7 Crore+ Customers

Affordable Premium

How to Get FASTag Instantly for New & Old Cars?

Imagine this: You are in a spanking new car, driving down to Goa with anticipation high, when suddenly, there is an endless string of cars at the toll booth. The excitement of the rides seems to die down.

But there's good news! The Indian government has launched FASTag, which has emerged as a revolutionised highway commuting method. It has been compulsory to use FASTag since February 16, 2021, and vehicles without this tag are charged twice the amount of toll tax.

This electronic toll collection system is an excellent idea for road trips, as annoying toll booth times are a thing of the past. Wondering how can you avail of FASTag for your car? Let’s define six easy steps to enter the fast line of carefree travelling.

Table of Contents

What is FASTag?

FASTag is an electronic toll collection system with advanced technology introduced by the National Highway Authority of India. It uses Radio Frequency Identification (RFID) to facilitate the payment of tolls on national and state highways.

FASTag involves an RFID tag that is rechargeable and attached to a car's windscreen so that the toll fees can be deducted from an associated account every time the vehicle passes through tolls.

This contactless payment mode offers many benefits for drivers. It replaces cash, substantially shortening the time taken at toll stations. Besides saving time, it eliminates the need to come to a complete standstill for the tag to be read and the account debited, conserving fuel.

These tags are valid without any time limit; however, they will be non-functional if they are not readable or intact. FASTag's effectiveness and ease of usability signify a significant improvement in India's highway system.

How Does FASTag Card Work?

FASTag is one of the contemporary ways of collecting tolls on India's highways, which was developed to enhance the operation of highways across the country's geographical territory. Here's how it works:

- Acquisition and Activation: FASTag can be obtained from designated banks of India, toll fee collection plazas, or online service providers. It is then affiliated with a prepaid or savings account using the registration number of the particular vehicle and/or any other pertinent information.

- Installation: A FASTag is simply IRWMunted in the car's windscreen or other vehicles after activation.

- Toll Plaza Process: An RFID reader installed overhead near a vehicle reads the tag's identification number when it approaches a toll plaza that supports the FASTag.

- Automatic Payment: Where necessary, the toll amount is debited from the linked account using the efficient toll system.

Seamless Transit: The toll gate rises due to the point card, and the vehicle is allowed to proceed without coming to a halt.

Is Getting a FASTag Card Mandatory in India?

The National Highways Authority of India (NHAI) has made FASTags mandatory for all four-wheelers from February 15, 2021. (3)

Since December 2019, all lanes of national highways toll plazas have been declared “FASTag lanes,” Highways Minister Nitin Gadkari has announced that all vehicles must have FASTags or face specific penalties. (4)

Importance of FASTag Card for Your Vehicles

An advantage of making FASTag compulsory is that the stress accompanying the need for the correct change in cash when using other toll booths would no longer exist. The importance of the FASTag card is highlighted by the points below:

- Cashless Convenience: It also means there will be no ‘cash transactions’ at toll plazas since FASTag has taken centre stage. Money is debited from the linked account, relieving you of much stress.

- Effortless Recharging: Refilling the FASTag is straightforward. It is at least ₹100 maximum to ₹100,000, and you can hyperlink your bank account or recharge through many payment procedures.

- Time-Saving Solution: Let’s bid farewell to long hours wasted at toll plazas. FASTag lanes have further helped streamline the process, making it faster so that one does not have to stop in between.

- Nationwide Accessibility: Your FASTag will be functional at more than 520 toll plazas in India, regardless of the consumer who has bought it. This acceptance has made it a handy tool for travelling between states.

- Eco-Friendly Option: Toll collection through FASTag also saves time and fuel, helping minimise vehicle air pollution. It also owes its paperless transactions to the culture of saving trees.

- Real-Time Updates: Obtain instant text messages for each transaction made and low balance alerts to ensure the client is always in the know.

- Long-Term Validity: Once created, FASTag is valid for five years, so you only need to recharge it periodically.

How to Get a FASTag Card Online?

