GST registration certificate is mandatory for any business with a turnover beyond the amount mentioned in the criteria for GST registration. If a business is run in more than one state, it must be registered separately from each state. There are specific rules under the GST law failing to abide by which businesses are subject to penalties.

Keep reading to learn all about the certificate and the process to obtain it.

What Is a GST Registration Certificate?

A GST registration certificate (Form GST REG-06) is delivered to every taxpayer registered under the GST Act. Businesses must apply for registration within 30 days of becoming liable for GST. Failing to register will make businesses accountable for penalties. As per the law, the certificate must be displayed prominently at the principal place of business.

What Are the Types of GST Registrations?

There are 4 types of GST registrations:

1. Normal Taxpayers

When the annual turnover of a business exceeds ₹40 lakhs, they register as normal taxpayers.

The threshold limit of aggregate turnover for exemption from registration and payment of GST for suppliers of services is ₹ 20 Lakh (₹ 10 Lakh for States of

Manipur, Mizoram, Nagaland and Tripura). The threshold limit of aggregate turnover for exemption from registration and payment of GST for suppliers of goods is ₹ 40 Lakh (₹ 20

Lakh in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura and Uttarakhand).

2. Casual Taxable Individual

When a business is seasonal, it is registered under this category.

3. Non-Resident Taxpayers

Individuals who are not Indian residents but have business in India as suppliers or principals fall under this category of registration.

4. Composition Registration

Businesses with an annual turnover of Rupees one crore or more fall under this category. Under this, businesses pay a fixed amount of GST irrespective of their turnover.

What Are the Contents of a GST Registration Certificate?

GST registration certificates include the main certificate along with two annexures – Annexure A and Annexure B.

Contents of Main Certificate

The contents of the main certificate are as follows:

- Goods and Services Tax Identification Number or GSTIN

- The legal name of the business and its Trade name

- Type of business

- Type of registration

- Validity period

- Details of approving authority, including their name, designation, office of jurisdiction and signature

- Date of issue

Contents of Annexure A

Annexure A includes the following details:

- Goods and Services Tax Identification Number or GSTIN

- Legal name and Trade name of the business

- Other places where the business is set. This is in the case of businesses run in more than one place.

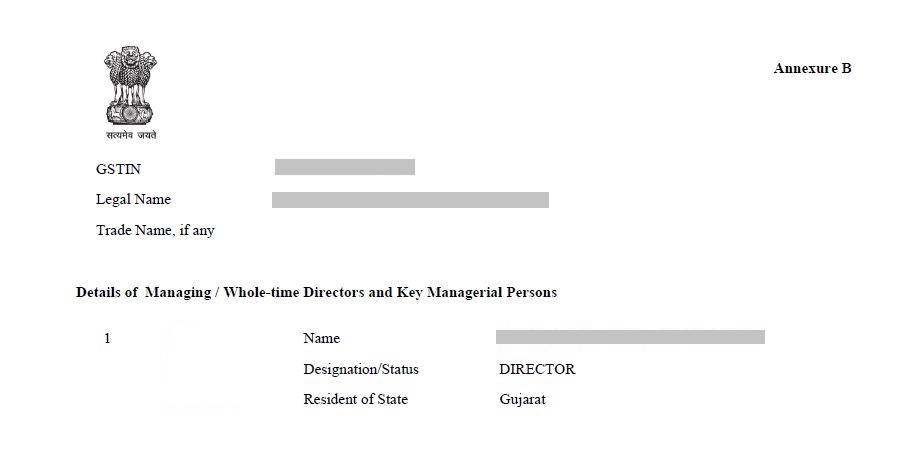

Contents of Annexure B

Annexure B includes the following details:

- Goods and Services Tax Identification Number or GSTIN

- Legal name and Trade name of the business

- Owner's information, along with details about business partners, directors and trustees. It includes their names along with their designations and their residential state.

How to Register for a GST Registration Certificate?

People can apply for GST registration from the website.

Step 1: Visit the GST Portal

Step 2: Click on ’Services’

Step 3: Click on ‘Registration’, then click on ‘New Registration’

A page will open which will ask for details like PAN number, Identity Proof and Contact details

Step 4: An OTP will be generated, which will be valid for 10 minutes

Step 5: Then, a Temporary Registration Number or TRN will be generated

Step 6: Login again and follow the previous order, i.e.,

- Services

- Registration

- New Registration

- TRN Number

Step 7: Now, verify the OTP

Users will find an option called 'My Saved Applications' from where they can fill out the application form.It is required to fill out the form within 15 days of registration. Approval of applications and the process of certificate registration begins when a designated official verifies the details.

What Are the Documents Required for a GST Registration Certificate?

The below-mentioned documents will be required in order to register for GST:

- Applicant’s PAN number

- Copy of Aadhaar Card

- Proof of business registration

- Proof of Principal Place of Business

- Details of all the proprietor, partners, directors, or trustees of the company, which includes their photograph, identity proof and address proof

- Details of all the directors and trustees of the company, which includes their photograph, identity proof and address proof

- Bank statements and a cancelled cheque

- Digital signature

How to Download a GST Registration Certificate?

The government does not issue any physical copies of the certificate. They can only be downloaded online.

The steps to download the certificate are as follows:

Step 1: Visit the GST Portal

Step 2: Click on the ‘Login’ button on the right-hand side of the page

Step 3: Put the Username and Password in the respective fields, along with the Captcha

Step 4: After logging in, click on the ‘Services’ option

Step 5: A drop-down list will open, then click on 'User Services'

Step 6: The ‘User Services’ option will have an option saying ‘View/Download Certificate’

Step 7: After clicking on the 'View/Download Certificate' option, users will find the 'Download' option

Step 8: Click on the ‘Download’ option to download the certificate

What Is the Validity Period of the GST Registration Certificate?

Certificates that are issued for normal taxpayers or businesses do not have an expiry date. They remain valid unless cancelled by taxpayers themselves or the department.

However, for non-resident taxpayers, certificates are valid for 90 days. Therefore, in order to avoid it from expiring, they need to apply for it again before it expires.

Registering a business within 30 days is necessary after it exceeds the amount mentioned in the GST criteria. The Goods and Services Tax is the government's initiative that has unified the county's tax structure. The certificates are issued to ensure businesses have registered under the GST laws. Therefore, they must display the certificates at the place of business.