The process of FASTag has been simplified and made affordable to meet the requirements of the vehicle owners. There are two primary methods to obtain your FASTag online:

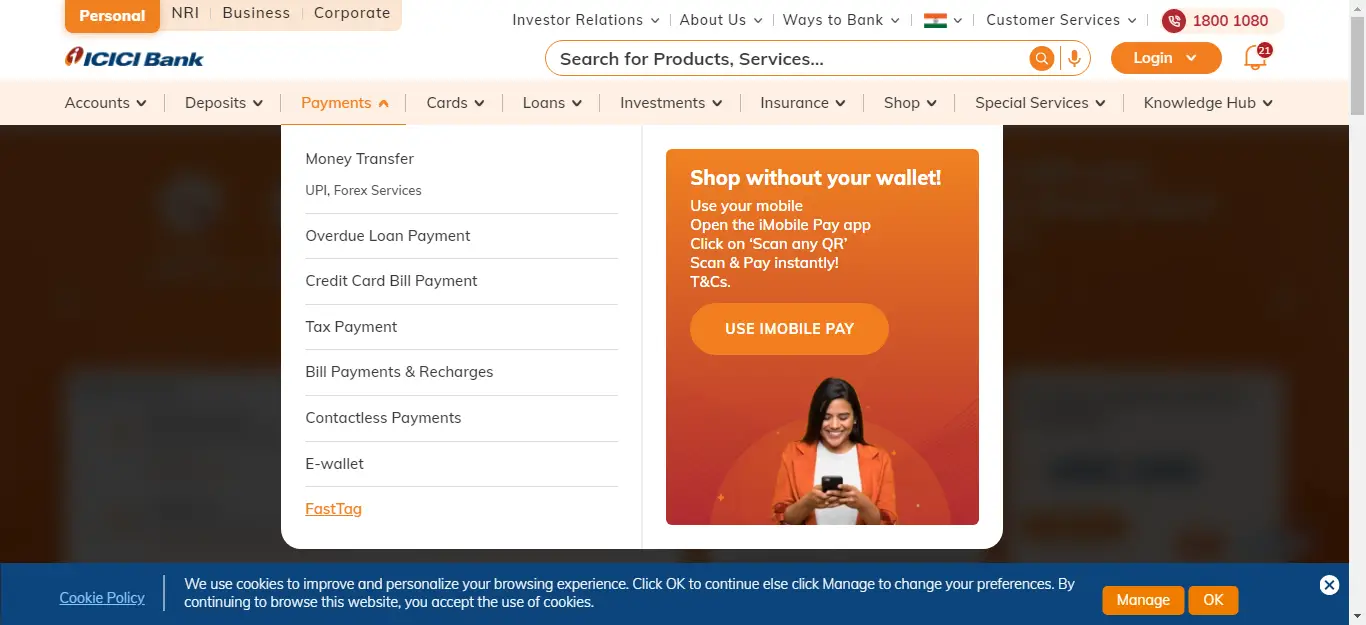

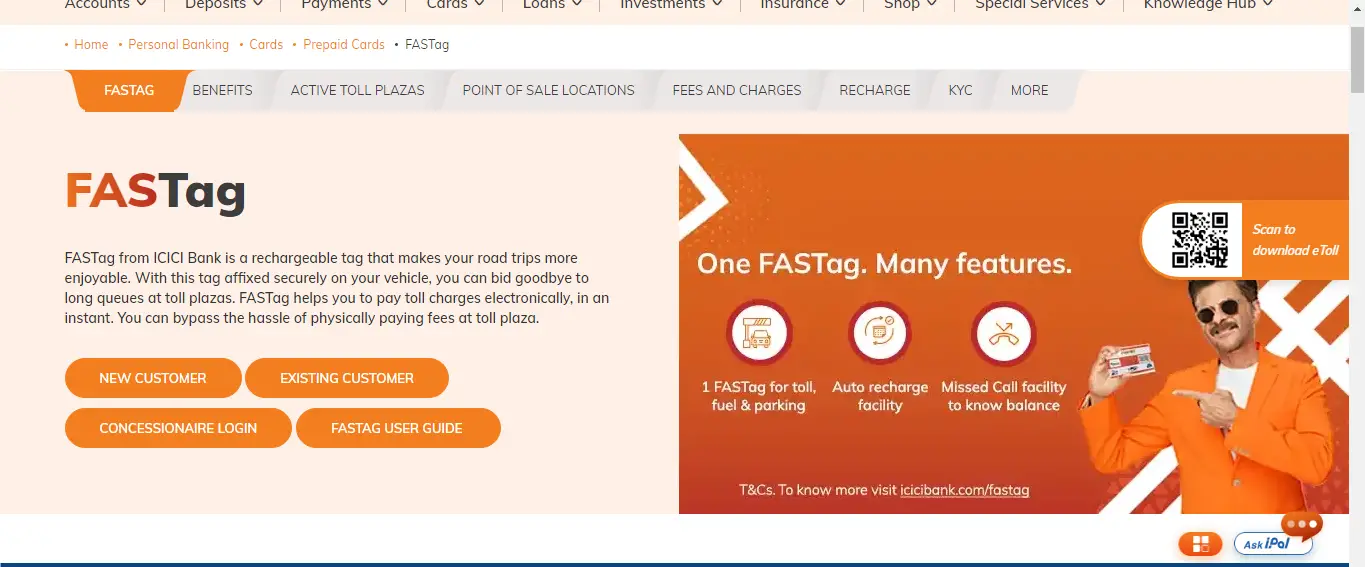

1. Through Authorized Banks

- Go to the bank’s FASTag page.

- Click on the “Payments” tab once the window appears, and click on Fastag.

- Select whether you are a new customer or an existing one.

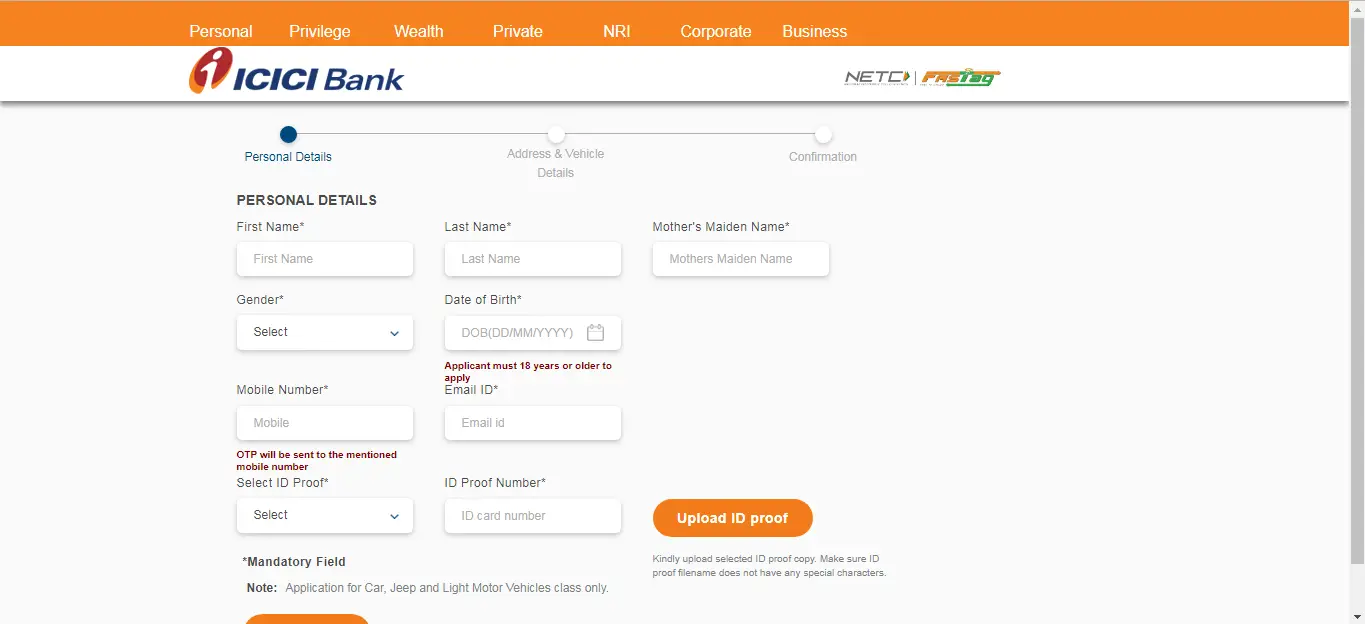

- Key in all your personal information in the application form.

- Scan and upload the docs – ID proof, vehicle RC, KYC.

- Click on “Continue” to agree to the terms and conditions.

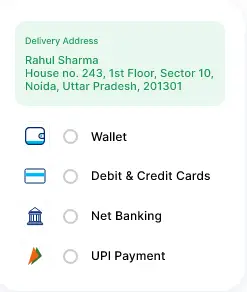

- Make the payment.

- Collect them at your convenience, and you will receive them at your registered address.

2. Via Digital Payment Applications

- Select a compatible digital payment app like Paytm.

- Search for FASTag on your App.

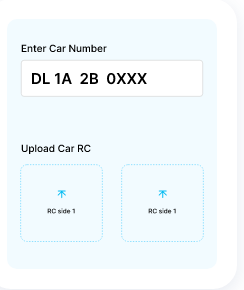

Enter the required information like car number.

- Upload necessary documents.

- Complete the payment at the end.

- FASTag will be home-delivered to your address.

How to Get FASTag Card Offline?

Notably, offline methods are easily accessible for those who like to be involved in the process or prefer using FASTag. Below are the different methods:

1. At Toll Plazas or NHAI Booths

- Find an NHAI FASTag booth near you with the help of the My FASTag app.

- To update the FASTag details, the registered vehicle should be taken to the nearest toll plaza of the respective category, i.e., an FASTag-enabled toll plaza.

- In addition, you will be required to present your vehicle’s Registration Certificate (RC) and a valid photo identification.

- Give the booth operator the required information.

- The required amount must be paid, which becomes the initial FASTag balance.

- Receive and paste the FASTag on your vehicle's windshield.

2. Authorised Banks or Issuing Bodies

- Find an associated branch of any bank or any of the authorised FASTag centres.

- Please ensure you carry your vehicle’s RC and a valid identity document (Aadhaar or driving license).

- Provide the necessary documents to the bank's official.

- The final application process is also carried out on the site.

- Pay the activation amount of FASTag at the time of registration.

- Get your FASTag as soon as possible to fix it.

Documents Required to Apply for FASTag

The documents required for obtaining a FASTag include specific documents showing proof of identity and vehicle ownership. This documentation helps optimise the distribution and deployment of FASTags in the national electronic toll collection system.

Essential Documents for the FASTag Application are as follows:

- Vehicle Registration Certificate (RC)

- Passport-sized Photograph

- KYC Documents (Know Your Customer)

- Address Proof

Fees for Availing of FASTag Card

The breakdown of FASTag charges for various vehicles is provided in the table below:

What is the Process for Activating the FASTag Card?

In the event you avail the FASTag card from any of the 22 authorised banks or POS terminals, it will be activated beforehand.

What is Meant by FASTag Card Activation?

Activation implies registering the card with your vehicle and a linked payment method. This payment method can be used in either a digital wallet or any bank account (savings or current).

If you purchase the card from Amazon, you will receive a blank FASTag sticker. Next, you will need to register the card with your vehicle and then add a payment method from your end once you receive it.

How to Activate Your FASTag Card Online?

Activating your FASTag online is designed to be simple and effective, ensuring every driver can return to the road as soon as possible. This way, the users of the FASTag can be assured of its usability on India's highways.

Here's a guide to activating your FASTag online:

- Step 1: Open your My FASTag app and create your account by pinning your registered mobile number.

- Step 2: Verify your account by typing the OTP received and completing the registration process.

- Step 3: On the App's home page, click ‘Activate FASTag.’

- Step 4: From the drop-down menu, select the E-commerce site from where you purchased teh NHAI FASTag.

- Step 5: Scan the QR code of the FASTag or manually enter the 24-digit ID.

- Step 6: Also, provide the vehicle details, such as the registration number, type, and class.

- Step 7: Select the preferred bank you want to link the FASTag with.

- Step 8: Complete the linking process by providing all the bank details and credentials.

- Step 9: Recharge your Fastag account with some initial balance using available payment methods.

- Step 10: Review the information entered one last time to ensure accuracy and click on ‘Activate’

The FASTag account will be activated instantaneously and will be ready to use.

How to Activate Your FASTag Card Offline?

Here are the different convenient ways FASTag can be activated offline, according to the user’s needs and ease of interaction:

Via Bank Branch

- Go to any of the FASTag issuing banks.

- Please fill out the application form and enclose the necessary documents.

- Make initial payment.

- Receive pre-activated FASTag with a few instructions.

- Place the tag on the windshield and use the details for the account creation process.

Point of Sale (POS) Location

- Find one of the POSs (for example, petrol stations or toll barriers).

- Show current vehicle RC and FASTag ID/QR code.

- Connect a bank account or any prepaid wallet.

- Determine and set the first account balance.

- Additional steps in the activation process are accomplished on location.

NHAI FASTag Booth

- Install My FASTag app to locate NHAI booths around you.

- Go to the booth or a bank affiliated with the toll booth.

- It is mandatory to submit proof of RC and ID.

- You must pay the required amount, which must be the initial balance.

- Obtain and get FASTag fitted on the car.

Given its positive aspects, FASTag has become a game changer in toll collection in India by providing convenience, time efficiency, and improved environmental impact.

Whether you wish to activate your FASTag through Internet banking or a registered/authorised customer service centre/office, the process is easy and hassle-free. Adopt this technology to have better road experiences on highways in India.